Equifax's (EFX) Strong Q[Quarter] Earnings: Profit Exceeds Forecasts

![Equifax's (EFX) Strong Q[Quarter] Earnings: Profit Exceeds Forecasts Equifax's (EFX) Strong Q[Quarter] Earnings: Profit Exceeds Forecasts](https://wjuc2010.de/image/equifaxs-efx-strong-q-quarter-earnings-profit-exceeds-forecasts.jpeg)

Table of Contents

Strong Revenue Growth Fuels Equifax's Q3 Performance

Equifax's Q3 financial performance was fueled by robust revenue growth, showcasing the company's resilience and strategic success. Year-over-year revenue growth significantly outpaced analysts' forecasts.

-

Overall Revenue Growth: Equifax reported a [Insert Percentage]% increase in total revenue compared to Q3 2022. This impressive growth reflects a strong demand for Equifax's credit reporting and data analytics services.

-

Segment Performance: The US Consumer segment experienced a [Insert Percentage]% increase in revenue, driven by increased consumer lending activity and the expansion of its data and analytics solutions. The International segment also performed strongly, with a [Insert Percentage]% revenue increase, highlighting Equifax's global reach and market penetration.

-

Driving Factors: This exceptional revenue growth can be attributed to several factors, including the recovery in the overall economy, increased consumer spending, and the continued growth of Equifax's data analytics business. The company's strategic investments in technology and its ability to leverage big data analytics have also played a crucial role.

-

Macroeconomic Impact: While macroeconomic headwinds like inflation and interest rate hikes present challenges, Equifax has shown resilience, effectively navigating these complex conditions and capitalizing on opportunities within the market.

Profitability Surpasses Analyst Expectations

Equifax's Q3 profitability not only met but significantly surpassed analyst expectations. The robust revenue growth translated into exceptional earnings per share (EPS).

-

EPS and Analyst Estimates: Equifax reported an EPS of $[Insert EPS], exceeding the consensus analyst estimate of $[Insert Analyst Estimate] by [Insert Percentage]%. This substantial beat reflects Equifax's efficient cost management and operational excellence.

-

Factors Contributing to Profitability: The impressive profitability is a result of several key factors, including effective cost-cutting measures, improved operational efficiency, and the successful implementation of new revenue-generating strategies. Margin expansion also contributed significantly to the improved bottom line.

-

Stock Price Impact: The positive earnings announcement triggered a [Insert Percentage]% increase in Equifax's stock price, reflecting investor confidence in the company's future performance and financial strength.

-

Profit Margin: Equifax's profit margin experienced a notable increase, demonstrating the effectiveness of its cost management strategies and the high value of its services.

Key Insights into Equifax's Future Outlook

Equifax's Q3 earnings provide a positive outlook for the remainder of 2023 and beyond. The company's guidance reinforces this optimistic perspective.

-

Guidance: Equifax provided guidance for Q4 2023 and the full year 2023, indicating continued growth in revenue and profitability. [Insert specific details from the guidance].

-

Economic Climate: Management's commentary acknowledged the ongoing macroeconomic uncertainties but expressed confidence in Equifax's ability to navigate these challenges and maintain its growth trajectory.

-

Strategic Investments: Equifax is investing in new technologies and expanding its data analytics capabilities to further drive growth and strengthen its market position. This proactive approach highlights the company's commitment to innovation and long-term success.

-

Potential Risks: While the outlook is positive, Equifax acknowledged potential risks such as increased competition, regulatory changes, and economic downturns. However, the company's strong financial position and diversified business model are expected to mitigate these risks.

Data Analytics Segment Drives Growth

Equifax's data analytics segment continues to be a key driver of growth, contributing significantly to both revenue and profitability.

-

Segment Contribution: The data analytics segment reported strong growth, showcasing the increasing demand for its consumer insights and business solutions.

-

Successful Solutions: Equifax highlighted the success of specific data analytics solutions and their impact on various industries. [Insert specific examples].

-

Market Trends: The company's strategic focus on leveraging big data and advanced analytics positions it favorably to capitalize on emerging market trends and maintain its leadership position.

Conclusion:

Equifax's (EFX) Q3 2023 earnings report delivered a significant positive surprise, showcasing strong revenue growth of [Insert Percentage]% and an EPS of $[Insert EPS] that significantly exceeded analyst expectations. The company's robust performance reflects its efficient operations, strategic investments, and strong market position in credit reporting and data analytics. The positive outlook provided by Equifax's management, coupled with its planned investments, suggests continued growth and success. Stay informed about Equifax (EFX)'s future performance by following their investor relations updates and consider Equifax (EFX) earnings as a key factor in your investment decisions. Visit the Equifax investor relations website for further details.

![Equifax's (EFX) Strong Q[Quarter] Earnings: Profit Exceeds Forecasts Equifax's (EFX) Strong Q[Quarter] Earnings: Profit Exceeds Forecasts](https://wjuc2010.de/image/equifaxs-efx-strong-q-quarter-earnings-profit-exceeds-forecasts.jpeg)

Featured Posts

-

Pierre Poilievre From 20 Point Lead To Election Loss What Happened

Apr 23, 2025

Pierre Poilievre From 20 Point Lead To Election Loss What Happened

Apr 23, 2025 -

The Ultimate Guide To Removing Your Online Presence

Apr 23, 2025

The Ultimate Guide To Removing Your Online Presence

Apr 23, 2025 -

Solutions 30 Analyse Boursiere Et Previsions De Cours

Apr 23, 2025

Solutions 30 Analyse Boursiere Et Previsions De Cours

Apr 23, 2025 -

Gestion Du Portefeuille Bfm L Arbitrage Du 17 Fevrier

Apr 23, 2025

Gestion Du Portefeuille Bfm L Arbitrage Du 17 Fevrier

Apr 23, 2025 -

Calendario Laboral Espana Festivo 21 De Abril Y Puente Para 16 5 Millones

Apr 23, 2025

Calendario Laboral Espana Festivo 21 De Abril Y Puente Para 16 5 Millones

Apr 23, 2025

Latest Posts

-

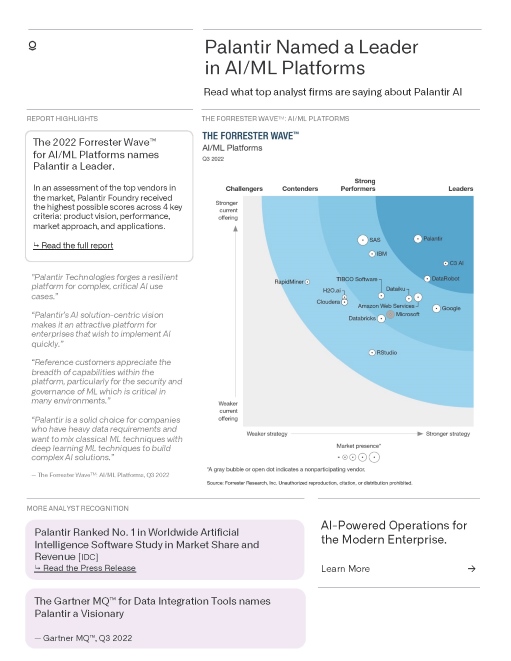

Predicting The Future Palantirs Impact On Public Sector Ai With Its Nato Deal

May 10, 2025

Predicting The Future Palantirs Impact On Public Sector Ai With Its Nato Deal

May 10, 2025 -

Government And Commercial Business Drive Palantir Stock Performance In Q1 2024

May 10, 2025

Government And Commercial Business Drive Palantir Stock Performance In Q1 2024

May 10, 2025 -

How Palantirs Nato Partnership Will Transform Public Sector Ai

May 10, 2025

How Palantirs Nato Partnership Will Transform Public Sector Ai

May 10, 2025 -

Palantirs Q1 2024 Financial Results A Deep Dive Into Government And Commercial Sectors

May 10, 2025

Palantirs Q1 2024 Financial Results A Deep Dive Into Government And Commercial Sectors

May 10, 2025 -

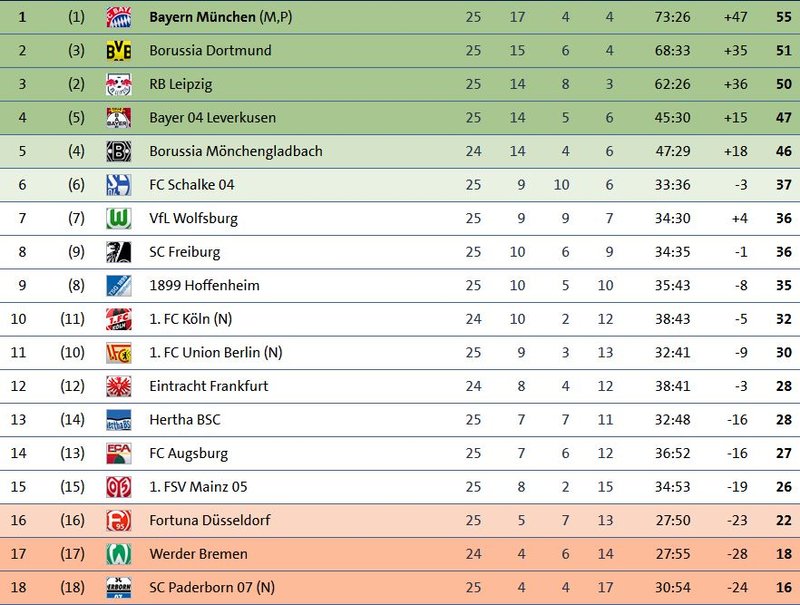

Bundesliga 2 Ergebnisse Und Tabelle Nach Spieltag 27 Koeln Auf Platz 1

May 10, 2025

Bundesliga 2 Ergebnisse Und Tabelle Nach Spieltag 27 Koeln Auf Platz 1

May 10, 2025