Effective Use Of Proxy Statements (Form DEF 14A) For Informed Decision-Making

Table of Contents

Decoding the Structure and Key Components of a Proxy Statement (DEF 14A)

A DEF 14A filing typically follows a standardized structure, though the length and complexity vary depending on the company's size and activities. Understanding this structure is the first step in effectively using Proxy Statements (Form DEF 14A). Key sections include:

-

Notice of Meeting: This section outlines the date, time, and location (if applicable) of the shareholder meeting. It also specifies the record date, determining which shareholders are eligible to vote. Pay close attention to this section to ensure you meet any deadlines.

-

Proposals: This is arguably the most important section. Here, you'll find the specific proposals the company is putting before shareholders for a vote. These can include electing directors, approving executive compensation, ratifying auditors, and considering other significant matters affecting the company’s future.

-

Voting Instructions: This section clearly details how to cast your vote—whether it's through online voting, mail-in ballots, or by appointing a proxy to vote on your behalf. Carefully follow these instructions to ensure your vote is counted.

-

Director Information: This section provides biographies and qualifications of the board of directors. Analyze their experience, expertise, and potential conflicts of interest to assess their suitability for overseeing the company.

-

Executive Compensation: This section provides detailed information on the compensation packages of the company's top executives. We will delve deeper into analyzing this section later.

-

Shareholder Proposals: Shareholders can submit proposals for consideration at the annual meeting. These proposals often address significant corporate governance or social responsibility issues.

Key information to extract from each section:

- Identify the company's key proposals and their potential impact.

- Analyze executive compensation packages for reasonableness and alignment with performance.

- Understand shareholder proposals and their implications for the company's strategy and future.

- Review director biographies and qualifications to assess their independence and expertise.

- Assess any potential conflicts of interest among directors or executives.

- Locate the information on voting procedures and ensure you understand how to submit your vote.

Analyzing Executive Compensation and Corporate Governance Practices

The executive compensation section within a DEF 14A is crucial for evaluating corporate governance practices and assessing alignment between executive pay and company performance. Scrutinize this section carefully.

-

Compensation Ratios: Compare the CEO's pay ratio to the median employee's compensation. A significantly high ratio might indicate potential issues with executive pay disparity.

-

Unusual Compensation Arrangements: Look for any unusual or excessive compensation arrangements, such as golden parachutes or excessive bonuses not tied to performance.

-

Compensation Committee Independence: Assess the independence of the compensation committee responsible for setting executive pay. An independent committee is more likely to make objective decisions.

-

Risk Management: Analyze the company's approach to risk management and how it relates to executive compensation. Excessive risk-taking might incentivize executives to prioritize short-term gains over long-term sustainability.

-

Board Effectiveness: Evaluate the effectiveness of the board of directors in overseeing executive compensation and ensuring accountability.

By carefully analyzing these aspects, you gain valuable insights into the company's corporate governance and its commitment to shareholder value.

Identifying and Evaluating Shareholder Proposals

Shareholder proposals offer a direct avenue for shareholders to influence corporate strategy and hold the company accountable. These proposals often focus on Environmental, Social, and Governance (ESG) issues, such as climate change, diversity and inclusion, and executive compensation.

-

Proposal Rationale: Understand the rationale behind each proposal and assess its alignment with your investment goals and values.

-

Risk and Benefit Assessment: Evaluate the potential risks and benefits of each proposal for the company's long-term sustainability and shareholder value.

-

Management Response: Review the management's response to each proposal, paying attention to their arguments for or against the proposal.

-

Investment Alignment: Determine how each proposal aligns with your investment objectives, considering your personal values and risk tolerance.

Using Proxy Statements for Informed Voting Decisions

Informed voting is a critical aspect of responsible investing. Proxy Statements (Form DEF 14A) empower you to cast informed votes on important corporate matters.

-

Voting Rights: Understand your voting rights as a shareholder and how you can exercise them effectively.

-

Voting Methods: Familiarize yourself with the various voting methods (online, mail, proxy) and choose the one that best suits your needs and preferences.

-

Voting Strategy: Develop a voting strategy based on your investment goals and your assessment of the company's performance, governance, and future prospects.

-

Deadline: Ensure you submit your proxy vote on time to ensure your voice is heard. Failing to vote, or voting blindly, forfeits your opportunity to influence the direction of the company.

Conclusion: Mastering Proxy Statements (Form DEF 14A) for Better Investment Outcomes

Effectively using Proxy Statements (Form DEF 14A) is essential for informed decision-making in investing. By carefully analyzing the information contained within these documents, investors can make better-informed voting decisions, hold companies accountable, and ultimately improve their investment outcomes. Don't miss out on leveraging the power of DEF 14A for better investment outcomes – start analyzing proxy statements today!

Featured Posts

-

Instant Withdrawals Why Jack Bit Is The Best Bitcoin Casino

May 17, 2025

Instant Withdrawals Why Jack Bit Is The Best Bitcoin Casino

May 17, 2025 -

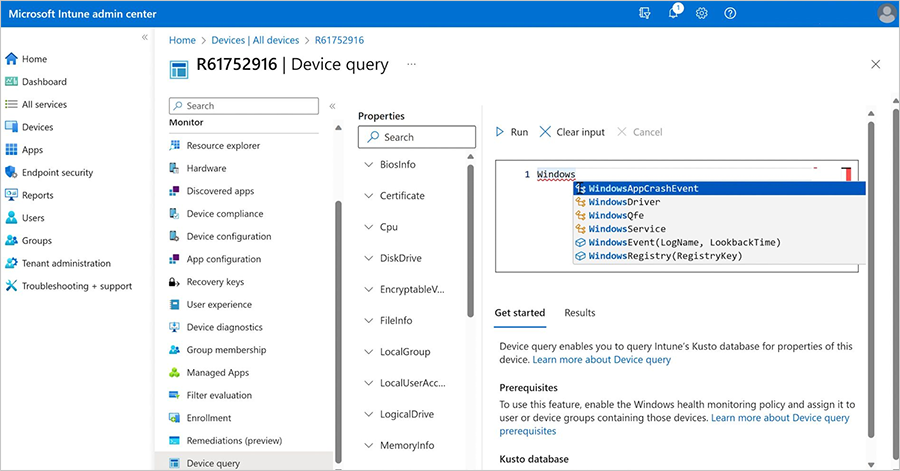

Microsoft Streamlines Surface Which Device Is Next

May 17, 2025

Microsoft Streamlines Surface Which Device Is Next

May 17, 2025 -

Is Melania Trump Still Married To Donald Trump Exploring The Rumors

May 17, 2025

Is Melania Trump Still Married To Donald Trump Exploring The Rumors

May 17, 2025 -

Tigers Vs Mariners Mlb Game Prediction Picks And Betting Odds

May 17, 2025

Tigers Vs Mariners Mlb Game Prediction Picks And Betting Odds

May 17, 2025 -

Fortnites 1000 Day Skin Comeback Item Shop Updates

May 17, 2025

Fortnites 1000 Day Skin Comeback Item Shop Updates

May 17, 2025

Latest Posts

-

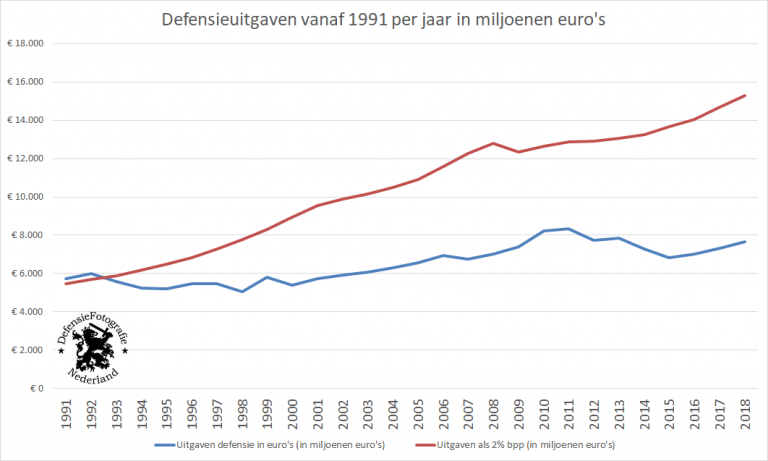

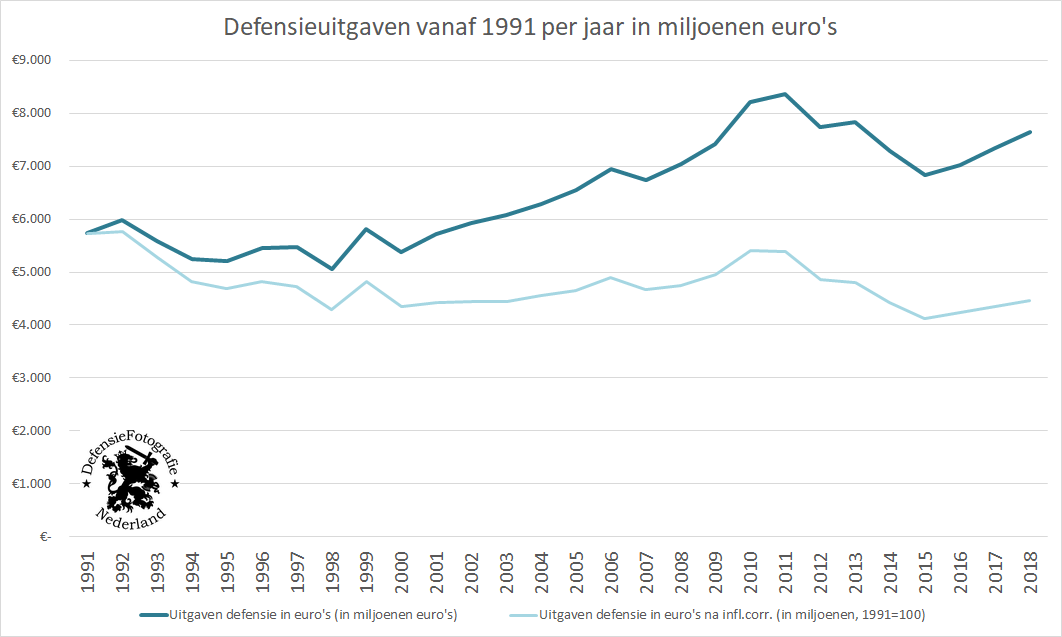

Defensie Industrie Nederland Toekomstgericht En Uitgebreid

May 18, 2025

Defensie Industrie Nederland Toekomstgericht En Uitgebreid

May 18, 2025 -

Discovering The Mining History Of The Switzerland Trail In Boulder County

May 18, 2025

Discovering The Mining History Of The Switzerland Trail In Boulder County

May 18, 2025 -

Meer Steun Voor Groei Nederlandse Defensie Industrie

May 18, 2025

Meer Steun Voor Groei Nederlandse Defensie Industrie

May 18, 2025 -

Uitbreiding Nederlandse Defensie Industrie Een Groeiende Noodzaak

May 18, 2025

Uitbreiding Nederlandse Defensie Industrie Een Groeiende Noodzaak

May 18, 2025 -

Toenemende Internationale Spanningen Stimuleren Steun Voor Nederlandse Defensie

May 18, 2025

Toenemende Internationale Spanningen Stimuleren Steun Voor Nederlandse Defensie

May 18, 2025