Economists Forecast Bank Of Canada Interest Rate Cuts Due To Tariff Impacts

Table of Contents

Weakening Economic Growth Due to Tariffs

Tariffs are significantly impacting the Canadian economy, slowing growth and creating uncertainty. This is primarily due to two key factors: reduced exports and increased import costs.

Reduced Exports and Increased Import Costs

Tariffs directly impact Canadian exports, making them less competitive in global markets. Key sectors like lumber and automobiles are feeling the pinch. Increased import costs, resulting from retaliatory tariffs imposed on Canadian goods by other countries, further exacerbate the problem, leading to higher prices for consumers.

- Specific Examples: The lumber industry has seen a significant decrease in exports to the US, a key trading partner. The automotive sector is also facing challenges due to increased tariffs on parts and finished vehicles.

- Projected Decline: Statistics Canada projects a [insert projected percentage] decline in exports due to tariffs in [insert timeframe].

- Rising Prices: Consumers are already experiencing increased prices for a range of imported goods, impacting their purchasing power and overall consumer confidence. For example, the price of [insert example, e.g., steel] has increased by [insert percentage] due to tariffs.

Business Investment Uncertainty

The uncertainty surrounding tariffs is discouraging business investment and hiring. Businesses are hesitant to commit to expansion plans or significant capital expenditures when facing unpredictable trade policies. This hesitancy translates to slower economic activity and potential job losses.

- Delayed Expansion: Many companies are delaying expansion plans, waiting for clarity on trade relations before making significant investments.

- Reduced Capital Expenditures: Businesses are cutting back on capital expenditures, opting to conserve cash rather than risk further losses due to unpredictable market conditions.

- Potential Job Losses: The reduced investment and slowdown in economic activity could lead to job losses across various sectors. Recent news articles highlight concerns from businesses about the potential for layoffs. [Link to relevant news article].

Inflationary Pressures and the Bank of Canada's Mandate

The Bank of Canada faces a complex challenge: balancing inflation and economic growth. Tariffs are creating a difficult environment for this dual mandate.

Balancing Inflation and Growth

The Bank of Canada's mandate is to maintain price stability and foster sustainable economic growth. However, tariffs are simultaneously pushing inflation upward (due to increased import costs) and slowing economic growth (due to reduced exports and investment). This creates a dilemma for monetary policy.

- Current Inflation Rate: The current inflation rate in Canada is [insert current inflation rate].

- Bank of Canada's Inflation Target: The Bank of Canada's inflation target is [insert inflation target percentage].

- Tariff Impact: Tariffs are contributing to both higher inflation and slower growth, making it challenging for the Bank of Canada to achieve both its objectives simultaneously.

Potential for Interest Rate Cuts to Stimulate the Economy

To counter the negative economic effects of tariffs, the Bank of Canada may choose to lower interest rates. Lower interest rates make borrowing cheaper for businesses and consumers, potentially stimulating economic activity.

- Consumer Spending: Lower interest rates could encourage consumers to increase spending, boosting demand and economic growth.

- Business Investment: Cheaper borrowing costs could incentivize businesses to invest in expansion and hiring.

- Housing Market: Lower interest rates could also stimulate the housing market, though this could also have negative consequences if not carefully managed.

- Downside Risks: The risk of lowering interest rates too much is increased inflation. The Bank of Canada needs to carefully balance these risks.

Economists' Predictions and Diverging Opinions

Economists have varying predictions regarding the timing and magnitude of potential Bank of Canada interest rate cuts.

Range of Forecasts for Interest Rate Cuts

There's a wide range of forecasts from leading economists. Some predict cuts in the next quarter, while others anticipate cuts later in the year or even into next year. The magnitude of these potential cuts is also debated, with some predicting larger reductions than others.

- Economist A: [Quote from Economist A, including predicted timeline and magnitude of rate cuts].

- Economist B: [Quote from Economist B, highlighting a differing perspective].

- Uncertainty: There's significant uncertainty about the future path of interest rates.

Factors Influencing Forecasts

Several factors are influencing economists' forecasts, including global trade negotiations, the strength of the US dollar, and domestic consumer spending.

- Global Trade Negotiations: The outcome of ongoing trade negotiations will significantly impact future interest rate decisions. A resolution to trade disputes could ease concerns and lessen the need for rate cuts.

- US Dollar Strength: The strength of the US dollar relative to the Canadian dollar also plays a role. A stronger US dollar can negatively impact Canadian exports, adding pressure on the Bank of Canada to cut rates.

- Domestic Consumer Spending: Consumer spending is a key driver of economic growth. Strong consumer spending might lessen the need for aggressive rate cuts.

Conclusion

Tariffs are negatively impacting the Canadian economy, causing slower growth and inflationary pressures. Economists predict that the Bank of Canada will respond by cutting interest rates to stimulate economic activity. However, there's divergence in opinion regarding the timing and magnitude of these cuts. Understanding the potential implications of Bank of Canada interest rate cuts is crucial for businesses and individuals alike.

Call to Action: Stay informed about potential Bank of Canada interest rate cuts and their impact on your finances and investments by following reputable financial news sources. Understanding the potential implications of Bank of Canada interest rate cuts is crucial for navigating the current economic uncertainty. Keep an eye on the Bank of Canada's announcements for the latest updates on monetary policy. Learn more about managing your finances in times of economic uncertainty by [link to relevant resource].

Featured Posts

-

I Os 19 Apple Leverages Ai For Enhanced Battery Management

May 14, 2025

I Os 19 Apple Leverages Ai For Enhanced Battery Management

May 14, 2025 -

Banned Candle Sales On Etsy Walmart And Amazon A Canadian Perspective

May 14, 2025

Banned Candle Sales On Etsy Walmart And Amazon A Canadian Perspective

May 14, 2025 -

Why Parker Mc Collum Is Being Compared To George Strait

May 14, 2025

Why Parker Mc Collum Is Being Compared To George Strait

May 14, 2025 -

The Ukraine Conflict Examining Trumps Impact On United States And European Policy Towards Russia

May 14, 2025

The Ukraine Conflict Examining Trumps Impact On United States And European Policy Towards Russia

May 14, 2025 -

Watch Young Son Of Scotty Mc Creery Pays Tribute To Country Legend George Strait

May 14, 2025

Watch Young Son Of Scotty Mc Creery Pays Tribute To Country Legend George Strait

May 14, 2025

Latest Posts

-

Dodgers Rally Past Diamondbacks Ohtanis Late Homer The Key

May 14, 2025

Dodgers Rally Past Diamondbacks Ohtanis Late Homer The Key

May 14, 2025 -

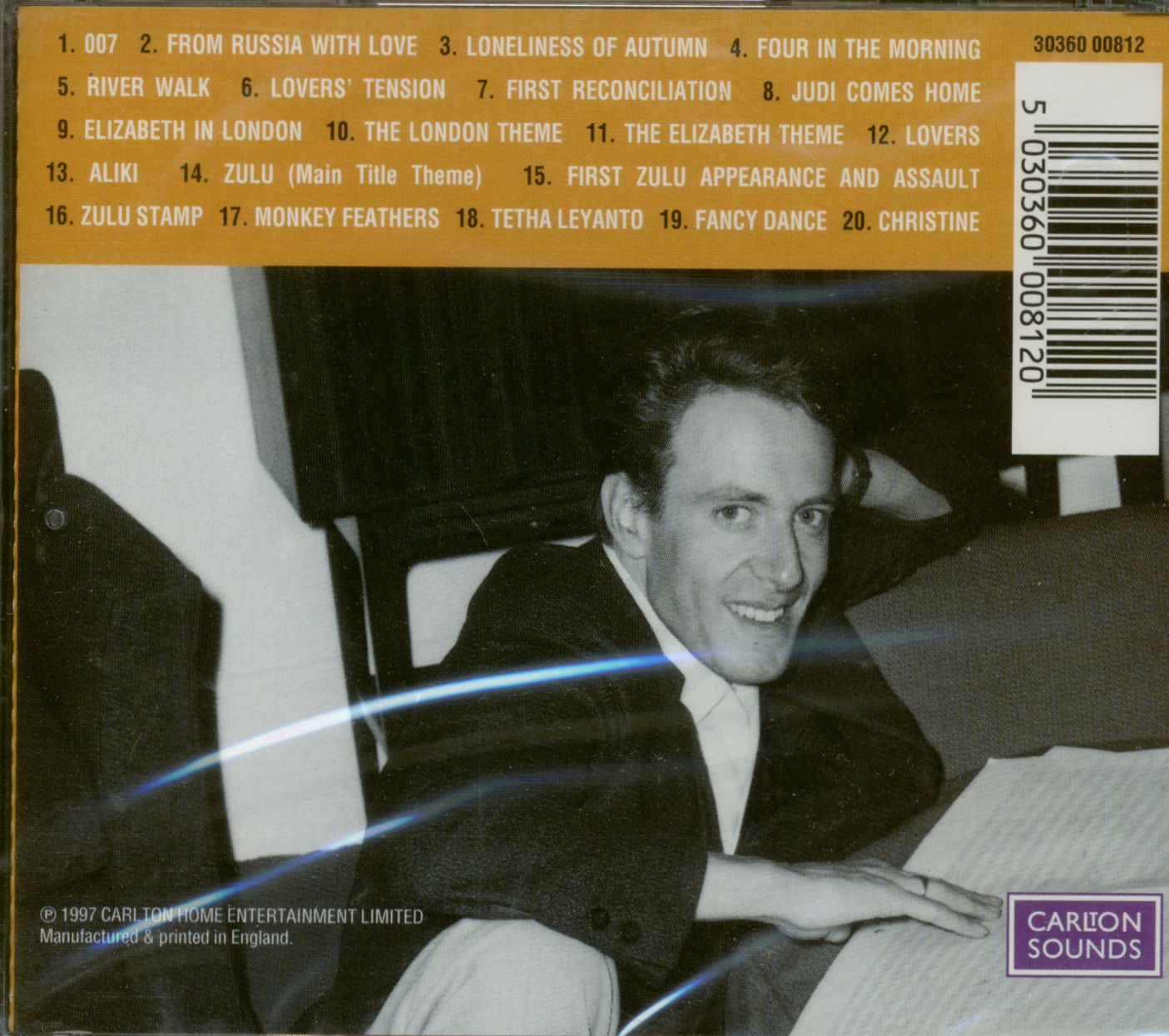

Experience John Barrys From York With Love At Your Local Everyman

May 14, 2025

Experience John Barrys From York With Love At Your Local Everyman

May 14, 2025 -

John Barrys From York With Love Film Screening At Everyman

May 14, 2025

John Barrys From York With Love Film Screening At Everyman

May 14, 2025 -

See John Barrys From York With Love At Everyman

May 14, 2025

See John Barrys From York With Love At Everyman

May 14, 2025 -

Everyman Cinema Presents John Barrys From York With Love

May 14, 2025

Everyman Cinema Presents John Barrys From York With Love

May 14, 2025