Economic Concerns Drive Gas Prices Down: National Average Nears $3

Table of Contents

The Role of Recessionary Fears in Lowering Gas Demand

Concerns about a potential recession are significantly impacting consumer behavior and, consequently, demand for gasoline. Economic uncertainty is leading to a decrease in discretionary spending, with consumers cutting back on non-essential expenses, including travel and driving. This reduced demand directly affects gas prices. The correlation between economic uncertainty and lower gasoline consumption is undeniable.

- Reduced consumer confidence leads to less discretionary spending on things like leisure trips and weekend getaways, reducing gasoline consumption.

- Companies are cutting back on business travel, further diminishing the demand for fuel.

- The tourism and related industries are experiencing a slowdown, impacting the overall demand for gasoline.

- Consumers are increasingly shifting towards fuel-efficient vehicles and adopting more fuel-conscious driving habits.

Increased Oil Supply and Production

A global increase in oil production has played a crucial role in lowering crude oil prices, which directly impacts the price at the pump. Several countries and regions have contributed to this surge in supply.

- OPEC+ decisions on oil production have had a significant impact, with adjustments in output quotas influencing global supply.

- Strategic petroleum reserve releases by various governments have added to the available oil supply.

- Increased domestic oil production in certain regions, driven by technological advancements and investment, has further boosted supply.

- Technological advancements in oil extraction, such as improved fracking techniques, have also increased the efficiency and output of oil production.

The Impact of the Strengthening Dollar

The strengthening of the US dollar against other major currencies has significantly impacted global oil prices. Crude oil is primarily traded in US dollars, and a stronger dollar makes it more expensive for buyers using other currencies. This decreased demand from international buyers, in turn, helps to lower prices.

- The impact of exchange rates on importing oil is substantial, as a stronger dollar reduces the cost for US importers.

- This influences international trade and global oil markets, leading to a more competitive pricing environment.

- Ultimately, a stronger dollar influences the final gas price at the pump, contributing to the overall decrease.

Government Regulations and Policies

Government regulations and policies at both national and international levels can influence gas prices, either directly or indirectly. While some environmental regulations might increase production costs, other policies can impact fuel prices.

- Environmental regulations can influence the cost of production and distribution, potentially impacting the final price.

- Tax policies related to fuel can directly affect the price consumers pay at the pump.

- Government subsidies or incentives for alternative energy sources can indirectly impact gasoline demand by encouraging the adoption of cleaner energy options.

Looking Ahead: Potential Fluctuations in Gas Prices

While gas prices are currently down, several factors could cause future fluctuations. Predicting the exact trajectory is challenging, but monitoring certain indicators is crucial.

- Geopolitical events can significantly disrupt oil supply chains, leading to price increases.

- Changes in global demand for gasoline, driven by economic growth or recessionary trends, will have a direct effect on prices.

- Unexpected economic shifts and their effect on consumer behavior can also lead to price volatility.

Conclusion: Navigating the Shifting Landscape of Gas Prices

The recent decrease in gas prices is a multifaceted phenomenon driven by recessionary fears, increased oil supply, a stronger dollar, and potentially government policies. While the current low prices offer temporary relief, it's crucial to remain aware of the economic indicators and global events that can impact fuel costs. To make informed decisions regarding your fuel consumption and budget, stay informed about gas prices and related economic news. Further research into fuel price forecasts, gas price trends, and the overall economic outlook will help you navigate the shifting landscape of gas prices effectively.

Featured Posts

-

Falling Gas Prices In Illinois A Nationwide Trend

May 22, 2025

Falling Gas Prices In Illinois A Nationwide Trend

May 22, 2025 -

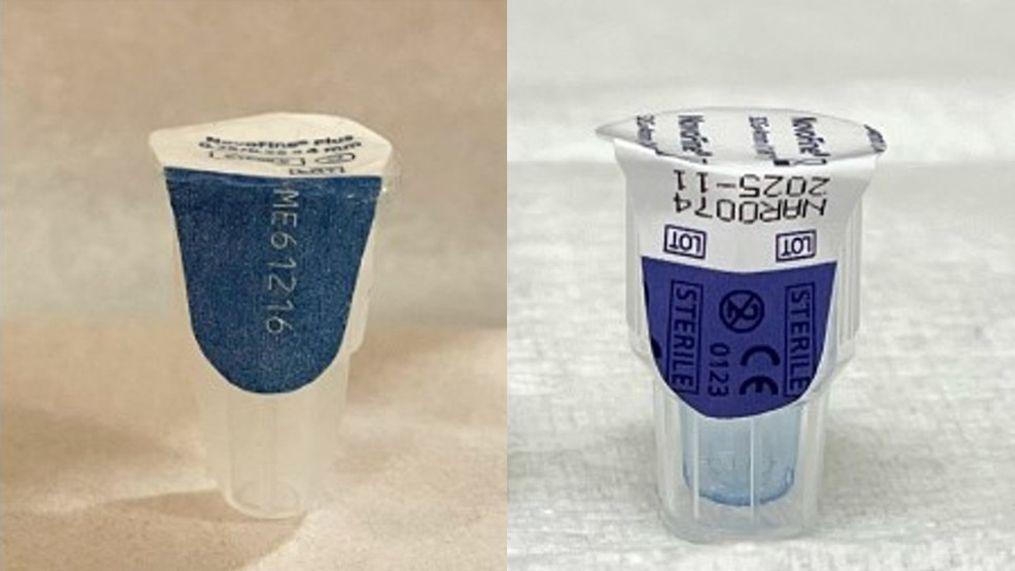

The Fdas Action On Counterfeit Ozempic Implications For Patients

May 22, 2025

The Fdas Action On Counterfeit Ozempic Implications For Patients

May 22, 2025 -

Invasive Zebra Mussels A Casper Boat Lift Infestation

May 22, 2025

Invasive Zebra Mussels A Casper Boat Lift Infestation

May 22, 2025 -

Recent Drop In Illinois Gas Prices Part Of National Pattern

May 22, 2025

Recent Drop In Illinois Gas Prices Part Of National Pattern

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Latest Posts

-

Big Rig Rock Report 3 12 Updates From 99 7 The Fox On Trucking

May 23, 2025

Big Rig Rock Report 3 12 Updates From 99 7 The Fox On Trucking

May 23, 2025 -

Big Rig Rock Report 3 12 99 7 The Fox Trucking Industry News And Analysis

May 23, 2025

Big Rig Rock Report 3 12 99 7 The Fox Trucking Industry News And Analysis

May 23, 2025 -

How To Get Metallica Hampden Park Glasgow Tickets

May 23, 2025

How To Get Metallica Hampden Park Glasgow Tickets

May 23, 2025 -

Metallica Glasgow Hampden Ticket Information And How To Buy

May 23, 2025

Metallica Glasgow Hampden Ticket Information And How To Buy

May 23, 2025 -

Liga De Naciones Concacaf Mexico Vs Panama Fecha Hora Y Canales De Transmision

May 23, 2025

Liga De Naciones Concacaf Mexico Vs Panama Fecha Hora Y Canales De Transmision

May 23, 2025