Fed Holds Interest Rates Steady: Balancing Inflation And Job Market Risks

Table of Contents

Inflationary Pressures Remain a Concern

While inflation has shown signs of cooling, inflationary pressures remain a significant concern for the Federal Reserve. The latest Consumer Price Index (CPI) and Producer Price Index (PPI) data reveal a persistent, albeit slowing, increase in prices. Several factors contribute to this ongoing inflation:

- Supply Chain Disruptions: Although easing, lingering supply chain bottlenecks continue to impact the availability and cost of goods.

- Elevated Energy Prices: Fluctuations in global energy markets, particularly oil prices, continue to exert upward pressure on inflation.

- Strong Wage Growth: While positive for workers, robust wage growth can contribute to a wage-price spiral, where rising wages fuel further price increases.

The Fed's target inflation rate is 2%, and current figures, while lower than recent peaks, still remain above this target.

- CPI: The latest CPI report showed a year-over-year increase of X%, down from Y% the previous month. (Replace X and Y with actual data when available)

- Core Inflation: Core inflation (excluding volatile food and energy prices) remains at Z%. (Replace Z with actual data when available)

- Analysis: While the trend suggests a cooling effect, whether this slowdown is sustainable remains a key question for the Fed.

The Strength of the Job Market – A Two-Sided Coin

The U.S. job market continues to exhibit remarkable strength, with unemployment rates remaining low and job creation figures exceeding expectations. This positive aspect of the economy presents a double-edged sword for the Fed.

- Low Unemployment: The unemployment rate currently sits at X% (Replace X with the actual data when available), a historically low level.

- Robust Job Growth: The economy added Y jobs in the last month (Replace Y with actual data when available), indicating strong labor market demand across various sectors.

- Wage-Price Spiral Risk: The tight labor market is driving up wages, potentially fueling the wage-price spiral mentioned earlier. Labor shortages in key industries contribute to this upward wage pressure.

Fed's Justification for Holding Rates Steady – A Cautious Approach

The Fed's decision to hold interest rates reflects a cautious approach, acknowledging the complexities of the current economic environment. Raising rates too aggressively could trigger a recession by dampening economic growth and increasing unemployment. The central bank is carefully monitoring several key indicators:

- Inflation Data: The Fed is closely scrutinizing CPI and PPI data to gauge the effectiveness of past rate hikes and the persistence of inflationary pressures.

- Employment Figures: The strength of the job market is a critical factor in the Fed’s decision-making process. Maintaining employment levels is a key policy objective.

- Consumer Spending: Consumer spending is a significant driver of economic growth, and the Fed is watching closely for any signs of weakening demand.

The Fed’s statement emphasized a data-dependent approach, suggesting future rate decisions will hinge on upcoming economic data and their assessment of the inflation outlook.

- Fed Statements: Quotes from recent Fed press conferences highlight the importance of balancing inflation control with maintaining economic stability. (Insert relevant quotes here)

- Impact of Rate Hikes: Raising interest rates impacts various sectors differently; higher rates can slow borrowing and investment, affecting business expansion and consumer spending.

- Soft Landing Scenario: The Fed is aiming for a "soft landing"—slowing inflation without causing a recession—but the probability of achieving this remains uncertain.

Market Reaction and Future Outlook – What to Expect

The market's initial reaction to the Fed holding rates steady was mixed. Stock markets generally showed a positive response, while bond yields experienced modest changes. The outlook for future rate hikes depends heavily on upcoming economic data releases.

- Stock Market Performance: Major stock market indices (e.g., the Dow Jones Industrial Average, S&P 500, Nasdaq) displayed X% change following the announcement. (Replace X with actual data when available)

- Bond Yields: Changes in bond yields reflect shifts in investor expectations regarding future interest rates. (Provide relevant bond yield data when available)

- Expert Forecasts: Many economists and financial analysts predict further rate hikes later in the year, with the timing and magnitude depending on evolving economic conditions. (Include expert opinions and predictions here)

Conclusion: Understanding the Fed's Decision to Hold Interest Rates Steady – Looking Ahead

The Federal Reserve's decision to hold interest rates steady reflects a careful balancing act between addressing persistent inflation and safeguarding the robust job market. The central bank's approach is data-dependent, with future rate decisions hinging on upcoming economic data and their assessment of inflationary pressures. The ongoing interplay between inflation and employment will significantly shape the economic landscape in the coming months. Understanding the complexities surrounding the "Fed holds interest rates steady" announcement and its implications is vital for informed financial decision-making. Stay updated on future Federal Reserve interest rate decisions, interest rate policy updates, and monitoring future Fed rate hikes by subscribing to our newsletter and following our blog for the latest economic analysis.

Featured Posts

-

Investing In Palantir Is It The Right Time To Buy

May 09, 2025

Investing In Palantir Is It The Right Time To Buy

May 09, 2025 -

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025 -

Palantir Stock Is It Too Late To Buy In 2024

May 09, 2025

Palantir Stock Is It Too Late To Buy In 2024

May 09, 2025 -

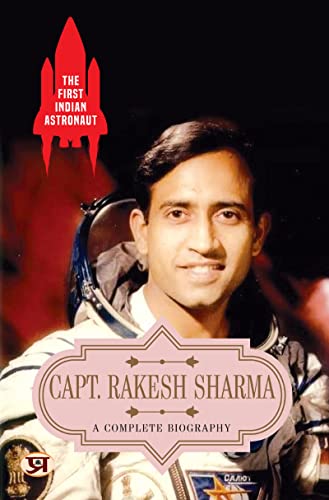

Indias First Astronaut Rakesh Sharma Current Occupation And Contributions

May 09, 2025

Indias First Astronaut Rakesh Sharma Current Occupation And Contributions

May 09, 2025 -

Nyt Spelling Bee April 4 2025 Complete Guide To Solving The Puzzle

May 09, 2025

Nyt Spelling Bee April 4 2025 Complete Guide To Solving The Puzzle

May 09, 2025