Economists Forecast Bank Of Canada Interest Rate Reductions Following Tariff-Related Job Losses

Table of Contents

Tariff Impacts and Economic Slowdown

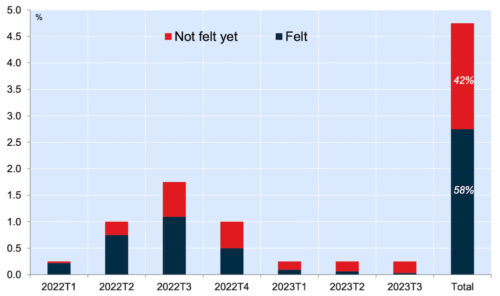

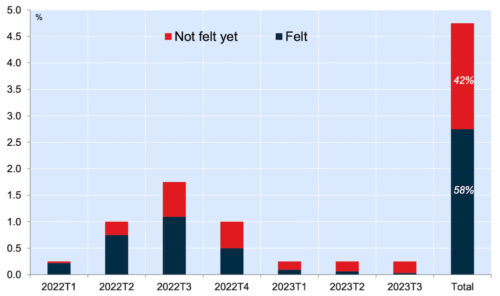

The imposition of tariffs has created a ripple effect, directly impacting various sectors of the Canadian economy. The most significant consequences are felt in manufacturing and agriculture, where job losses have been substantial. This decreased economic activity stems from reduced exports, increased input costs, and decreased consumer confidence.

- Manufacturing Job Losses: Statistics Canada reported a significant decline in manufacturing employment in the last quarter, particularly in Ontario and Quebec, regions heavily reliant on export-oriented industries. These losses are directly attributable to retaliatory tariffs imposed by trading partners.

- Agricultural Sector Strain: The agricultural sector is also experiencing hardship, with decreased export volumes and depressed prices for certain commodities, leading to farm closures and job losses in rural communities.

- Weakening Consumer Spending: Economic uncertainty generated by tariff disputes has led to decreased consumer spending and a drop in business investment, further dampening economic growth. This creates a vicious cycle, exacerbating the initial negative impacts of the tariffs.

- Keywords: tariff impact Canada, Canadian job losses, economic slowdown Canada, Canadian economic outlook

Economists' Predictions and Reasoning

Several leading economists are forecasting Bank of Canada interest rate reductions in response to the weakening economy and rising unemployment. These predictions are primarily based on the need to stimulate economic growth and counteract the negative effects of the tariffs.

- Stimulating Economic Growth: Lower interest rates make borrowing cheaper, encouraging businesses to invest and consumers to spend, thereby boosting economic activity and potentially creating new jobs.

- Combating Unemployment: The rate reductions aim to mitigate the impact of job losses by encouraging hiring and preventing further economic contraction.

- Modeling and Data: The forecasts are supported by various econometric models analyzing macroeconomic indicators such as GDP growth, inflation, and unemployment rates. These models suggest that interest rate cuts are necessary to prevent a deeper recession.

- Expert Opinions: [Insert quotes from economists here, if available, citing their sources].

- Keywords: Bank of Canada forecast, interest rate prediction Canada, economic stimulus Canada, monetary policy Canada

Potential Consequences of Interest Rate Reductions

A reduction in interest rates by the Bank of Canada will likely have both positive and negative consequences:

- Positive Impacts: Lower interest rates can stimulate borrowing and investment, potentially leading to increased job creation and economic growth. Homeowners could benefit from lower mortgage payments, freeing up disposable income.

- Negative Impacts: A significant concern is the potential for increased inflation if the rate cuts are too aggressive. A weaker Canadian dollar could also result, potentially impacting import costs and the competitiveness of Canadian businesses.

- Impact on Different Groups: Borrowers will benefit from lower interest payments, while savers may see lower returns on their investments. The impact on homeowners will depend on the magnitude of the rate reductions and the type of mortgage they hold.

- Keywords: inflation Canada, Canadian dollar exchange rate, monetary policy Canada, Bank of Canada interest rates

Alternative Policy Responses Considered

While interest rate reductions are the most likely response, the Bank of Canada might consider other policy options, either in conjunction with or instead of rate cuts. Furthermore, the federal government could implement fiscal policies to provide additional support.

- Quantitative Easing: The Bank of Canada could resort to quantitative easing (QE), a policy involving the purchase of government bonds to increase the money supply and lower long-term interest rates.

- Fiscal Policy Interventions: The government might consider fiscal stimulus measures such as tax cuts or increased infrastructure spending to boost aggregate demand and create jobs. Such measures would work in tandem with monetary policy.

- Coordination of Policies: Effective economic management requires coordinated efforts between the Bank of Canada and the federal government. A well-coordinated approach involving both monetary and fiscal policies is crucial to maximize the positive impacts.

- Keywords: fiscal policy Canada, government spending Canada, Bank of Canada policy options, quantitative easing Canada

Conclusion: The Future of Bank of Canada Interest Rates and the Canadian Economy

Economists are increasingly predicting Bank of Canada interest rate reductions in response to tariff-related job losses and a slowing economy. While these reductions could stimulate economic growth and create jobs, they also pose risks, including increased inflation and a weaker Canadian dollar. The Bank of Canada's response will be crucial in navigating these challenges and ensuring the stability of the Canadian economy. The interplay between monetary and fiscal policy will play a pivotal role in determining the effectiveness of the measures taken. To stay informed about the evolving situation and the implications of Bank of Canada interest rate reductions, continue to follow reputable economic news sources and official Bank of Canada publications. Understanding these changes is vital for making informed financial decisions in the current economic climate.

Featured Posts

-

Indy Car Season Opener Palou Takes The Win De Francescos Return

May 12, 2025

Indy Car Season Opener Palou Takes The Win De Francescos Return

May 12, 2025 -

John Wick 5 Keanu Reeves Return And The Franchises Future

May 12, 2025

John Wick 5 Keanu Reeves Return And The Franchises Future

May 12, 2025 -

Payton Pritchards Career Milestone Made More Meaningful By Childhood Memories

May 12, 2025

Payton Pritchards Career Milestone Made More Meaningful By Childhood Memories

May 12, 2025 -

100 000 Bass Fishing Tournament B And W Trailer Hitches Heavy Hitters Event At Smith Mountain Lake Next Week

May 12, 2025

100 000 Bass Fishing Tournament B And W Trailer Hitches Heavy Hitters Event At Smith Mountain Lake Next Week

May 12, 2025 -

Rare Conor Mc Gregor And Adam Sandler Photo Surfaces Happy Gilmore Connection

May 12, 2025

Rare Conor Mc Gregor And Adam Sandler Photo Surfaces Happy Gilmore Connection

May 12, 2025

Latest Posts

-

Tributes Paid At Funeral For Teenager Stabbed At School

May 13, 2025

Tributes Paid At Funeral For Teenager Stabbed At School

May 13, 2025 -

Services Held For 15 Year Old Boy Killed In School Attack

May 13, 2025

Services Held For 15 Year Old Boy Killed In School Attack

May 13, 2025 -

Your Source For Efl Highlights Videos And Analysis

May 13, 2025

Your Source For Efl Highlights Videos And Analysis

May 13, 2025 -

Community Gathers To Remember 15 Year Old Stabbing Victim

May 13, 2025

Community Gathers To Remember 15 Year Old Stabbing Victim

May 13, 2025 -

Efl Highlights Key Moments And Talking Points

May 13, 2025

Efl Highlights Key Moments And Talking Points

May 13, 2025