ETFs To Consider: Capitalizing On Uber's Autonomous Driving Technology

Table of Contents

Understanding the Autonomous Driving Market and Uber's Role

The autonomous vehicle market is poised for explosive growth. Analysts predict a massive expansion in the coming decades, transforming transportation and logistics as we know it. This burgeoning market presents significant investment opportunities. Uber, through its Advanced Technologies Group (Uber ATG), is a key player, heavily investing in the research, development, and deployment of self-driving technology. Uber ATG's progress, while facing challenges, signifies a substantial commitment to this transformative sector. Uber's existing infrastructure and vast network of drivers provide a significant competitive advantage as it transitions towards a fully autonomous fleet.

- Market size projections for autonomous vehicles: Estimates range from hundreds of billions to trillions of dollars in market value by 2030, depending on the adoption rate and technological advancements.

- Uber's competitive advantages in the autonomous driving sector: Existing user base, extensive mapping data, and a strong brand presence provide a significant head start.

- Potential impact of autonomous vehicles on various industries: Revolutionizing transportation, logistics, delivery services, and potentially even impacting urban planning and infrastructure development. This ripple effect creates investment opportunities across various related sectors.

Identifying Relevant ETFs for Exposure to Autonomous Driving

Gaining exposure to the autonomous driving market requires a strategic approach. Diversification across different ETF categories is crucial due to the inherent risks in this emerging technology. Here are some ETF categories and examples to consider:

-

Technology ETFs focusing on AI and robotics: These ETFs often hold companies developing crucial components for autonomous vehicles, such as sensors, software, and AI algorithms. For example, the ROBO Global Robotics and Automation Index ETF (ROBO) invests in a diverse range of companies involved in robotics and automation, many of which contribute to the autonomous vehicle ecosystem. Its holdings include companies developing crucial AI and sensor technologies.

-

Transportation ETFs with exposure to autonomous vehicle development: While a dedicated "DRIV" ETF (hypothetical example) doesn't currently exist, some transportation ETFs might have significant exposure to companies involved in autonomous vehicle development. Look for ETFs with holdings in companies producing autonomous driving systems or related technologies. Carefully review the ETF holdings to ensure significant exposure to this specific area.

-

Broad market ETFs with significant Uber holdings: ETFs like the Invesco QQQ Trust (QQQ), which tracks the Nasdaq-100 index, offer indirect exposure to Uber. While the exposure might be less focused than sector-specific ETFs, it can provide diversification and a broader market perspective. Check the ETF's holdings to assess the proportion of your investment dedicated to Uber.

Analyzing ETF Holdings and Performance

Before investing, thoroughly analyze the ETF holdings to ensure alignment with your investment strategy and risk tolerance. Review the ETF fact sheet and prospectus carefully. Compare the expense ratios, historical returns, and risk profiles of different ETFs. Remember that past performance doesn't guarantee future results.

- Tips on analyzing ETF fact sheets and prospectuses: Pay close attention to the top 10 holdings, sector allocation, and geographical diversification.

- Importance of considering risk tolerance when selecting ETFs: Autonomous driving is a high-growth, high-risk sector. Choose ETFs aligning with your comfort level with volatility.

- Guidance on comparing expense ratios among different ETFs: Lower expense ratios translate to higher returns over the long term.

Managing Risk and Diversification in Autonomous Vehicle Investments

Investing in emerging technologies like autonomous driving carries inherent risks. Regulatory hurdles, technological challenges, and intense competition can significantly impact investment returns. Diversification is key to mitigating these risks. Consider a diversified portfolio strategy combining several ETF types – technology, transportation, and even broader market ETFs – to reduce exposure to any single sector's volatility.

- Risks specific to the autonomous driving sector: Regulatory uncertainty, technological setbacks, safety concerns, and potential for market disruption by unexpected technological breakthroughs.

- Benefits of a diversified portfolio approach: Reduced risk, improved returns over the long term, and protection from significant losses in any one sector.

- Strategies for managing risk in volatile markets: Dollar-cost averaging, regular portfolio rebalancing, and setting realistic return expectations.

Conclusion

Investing in the autonomous driving revolution, particularly through ETFs that offer exposure to companies like Uber and its technological advancements, presents significant opportunities. However, understanding the risks and diversifying your portfolio across relevant ETF categories—including technology, robotics, and transportation ETFs—is crucial. By carefully researching and selecting ETFs that align with your investment goals and risk tolerance, you can strategically position yourself to capitalize on this transformative industry. Start capitalizing on the autonomous driving revolution today by researching the ETFs discussed and building a diversified portfolio that includes exposure to companies like Uber and other key players. Remember to conduct thorough due diligence before investing in any ETF related to autonomous driving technology.

Featured Posts

-

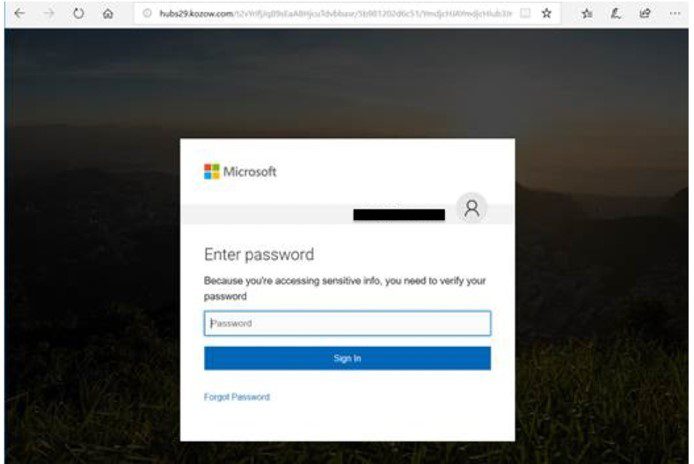

Large Scale Office365 Hack Leads To Multi Million Dollar Loss For Businesses

May 19, 2025

Large Scale Office365 Hack Leads To Multi Million Dollar Loss For Businesses

May 19, 2025 -

Espionage Probe Youtuber Jyoti Malhotra Puris Srimandir Footage Surfaces

May 19, 2025

Espionage Probe Youtuber Jyoti Malhotra Puris Srimandir Footage Surfaces

May 19, 2025 -

Where And When Will The Eurovision Song Contest 2025 Take Place

May 19, 2025

Where And When Will The Eurovision Song Contest 2025 Take Place

May 19, 2025 -

Uk Eurovision Host Withdraws Hours Before Grand Final Due To Unforeseen Circumstances

May 19, 2025

Uk Eurovision Host Withdraws Hours Before Grand Final Due To Unforeseen Circumstances

May 19, 2025 -

Nea Epoxi Gia Tis Sxeseis Ierosolymon Kai Antioxeias

May 19, 2025

Nea Epoxi Gia Tis Sxeseis Ierosolymon Kai Antioxeias

May 19, 2025