Extreme Price Hike Alert: Broadcom's VMware Deal Could Cost AT&T 1,050% More

Table of Contents

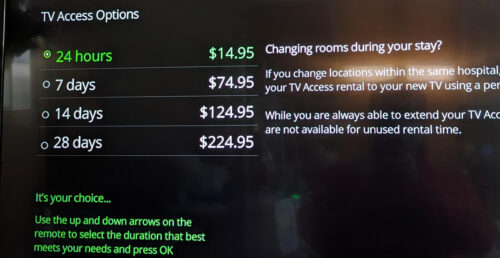

The VMware Price Hike: A Deep Dive into the Numbers

Understanding the potential financial burden on AT&T requires examining the current licensing costs and projecting the increase based on Broadcom's acquisition history. While precise figures regarding AT&T's current VMware licensing expenditure remain confidential, industry analysts suggest substantial investment in VMware's virtualization platform. This includes a wide range of products crucial for AT&T's operations.

Broadcom's past acquisitions demonstrate a pattern of significant price increases post-merger. Their track record suggests a potential for aggressive pricing strategies aimed at maximizing profitability. The projected 1,050% increase isn't an arbitrary figure; it's an extrapolation based on these past trends and the critical role VMware plays in AT&T's infrastructure.

- Specific examples of VMware products used by AT&T: vSphere, vSAN, NSX, vRealize Automation.

- Estimated cost increase per product/service: While precise figures are unavailable publicly, a 1,050% increase across the board would represent a catastrophic jump in expenditure. For example, a product costing $1 million annually could jump to $10.5 million.

- Potential impact on AT&T's overall IT budget: This extreme price hike could significantly strain AT&T's IT budget, forcing difficult choices regarding other investments and potentially impacting service quality.

Broadcom's Acquisition Strategy and Potential Anti-Competitive Practices

Broadcom's history of acquisitions is characterized by aggressive post-merger pricing strategies. This has raised concerns about potential anti-competitive practices, limiting choices for businesses and stifling innovation. The VMware acquisition, given VMware's dominant position in the virtualization market, is particularly worrying.

- Examples of past price hikes after Broadcom acquisitions: Numerous reports detail substantial price increases following Broadcom's acquisitions of other technology companies, highlighting a consistent pattern of cost escalation for clients.

- Potential for reduced competition in the virtualization market: The merger could lead to reduced competition, limiting choices for businesses and potentially resulting in less innovation and higher prices across the board.

- Regulatory bodies investigating the merger: Regulatory bodies in various jurisdictions are likely to scrutinize the deal to assess its potential anti-competitive implications. The outcome of these investigations could significantly impact the final pricing structure.

Impact on AT&T's Services and Consumers

The extreme price hike resulting from the Broadcom-VMware deal could ripple through AT&T's services and ultimately impact its consumers. The increased costs could necessitate difficult decisions:

- Potential service cuts or reductions in quality: To absorb the increased costs, AT&T might be forced to reduce service quality or cut certain offerings.

- Possibility of increased consumer bills: The increased operational costs could be passed on to consumers through higher bills for AT&T's telecommunication services.

- Impact on AT&T's competitiveness in the telecommunications market: This cost burden could weaken AT&T's competitive position, making it more challenging to compete with rivals who may not face similar price increases.

Mitigation Strategies for AT&T and Other Companies

Facing such an extreme price hike, AT&T and other companies relying on VMware need proactive mitigation strategies. These might include:

- Negotiating better licensing terms with Broadcom: AT&T could attempt to negotiate more favorable licensing agreements, seeking discounts or alternative pricing models.

- Exploring open-source alternatives to VMware products: Migrating to open-source virtualization solutions could provide a long-term cost-effective alternative, though it may require significant investment in migration and retraining.

- Strategies for optimizing VMware usage to minimize costs: Careful optimization of VMware usage, including consolidation and efficient resource management, can help reduce costs even within the existing framework.

Conclusion: Navigating the Extreme Price Hike from Broadcom's VMware Deal

The Broadcom-VMware merger presents a significant challenge for AT&T and other businesses reliant on VMware's virtualization technology. The potential for an extreme price hike is undeniable, carrying serious implications for finances, service quality, and consumer costs. This situation underscores the importance of understanding the implications of such large-scale mergers within the tech industry and the need for proactive planning. Don't get caught off guard by this extreme price hike. Stay informed about the latest developments and explore alternative virtualization solutions to protect your business from escalating costs. Consider carefully your options and actively seek mitigation strategies to navigate this challenging new landscape.

Featured Posts

-

Naomi Campbells Reported Met Gala 2025 Ban Truth Behind The Anna Wintour Dispute

May 26, 2025

Naomi Campbells Reported Met Gala 2025 Ban Truth Behind The Anna Wintour Dispute

May 26, 2025 -

Naomi Kempbell U Vidvertikh Obrazakh Dlya Novogo Glyantsyu

May 26, 2025

Naomi Kempbell U Vidvertikh Obrazakh Dlya Novogo Glyantsyu

May 26, 2025 -

La Landlord Price Gouging After Fires A Reality Tv Stars Accusation

May 26, 2025

La Landlord Price Gouging After Fires A Reality Tv Stars Accusation

May 26, 2025 -

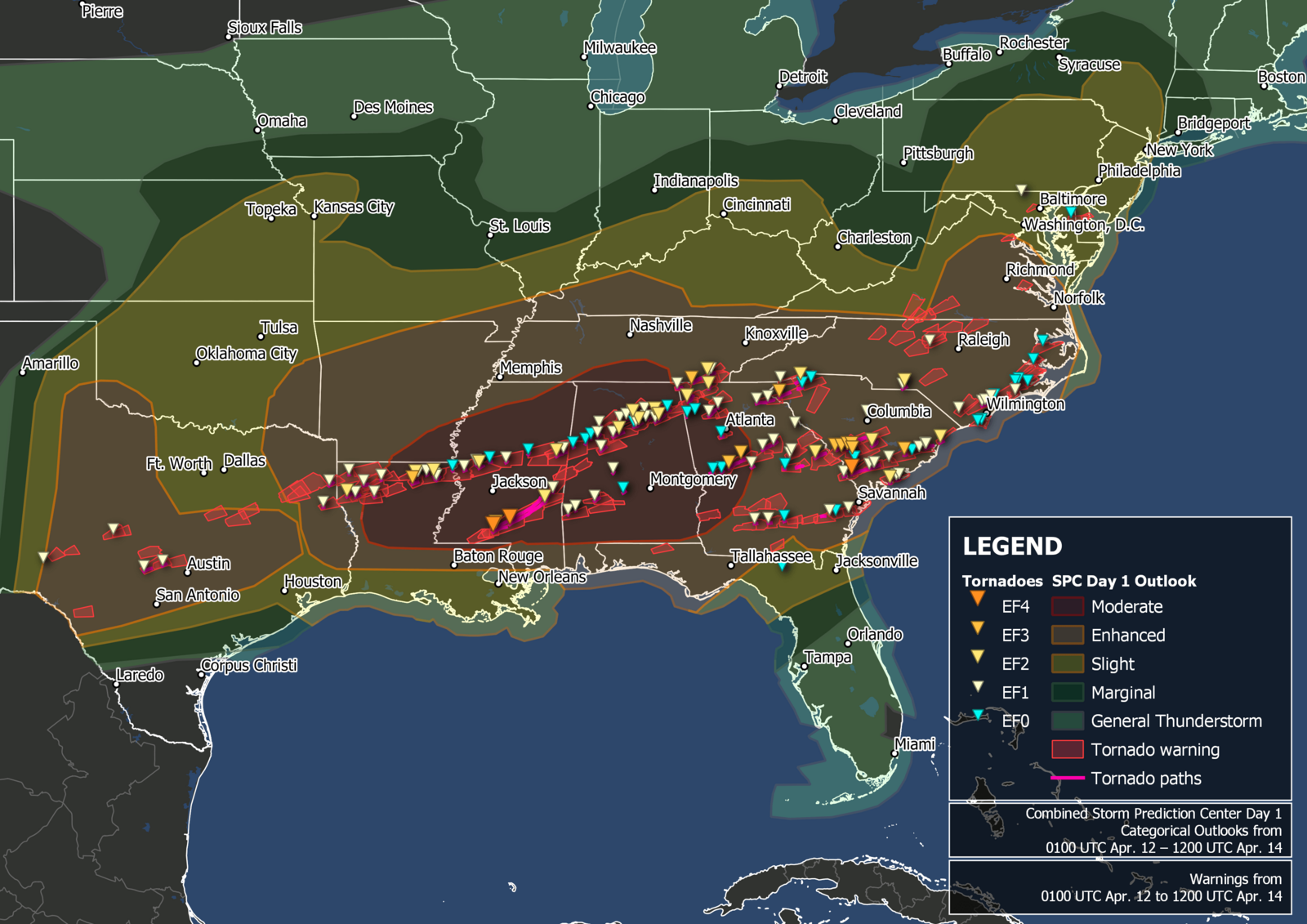

Flash Flood Warnings And April 2 Tornado Count Update April 4 2025

May 26, 2025

Flash Flood Warnings And April 2 Tornado Count Update April 4 2025

May 26, 2025 -

The Railway Station Man Unsung Hero Of Daily Commutes

May 26, 2025

The Railway Station Man Unsung Hero Of Daily Commutes

May 26, 2025

Latest Posts

-

Is Rayan Cherkis Move To Liverpool A Done Deal

May 28, 2025

Is Rayan Cherkis Move To Liverpool A Done Deal

May 28, 2025 -

Rayan Cherki To Manchester United Is The Transfer Happening

May 28, 2025

Rayan Cherki To Manchester United Is The Transfer Happening

May 28, 2025 -

Liverpool Face Man Utd Competition For 25m Transfer Target

May 28, 2025

Liverpool Face Man Utd Competition For 25m Transfer Target

May 28, 2025 -

Rayan Cherki Manchester Uniteds Lead Over Liverpool

May 28, 2025

Rayan Cherki Manchester Uniteds Lead Over Liverpool

May 28, 2025 -

Man Uniteds Pursuit Of Rayan Cherki Transfer Update

May 28, 2025

Man Uniteds Pursuit Of Rayan Cherki Transfer Update

May 28, 2025