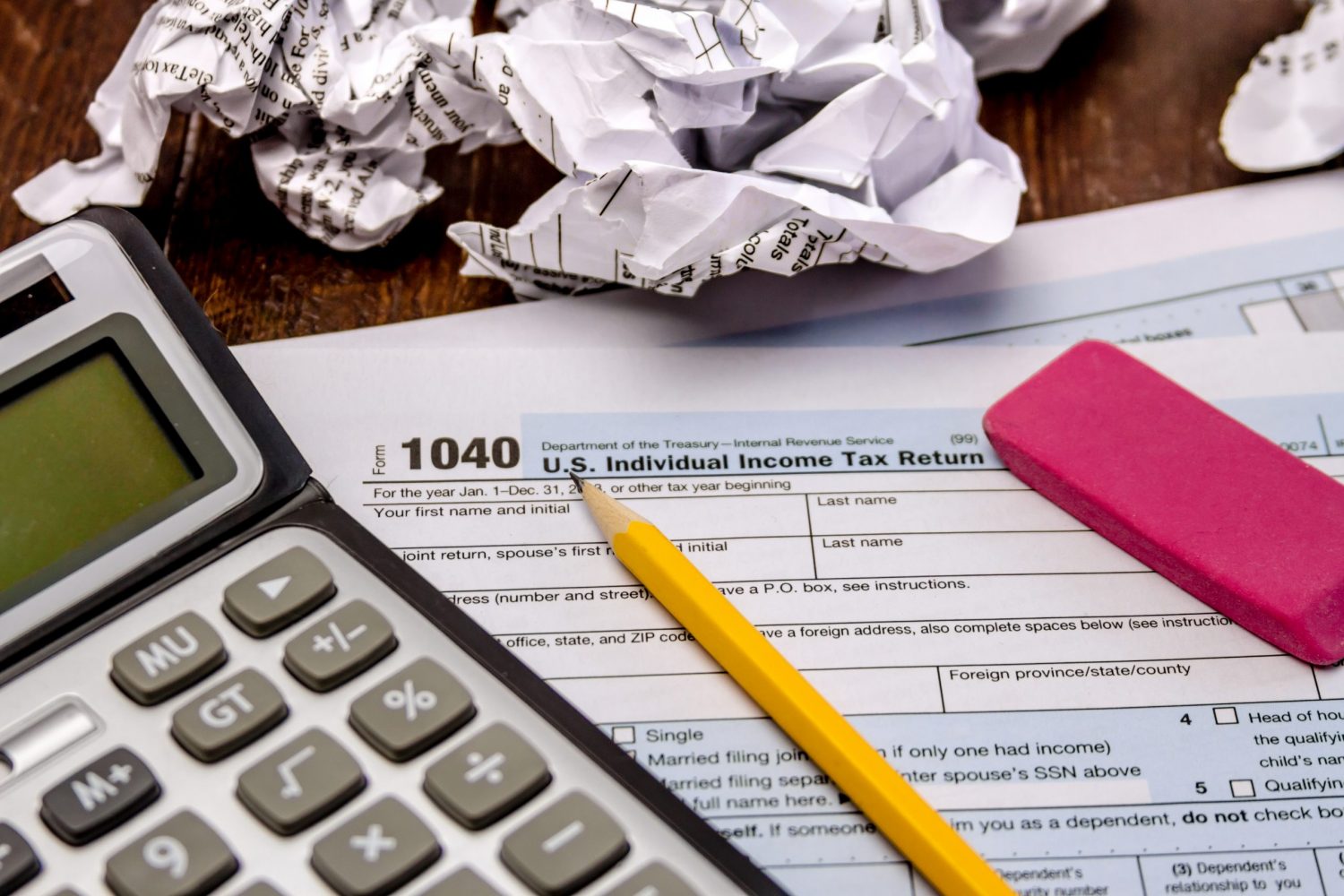

Facing Government Action For Delinquent Student Loans? Here's What To Do

Table of Contents

Understanding the Stages of Government Action for Delinquent Student Loans

The process of government action for delinquent student loans typically progresses through several stages. Ignoring initial warnings can lead to increasingly serious consequences. Understanding this progression is crucial for taking timely action.

-

Initial delinquency notices and warning letters: These are early warnings indicating your loan payments are overdue. Responding promptly is vital to avoid further action. These letters often outline options for bringing your account current.

-

Default status and its implications: Failure to respond to delinquency notices results in your loans entering default status. This has severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. Defaulting on student loans significantly impacts your financial health.

-

Collection agency involvement: The government may assign your delinquent student loans to a collection agency. These agencies are more aggressive in their collection efforts, increasing the pressure to repay the debt.

-

Wage garnishment and its effects on income: The government can garnish your wages to recover the delinquent debt. This means a portion of your paycheck will be automatically deducted to pay down your student loans. This can significantly impact your ability to meet your other financial obligations.

-

Tax refund offset process: The government can seize your tax refund to apply it towards your delinquent student loans. This can leave you with little or no refund, potentially worsening your financial situation.

-

Potential legal action and lawsuits: In some cases, the government may take legal action to recover the debt, which can involve lawsuits and court judgments. This is a severe consequence of prolonged delinquency and can result in additional fees and costs.

Keyword Optimization: delinquent student loans, student loan default, government collection, wage garnishment, student loan debt, defaulted student loans

Exploring Your Options for Resolving Delinquent Student Loans

Facing delinquent student loans doesn't mean you're without options. Several programs and strategies can help you manage and resolve your debt.

Rehabilitation Programs

Rehabilitation programs offer a path to bring defaulted federal student loans back to good standing. By making consistent, on-time payments for a specified period (usually nine months), you can rehabilitate your loans.

-

Making timely payments for a specified period: This demonstrates your commitment to repayment.

-

Credit reporting implications: Successful rehabilitation can improve your credit score over time.

-

Restoration of eligibility for future federal aid: This allows you to access federal student aid programs again in the future.

Income-Driven Repayment (IDR) Plans

IDR plans adjust your monthly payments based on your income and family size. Several plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

-

Lower monthly payments based on income: This makes repayment more manageable during periods of financial hardship.

-

Potential for loan forgiveness after 20-25 years: Depending on the plan and your circumstances, a portion of your remaining balance may be forgiven after a set period of payments.

-

Application process and required documentation: You'll need to submit an application and provide documentation verifying your income and family size.

Consolidation

Consolidating your federal student loans combines multiple loans into a single loan with a new repayment plan.

-

Simplifying repayment with a single monthly payment: This simplifies your finances by managing one payment instead of multiple.

-

Potentially lower interest rates (depending on the loan types): This can save you money in the long run, depending on the interest rate of your existing loans.

-

Eligibility requirements and potential downsides: While consolidation simplifies repayments, it might extend the repayment period, potentially increasing the total interest paid.

Forbearance and Deferment

Forbearance and deferment temporarily postpone your student loan payments. However, interest may still accrue during these periods. Forbearance is generally granted due to financial hardship, while deferment is granted for specific reasons like returning to school.

-

Temporary suspension of payments: This provides temporary relief from monthly payments.

-

Eligibility criteria: Eligibility depends on the specific program and your circumstances.

-

Impact on long-term repayment costs: The interest that accrues during forbearance or deferment increases the total amount you will eventually repay.

Keyword Optimization: student loan rehabilitation, income-driven repayment, student loan consolidation, forbearance, deferment, student loan forgiveness

Seeking Professional Assistance for Delinquent Student Loans

Navigating the complexities of delinquent student loans can be overwhelming. Seeking professional assistance can significantly improve your chances of a positive outcome.

-

Benefits of professional guidance: A qualified professional can help you understand your options, navigate the application process, and negotiate with lenders.

-

Finding reputable credit counseling agencies: Look for agencies accredited by the National Foundation for Credit Counseling (NFCC).

-

When to seek legal advice: If you're facing legal action or complex repayment issues, consulting a student loan attorney is crucial.

Keyword Optimization: student loan attorney, credit counseling, student loan help, financial advisor, student loan lawyer

Conclusion

Facing government action for delinquent student loans can be stressful, but it's crucial to understand your options and take proactive steps. By exploring rehabilitation programs, income-driven repayment plans, loan consolidation, forbearance and deferment, and seeking professional guidance when needed, you can work towards a solution. Don't let the weight of delinquent student loans overwhelm you; take control and find the right path to manage your debt. Start exploring your options for resolving your delinquent student loans today.

Featured Posts

-

Open Ai Under Ftc Scrutiny Implications For Chat Gpt And Ai Development

May 17, 2025

Open Ai Under Ftc Scrutiny Implications For Chat Gpt And Ai Development

May 17, 2025 -

Yankees Vs Mariners Mlb Game Prediction Picks And Betting Odds

May 17, 2025

Yankees Vs Mariners Mlb Game Prediction Picks And Betting Odds

May 17, 2025 -

Thibodeaus Coaching Adjustments Key To The Knicks Improved Season

May 17, 2025

Thibodeaus Coaching Adjustments Key To The Knicks Improved Season

May 17, 2025 -

Microsofts Strategic Changes Impact On The Surface Product Line

May 17, 2025

Microsofts Strategic Changes Impact On The Surface Product Line

May 17, 2025 -

Analyzing Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025

Analyzing Warner Bros Pictures Cinema Con 2025 Presentation

May 17, 2025

Latest Posts

-

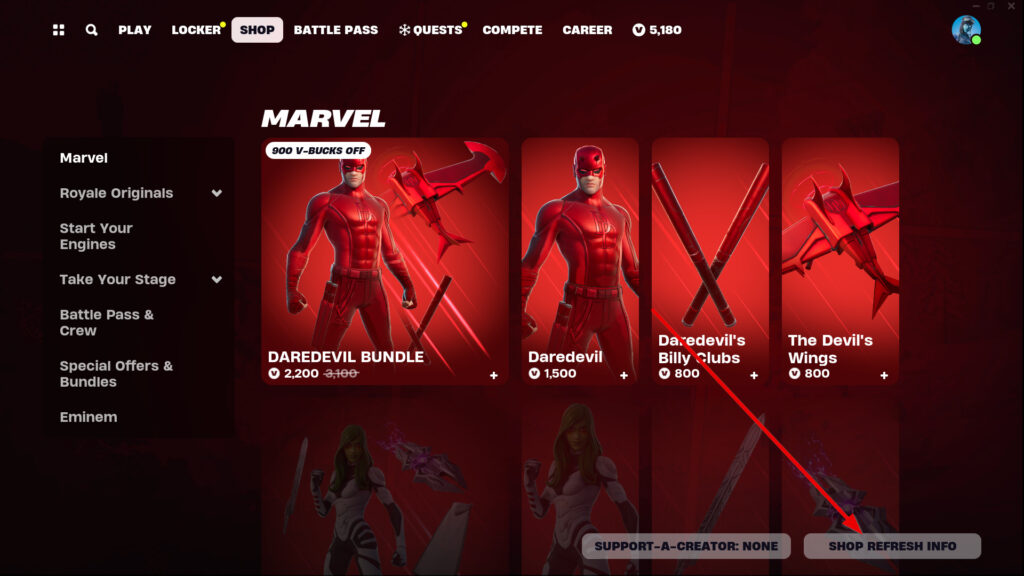

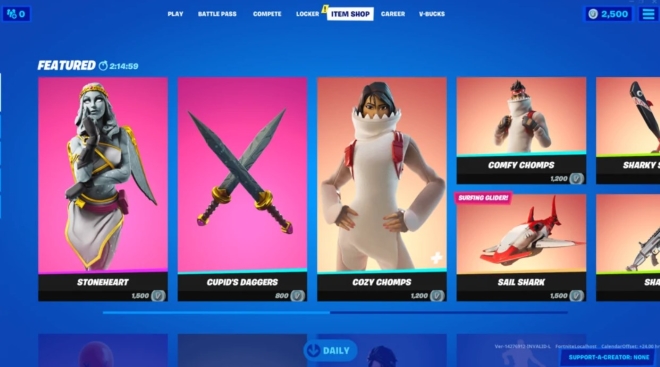

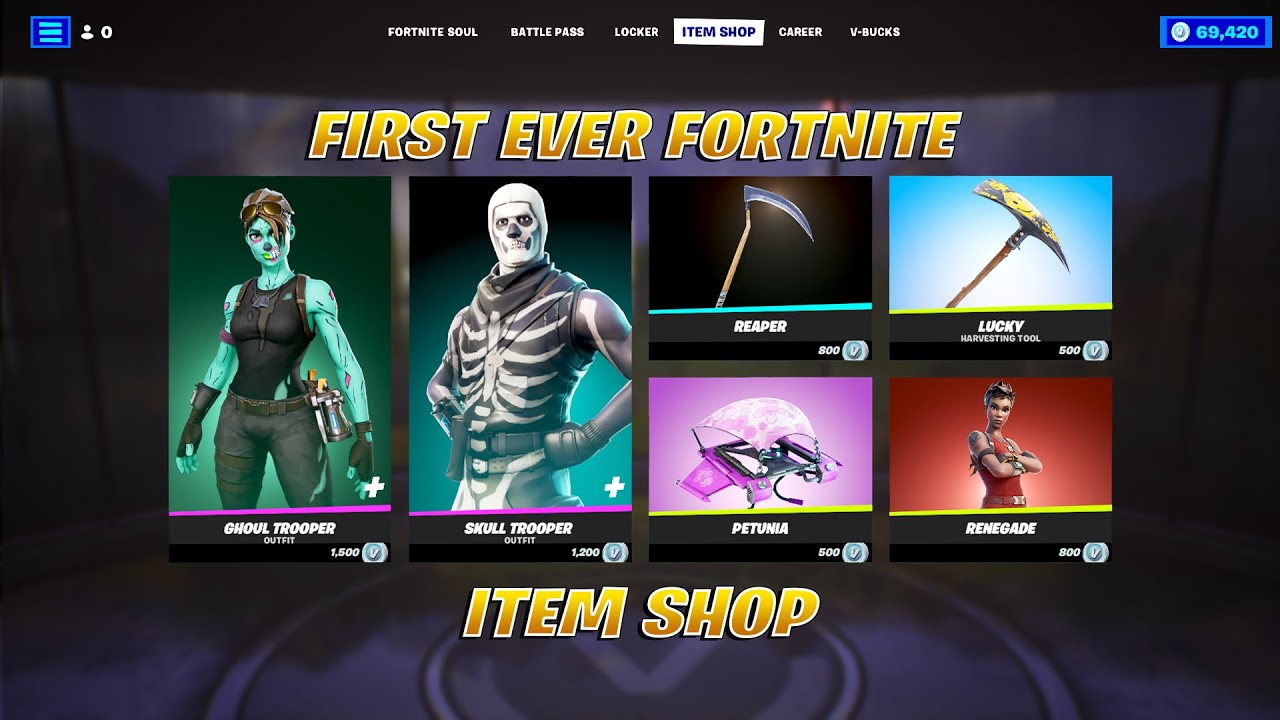

Fortnite Item Shop Enhancement A Helpful New Feature

May 17, 2025

Fortnite Item Shop Enhancement A Helpful New Feature

May 17, 2025 -

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025 -

Fortnite Item Shop Gets A Helpful New Feature For Players

May 17, 2025

Fortnite Item Shop Gets A Helpful New Feature For Players

May 17, 2025 -

New Feature In Fortnite Item Shop Makes Shopping Easier

May 17, 2025

New Feature In Fortnite Item Shop Makes Shopping Easier

May 17, 2025 -

Fortnite Item Shop Update Helpful New Feature Added

May 17, 2025

Fortnite Item Shop Update Helpful New Feature Added

May 17, 2025