Evaluating Uber Technologies (UBER) As An Investment

Table of Contents

Uber's Financial Performance and Growth

Understanding Uber's financial health is crucial for any potential investor. Uber generates revenue from several key segments: Rides, Uber Eats (food delivery), and Freight (logistics). Analyzing revenue growth trends across these segments paints a picture of the company's overall financial performance. While Uber has experienced significant revenue growth, profitability remains a key challenge. The company has historically prioritized market share expansion over immediate profitability, leading to substantial operating losses in the past. However, recent financial reports show a shift towards greater efficiency and cost-cutting measures.

- Key Financial Metrics: Investors should carefully examine key metrics such as Earnings Per Share (EPS), total revenue, and operating margin to gauge the company's financial health. Tracking these metrics year-over-year allows for a clear understanding of growth trajectories.

- Comparison to Competitors: Benchmarking Uber's performance against competitors like Lyft provides valuable context. Analyzing their respective market capitalization, revenue growth, and profitability can highlight Uber's relative strengths and weaknesses.

- Historical and Projected Data: Examining past performance alongside analyst forecasts helps to project future growth potential. Analyzing historical trends in revenue growth, customer acquisition costs, and profitability offers insights into the company's future financial trajectory.

Competitive Landscape and Market Share

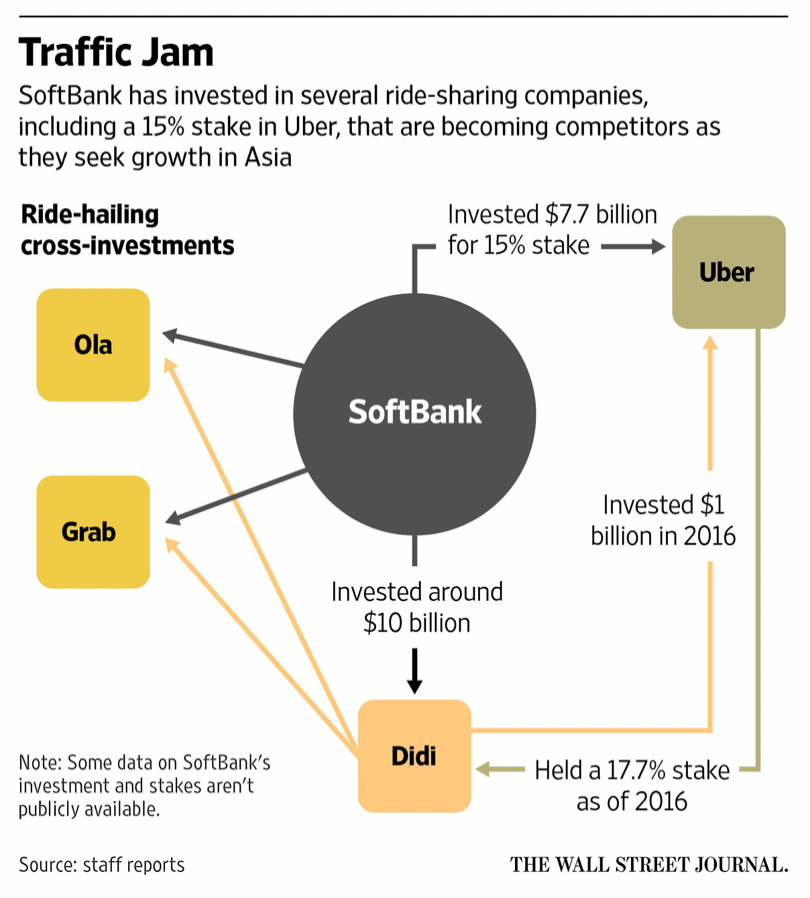

Uber operates in a fiercely competitive market. Key competitors include Lyft, traditional taxi services, and increasingly, public transportation systems. Uber's competitive advantage stems from its strong brand recognition, sophisticated technology platform, and expansive global reach. However, the company faces constant pressure from new entrants and evolving technologies.

- Porter's Five Forces Analysis: Analyzing the competitive intensity using Porter's Five Forces framework helps understand the market dynamics. This includes examining the threat of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry among existing competitors.

- Strategic Initiatives: Uber consistently deploys strategic initiatives to maintain and expand its market share. These include investments in new technologies, expansion into new markets, and strategic partnerships.

- Regulatory Impact: Government regulations significantly impact the ride-sharing industry. Changes in licensing, driver classifications, and safety regulations can significantly affect Uber's operational costs and profitability.

Technological Innovation and Future Growth Potential

Uber's commitment to technological innovation is a critical factor in evaluating Uber Technologies (UBER) as an investment. Investments in autonomous vehicle technology, advanced delivery systems (Uber Eats expansion), and other innovative services have the potential to significantly shape the company's future.

- R&D Spending and Partnerships: Uber's research and development spending and strategic partnerships reflect its commitment to innovation. Analyzing these investments provides insights into the company's long-term vision and potential for future growth.

- Autonomous Vehicles and Delivery Services: The development and deployment of autonomous vehicles and expanded delivery services present substantial growth opportunities. The potential market for these services is vast, offering significant revenue potential.

- Technological Disruption Risks: Technological advancements also carry inherent risks. Competition from other innovative companies, regulatory hurdles, and unexpected technological challenges could impact Uber's growth trajectory.

Risks and Challenges Facing Uber

Despite its strong position, Uber faces several significant challenges. These include regulatory hurdles, driver-related issues, and considerable financial risks.

- Legal and Regulatory Risks: Uber constantly faces legal and regulatory challenges related to driver classification, data privacy, and antitrust concerns. These legal battles can lead to significant financial liabilities and operational disruptions.

- Labor Relations: The ongoing debate regarding driver classification and compensation presents significant labor relations challenges. These issues impact operational costs and can lead to disruptions.

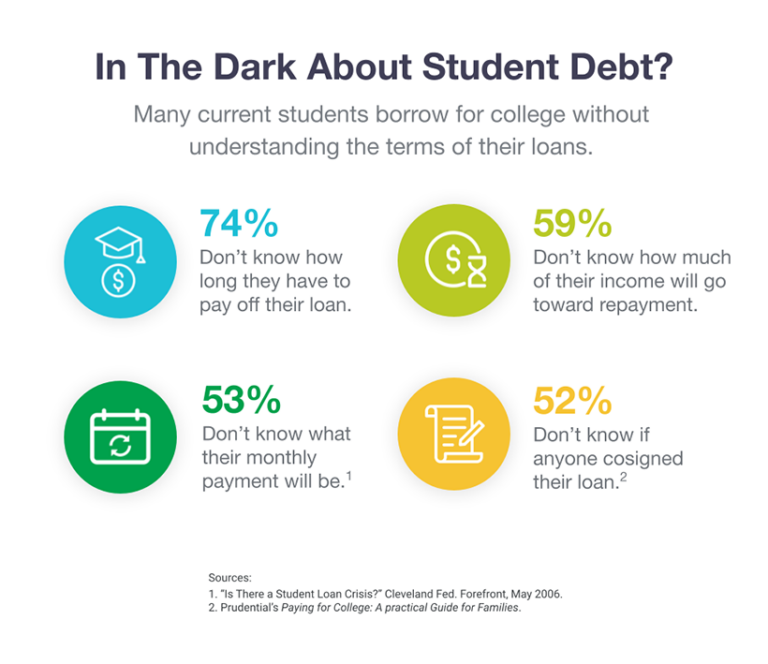

- Debt Levels and Capital Structure: Uber's high debt levels and operating expenses pose financial risks. Analyzing the company's debt-to-equity ratio and cash flow generation capacity is crucial for assessing its financial stability.

Conclusion: Should You Invest in Uber Stock?

Evaluating Uber Technologies (UBER) as an investment requires a careful assessment of its financial performance, competitive position, technological advancements, and inherent risks. While Uber's revenue growth and technological innovation hold significant promise, profitability and regulatory uncertainties remain key concerns. The company’s expansion into new markets and technological advancements offer substantial long-term potential, but these opportunities are counterbalanced by intense competition and ongoing regulatory challenges. Before making any investment decisions, conduct thorough due diligence, considering your own risk tolerance and investment goals. Remember, this analysis provides a framework; further research is crucial before making any investment in Uber or any other company.

Featured Posts

-

The Warner Bros Pictures Showcase At Cinema Con 2025 A Summary

May 17, 2025

The Warner Bros Pictures Showcase At Cinema Con 2025 A Summary

May 17, 2025 -

2025s Leading Bitcoin And Cryptocurrency Casinos Players Guide

May 17, 2025

2025s Leading Bitcoin And Cryptocurrency Casinos Players Guide

May 17, 2025 -

Refinance Federal Student Loans Weighing The Pros And Cons

May 17, 2025

Refinance Federal Student Loans Weighing The Pros And Cons

May 17, 2025 -

Exclusive Interview The Air Traffic Controller Who Averted A Catastrophe

May 17, 2025

Exclusive Interview The Air Traffic Controller Who Averted A Catastrophe

May 17, 2025 -

Thibodeaus Papal Prank A Look At The Knicks Coachs Humor

May 17, 2025

Thibodeaus Papal Prank A Look At The Knicks Coachs Humor

May 17, 2025

Latest Posts

-

Povredeni Alkaras Gubi Finale Barselone Od Runea

May 17, 2025

Povredeni Alkaras Gubi Finale Barselone Od Runea

May 17, 2025 -

Rune Osvaja Barselonu Pobeda Nad Povredjenim Alkarasom

May 17, 2025

Rune Osvaja Barselonu Pobeda Nad Povredjenim Alkarasom

May 17, 2025 -

Final Barselone Rune Trijumfuje Nad Povredenim Alkarasom

May 17, 2025

Final Barselone Rune Trijumfuje Nad Povredenim Alkarasom

May 17, 2025 -

Alkaras Povredjen Rune Slavi U Finalu Barselone

May 17, 2025

Alkaras Povredjen Rune Slavi U Finalu Barselone

May 17, 2025 -

Neverovatna Pobeda Runea Nad Povredjenim Alkarasom U Barseloni

May 17, 2025

Neverovatna Pobeda Runea Nad Povredjenim Alkarasom U Barseloni

May 17, 2025