Eramet CEO: China's Lithium Tech Export Curbs Could Be Beneficial

Table of Contents

Eramet's Strategic Positioning in the Lithium Market

Eramet is strategically positioned to capitalize on the shifting dynamics of the lithium market. The company boasts significant existing capabilities and a forward-looking investment strategy.

Eramet's existing lithium production and refining capabilities

- Significant lithium mining operations in Australia: Contributing substantially to Eramet's overall lithium production.

- State-of-the-art lithium refining facilities in France: Utilizing sustainable practices and ensuring high-quality battery materials.

- Production capacity continually expanding: Eramet is actively pursuing projects to increase its lithium production capacity, aiming to meet the growing global demand. This includes both organic growth and strategic acquisitions. This expansion focuses on sustainable lithium mining practices, minimizing environmental impact.

- Growing market share: Eramet is steadily increasing its global market share of lithium production and refining, becoming a major player in the sustainable lithium sector.

Eramet's commitment to responsible sourcing and sustainable lithium mining practices sets it apart in a market increasingly focused on ethical and environmentally friendly production.

Eramet's investment in lithium technology and downstream processing

- Strategic partnerships with battery manufacturers: Collaboration on the development and supply of advanced cathode materials for lithium-ion batteries.

- Significant R&D investments in lithium-ion battery technologies: Focusing on next-generation battery technologies and innovative cathode material development.

- Expansion plans into downstream processing: Eramet is actively investing in expanding its capabilities in lithium-ion battery production, encompassing cathode materials and advanced battery technology.

These investments demonstrate Eramet's long-term commitment to the lithium value chain, positioning the company for substantial growth even amidst China's export restrictions.

Analysis of China's Lithium Technology Export Curbs

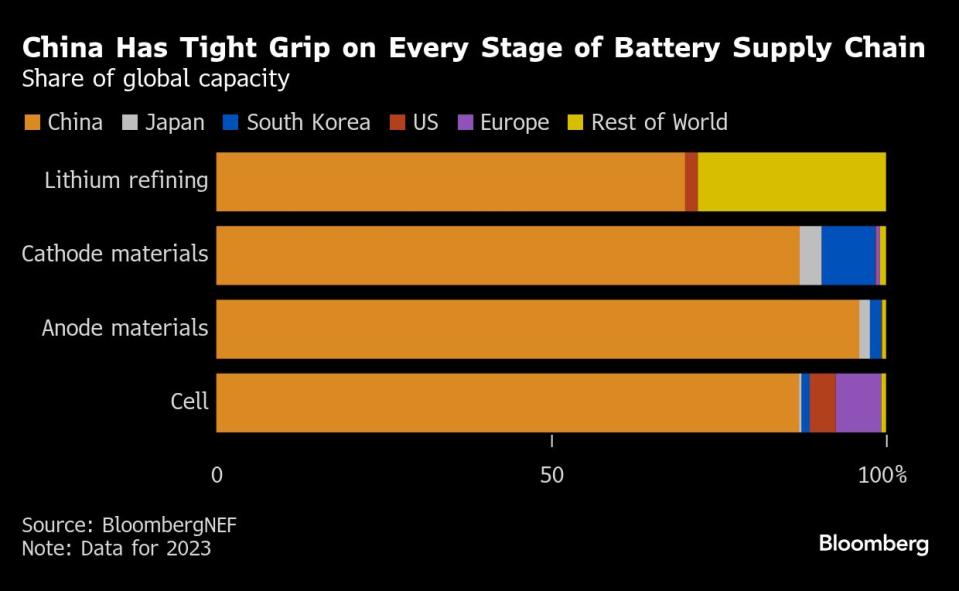

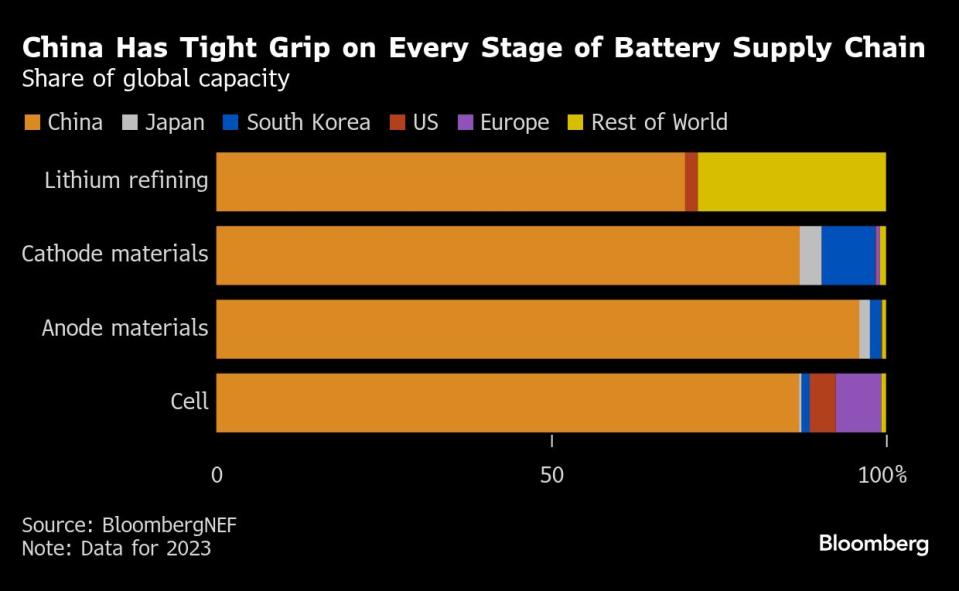

China's recent export curbs on key lithium technologies represent a significant development in the global lithium landscape.

The rationale behind China's export restrictions

- Securing domestic lithium supply: Ensuring sufficient lithium resources for its own rapidly growing electric vehicle (EV) industry.

- Technological leadership: Protecting its advanced lithium-ion battery technology from foreign competition.

- Geopolitical strategies: Using lithium as a strategic resource to influence global markets and leverage its technological dominance.

These restrictions have already begun to impact the global lithium market, creating both challenges and opportunities.

Potential negative consequences of these curbs

- Supply chain disruptions: The potential for delays and shortages of key components for lithium-ion battery production.

- Lithium price volatility: Increased price fluctuations due to limited supply and increased demand.

- Impact on global battery production: Potentially slower growth in the global EV industry due to constrained access to essential battery components.

The short-term effects are already being felt, with price increases and supply chain anxieties. The long-term effects remain to be seen, but will undoubtedly reshape the global landscape.

Eramet CEO's Argument for Potential Benefits

Eramet's CEO believes that China's export curbs, while presenting initial challenges, could ultimately create significant opportunities.

Diversification and localization of lithium production

- Incentivizing investment in other regions: The curbs are pushing companies to explore and develop lithium resources outside of China, leading to greater diversification of the lithium supply chain.

- Regional lithium production hubs: The emergence of new regional lithium production centers, reducing reliance on China for key raw materials.

- Strengthening global lithium supply resilience: A more geographically diverse supply chain reduces vulnerability to disruptions in any single region.

This diversification directly benefits Eramet's strategy by providing access to a more robust and less centralized supply chain.

Accelerated innovation and technological advancements outside of China

- Stimulating R&D investment: Companies are investing more heavily in R&D to develop alternative technologies and supply chains, fostering innovation in the industry.

- Development of sustainable lithium technologies: The push for independence from China is accelerating the development of environmentally sustainable and ethically sourced lithium technologies.

- Enhanced battery technology development: This accelerated innovation benefits the entire industry and, in turn, Eramet's ability to provide cutting-edge solutions.

This increased innovation is directly beneficial to Eramet, enabling it to compete with and potentially surpass Chinese technologies.

Enhanced market opportunities for Eramet

- Increased demand for lithium from outside of China: The growing need for alternative lithium sources presents a significant opportunity for companies like Eramet.

- Strengthening Eramet's market position: Eramet is well-positioned to capitalize on the increased demand and supply chain disruptions.

- Attractive investment opportunities: The current market dynamics present lucrative investment opportunities for companies with strong positions in the lithium value chain.

Eramet can leverage its existing capabilities and strategic investments to become a leading supplier in this new, diversified market.

Conclusion: Eramet CEO's Positive Outlook on China's Lithium Export Restrictions

The Eramet CEO's perspective highlights the potential for positive change brought about by China's lithium technology export curbs. Key takeaways include the diversification of lithium production, accelerated innovation in battery technologies, and enhanced market opportunities for companies like Eramet that are prepared to seize this moment. The long-term impact of China's policy will continue to shape the lithium market landscape. To learn more about Eramet's strategy and the evolving dynamics within the lithium industry, please visit their website or follow their news for updates on "Eramet's lithium strategy" and "China's impact on the lithium market," ultimately gaining insight into the "future of the lithium industry."

Featured Posts

-

Dokovicev Uspon Preuzimanje Federerove Dominacije

May 14, 2025

Dokovicev Uspon Preuzimanje Federerove Dominacije

May 14, 2025 -

Speeding Ticket For Tommy Fury Days After Molly Mae Hague Separation

May 14, 2025

Speeding Ticket For Tommy Fury Days After Molly Mae Hague Separation

May 14, 2025 -

Droits De Vote Eramet Acces Aux Donnees Et Informations Officielles

May 14, 2025

Droits De Vote Eramet Acces Aux Donnees Et Informations Officielles

May 14, 2025 -

Snow Whites Opening Weekend A Critical And Commercial Failure

May 14, 2025

Snow Whites Opening Weekend A Critical And Commercial Failure

May 14, 2025 -

Soaring Swiss Franc A Financial Headache For Eurovision Fans

May 14, 2025

Soaring Swiss Franc A Financial Headache For Eurovision Fans

May 14, 2025

Latest Posts

-

Liverpools Summer Transfer Plans Teammates Confirmation

May 14, 2025

Liverpools Summer Transfer Plans Teammates Confirmation

May 14, 2025 -

Summer Move All But Confirmed For Liverpool Targets Teammate

May 14, 2025

Summer Move All But Confirmed For Liverpool Targets Teammate

May 14, 2025 -

Donny Huijsen Johan Derksen Praat Over De Vader Van Dean Huijsen En Zijn Verkeerde Vrienden In Vandaag Inside

May 14, 2025

Donny Huijsen Johan Derksen Praat Over De Vader Van Dean Huijsen En Zijn Verkeerde Vrienden In Vandaag Inside

May 14, 2025 -

Is June 14th The Day Dean Huijsen Joins Chelsea

May 14, 2025

Is June 14th The Day Dean Huijsen Joins Chelsea

May 14, 2025 -

Liverpool Transfer News Teammate All But Confirms Summer Signing

May 14, 2025

Liverpool Transfer News Teammate All But Confirms Summer Signing

May 14, 2025