Exploring The Reasons For D-Wave Quantum Inc.'s (QBTS) 2025 Stock Slump

Table of Contents

Technological Challenges and Competition in the Quantum Computing Market

The quantum computing industry is rapidly evolving, with intense competition and significant technological hurdles. The D-Wave Quantum Inc. (QBTS) stock slump can be partly attributed to challenges inherent in its chosen technology and the emergence of powerful competitors.

Limited Scalability of D-Wave's Quantum Annealers

D-Wave's approach utilizes quantum annealers, a type of quantum computer designed to solve specific optimization problems. However, these annealers face limitations compared to gate-based quantum computers pursued by other companies.

- Scalability Challenges: Increasing the number of qubits (the fundamental units of quantum information) in annealers presents significant engineering difficulties, hindering the ability to tackle more complex problems.

- Error Correction Issues: Quantum annealers are inherently more susceptible to noise and errors than gate-based models, impacting the accuracy and reliability of their computations.

- Problem Applicability: Quantum annealers are not universally applicable to all types of quantum algorithms, limiting their potential compared to more versatile gate-based systems. This restricts the range of problems they can effectively address, impacting their overall value proposition. The limitations in solving certain types of problems further impacted the QBTS stock decline.

These limitations in qubit scalability and error correction have hampered D-Wave's progress, contributing to investor concerns regarding the D-Wave Quantum Inc. (QBTS) stock slump.

Intensifying Competition from Other Quantum Computing Companies

D-Wave faces stiff competition from major players like IBM, Google, IonQ, and Rigetti Computing. These companies are aggressively pursuing gate-based quantum computing, which offers greater versatility and scalability.

- IBM Quantum: IBM is a leading force in gate-based quantum computing, boasting a large number of qubits and a robust software ecosystem.

- Google Quantum AI: Google has demonstrated "quantum supremacy" – achieving a computational task beyond the capabilities of classical computers – furthering the perception of gate-based superiority.

- IonQ and Rigetti Computing: These companies are also making significant strides in gate-based quantum computing, adding to the competitive pressure on D-Wave.

This intensifying competition, with its focus on more versatile technologies, directly impacted the market share and the perception of D-Wave's technology, contributing significantly to the D-Wave stock performance issues.

Market Expectations and Investor Sentiment

The D-Wave Quantum Inc. (QBTS) stock slump was also influenced by market expectations and investor sentiment.

Overly Optimistic Initial Expectations

The initial hype surrounding quantum computing created unrealistic expectations for D-Wave's progress and potential. The technology, while promising, is still in its early stages of development, leading to a disconnect between early investor enthusiasm and the slower-than-anticipated advancements.

- Hype Cycle: The quantum computing field experienced a significant hype cycle, leading to inflated valuations for companies in the sector.

- Technological Hype: The promise of transformative applications in various industries fueled speculative investment, creating a bubble susceptible to bursting.

This disconnect between the hype and the reality of technological development led to disappointment among investors, contributing to the QBTS stock decline.

Lack of Significant Commercial Breakthroughs

Another contributing factor to the D-Wave Quantum Inc. (QBTS) stock slump is the limited commercial success to date. The company has struggled to demonstrate significant revenue generation and profitability, leading to concerns about its long-term viability.

- Commercial Applications: Finding commercially viable applications for quantum annealers remains a challenge. The limited number of real-world applications slowed down the adoption of D-Wave's technology.

- Return on Investment (ROI): The lack of clear ROI for investors contributed to negative sentiment and a sell-off.

Macroeconomic Factors and Overall Market Conditions

The D-Wave Quantum Inc. (QBTS) stock performance was not solely driven by company-specific factors; broader macroeconomic conditions also played a role.

The Impact of Broader Market Downturns

The overall market downturn in 2025, characterized by rising interest rates and inflation, negatively impacted high-growth technology stocks like QBTS.

- Interest Rate Hikes: Increased interest rates made investing in riskier assets less appealing, leading to a flight to safety.

- Inflation and Recessionary Fears: Economic uncertainty and recessionary fears further dampened investor appetite for speculative investments.

These macroeconomic headwinds exacerbated the challenges facing D-Wave, contributing to the QBTS stock decline.

Sector-Specific Investment Trends

Shifts in investor interest towards other technology sectors, such as artificial intelligence (AI) and machine learning, also affected the quantum computing investment landscape.

- Portfolio Allocation: Investors reallocated their portfolios away from quantum computing towards sectors perceived as having more immediate returns.

- Emerging Technologies: The allure of other emerging technologies diverted capital from the quantum computing field, further impacting D-Wave's stock valuation.

Conclusion: Understanding and Navigating the D-Wave Quantum Inc. (QBTS) Stock Situation

The D-Wave Quantum Inc. (QBTS) stock slump of 2025 resulted from a combination of technological challenges, intense competition, unmet market expectations, and unfavorable macroeconomic conditions. While D-Wave's quantum annealers offer a unique approach to quantum computing, their limitations in scalability and applicability, coupled with the emergence of more versatile gate-based technologies, have created headwinds. The lack of significant commercial breakthroughs and the impact of broader market downturns further contributed to the decline. Understanding the complexities of the D-Wave Quantum Inc. (QBTS) stock situation requires careful consideration of these factors. Further research and a long-term perspective are crucial for informed decision-making concerning QBTS stock investments. The future of D-Wave and the quantum computing sector remains uncertain, but a thorough understanding of these challenges is essential for navigating the potential risks and rewards.

Featured Posts

-

Why Climate Risk Impacts Your Home Loan Approval

May 20, 2025

Why Climate Risk Impacts Your Home Loan Approval

May 20, 2025 -

Show Name S Future On Abc News Post Layoff Analysis

May 20, 2025

Show Name S Future On Abc News Post Layoff Analysis

May 20, 2025 -

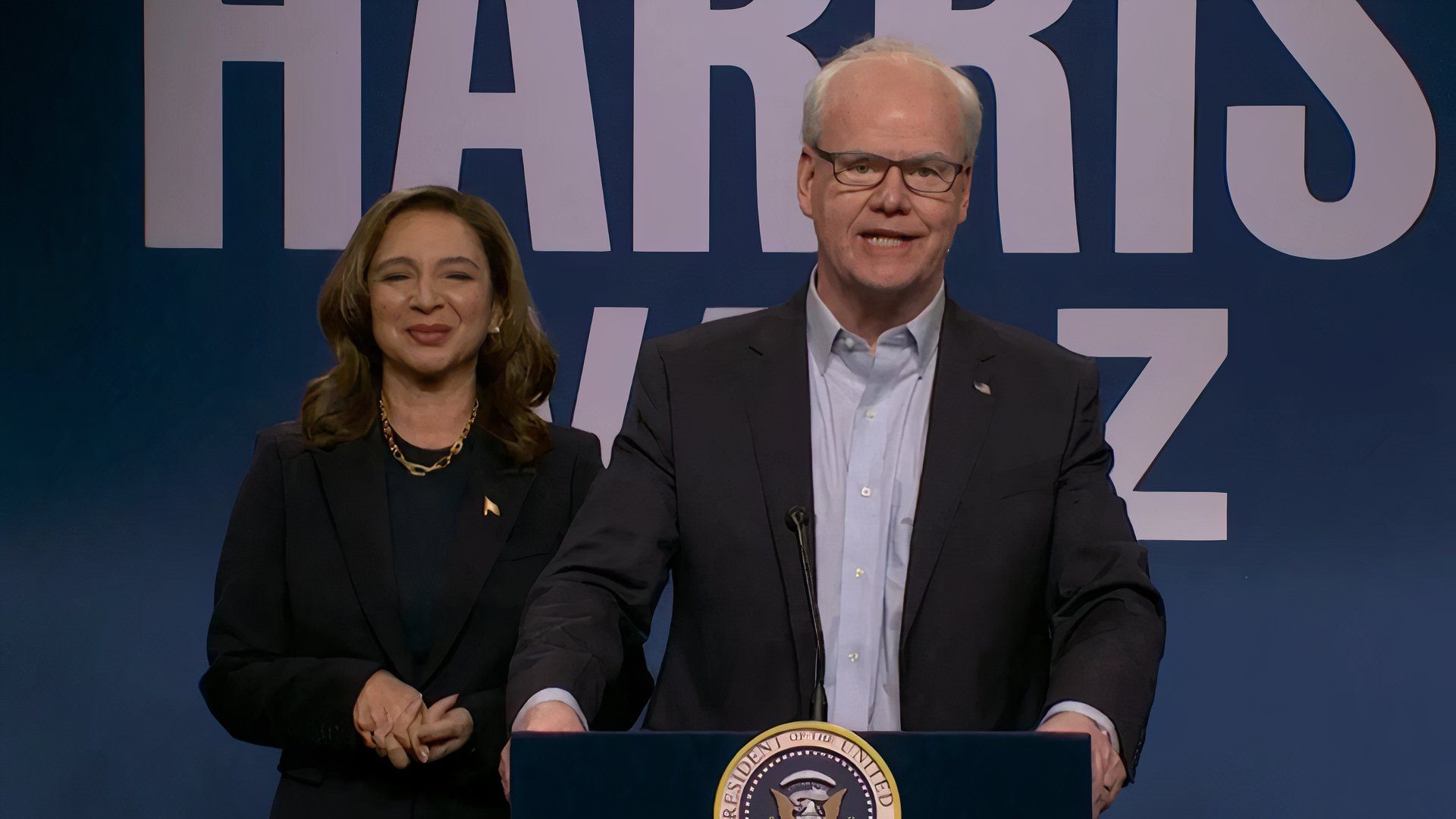

Snls 50th Season Ends On A High Note Record Breaking Viewership

May 20, 2025

Snls 50th Season Ends On A High Note Record Breaking Viewership

May 20, 2025 -

Cin Grand Prix Si Hamilton Ve Leclerc Diskalifiye Edildi

May 20, 2025

Cin Grand Prix Si Hamilton Ve Leclerc Diskalifiye Edildi

May 20, 2025 -

Schumacher El Hijo De Michael Enfrenta Crisis Personal Con Separacion Y Nueva Aplicacion De Citas

May 20, 2025

Schumacher El Hijo De Michael Enfrenta Crisis Personal Con Separacion Y Nueva Aplicacion De Citas

May 20, 2025

Latest Posts

-

Huuhkajien Avauskokoonpano Naein Se Muuttuu

May 20, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttuu

May 20, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025

Huuhkajat Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025 -

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Etsivaet Uutta Seuraa

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Etsivaet Uutta Seuraa

May 20, 2025