Elon Musk's Net Worth: How US Policy Impacts Tesla's CEO Fortune

Table of Contents

Tax Policies and Their Effect on Elon Musk's Wealth

US tax policies play a pivotal role in shaping Elon Musk's net worth, primarily through their impact on Tesla's profitability and Musk's personal investment strategies.

Capital Gains Taxes

Capital gains taxes, levied on profits from the sale of assets like stocks, significantly influence Musk's decisions regarding his Tesla shares.

- High capital gains taxes: Could incentivize Musk to hold Tesla stock longer, reducing the frequency of sales and potentially impacting market fluctuations. A reluctance to sell could lead to less immediate liquidity for Musk, but it might also signal confidence in Tesla's long-term prospects, potentially bolstering investor sentiment.

- Lower capital gains taxes: Could encourage more frequent stock sales, increasing his immediate liquidity. However, increased selling pressure from Musk himself could potentially depress Tesla's stock price, counteracting the benefit of lower taxes.

- Historical Analysis: Examining historical data reveals a correlation between changes in capital gains tax rates and the trading volume of Tesla stock. Periods of lower capital gains taxes have historically coincided with increased trading activity, suggesting a responsiveness to these tax incentives. Further research into this correlation could offer deeper insights into the complex interplay between tax policy and Musk's investment strategies.

Corporate Tax Rates

Corporate tax rates directly impact Tesla's profitability, subsequently affecting the value of Musk's substantial stake in the company.

- Lower corporate taxes: Increase Tesla's profitability, directly increasing the value of Musk’s shares. This translates to a higher net worth for Musk, encouraging investment and expansion.

- Higher corporate taxes: Reduce Tesla's profit margins, potentially impacting Musk's net worth. Increased taxes could limit Tesla's ability to invest in research and development, impacting future growth and long-term profitability.

- Comparative Analysis: A comparison of Tesla's profitability under different corporate tax regimes (where data is available from other countries with differing rates) would provide a valuable quantitative analysis of the tax impact on the company's overall success and valuation, thus impacting Musk's wealth directly.

Environmental Regulations and Tesla's Growth

US environmental regulations significantly influence Tesla's market position and, consequently, Elon Musk's net worth.

Clean Energy Incentives

Government incentives for electric vehicles (EVs) and clean energy technologies are crucial drivers of Tesla's success.

- Tax credits and subsidies for EV purchases: Boost Tesla's sales, positively impacting Musk's net worth. These incentives make EVs more affordable and attractive to consumers, increasing demand for Tesla's products.

- Government investments in charging infrastructure: Further enhance Tesla's market position by improving the convenience and practicality of owning an electric vehicle. This expanded infrastructure reduces range anxiety, a major barrier for potential EV buyers.

- Quantitative Impact: Analyzing sales data before and after the introduction or expansion of EV tax credits clearly demonstrates the positive correlation between government incentives and Tesla's market share and profitability. The magnitude of this impact can be quantified to better understand the financial advantage for Tesla and, by extension, Elon Musk.

Emission Standards

Stricter emission standards create a more favorable market environment for electric vehicles like Tesla's.

- Stricter emission standards: Create a more favorable market for electric vehicles, benefiting Tesla and consequently, Musk's wealth. They make combustion engine vehicles less competitive, driving up demand for electric alternatives.

- Relaxed emission standards: Could reduce Tesla's competitive edge, potentially impacting Musk’s wealth. A less stringent regulatory environment could allow traditional automakers more time and less pressure to transition to electric vehicles, intensifying competition for Tesla.

- Future Growth Projections: The impact of different emission standards on Tesla’s future growth projections can be modeled to highlight the potential variability in Musk’s net worth based on future regulatory decisions.

Infrastructure Investments and Their Ripple Effect

Government investments in infrastructure directly and indirectly influence Tesla's market success and Musk’s wealth.

Government Spending on Infrastructure

Investments in renewable energy infrastructure and transportation networks are critical to Tesla's long-term growth.

- Increased government spending on charging stations and renewable energy sources: Benefits Tesla’s growth by expanding the market for its vehicles and supporting its energy business. This improves accessibility and convenience for EV users.

- Lack of government investment in supporting infrastructure: Can hinder Tesla's expansion and market penetration, making it more challenging to compete with established automakers in regions with limited charging infrastructure.

- Examples of Influence: Government-funded highway projects that include EV charging stations and initiatives promoting renewable energy are clear examples of infrastructure investments that directly and indirectly benefit Tesla's growth.

Space Exploration Policy and SpaceX

US space exploration policies significantly impact SpaceX's success, which indirectly influences Musk's overall net worth.

- Government contracts and funding for space exploration projects: Directly benefit SpaceX, providing crucial funding for research, development, and launch capabilities.

- Changes in space exploration priorities: Can impact SpaceX's funding and growth, indirectly affecting Musk's net worth. Shifting priorities could reduce funding or result in fewer government contracts, affecting SpaceX's revenue and valuation.

- SpaceX and Government Spending: Analyzing the correlation between government spending on space exploration and SpaceX's revenue highlights the crucial relationship between US policy and SpaceX's financial success, a significant component of Elon Musk's overall net worth.

Conclusion

Elon Musk's net worth is inextricably linked to the success of Tesla and SpaceX, and US government policies play a crucial role in shaping that success. From tax policies influencing profitability to environmental regulations driving market demand and infrastructure investments fostering growth, the impact is undeniable. Understanding this complex relationship is key to comprehending the fluctuations in Elon Musk's net worth and the future trajectory of his business empire. To stay informed on how policy impacts this ever-evolving financial landscape, continue researching the effects of US policy on Elon Musk's net worth and the broader electric vehicle and space exploration industries.

Featured Posts

-

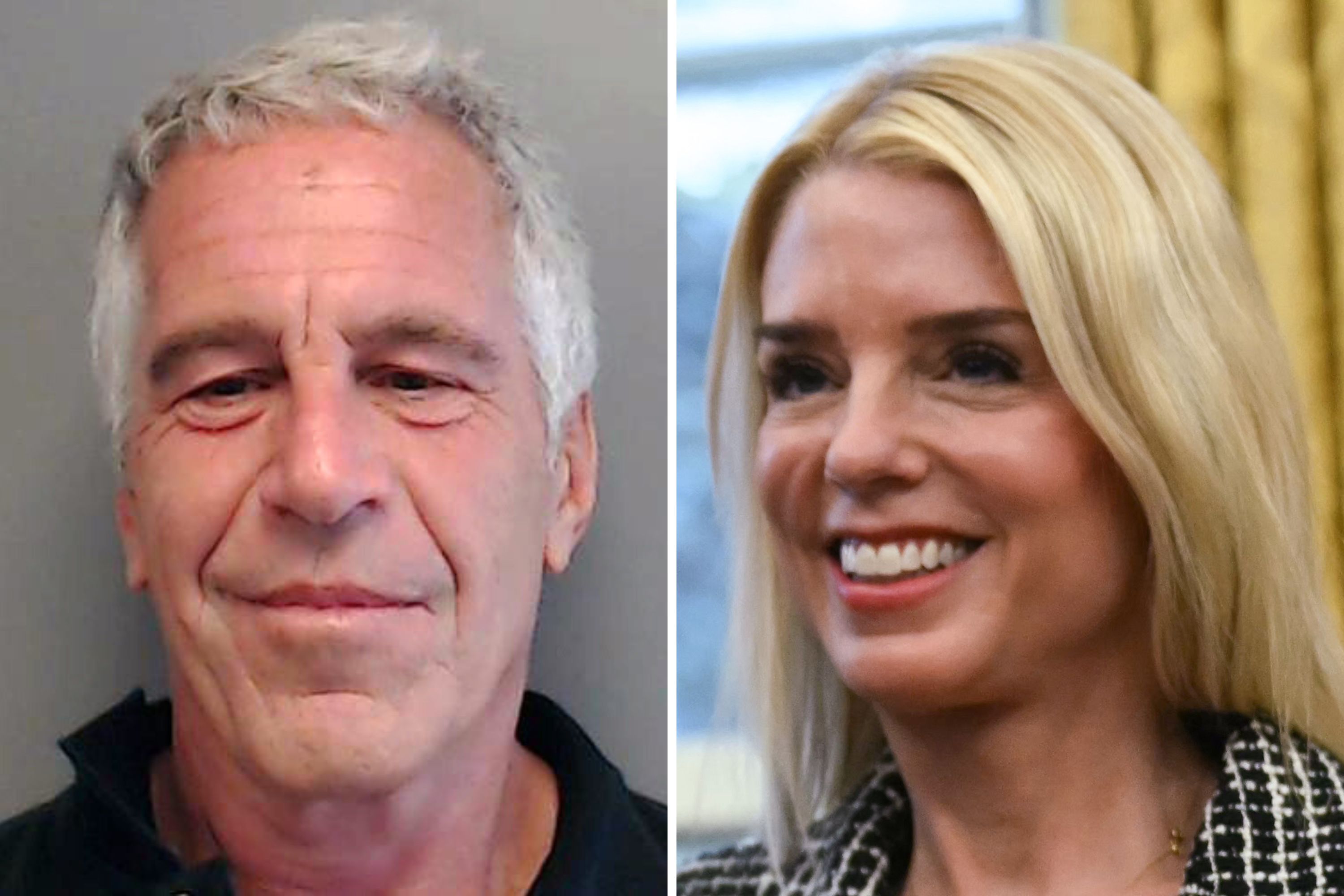

Pam Bondis Claims Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 09, 2025

Pam Bondis Claims Upcoming Release Of Epstein Diddy Jfk And Mlk Files

May 09, 2025 -

100 Days 194 Billion Lost The Cost Of Tech Billionaires Trump Inauguration Support

May 09, 2025

100 Days 194 Billion Lost The Cost Of Tech Billionaires Trump Inauguration Support

May 09, 2025 -

Kholodniy Aprel 2025 V Permi I Permskom Krae Prognoz Pogody So Snegopadami

May 09, 2025

Kholodniy Aprel 2025 V Permi I Permskom Krae Prognoz Pogody So Snegopadami

May 09, 2025 -

Hl Yktb Barys San Jyrman Asmh Fy Sjlat Abtal Awrwba

May 09, 2025

Hl Yktb Barys San Jyrman Asmh Fy Sjlat Abtal Awrwba

May 09, 2025 -

F1 Insider Montoya On Doohans Confirmed F1 Plans

May 09, 2025

F1 Insider Montoya On Doohans Confirmed F1 Plans

May 09, 2025