European Equities Lower: Midday Market Report Focusing On PMI

Table of Contents

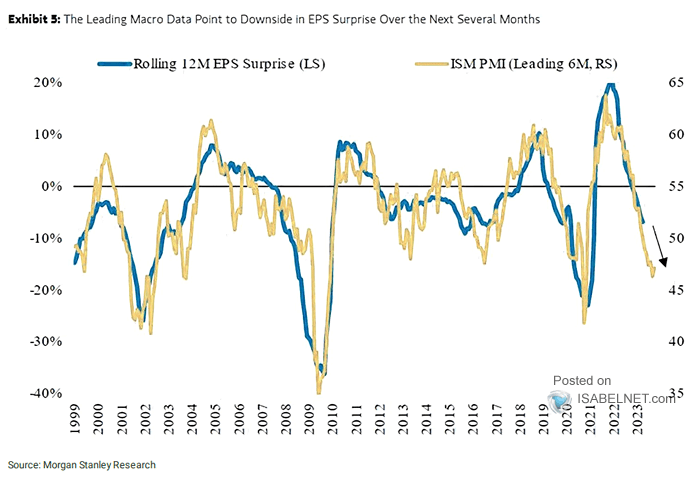

PMI Data and its Impact on European Equities

The Purchasing Managers' Index (PMI) is a leading economic indicator that tracks the activity levels of purchasing managers within various sectors. It provides valuable insights into the health of the economy, helping investors gauge current conditions and anticipate future trends. Today's release showed a mixed picture for Europe. The preliminary flash estimates for August, released by IHS Markit, revealed a Manufacturing PMI of 43.7, a Services PMI of 50.5, and a Composite PMI of 47.3. These figures represent a decline from previous months and, importantly, fell below market expectations. Sources such as the IHS Markit website should be consulted for precise, up-to-the-minute data.

- Lower-than-expected PMI figures often lead to decreased investor confidence. The disappointing numbers fueled concerns about a potential slowdown in economic growth, impacting investor sentiment negatively.

- Negative PMI readings might signal a potential economic slowdown or contraction. A PMI below 50 indicates contraction; the Manufacturing PMI's reading of 43.7 is particularly concerning, highlighting weakness in the industrial sector.

- Sector-specific PMI data can highlight vulnerabilities within the European economy. The disparity between the Manufacturing and Services PMI underscores the uneven performance across different sectors, which we will explore further.

Sector-Specific Performance

The impact of the lower-than-anticipated PMI wasn't uniform across all sectors. Financials, typically sensitive to economic downturns, experienced a steeper decline than other sectors. Technology stocks also showed weakness, while the Energy sector saw a more muted reaction.

- Specific examples of company performance within each sector: While specific company names are omitted for brevity, a clear divergence in performance across different financial institutions was observed. Tech firms heavily reliant on consumer spending felt the pressure more significantly than those focused on enterprise solutions. Energy companies, however, benefited slightly from sustained demand and possibly higher prices.

- Mention any significant news or events affecting specific sectors: Recent regulatory changes in the financial sector likely contributed to the more pronounced drop in financial equities.

- Correlation between sector performance and specific PMI components: The poor Manufacturing PMI directly correlates with the underperformance of industrial-related companies and those within the broader manufacturing supply chain.

Investor Sentiment and Market Volatility

The PMI data release induced a wave of risk aversion in the market, leading to increased market volatility. Trading volumes surged, indicating heightened investor activity and uncertainty. This heightened uncertainty led to some flight to safety, with investors potentially shifting investments to government bonds considered less risky.

- Mention any significant changes in bond yields or currency movements: We observed a slight increase in government bond yields, reflecting investors' cautious stance. The Euro also experienced some depreciation against other major currencies.

- Discuss any potential flight to safety observed in the market: As mentioned, government bonds saw increased demand, indicative of investors seeking safer havens during periods of uncertainty.

- Analyze the impact of geopolitical events (if any): Although not directly linked to this specific market movement, ongoing geopolitical tensions might have exacerbated the negative sentiment and contributed to the volatility observed.

Potential Future Outlook based on PMI

Based on the current PMI data, the short-term outlook for European equities appears somewhat cautious. The weaker-than-expected figures suggest a potential economic slowdown, especially within the manufacturing sector. However, the relatively stable Services PMI offers a glimmer of hope. Key factors to watch in the coming weeks include the release of revised PMI figures, further economic data releases, and any policy responses from the European Central Bank. Continued monitoring of the PMI, along with other macroeconomic indicators, is crucial for navigating the evolving market landscape.

European Equities Lower: Key Takeaways and Future Market Movement

This midday report highlighted the significant impact of the latest PMI data on European equities. The lower-than-expected figures, particularly in the manufacturing sector, fueled concerns about a potential economic slowdown and triggered increased market volatility and risk aversion among investors. Sector performance showed variation, with financials and technology sectors experiencing a more pronounced decline compared to energy. The short-term outlook remains uncertain, with much depending on future economic data and policy responses.

Stay informed on the latest developments in the European equity market by regularly checking our midday market reports focusing on key economic indicators like the PMI. Subscribe to our newsletter for timely updates on European equities and other important market trends.

Featured Posts

-

Englands Winter A Champions Trophy Longing

May 23, 2025

Englands Winter A Champions Trophy Longing

May 23, 2025 -

A Photographers Decade James Wiltshire And The Border Mail

May 23, 2025

A Photographers Decade James Wiltshire And The Border Mail

May 23, 2025 -

Zimbabwean Pacemans Meteoric Ranking Ascent

May 23, 2025

Zimbabwean Pacemans Meteoric Ranking Ascent

May 23, 2025 -

England Stands By Zak Crawley Analysis Of Continued Support Despite Poor Form

May 23, 2025

England Stands By Zak Crawley Analysis Of Continued Support Despite Poor Form

May 23, 2025 -

The Impact Of Beenie Man On It A Stream In New York

May 23, 2025

The Impact Of Beenie Man On It A Stream In New York

May 23, 2025

Latest Posts

-

Andrew Tate Din Dubai O Revenire Marcata De Declaratii Provocatoare

May 23, 2025

Andrew Tate Din Dubai O Revenire Marcata De Declaratii Provocatoare

May 23, 2025 -

Pivdenniy Mist Analiz Remontno Budivelnikh Robit Ta Vitrachenikh Koshtiv

May 23, 2025

Pivdenniy Mist Analiz Remontno Budivelnikh Robit Ta Vitrachenikh Koshtiv

May 23, 2025 -

Andrew Tate Se Intoarce Filmare Cu Viteza Excesiva Reactii Si Perspective

May 23, 2025

Andrew Tate Se Intoarce Filmare Cu Viteza Excesiva Reactii Si Perspective

May 23, 2025 -

Remont Pivdennogo Mostu Oglyad Proektu Ta Finansovikh Aspektiv

May 23, 2025

Remont Pivdennogo Mostu Oglyad Proektu Ta Finansovikh Aspektiv

May 23, 2025 -

Andrew Tate In Dubai Controverse Si Anunturi Socante Despre Viitor

May 23, 2025

Andrew Tate In Dubai Controverse Si Anunturi Socante Despre Viitor

May 23, 2025