Early Indicators: Could The U.S. Dollar Face Its Worst 100 Days Since Nixon?

Table of Contents

Weakening Economic Fundamentals

The foundation of a strong currency rests on solid economic fundamentals. Currently, several indicators point towards weakening economic health in the United States, potentially impacting the U.S. dollar's value.

Inflation and Interest Rates

Inflation remains stubbornly high, eroding purchasing power and impacting consumer confidence. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are creating a complex scenario. While higher interest rates typically attract foreign investment, boosting the dollar's value, the current situation is more nuanced.

- Current inflation: Inflation currently sits significantly above the Federal Reserve's target of 2%, leading to concerns about persistent price increases.

- Effectiveness of monetary policy: The impact of interest rate hikes on inflation remains to be seen, with a lag effect often observed between policy changes and their full impact on the economy.

- Potential for further rate hikes: The possibility of further interest rate increases could stifle economic growth, leading to a weakening of the dollar despite attracting short-term investment.

National Debt and Budget Deficit

The soaring national debt and persistent budget deficit are major concerns for investors. These figures signal a lack of fiscal discipline and raise questions about the long-term sustainability of the U.S. economy, affecting investor confidence in the U.S. dollar.

- Statistics on debt and deficit: The U.S. national debt is at an all-time high, with the annual budget deficit consistently exceeding projections.

- Consequences of unsustainable fiscal policy: Continued large deficits could lead to increased inflation, higher interest rates, and ultimately, a decline in the value of the U.S. dollar.

- Impact on investor sentiment: Investors are increasingly concerned about the long-term solvency of the U.S. government, potentially leading to a reduction in demand for U.S. dollar-denominated assets.

Geopolitical Risks and Global Uncertainty

Geopolitical events and global instability significantly impact currency markets. Several current events cast a shadow of uncertainty over the U.S. dollar's future.

The War in Ukraine and Global Supply Chains

The ongoing war in Ukraine has disrupted global energy markets and supply chains, leading to increased inflation and volatility in commodity prices. These disruptions create uncertainty and negatively affect the U.S. dollar.

- Effect on inflation: The war has exacerbated inflationary pressures globally, impacting the U.S. economy and contributing to a weakening of the U.S. dollar.

- Impact on international trade: Disruptions to supply chains have hindered international trade, creating further economic uncertainty.

- Effect on currency markets: Uncertainty surrounding the conflict's duration and impact contributes to volatility in currency markets, potentially driving investors away from the U.S. dollar.

US Relations with Other Global Powers

Strained relationships with major global powers, particularly China, add to the instability. Trade tensions and geopolitical rivalries can impact the U.S. dollar's international standing.

- Implications of trade disputes: Trade wars and tariffs create uncertainty and reduce international trade, impacting the demand for the U.S. dollar.

- Shift in global currency reserves: Some countries are diversifying their currency reserves, reducing their reliance on the U.S. dollar, potentially diminishing its dominance.

- Potential for currency manipulation: Geopolitical tensions can lead to accusations of currency manipulation, further undermining confidence in the U.S. dollar.

Alternative Currency Strength and Flight to Safety

The rise of alternative currencies and a shift in investor sentiment toward safer assets are further indicators of potential U.S. dollar weakness.

The Rise of Other Global Currencies

The Euro and the Chinese Yuan are gaining strength, posing a challenge to the U.S. dollar's dominance as a global reserve currency.

- Comparison of major currencies: The Euro and Chinese Yuan have shown relative strength against the U.S. dollar in recent periods.

- Factors driving demand for alternative currencies: Increased economic stability in the Eurozone and China's growing global influence are contributing to the rise of these currencies.

Investor Sentiment and Capital Flows

Investor sentiment and capital flows are crucial indicators. A shift towards risk aversion could lead to a "flight to safety," reducing demand for the U.S. dollar.

- Movement of capital to safer assets: Investors may move funds to assets perceived as safer, such as gold or government bonds of more stable economies, leading to a decrease in demand for U.S. dollar-denominated assets.

- Impact of negative sentiment: Negative sentiment surrounding the U.S. economy and geopolitical risks can trigger capital flight, weakening the U.S. dollar.

- Role of speculation: Speculation in currency markets can amplify any negative trends, contributing to a more significant decline in the U.S. dollar's value.

Conclusion

Weakening economic fundamentals, escalating geopolitical risks, and the strengthening of alternative currencies paint a concerning picture for the U.S. dollar. The combination of high inflation, a burgeoning national debt, global supply chain disruptions, and strained international relations creates a perfect storm that could potentially lead to the U.S. dollar facing its worst 100 days since the Nixon shock. While predicting the future with certainty is impossible, the indicators strongly suggest a potential for significant decline. Stay informed about the evolving situation of the U.S. dollar and its potential for decline. Regularly monitor key economic indicators and geopolitical events to understand the future trajectory of the U.S. dollar.

Featured Posts

-

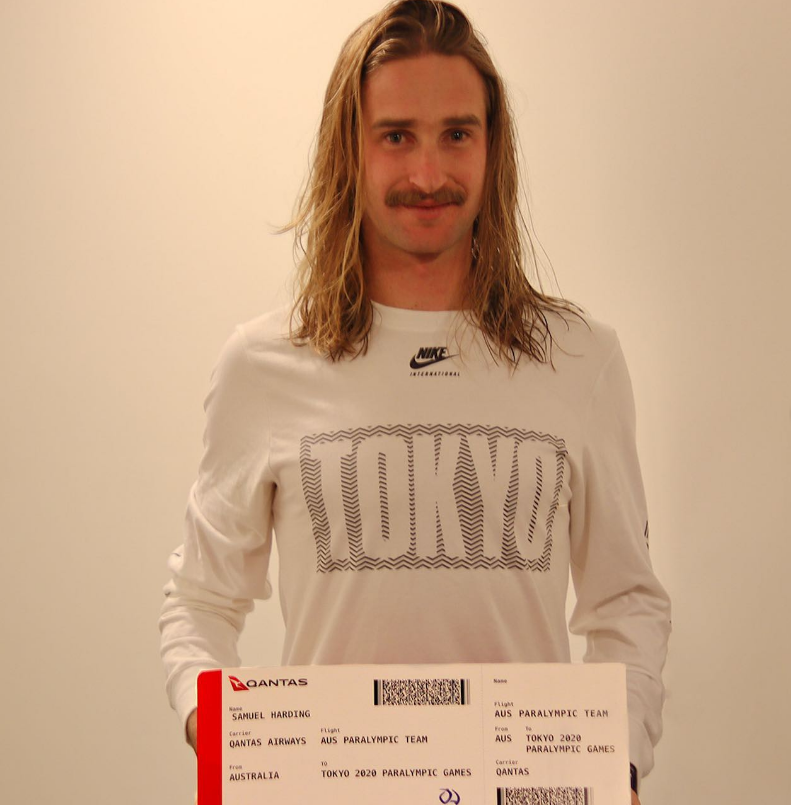

Update British Paralympian Sam Ruddock Still Missing In Las Vegas

Apr 29, 2025

Update British Paralympian Sam Ruddock Still Missing In Las Vegas

Apr 29, 2025 -

British Paralympians Disappearance In Las Vegas A Developing Story

Apr 29, 2025

British Paralympians Disappearance In Las Vegas A Developing Story

Apr 29, 2025 -

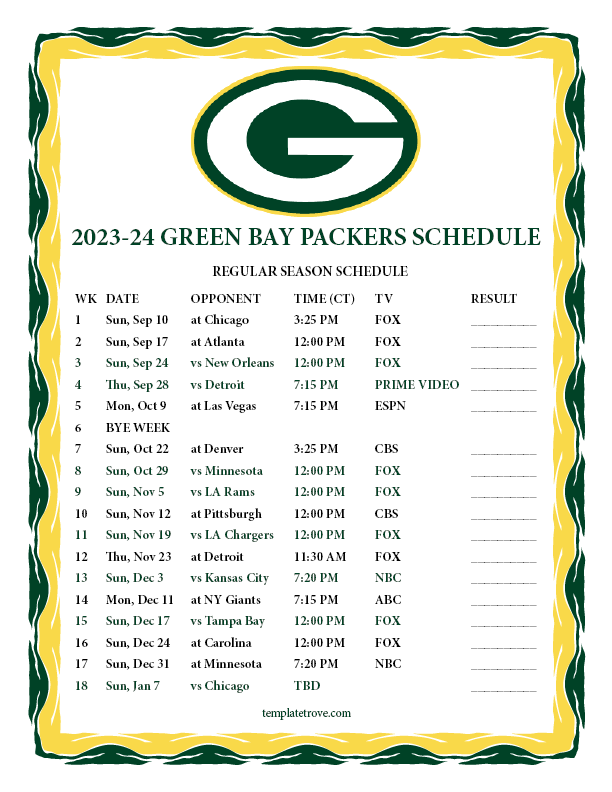

Green Bay Packers Two International Games On The Horizon For 2025

Apr 29, 2025

Green Bay Packers Two International Games On The Horizon For 2025

Apr 29, 2025 -

Senate Leader Schumer Defends His Position I M Staying Put

Apr 29, 2025

Senate Leader Schumer Defends His Position I M Staying Put

Apr 29, 2025 -

Parita Di Genere Sul Lavoro La Situazione Attuale In Italia

Apr 29, 2025

Parita Di Genere Sul Lavoro La Situazione Attuale In Italia

Apr 29, 2025

Latest Posts

-

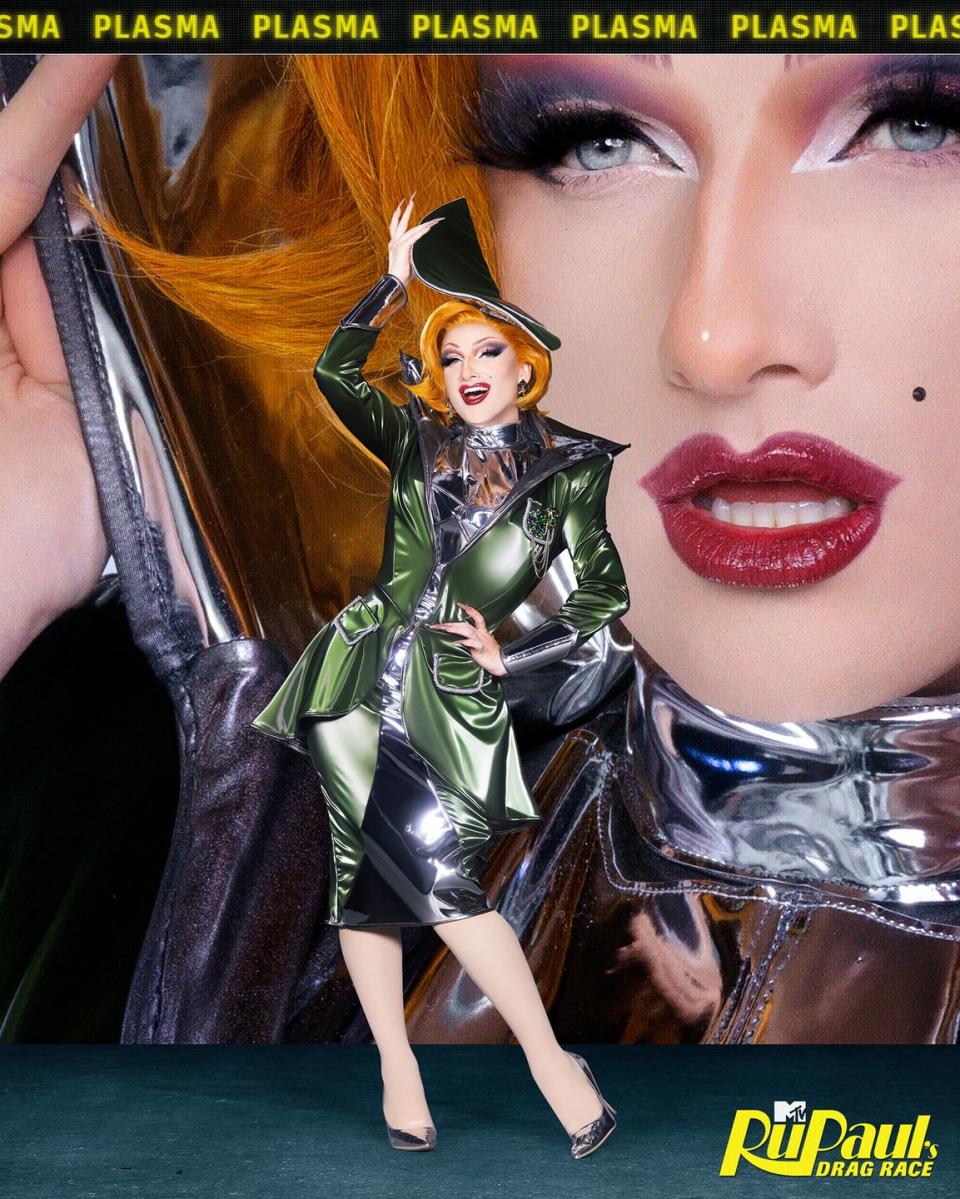

Ru Pauls Drag Race S17 E13 Preview A Family Affair Drag Baby Mamas

May 12, 2025

Ru Pauls Drag Race S17 E13 Preview A Family Affair Drag Baby Mamas

May 12, 2025 -

Cbs Simulcast Of The Vmas A Sign Of Mtvs Decline

May 12, 2025

Cbs Simulcast Of The Vmas A Sign Of Mtvs Decline

May 12, 2025 -

Watch 100 Mtv Unplugged Episodes Online Your Ultimate Streaming Guide

May 12, 2025

Watch 100 Mtv Unplugged Episodes Online Your Ultimate Streaming Guide

May 12, 2025 -

Drag Baby Mamas Ru Pauls Drag Race Season 17 Episode 13 Preview

May 12, 2025

Drag Baby Mamas Ru Pauls Drag Race Season 17 Episode 13 Preview

May 12, 2025 -

Mtv Cribs The Lavish Lifestyles Of Wealthy Young Adults

May 12, 2025

Mtv Cribs The Lavish Lifestyles Of Wealthy Young Adults

May 12, 2025