Energy Price Uncertainty: Experts Warn Of New US Policy Impacts

Table of Contents

The Impact of New Renewable Energy Mandates on Energy Prices

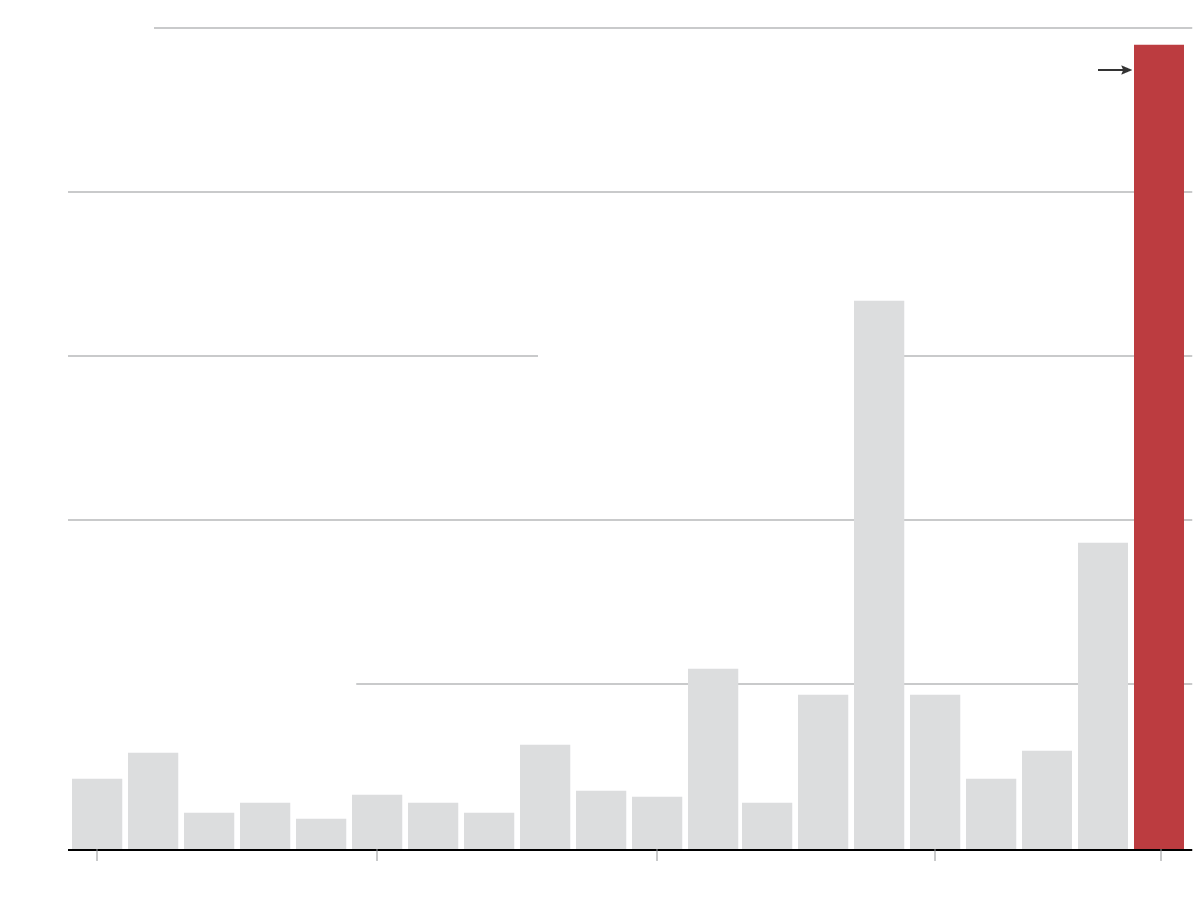

The increasing demand for renewable energy sources, driven by new mandates and a growing commitment to sustainability, is significantly impacting energy costs. While the shift towards cleaner energy is vital for long-term environmental health, the transition presents challenges. The rapid expansion of solar and wind power creates increased demand for raw materials and specialized labor, leading to higher installation and maintenance costs. This increased demand, coupled with potential supply chain disruptions and the inherent intermittency of renewable energy sources, introduces significant price volatility.

- Increased costs of solar panel installation and maintenance: The price of solar panels, while decreasing overall, can still fluctuate based on global supply chains and raw material costs like silicon. Installation and maintenance costs also represent a significant portion of the overall expense.

- Intermittency of renewable energy sources (wind and solar) requiring backup power: The fluctuating nature of solar and wind power requires reliable backup power sources, typically fossil fuels, which adds complexity and cost to the energy grid. This adds to the overall energy price uncertainty.

- Potential job creation in the renewable energy sector offsetting some costs: While costs are rising, the transition to renewable energy is creating jobs in manufacturing, installation, and maintenance, potentially offsetting some of the economic impacts. However, this positive aspect doesn't fully alleviate the energy price uncertainty.

Fossil Fuel Production and Regulation's Role in Energy Price Volatility

Government regulations on fossil fuel production play a crucial role in shaping energy prices. Increased regulations aimed at reducing environmental impact, such as stricter emission standards or limitations on extraction methods, can lead to higher production costs and consequently, higher energy prices. Conversely, reduced regulations might initially lower prices but also increase volatility, making them susceptible to market fluctuations and geopolitical events.

- Impact of environmental regulations on extraction costs: Regulations requiring companies to mitigate environmental damage during extraction processes increase operational expenses, which are passed on to consumers.

- Geopolitical factors influencing fossil fuel availability and prices: Global events, political instability in major oil-producing regions, and international sanctions significantly impact the availability and price of fossil fuels, adding to energy price uncertainty.

- Potential for increased reliance on foreign energy sources: Decreased domestic fossil fuel production due to regulations can lead to increased reliance on foreign energy sources, making the US economy more vulnerable to global price swings and geopolitical instability.

The Influence of Energy Price Uncertainty on the US Economy

The volatility in energy prices has significant consequences for both businesses and consumers. Businesses face increased operational costs, reducing profits and potentially hindering growth. Consumers experience higher living costs, impacting disposable income and overall economic well-being. Long-term energy price uncertainty creates economic instability and hampers investment and long-term planning.

- Impact on inflation and consumer spending: Rising energy prices contribute directly to inflation, reducing consumer purchasing power and potentially triggering a slowdown in economic growth.

- Effect on manufacturing and industrial production: Energy-intensive industries are particularly vulnerable to price fluctuations, impacting production costs and potentially leading to job losses or relocation of facilities.

- Potential for job losses in energy-intensive sectors: Industries heavily reliant on energy, such as manufacturing and transportation, might face reduced competitiveness and potential job losses if energy costs remain volatile and high.

Strategies for Businesses to Manage Energy Price Uncertainty

Businesses can implement several strategies to mitigate the risks associated with volatile energy prices. Proactive planning and risk management are crucial for navigating this uncertainty.

- Diversification of energy sources: Reducing reliance on a single energy source by incorporating renewable energy or alternative fuels can lessen the impact of price fluctuations in any one sector.

- Investment in energy efficiency technologies: Improving energy efficiency through technological upgrades can reduce overall energy consumption and lower costs.

- Negotiating favorable energy contracts: Securing long-term contracts with fixed or capped prices can provide a degree of price certainty and mitigate risks associated with short-term volatility.

Government Policies and Their Intended (and Unintended) Consequences on Energy Prices

Government policies aimed at addressing climate change, such as carbon pricing mechanisms and investments in renewable energy infrastructure, have profound implications for energy costs. While intended to promote sustainability, these policies can also have unintended consequences on energy prices.

- Carbon pricing mechanisms and their impact on energy prices: Carbon taxes or cap-and-trade systems can increase the cost of fossil fuels, potentially leading to higher energy prices for consumers and businesses.

- Investment in energy infrastructure and its long-term cost benefits: Investments in renewable energy infrastructure and smart grids may result in higher upfront costs, but they can also lead to long-term cost savings and improved grid reliability.

- Potential for unintended consequences of policy decisions: Policy decisions can have unforeseen impacts on energy markets. Careful analysis and modeling are crucial to mitigate unintended negative consequences on energy price stability.

Conclusion: Understanding and Addressing Energy Price Uncertainty

New US energy policies significantly contribute to energy price uncertainty through a complex interplay of renewable energy mandates, fossil fuel regulations, and broader economic factors. This volatility poses a considerable challenge to the US economy and its citizens. Understanding the various factors driving energy price uncertainty is crucial for developing effective strategies to mitigate risks and promote both economic stability and environmental sustainability. We need balanced policies that foster innovation in renewable energy while ensuring a stable and affordable energy supply. Stay informed about the latest developments in energy policy and how to mitigate the risks associated with energy price uncertainty, including strategies for managing energy price uncertainty and predicting energy price uncertainty to protect your business and your future.

Featured Posts

-

Another Day Of School Closures Due To Severe Winter Weather

May 30, 2025

Another Day Of School Closures Due To Severe Winter Weather

May 30, 2025 -

Citywide Curfew Following Fatal Shooting Of Baylor Football Player Alex Foster

May 30, 2025

Citywide Curfew Following Fatal Shooting Of Baylor Football Player Alex Foster

May 30, 2025 -

Slight Rise In Us Measles Cases Total Reaches 1 046

May 30, 2025

Slight Rise In Us Measles Cases Total Reaches 1 046

May 30, 2025 -

The Bts Reunion Teaser A Deep Dive Into Comeback Possibilities

May 30, 2025

The Bts Reunion Teaser A Deep Dive Into Comeback Possibilities

May 30, 2025 -

Monte Carlo Masters 2025 Final Preview Alcaraz Vs Musetti

May 30, 2025

Monte Carlo Masters 2025 Final Preview Alcaraz Vs Musetti

May 30, 2025

Latest Posts

-

Deutsche Stadt Bietet Kostenlose Unterkuenfte Fuer Neubuerger An

May 31, 2025

Deutsche Stadt Bietet Kostenlose Unterkuenfte Fuer Neubuerger An

May 31, 2025 -

Kostenlose Unterkunft Lockt Neue Bewohner In Diese Deutsche Stadt

May 31, 2025

Kostenlose Unterkunft Lockt Neue Bewohner In Diese Deutsche Stadt

May 31, 2025 -

Former Nypd Chief Kerik Hospitalized Doctors Expect Full Recovery

May 31, 2025

Former Nypd Chief Kerik Hospitalized Doctors Expect Full Recovery

May 31, 2025 -

Former Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025

Former Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025 -

Etoiles De Mer Et Droits Du Vivant Une Question De Justice Environnementale

May 31, 2025

Etoiles De Mer Et Droits Du Vivant Une Question De Justice Environnementale

May 31, 2025