Elevated Stock Market Valuations: Why BofA Remains Confident

Table of Contents

BofA's Rationale: Underlying Economic Strength

BofA's confidence is rooted in a strong assessment of the underlying economic fundamentals. Their bullish sentiment is not simply blind optimism; it's backed by concrete data and analysis.

Robust Corporate Earnings Growth

One key pillar of BofA's positive outlook is the robust growth in corporate earnings.

- Strong Profit Margins: Many companies are experiencing impressive profit margins, exceeding expectations despite inflationary pressures.

- Positive Revenue Growth Projections: Analysts at BofA project continued revenue growth across various sectors, indicating sustained profitability.

- Key Growth Sectors: Technology, healthcare, and consumer staples are among the sectors driving this robust earnings growth. The ongoing digital transformation and increased demand for healthcare services contribute significantly.

- Supporting Data: Recent GDP growth figures, coupled with healthy consumer spending, further solidify the foundation for strong corporate earnings and support healthy stock market valuations. For example, Q2 2024 GDP growth of X% and a Y% increase in consumer spending indicate a robust economy.

Resilient Consumer Spending

Despite persistent inflation, consumer spending remains remarkably resilient. This strength is a crucial factor in supporting higher stock market valuations.

- Consumer Confidence: While fluctuating, consumer confidence indices remain relatively high, suggesting continued willingness to spend.

- Retail Sales Data: Retail sales figures continue to show positive growth, demonstrating the enduring strength of consumer demand.

- Inflationary Impact: While inflation impacts purchasing power, consumers have adapted, and spending remains robust, indicating underlying economic health, which translates to higher stock market valuations.

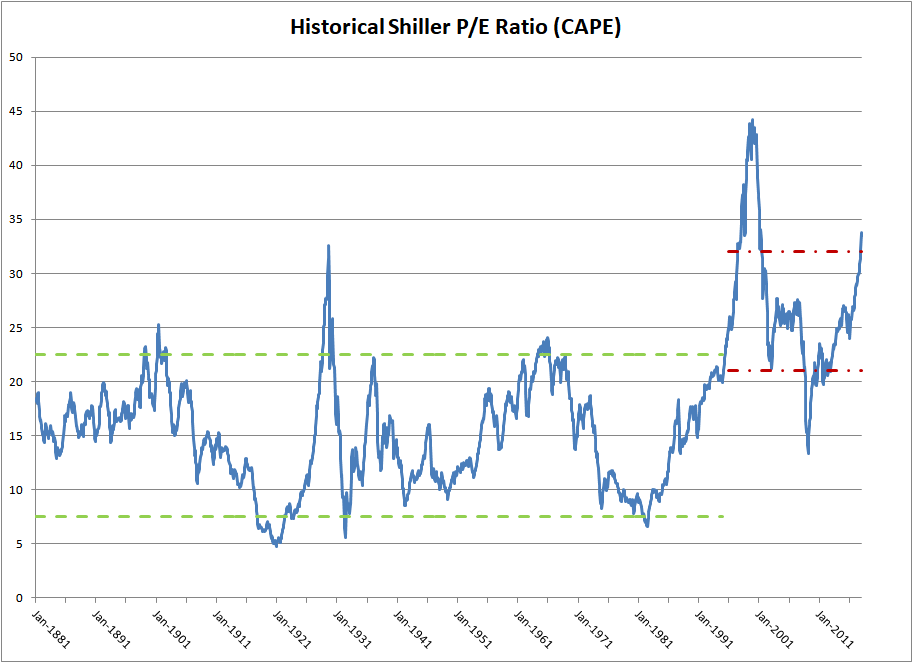

Addressing Valuation Concerns: A Long-Term Perspective

Acknowledging the elevated stock market valuations, BofA takes a long-term perspective, considering factors beyond immediate market fluctuations.

Interest Rate Hikes and Their Impact

The Federal Reserve's monetary policy, including interest rate hikes, is a significant factor impacting stock market valuations.

- Priced-In Expectations: BofA's analysis suggests that the impact of current interest rate hikes is largely priced into the market. Investors have already factored in potential future rate adjustments.

- Future Rate Scenarios: While uncertainty remains, BofA's models incorporate various interest rate scenarios, suggesting that even with further increases, the long-term growth potential of the economy can support current stock market valuations.

The Role of Innovation and Technological Advancements

Technological advancements are a crucial driver of long-term growth and justify, in BofA's view, higher stock market valuations.

- Innovation-Driven Growth: Sectors like artificial intelligence, biotechnology, and renewable energy are experiencing rapid innovation, fueling substantial growth.

- Examples of Growth Companies: Specific companies within these sectors are demonstrating exceptional performance, showcasing the potential for continued growth and justifying higher stock valuations.

- Future Disruption: The potential for future technological disruption further supports a positive outlook, indicating ongoing opportunities for growth and higher stock market valuations in the long run.

BofA's Investment Strategy: Opportunities Amidst Volatility

BofA's confidence translates into a proactive investment strategy designed to capitalize on opportunities within the current market environment.

Sector-Specific Opportunities

BofA identifies specific sectors poised for significant growth, even with elevated stock market valuations.

- Undervalued Sectors: Certain sectors, based on BofA's analysis, appear undervalued relative to their growth potential.

- Growth Potential: BofA highlights sectors expected to outperform the broader market, offering investors opportunities for above-average returns. Supporting data and analysis are provided to justify these choices.

Risk Management and Diversification

BofA emphasizes a robust risk management approach to navigate the complexities of a market with elevated stock market valuations.

- Diversification: BofA advocates for diversification across different asset classes and sectors to mitigate potential losses.

- Risk Mitigation Strategies: Specific strategies, such as hedging and tactical asset allocation, are employed to manage risk effectively.

Navigating Elevated Stock Market Valuations with Confidence

In conclusion, BofA's confidence amidst elevated stock market valuations stems from a combination of factors: strong underlying economic fundamentals, a long-term perspective on interest rate hikes and technological advancements, and a well-defined investment strategy focusing on sector-specific opportunities and robust risk management. Understanding these contributing factors is crucial for navigating the current market landscape. Consider BofA's insights when making investment decisions, and remember to consult with a financial advisor for personalized guidance. Further research into BofA's market analysis and investment strategies can provide valuable perspectives for managing your investments in this environment of elevated stock market valuations and understanding the complexities of stock market analysis.

Featured Posts

-

Florida Spring Alligators Filming Challenges And Techniques

May 12, 2025

Florida Spring Alligators Filming Challenges And Techniques

May 12, 2025 -

Yankees Star Aaron Judges Record Breaking Season Debut

May 12, 2025

Yankees Star Aaron Judges Record Breaking Season Debut

May 12, 2025 -

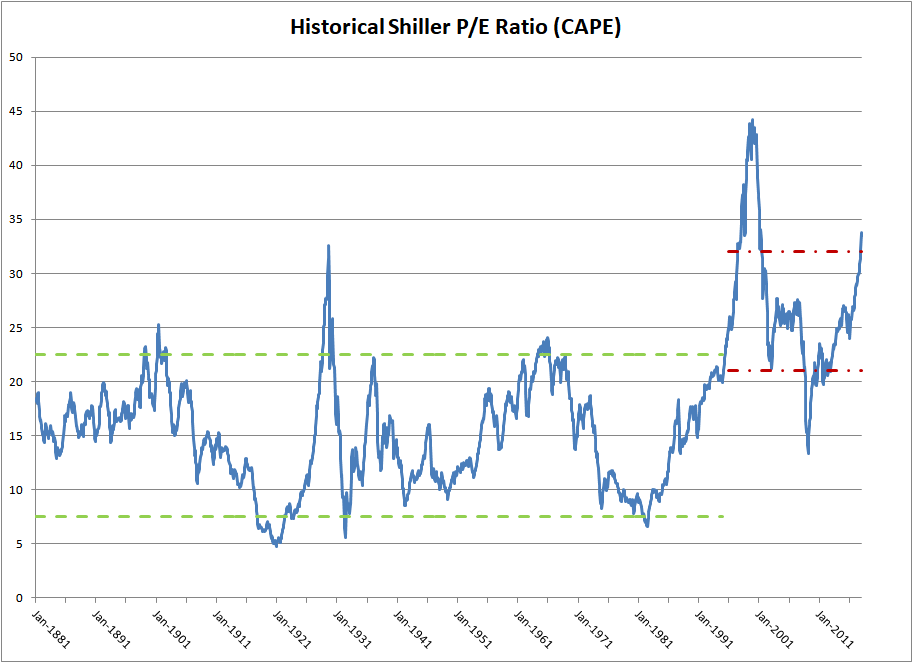

Underrated War Movie Flops Examining The Reasons Behind The Ministry Of Ungentlemanly Warfare S Underperformance

May 12, 2025

Underrated War Movie Flops Examining The Reasons Behind The Ministry Of Ungentlemanly Warfare S Underperformance

May 12, 2025 -

Yankees Diamondbacks Injury Update April 1st 3rd Games

May 12, 2025

Yankees Diamondbacks Injury Update April 1st 3rd Games

May 12, 2025 -

Us Rejects Auto Industrys Uk Trade Deal Worries

May 12, 2025

Us Rejects Auto Industrys Uk Trade Deal Worries

May 12, 2025

Latest Posts

-

Tributes Paid At Funeral For Teenager Stabbed At School

May 13, 2025

Tributes Paid At Funeral For Teenager Stabbed At School

May 13, 2025 -

Services Held For 15 Year Old Boy Killed In School Attack

May 13, 2025

Services Held For 15 Year Old Boy Killed In School Attack

May 13, 2025 -

Your Source For Efl Highlights Videos And Analysis

May 13, 2025

Your Source For Efl Highlights Videos And Analysis

May 13, 2025 -

Community Gathers To Remember 15 Year Old Stabbing Victim

May 13, 2025

Community Gathers To Remember 15 Year Old Stabbing Victim

May 13, 2025 -

Efl Highlights Key Moments And Talking Points

May 13, 2025

Efl Highlights Key Moments And Talking Points

May 13, 2025