Escape To The Country: Financing Your Rural Property Purchase

Table of Contents

Understanding Rural Property Financing Challenges

Rural properties present a unique set of financing challenges compared to their urban counterparts. Lenders often view rural properties as higher-risk investments due to several factors:

- Higher Interest Rates: Expect potentially higher interest rates on rural property loans compared to urban loans due to perceived increased risk.

- Stricter Lending Criteria: Lenders often have stricter requirements for loan approval, demanding higher credit scores, larger down payments, and more comprehensive financial documentation.

- Appraisals that May Undervalue the Property: Appraisals in rural areas can sometimes undervalue properties due to a lower number of comparable sales, potentially impacting your loan amount.

- Limited Availability of Lenders Specializing in Rural Properties: Finding lenders with experience and expertise in rural property financing can be more difficult than in urban areas.

- Difficulties Securing Financing for Land Without Existing Structures: Financing vacant land or land with minimal improvements can be particularly challenging, as lenders require more assurance of the property's value.

Thorough research and preparation are crucial to navigate these challenges successfully. Understanding these potential hurdles is the first step towards a smooth financing process for your rural property.

Exploring Different Financing Options

Several financing options exist for purchasing rural properties, each with its own advantages and disadvantages:

-

Conventional Mortgages: These mortgages are offered by traditional banks and mortgage companies. Eligibility generally requires a good credit score (typically above 680), a substantial down payment (often 20% or more for rural properties), and stable income. Interest rates are subject to market fluctuations and your creditworthiness. They may be harder to obtain for rural properties due to appraisal challenges.

-

USDA Rural Development Loans: The USDA (United States Department of Agriculture) offers loans specifically designed to assist individuals in purchasing rural properties. These "USDA loans for rural properties" are attractive because they often require smaller down payments or even no down payment in some cases. Eligibility is based on income limits and the property's location within a designated rural area. The application process involves proving eligibility and meeting USDA guidelines. Search for "USDA loans for rural properties" for more detailed information.

-

Farm Credit Loans: If you're purchasing agricultural land or property, Farm Credit banks and associations provide financing options specifically tailored for agricultural purposes. These "farm loans" and "agricultural financing" options often have more flexible terms for those involved in farming or ranching operations. Eligibility usually depends on the type of agricultural operation and the property’s suitability for agricultural use.

-

Private Lenders and Banks: Some private lenders and smaller regional banks offer financing for rural properties. However, it's crucial to conduct thorough due diligence to ensure their legitimacy and understand their lending terms and fees. Interest rates and loan requirements can vary significantly.

-

Seller Financing: In some cases, the seller of the rural property may offer financing. This can be beneficial if you have difficulty securing traditional financing but should be approached cautiously, ensuring you fully understand the terms of the agreement.

Improving Your Chances of Approval

A strong financial profile significantly increases your chances of securing financing for your rural property. Consider these actions:

- Maintain a Good Credit Score: A high credit score demonstrates your creditworthiness and significantly improves your loan application's success rate. Aim for a score above 700.

- Save for a Substantial Down Payment: Rural property loans frequently require higher down payments (20% or more) compared to urban properties. Saving a larger down payment showcases your commitment and reduces the lender's risk.

- Secure Pre-Approval from a Lender Before Starting Your Property Search: Pre-approval provides you with a clear understanding of your borrowing power and strengthens your position when making an offer on a property.

- Prepare a Detailed Financial Plan: Showcasing your ability to repay the loan through a well-documented financial plan, including income statements, debt obligations, and future financial projections, builds confidence with lenders.

- Find a Lender Experienced in Rural Property Financing: Seek out lenders with expertise in rural markets. They understand the nuances and challenges associated with rural property financing.

Essential Considerations for Rural Property Buyers

Beyond financing, several essential factors impact the viability of buying rural property:

- Property Taxes and Insurance Costs: Property taxes and insurance costs in rural areas can be considerably higher than in urban areas, significantly impacting your overall expenses.

- Maintenance and Upkeep: Rural properties often require more extensive and costly maintenance and upkeep compared to urban properties. Consider the potential for higher repair costs and the increased responsibilities of homeownership in a rural setting.

- Distance to Services and Amenities: Evaluate the distance to essential services like hospitals, schools, and grocery stores. This distance can impact your lifestyle and potentially add expenses related to travel.

- Potential Impact of Property Value Fluctuations: Rural property markets can experience greater fluctuations in value compared to urban markets. Understanding this potential volatility is crucial.

Working with a Real Estate Agent Specialized in Rural Properties

Partnering with a real estate agent experienced in rural property transactions provides invaluable support. They can:

- Identify Suitable Properties: They have a deep understanding of the rural market and can help you find properties that meet your needs and budget.

- Navigate the Financing Process: They can guide you through the complexities of rural property financing, connecting you with appropriate lenders and helping you prepare the necessary documentation.

- Understand Local Market Conditions: Their knowledge of local market conditions, including property values, tax rates, and regulations, provides you with crucial insights.

Realizing Your Escape to the Country

Successfully financing your rural property purchase requires meticulous planning, thorough research into different financing options, and seeking expert advice from lenders and real estate agents specializing in rural properties. By understanding the challenges and preparing effectively, you can significantly increase your chances of securing the financing you need to realize your dream. Begin your escape to the country journey today by exploring the various financing options available, researching lenders, and contacting a real estate agent specializing in rural properties. Securing your country property is a significant undertaking, but with the right preparation and guidance, financing your rural dream is achievable!

Featured Posts

-

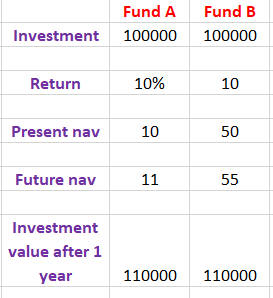

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Green Spaces And Mental Wellbeing A Seattle Womans Pandemic Story

May 24, 2025

Green Spaces And Mental Wellbeing A Seattle Womans Pandemic Story

May 24, 2025 -

Escape To The Country A Relaxing Break From City Life

May 24, 2025

Escape To The Country A Relaxing Break From City Life

May 24, 2025 -

Lady Gaga And Michael Polanskys Couples Appearance At Snl Afterparty

May 24, 2025

Lady Gaga And Michael Polanskys Couples Appearance At Snl Afterparty

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Daily Nav Updates And Analysis

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav Updates And Analysis

May 24, 2025

Latest Posts

-

La Caduta Delle Borse La Reazione Dell Ue Ai Nuovi Dazi

May 24, 2025

La Caduta Delle Borse La Reazione Dell Ue Ai Nuovi Dazi

May 24, 2025 -

11 Drop Amsterdam Stock Exchanges Continued Market Downturn

May 24, 2025

11 Drop Amsterdam Stock Exchanges Continued Market Downturn

May 24, 2025 -

Dazi E Mercati L Unione Europea Di Fronte Al Crollo Delle Borse

May 24, 2025

Dazi E Mercati L Unione Europea Di Fronte Al Crollo Delle Borse

May 24, 2025 -

Three Day Slide Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025

Three Day Slide Amsterdam Stock Exchange Experiences Significant Losses

May 24, 2025 -

Guerra Dei Dazi Le Borse Crollano La Ue Risponde

May 24, 2025

Guerra Dei Dazi Le Borse Crollano La Ue Risponde

May 24, 2025