European Market Update: Euro Gains, US Futures Decline (Swissquote Bank)

Table of Contents

Euro Gains Momentum

The Euro's appreciation against the US dollar and other major currencies is a key development in today's market. The EUR/USD exchange rate saw a significant jump, climbing to [insert current exchange rate]. Several factors contribute to this Euro strength:

-

Positive Economic Data from the Eurozone: Recent releases indicate robust economic growth within the Eurozone. Strong GDP figures and a decrease in unemployment signal a healthy economic climate, bolstering investor confidence in the Euro. [Cite specific data sources and percentages if available].

-

ECB Monetary Policy Expectations: Market participants anticipate the European Central Bank (ECB) to continue its current monetary policy, potentially including further interest rate hikes or a tapering of quantitative easing. This expectation of tighter monetary policy makes the Euro more attractive to investors seeking higher returns.

-

Weakening US Dollar: The US dollar's relative weakness against the Euro is also playing a role. Factors contributing to this weakening include [cite specific economic indicators or geopolitical events impacting the US dollar, e.g., inflation concerns, political uncertainty]. The EUR/GBP also saw [insert movement and percentage change] reflecting the overall Euro strength. Similar movements were observed in EUR/CHF [insert movement and percentage change].

US Futures Decline: A Closer Look

Conversely, US futures contracts experienced a decline, signaling potential concerns within the US market. The Dow Jones, S&P 500, and Nasdaq futures all saw percentage drops of [insert percentage changes for each index]. This decline can be attributed to several factors:

-

Inflation Concerns: Persistent inflationary pressures in the US continue to weigh on investor sentiment. Concerns about the Federal Reserve's ability to control inflation without triggering a recession are driving market volatility.

-

Anticipation of Further Interest Rate Hikes: The expectation of further interest rate hikes by the Federal Reserve to combat inflation is contributing to the decline in US futures. Higher interest rates typically dampen economic growth and reduce corporate profits.

-

Geopolitical Uncertainties: Ongoing geopolitical uncertainties, including [mention specific geopolitical events impacting investor confidence], are adding to the market's nervousness.

Swissquote Bank's Market Analysis

Swissquote Bank, a leading provider of online trading services, offers valuable insights into these market movements. [Insert a quote from a Swissquote Bank analyst or summarize their official market report, focusing on their perspective on the Euro's strength and the US futures decline]. Their analysis highlights the interplay between macroeconomic factors and investor sentiment.

-

Swissquote Bank's Trading Tools: Swissquote Bank offers a comprehensive range of trading tools and resources, empowering traders to navigate the complexities of the currency market and make informed decisions.

-

Swissquote Bank's Forecasts: [Mention any short-term or long-term predictions or forecasts provided by Swissquote Bank regarding the Euro, US futures, or broader market trends].

Implications for Traders

These market shifts present both opportunities and challenges for traders. Forex traders, for instance, may consider strategies leveraging the Euro's current strength, while those invested in US equities may need to adjust their portfolios based on the potential for further market corrections. However, it's crucial to remember that all trading involves risk. Risk management strategies, such as diversification and stop-loss orders, are essential for mitigating potential losses. It's always prudent to consult with a financial advisor before making any significant investment decisions.

Conclusion

Today's European market saw the Euro strengthen significantly amidst a decline in US futures. Positive economic data from the Eurozone, ECB monetary policy expectations, and a weakening US dollar all contributed to the Euro's gains. Conversely, concerns about US inflation, anticipated interest rate hikes, and geopolitical uncertainties drove down US futures contracts. Swissquote Bank's analysis provides valuable context and perspective on these market shifts. Stay ahead of the curve with our daily European market updates! [Insert link to Swissquote Bank's website]. Regularly checking Swissquote Bank's website and subscribing to their financial news updates will keep you informed about the latest developments in the European market and beyond.

Featured Posts

-

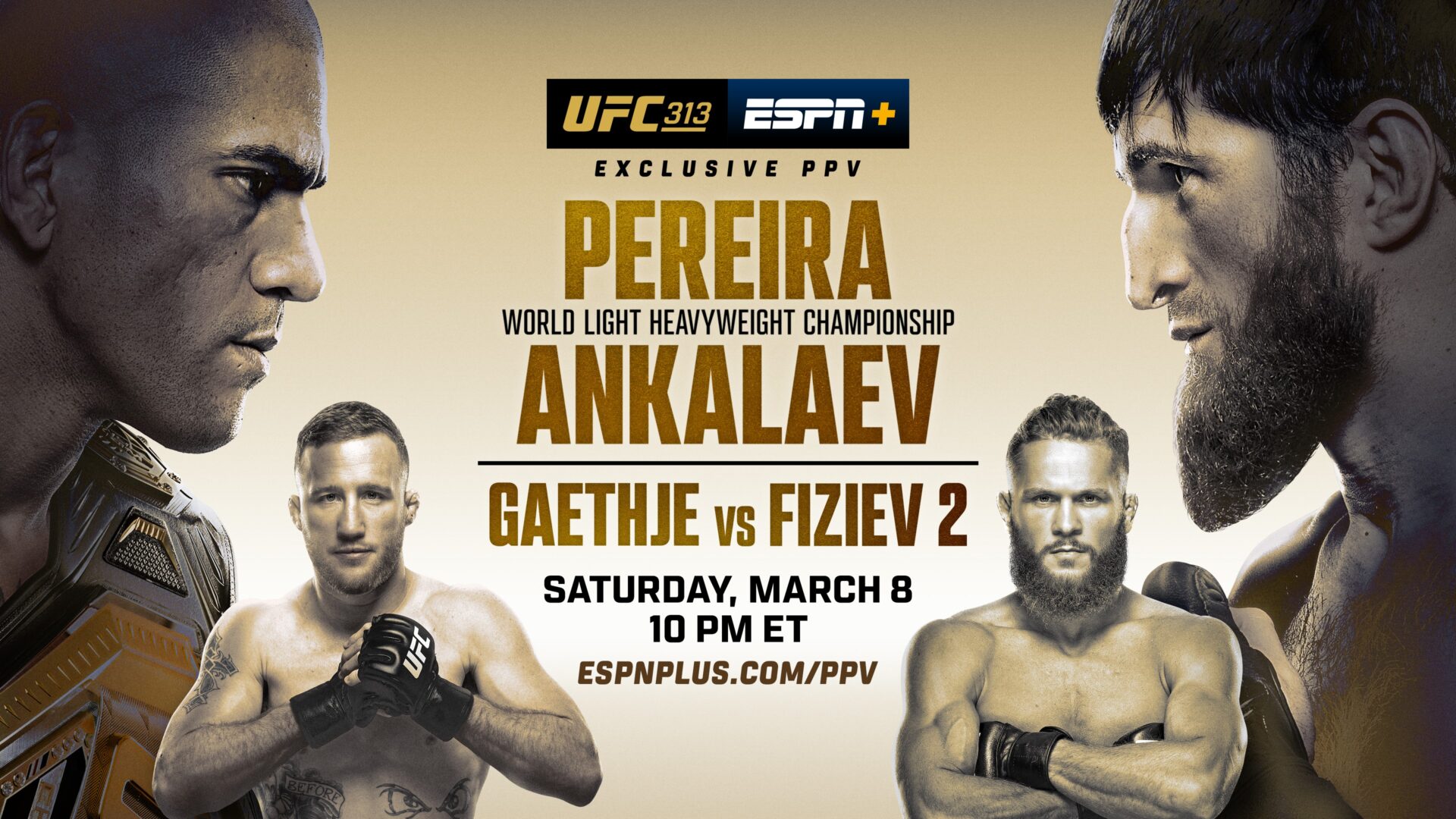

Controversial Ufc 313 Result Fighters Concession Ignites Discussion

May 19, 2025

Controversial Ufc 313 Result Fighters Concession Ignites Discussion

May 19, 2025 -

Brockwell Park Campaigners Legal Challenge Successful

May 19, 2025

Brockwell Park Campaigners Legal Challenge Successful

May 19, 2025 -

Amazon Faces Union Challenge Over Quebec Warehouse Closure In Labour Tribunal

May 19, 2025

Amazon Faces Union Challenge Over Quebec Warehouse Closure In Labour Tribunal

May 19, 2025 -

Ufc 313 Result Mairon Santos Admission Of Marshalls Victory

May 19, 2025

Ufc 313 Result Mairon Santos Admission Of Marshalls Victory

May 19, 2025 -

The Cost Of A First Class Stamp 1 70 And The Implications

May 19, 2025

The Cost Of A First Class Stamp 1 70 And The Implications

May 19, 2025