Euronext Amsterdam Stock Market Up 8%: Impact Of Trump's Tariff Pause

Table of Contents

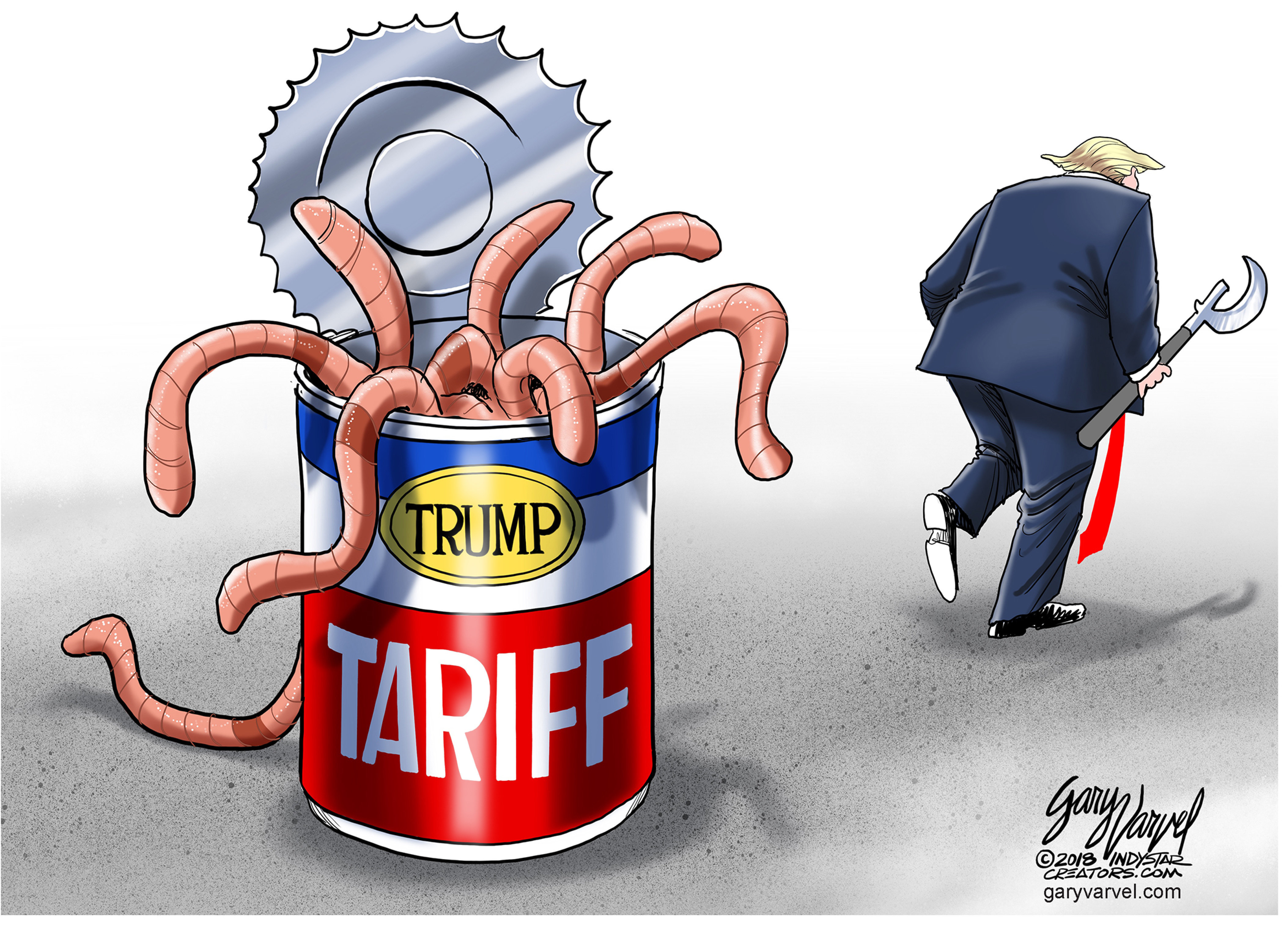

Understanding the Tariff Pause and its Global Implications

Trump's temporary pause on certain tariffs, announced [insert date], brought a wave of both relief and uncertainty across global markets. While the specifics of which sectors were affected and the precise duration of the pause need further clarification, the general impact was palpable. The pause initially triggered a global market rally, with many investors interpreting it as a sign of potential de-escalation in trade tensions. However, underlying uncertainty remains, as the future trajectory of trade policies continues to be debated. Other factors, such as fluctuating oil prices and broader economic growth concerns, also contributed to the overall market sentiment.

- Specific examples of impacted sectors: Steel, aluminum, and agricultural products were initially targeted by the tariffs, experiencing immediate relief following the pause.

- Global market indices reactions: Major indices like the Dow Jones Industrial Average and the FTSE 100 saw notable increases following the news, reflecting a broader positive market sentiment.

- Expert opinions on the short-term and long-term effects: Many economists predict a short-term positive impact, but the long-term effects remain uncertain and depend heavily on future policy decisions. Some warn of potential volatility if trade tensions resume.

Euronext Amsterdam's Sensitivity to Global Trade

The Euronext Amsterdam stock market's sensitivity to global trade policies is rooted in the nature of its listed companies. Many are multinational corporations heavily engaged in international trade, making them particularly vulnerable to shifts in tariff structures and trade agreements. The composition of the exchange includes a significant proportion of export-oriented businesses, whose profitability is directly tied to global demand and ease of international trade. This makes the market acutely responsive to changes in global trade dynamics.

- Specific examples of companies on Euronext Amsterdam sensitive to trade: Companies in the technology, logistics, and agricultural sectors listed on Euronext Amsterdam are particularly vulnerable to trade disputes.

- Import/export data relevant to Amsterdam-listed companies: Analysis of import and export data for these companies reveals a strong dependence on international trade, making them susceptible to tariff fluctuations.

- Analysis of the market capitalization of trade-sensitive sectors on Euronext Amsterdam: A significant portion of Euronext Amsterdam's market capitalization is held by companies heavily reliant on international trade, explaining the substantial market reaction to the tariff pause.

Analyzing the 8% Increase – Direct and Indirect Effects of the Tariff Pause

The 8% increase in the Euronext Amsterdam stock market following the tariff pause announcement was likely a multifaceted event. While the pause played a significant role, attributing the entire increase solely to this factor would be an oversimplification. A shift in investor sentiment, spurred by the reduced trade uncertainty, certainly contributed. Other positive economic indicators, both domestically and globally, also likely played a part.

- Graph showing the stock market trend before, during, and after the tariff pause announcement: [Insert graph here – a visual representation will strongly enhance the article's impact]

- Data comparing the performance of Euronext Amsterdam with other major European stock exchanges: This comparison would highlight whether the increase was unique to Amsterdam or part of a broader European market trend.

- Analysis of investor confidence indicators: Tracking investor confidence indices before and after the announcement can provide further insight into the impact of the tariff pause on market sentiment.

Future Outlook for Euronext Amsterdam and Global Trade Tensions

The long-term implications of the tariff pause on Euronext Amsterdam remain uncertain. The ongoing uncertainty regarding future trade policies creates volatility and challenges for long-term strategic planning. While the pause provided temporary relief, the potential for future trade disputes casts a shadow over future market performance.

- Potential scenarios for future trade policies and their impact on Euronext Amsterdam: Various scenarios, ranging from complete de-escalation to further escalation, must be considered when projecting the future.

- Predictions for key sectors listed on the exchange: Different sectors will likely experience varying impacts depending on the specifics of future trade policies.

- Expert opinions on the future trajectory of the Euronext Amsterdam stock market: Consulting expert opinions provides a well-rounded perspective on the market's future path.

Conclusion: Euronext Amsterdam Stock Market – Navigating the Uncertainties of Global Trade

The 8% surge in the Euronext Amsterdam stock market following the temporary pause in Trump's tariffs underscores the market's significant sensitivity to global trade policies. While the increase likely resulted from a combination of factors, the tariff pause played a crucial role in improving investor sentiment and boosting market confidence. However, the future outlook remains uncertain, heavily reliant on the evolution of global trade relations. To stay informed about Euronext Amsterdam stock market trends and the ongoing impact of global trade, subscribe to our newsletter and follow us on social media for in-depth Euronext market analysis. Understanding Amsterdam stock market trends and the influence of global trade impact is crucial for informed investment decisions.

Featured Posts

-

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025 -

Investing In Amundi Msci World Catholic Principles Ucits Etf Acc Nav Explained

May 24, 2025

Investing In Amundi Msci World Catholic Principles Ucits Etf Acc Nav Explained

May 24, 2025 -

Beurzen Herstellen Na Trump Uitstel Aex Fondsen Boeken Winsten

May 24, 2025

Beurzen Herstellen Na Trump Uitstel Aex Fondsen Boeken Winsten

May 24, 2025 -

Nouveautes Technologiques A Decouvrir Au Ces Unveiled Europe A Amsterdam

May 24, 2025

Nouveautes Technologiques A Decouvrir Au Ces Unveiled Europe A Amsterdam

May 24, 2025 -

Joy Crookes I Know You D Kill A Deep Dive Into The New Track

May 24, 2025

Joy Crookes I Know You D Kill A Deep Dive Into The New Track

May 24, 2025

Latest Posts

-

Selling Sunset Star Speaks Out Against La Fire Price Gouging

May 24, 2025

Selling Sunset Star Speaks Out Against La Fire Price Gouging

May 24, 2025 -

The Countrys Top New Business Locations Growth Opportunities Revealed

May 24, 2025

The Countrys Top New Business Locations Growth Opportunities Revealed

May 24, 2025 -

The Rising Tide Of Wildfires Driving Record Global Forest Loss

May 24, 2025

The Rising Tide Of Wildfires Driving Record Global Forest Loss

May 24, 2025 -

Chinas Automotive Landscape A Shifting Market For International Brands

May 24, 2025

Chinas Automotive Landscape A Shifting Market For International Brands

May 24, 2025 -

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025

Wildfires Intensify Global Forest Loss Hits Unprecedented Levels

May 24, 2025