Extreme Price Hike Concerns: AT&T On Broadcom's VMware Acquisition

Table of Contents

Broadcom's Acquisition of VMware: A Deep Dive

Broadcom's $61 billion acquisition of VMware, finalized in late 2023, represents one of the largest tech mergers in history. This deal unites a leading infrastructure software provider (VMware) with a prominent semiconductor and infrastructure software company (Broadcom). Broadcom's business model centers around acquiring and integrating key players in the tech space, often leading to significant changes in pricing and product offerings. This acquisition's significance lies in its potential to consolidate market power and reshape the competitive landscape of virtualization and cloud technologies.

- Key players: Broadcom (acquiring), VMware (acquired), private equity firms (involved in prior VMware ownership).

- Timeline: The deal was announced in May 2022 and faced regulatory scrutiny before closing in late 2023.

- Regulatory approvals: The acquisition received approvals from various regulatory bodies globally, although some concerns regarding competition were raised.

AT&T's Reliance on VMware Technology

AT&T, a major player in the telecommunications industry, heavily relies on VMware's virtualization technologies for its network infrastructure and data center operations. This extensive dependence makes them particularly vulnerable to any price increases implemented by Broadcom post-acquisition. Increased costs for VMware products will directly translate to higher operational expenses for AT&T.

- Specific VMware products: AT&T utilizes VMware vSphere, vCenter, NSX, and other VMware cloud solutions.

- Percentage of reliance: A significant portion of AT&T's network infrastructure and data centers rely on VMware's virtualization platform. The exact percentage isn't publicly available but is substantial.

- Alternative technologies: While alternatives exist (like OpenStack or other virtualization platforms), migrating away from VMware would be a costly and time-consuming endeavor for AT&T.

Analyzing the Potential for Extreme Price Hikes

The primary concern is that Broadcom, with its history of acquisitions and subsequent price adjustments, may significantly increase prices for VMware products. Broadcom's past acquisitions have demonstrated a pattern of consolidating market share and leveraging that position to adjust pricing strategies. This potential increase in VMware licensing and support costs could have cascading effects on AT&T's services and pricing for consumers. Reduced competition following the acquisition also raises concerns about stifled innovation and less choice for consumers.

- Factors influencing price increases: Market dominance, reduced competition, increased operational costs for Broadcom, and demand for VMware's products.

- Projected price increase percentages: While precise figures are unavailable, analysts predict substantial increases, potentially ranging from double-digit percentages to even more significant hikes depending on the specific VMware products.

- Consequences for AT&T customers: Higher monthly bills, reduced service offerings, potential service disruptions, or a decrease in overall service quality are all possible outcomes.

Consumer Impact and Regulatory Scrutiny

The potential for extreme price hikes resulting from the Broadcom-VMware acquisition poses a significant threat to AT&T customers and the broader consumer market. Higher operating costs for AT&T are likely to be passed on to consumers through increased prices for services. Regulatory bodies are actively scrutinizing the deal, investigating potential anti-competitive practices and the impact on pricing.

- Consumer rights: Consumers have the right to be informed about price increases and may have legal recourse if deemed unfair or anti-competitive.

- Regulatory bodies: The Federal Trade Commission (FTC), the Department of Justice (DOJ), and other international regulatory bodies are monitoring the situation closely.

- Potential outcomes: Investigations could result in regulatory interventions, potentially including mandated price controls or even the potential for parts of the merger to be unwound.

Addressing Extreme Price Hike Concerns: AT&T and the VMware Acquisition

The Broadcom-VMware acquisition presents a significant challenge for AT&T, potentially leading to substantial VMware price increases that directly impact AT&T service costs and ultimately affect consumers. The implications are far-reaching, potentially impacting not only AT&T's operational efficiency but also the affordability and accessibility of essential telecommunication services. To mitigate the potential negative effects of this acquisition, it's crucial to stay informed about developments, contact your elected representatives to voice your concerns about the Broadcom acquisition impact, and support consumer advocacy groups working to ensure fair pricing and protect consumer rights. We need to address these extreme price hike concerns proactively before they significantly impact our access to essential telecommunication services. Stay informed, stay engaged, and demand accountability.

Featured Posts

-

Sante Et Economie L Impact Positif Du Dry January Et De La Tournee Minerale Sur Le Marche Du Sans Alcool

Apr 23, 2025

Sante Et Economie L Impact Positif Du Dry January Et De La Tournee Minerale Sur Le Marche Du Sans Alcool

Apr 23, 2025 -

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

Apr 23, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

Apr 23, 2025 -

Arizona Diamondbacks Secure 5 2 Win Against Milwaukee Brewers

Apr 23, 2025

Arizona Diamondbacks Secure 5 2 Win Against Milwaukee Brewers

Apr 23, 2025 -

Zuckerbergs Leadership In The Age Of Trump

Apr 23, 2025

Zuckerbergs Leadership In The Age Of Trump

Apr 23, 2025 -

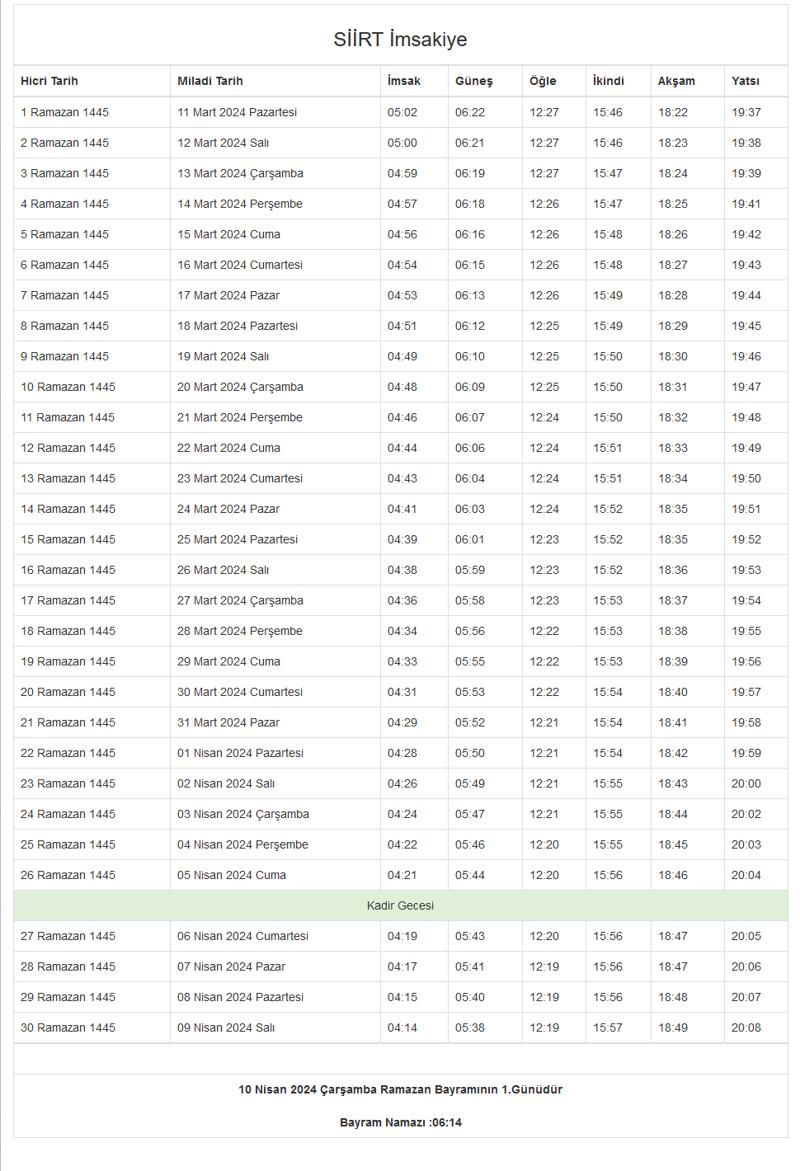

3 Mart 2024 Istanbul Iftar Ve Sahur Vakitleri

Apr 23, 2025

3 Mart 2024 Istanbul Iftar Ve Sahur Vakitleri

Apr 23, 2025

Latest Posts

-

Comparison To Harry Styles Benson Boones Perspective

May 10, 2025

Comparison To Harry Styles Benson Boones Perspective

May 10, 2025 -

Benson Boones Response To Harry Styles Sound Alike Claims

May 10, 2025

Benson Boones Response To Harry Styles Sound Alike Claims

May 10, 2025 -

The Harry Styles Comparison Benson Boones Official Statement

May 10, 2025

The Harry Styles Comparison Benson Boones Official Statement

May 10, 2025 -

Is Benson Boone Copying Harry Styles The Singer Responds

May 10, 2025

Is Benson Boone Copying Harry Styles The Singer Responds

May 10, 2025 -

Harry Styles Snl Impression Backlash How He Really Feels

May 10, 2025

Harry Styles Snl Impression Backlash How He Really Feels

May 10, 2025