EUR/USD Outlook: Lagarde's Impact On The Euro's International Role

Table of Contents

Lagarde's Monetary Policy and its Effect on the EUR/USD

Lagarde's monetary policy decisions directly impact the EUR/USD exchange rate. Her strategies, balancing economic growth with inflation control, significantly influence the Euro's value against the dollar. Understanding these nuances is key to forecasting EUR/USD movements.

Interest Rate Decisions

The ECB's interest rate decisions are a primary driver of EUR/USD fluctuations. Higher interest rates generally attract foreign investment, increasing demand for the Euro and strengthening its value against the dollar. Conversely, lower rates can weaken the Euro as investors seek higher returns elsewhere.

- Higher Rates: Attract foreign capital, boosting Euro demand and increasing its value against the USD. This is because investors seek higher returns on their investments, leading to increased demand for Euro-denominated assets.

- Lower Rates: Can lead to capital outflow, reducing demand for the Euro and weakening it against the dollar. Investors might shift their investments to currencies offering better returns.

- Diverging Monetary Policies: The difference between the ECB's interest rate policy and the Federal Reserve's (Fed) policy significantly impacts the EUR/USD. If the ECB adopts a more hawkish stance than the Fed, the Euro could appreciate; conversely, a more dovish stance could lead to depreciation.

- Market Reactions: Past interest rate announcements have shown significant market volatility. Unexpected rate hikes or cuts can trigger immediate and substantial EUR/USD movements, highlighting the importance of closely monitoring ECB announcements.

Quantitative Easing (QE) and Asset Purchases

Quantitative easing (QE) programs, involving the ECB purchasing assets to increase money supply, also impact the EUR/USD. While aimed at stimulating economic growth and inflation, QE's effects on the currency can be complex.

- Increased Liquidity: QE injects liquidity into the market, potentially leading to inflation and a weakening Euro if not managed effectively.

- Inflationary Pressures: Increased money supply can fuel inflation, which could erode the Euro's purchasing power and negatively impact its international role.

- Comparison with other Central Banks: The ECB's QE strategies are often compared to those of other central banks, such as the Fed, the Bank of Japan, and the Bank of England. A divergence in QE approaches can influence the relative value of currencies.

- Unintended Consequences: QE programs can have unintended consequences, such as asset bubbles or increased sovereign debt, which could negatively impact the Euro's stability and international standing.

Geopolitical Factors and the Euro's International Standing

Geopolitical events significantly influence the Euro's value and international role. Recent events highlight this dependence.

The War in Ukraine and Energy Crisis

The war in Ukraine and the subsequent energy crisis have severely impacted the Eurozone economy and the EUR/USD exchange rate.

- Sanctions and Economic Impact: Sanctions imposed on Russia have disrupted global supply chains and negatively affected the Eurozone economy, putting downward pressure on the Euro.

- Energy Price Volatility: Soaring energy prices caused by the war have fueled inflation, leading to uncertainty and impacting investor confidence in the Euro.

- Investor Confidence: The crisis has dampened investor confidence in the Eurozone, leading to capital flight and a weaker Euro.

- Geopolitical Risk Premium: The increased geopolitical risk associated with the war has contributed to a "risk premium" built into the EUR/USD exchange rate, making the Euro more volatile.

EU's Global Influence and Trade Relations

The EU's global influence and trade relations with other major economies impact the Euro's international standing.

- Trade Agreements: Trade agreements between the EU and other nations can strengthen the Euro by boosting economic activity and increasing demand.

- Political Stability: Political stability within the EU is crucial for maintaining the Euro's strength. Internal conflicts or political uncertainty can negatively impact investor confidence.

- Brexit's Impact: Brexit has had a notable impact on the Euro, creating uncertainty and potentially reducing the Eurozone's economic strength.

- China and US Relations: The EU's relationships with major economies like China and the US significantly influence the Euro's role in global trade and its exchange rate.

Market Sentiment and Speculation in the EUR/USD Market

Market sentiment and speculation play a vital role in EUR/USD fluctuations. Understanding market forecasts and technical analysis can offer insights into potential future movements, but it's crucial to remember that predictions are not guarantees.

Analyst Forecasts and Predictions

Current market predictions for the EUR/USD vary widely, reflecting the uncertainty surrounding the global economy and geopolitical landscape.

- Range of Opinions: Analysts offer diverse forecasts for the EUR/USD, depending on their interpretation of economic data and geopolitical risks. Some predict appreciation, others depreciation, and some suggest sideways movement.

- Economic Scenarios: Different scenarios are presented, factoring in various potential economic outcomes, like inflation rates, growth forecasts, and central bank policy changes.

- Expert Quotes: Incorporating quotes from leading economists and financial analysts provides valuable context and perspective on market sentiment.

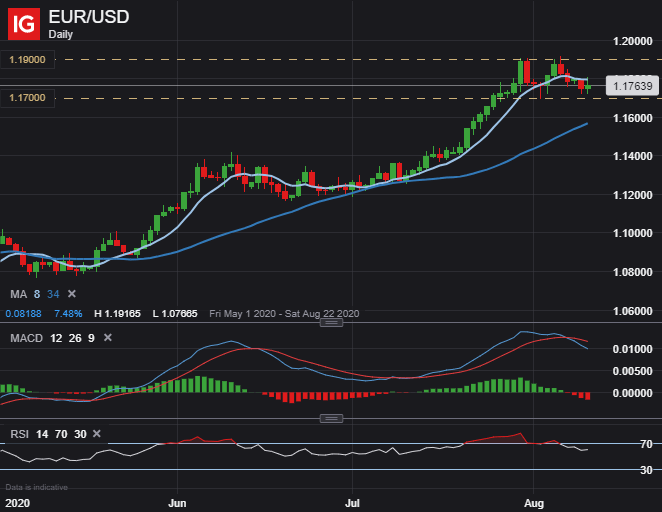

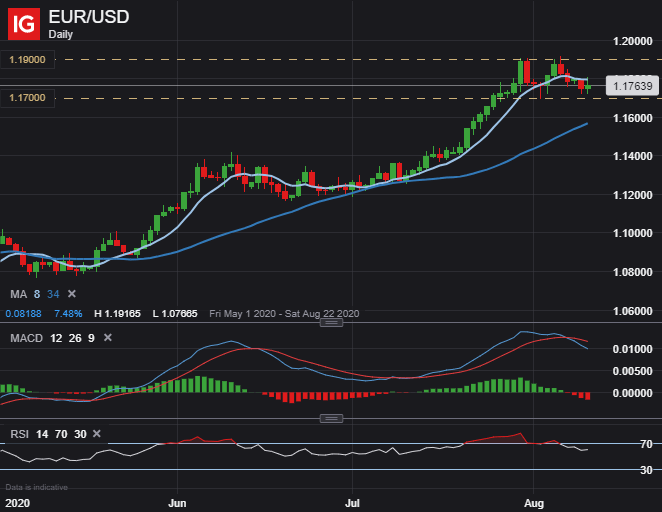

Technical Analysis and Chart Patterns

Technical analysis offers another approach to predicting EUR/USD movements, examining chart patterns and indicators.

- Support and Resistance Levels: Identifying key support and resistance levels helps traders anticipate potential price reversals.

- Trend Lines: Trend lines indicate the overall direction of the EUR/USD, providing insights into potential future price movements.

- Technical Indicators: Indicators such as moving averages, relative strength index (RSI), and MACD are used to gauge momentum and potential trend changes.

- Limitations: It's important to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Conclusion

Christine Lagarde's leadership at the ECB significantly impacts the EUR/USD outlook and the Euro's overall standing in the global financial system. Her monetary policy decisions, coupled with geopolitical events and market sentiment, play a crucial role in shaping the future trajectory of the Euro. Understanding these interwoven factors is critical for navigating the complexities of the EUR/USD exchange rate. To stay informed on the latest developments affecting the EUR/USD outlook and Lagarde’s influence, continue to monitor economic indicators, political developments, and market analysis for a comprehensive understanding of this dynamic currency pair. Regularly reviewing updated forecasts and analyses on the EUR/USD outlook will allow you to make better-informed decisions.

Featured Posts

-

Bon Plan Smartphone Samsung Galaxy S25 Ultra 1 To

May 28, 2025

Bon Plan Smartphone Samsung Galaxy S25 Ultra 1 To

May 28, 2025 -

Criticism Mounts For Man Utd Player Following Howler And Controversial Celebration

May 28, 2025

Criticism Mounts For Man Utd Player Following Howler And Controversial Celebration

May 28, 2025 -

The Phoenician Scheme A Wes Anderson Style Trailer Analysis

May 28, 2025

The Phoenician Scheme A Wes Anderson Style Trailer Analysis

May 28, 2025 -

Exploring Chicagos Century Of Progress Worlds Fair 1933 1934

May 28, 2025

Exploring Chicagos Century Of Progress Worlds Fair 1933 1934

May 28, 2025 -

Cbs Announces Jennifer Lopez As Host For 2025 Amas

May 28, 2025

Cbs Announces Jennifer Lopez As Host For 2025 Amas

May 28, 2025

Latest Posts

-

Mstqbl Alteawn Almayy Alardny Alswry Drast Mtfaylt

May 29, 2025

Mstqbl Alteawn Almayy Alardny Alswry Drast Mtfaylt

May 29, 2025 -

Gazze Deki Kanserli Cocuklarin Uerduen Deki Tedavisi

May 29, 2025

Gazze Deki Kanserli Cocuklarin Uerduen Deki Tedavisi

May 29, 2025 -

Uerduen Uen Gazze Den Kanserli Cocuklara Saglik Hizmeti Sunmasi

May 29, 2025

Uerduen Uen Gazze Den Kanserli Cocuklara Saglik Hizmeti Sunmasi

May 29, 2025 -

Alatfaqyat Almayyt Alardnyt Alswryt Twqeat Iyjabyt

May 29, 2025

Alatfaqyat Almayyt Alardnyt Alswryt Twqeat Iyjabyt

May 29, 2025 -

Gazze Den Kanser Hastasi Cocuklar Icin Uerduen Uen Destegi

May 29, 2025

Gazze Den Kanser Hastasi Cocuklar Icin Uerduen Uen Destegi

May 29, 2025