Falling Retail Sales Signal Potential Bank Of Canada Rate Cuts

Table of Contents

Main Points:

2.1 Weakening Consumer Spending: A Key Indicator

2.1.1 Decreased Consumer Confidence

Falling retail sales are intrinsically linked to declining consumer confidence. The Conference Board of Canada's Consumer Confidence Index [Insert recent data and source] shows a significant decrease, reflecting growing pessimism among Canadian consumers.

- The automotive sector experienced a [Insert percentage]% drop in sales, indicating reduced appetite for large purchases.

- Sales of durable goods, such as furniture and appliances, also plummeted by [Insert percentage]%, further highlighting weakened consumer spending.

- High inflation, persistent interest rate hikes, and ongoing geopolitical uncertainty are all contributing factors to this decreased consumer confidence.

2.1.2 The Impact of High Interest Rates

The Bank of Canada's aggressive interest rate hikes over the past year have significantly impacted consumer spending and borrowing.

- Increased interest rates lead to higher mortgage payments, making homeownership less affordable and potentially increasing mortgage defaults. [Insert data on mortgage delinquencies if available and source].

- Higher interest rates on personal loans and credit cards reduce disposable income, forcing consumers to cut back on spending.

- This ripple effect has stifled consumer demand across various sectors, contributing to the overall decline in retail sales.

2.1.3 Shifting Consumer Behavior

Faced with economic pressures, Canadian consumers are adapting their spending habits.

- There's a noticeable increase in reliance on budget grocery stores and discount retailers as consumers seek value.

- Discretionary spending on non-essential items has declined significantly, with consumers prioritizing essential expenses.

- Many are increasing their savings rate to cushion against potential economic hardship.

2.2 Inflationary Pressures and the Bank of Canada's Dilemma

2.2.1 Inflation's Persistent Grip

Inflation remains a persistent challenge for the Canadian economy. [Insert recent inflation data and source]. While inflation has begun to ease slightly, it still significantly exceeds the Bank of Canada's target rate of [Insert target rate]%, creating a complex policy dilemma.

- The Bank of Canada faces the difficult task of balancing inflation control with supporting economic growth.

- Continued high interest rates could further dampen economic activity, potentially leading to a recession.

2.2.2 The Risk of Recession

Sustained high interest rates increase the risk of a recession in Canada. Several economic forecasters [mention specific sources] predict [Insert predicted probability] chance of a recession within the next [timeframe].

- A recession would lead to job losses, reduced investment, and further weakening of consumer spending.

- This scenario would create a vicious cycle, making it even more challenging for the Bank of Canada to manage the economy.

2.2.3 The Bank of Canada's Communication Strategy

The Bank of Canada's recent communications regarding future interest rate decisions have been [Describe the tone - cautious, hawkish, dovish etc.].

- [Insert quotes from press releases or speeches highlighting any shifts in the central bank's stance].

- The central bank's messaging is crucial in guiding market expectations and influencing consumer and business behavior.

2.3 Potential Implications of Rate Cuts

2.3.1 Stimulating Economic Activity

Rate cuts could stimulate economic activity by encouraging borrowing, investment, and consumer spending.

- Lower interest rates would make mortgages and loans more affordable, potentially boosting the housing market and encouraging business expansion.

- Increased consumer spending could lead to higher demand and job creation.

2.3.2 Managing Inflationary Risks

However, rate cuts carry the risk of reigniting inflationary pressures.

- Lower interest rates could increase demand, putting upward pressure on prices.

- The Bank of Canada needs to carefully assess the trade-off between stimulating the economy and controlling inflation.

2.3.3 Uncertainty and Market Volatility

Any announcement of Bank of Canada rate cuts could cause market volatility.

- The Canadian dollar could depreciate, impacting imports and exports.

- Stock markets and bond yields could experience significant fluctuations.

Conclusion: Navigating Uncertain Times: The Future of Bank of Canada Rate Cuts

Falling Canadian retail sales, fueled by weakening consumer spending and persistent inflationary pressures, are creating a challenging environment for the Bank of Canada. The potential for Bank of Canada rate cuts is significant, and the central bank's upcoming decisions will have a substantial impact on the Canadian economy. While rate cuts could stimulate economic activity, they also carry the risk of reigniting inflation. The Bank of Canada must carefully navigate this delicate balance. To stay informed about the Bank of Canada’s announcements and future interest rate decisions, regularly check reputable financial news sources and monitor Canadian interest rates closely. Understanding these shifts is crucial for navigating the current economic uncertainty.

Featured Posts

-

One Plus 13 R Review A Detailed Look At Performance And Features

Apr 29, 2025

One Plus 13 R Review A Detailed Look At Performance And Features

Apr 29, 2025 -

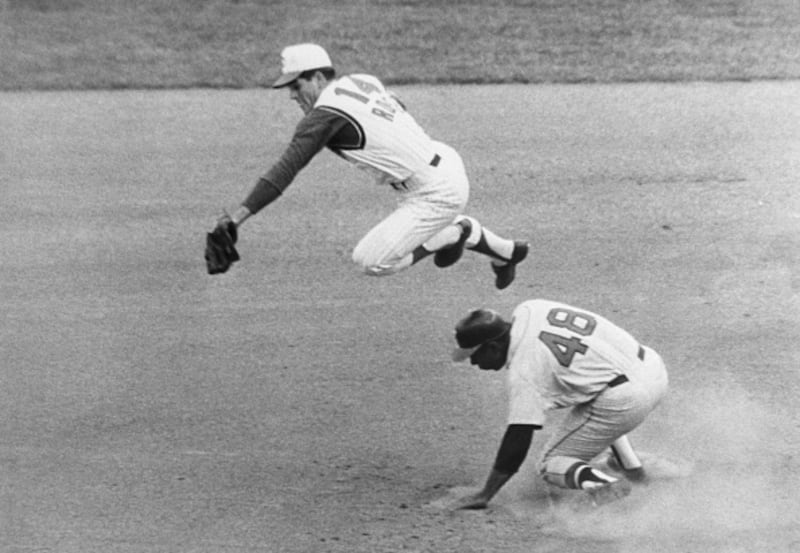

The Pete Rose Posthumous Pardon Details And Implications

Apr 29, 2025

The Pete Rose Posthumous Pardon Details And Implications

Apr 29, 2025 -

Unionized Starbucks Employees Turn Down Companys Guaranteed Raise

Apr 29, 2025

Unionized Starbucks Employees Turn Down Companys Guaranteed Raise

Apr 29, 2025 -

Remembering The Louisville Tornado 11th Anniversary Reflection

Apr 29, 2025

Remembering The Louisville Tornado 11th Anniversary Reflection

Apr 29, 2025 -

Long Lasting Power Kuxius Solid State Power Bank Review

Apr 29, 2025

Long Lasting Power Kuxius Solid State Power Bank Review

Apr 29, 2025

Latest Posts

-

Continued Stricter Border Checks In The Netherlands A Trend Analysis

May 12, 2025

Continued Stricter Border Checks In The Netherlands A Trend Analysis

May 12, 2025 -

Netherlands Increased Border Controls Continue Despite Falling Asylum Numbers

May 12, 2025

Netherlands Increased Border Controls Continue Despite Falling Asylum Numbers

May 12, 2025 -

Parliament Upholds Support For Asylum Minister Faber

May 12, 2025

Parliament Upholds Support For Asylum Minister Faber

May 12, 2025 -

Netherlands Extends Border Checks Despite Fewer Arrests And Asylum Claims

May 12, 2025

Netherlands Extends Border Checks Despite Fewer Arrests And Asylum Claims

May 12, 2025 -

No Confidence Vote Fails Against Asylum Minister Faber

May 12, 2025

No Confidence Vote Fails Against Asylum Minister Faber

May 12, 2025