Federal Reserve Maintains Rates, Weighing Inflation And Unemployment

Table of Contents

Inflation Remains a Key Concern

Persistent inflationary pressures remain a significant concern for the Federal Reserve. Despite previous interest rate hikes aimed at curbing inflation, price increases continue to outpace the central bank's target.

Persistent Inflationary Pressures

- Energy prices remain elevated due to geopolitical instability and supply chain disruptions.

- Food prices continue to climb, driven by factors such as adverse weather conditions and increased transportation costs.

- Core inflation, which excludes volatile food and energy prices, also remains stubbornly high, indicating broader inflationary pressures within the economy.

The impact of these factors is significant. Supply chain bottlenecks, exacerbated by global events, continue to constrain the availability of goods, driving up prices. Strong consumer demand, fueled by a robust labor market, also contributes to upward pressure on prices. Understanding the intricacies of the inflation rate and its components is crucial to comprehending the Fed's approach to monetary policy.

The Fed's Inflation Target

The Federal Reserve has a stated inflation target of 2%. Currently, inflation significantly exceeds this target, necessitating continued vigilance and potential future adjustments to monetary policy. The Fed closely monitors various inflation indicators, including:

- The Consumer Price Index (CPI)

- The Producer Price Index (PPI)

- Personal Consumption Expenditures (PCE) price index

Achieving the 2% inflation target without triggering a recession presents a formidable challenge for the Federal Open Market Committee (FOMC). The delicate balance between maintaining price stability and avoiding a sharp economic downturn requires careful consideration of the available data and potential ramifications of policy decisions. Analyzing inflation data and its components forms a critical aspect of understanding the rationale behind the Fed's decisions on Federal Reserve interest rates.

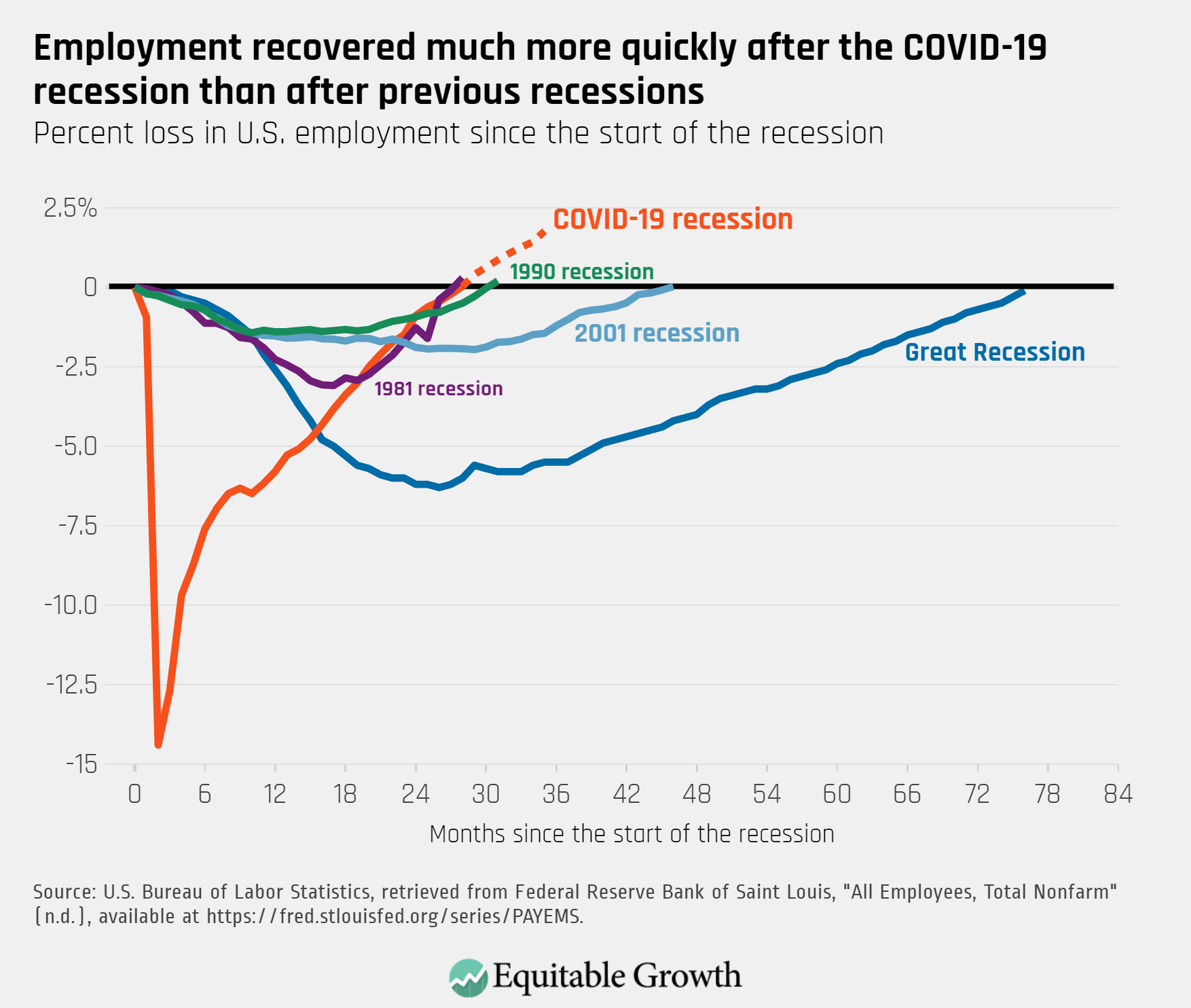

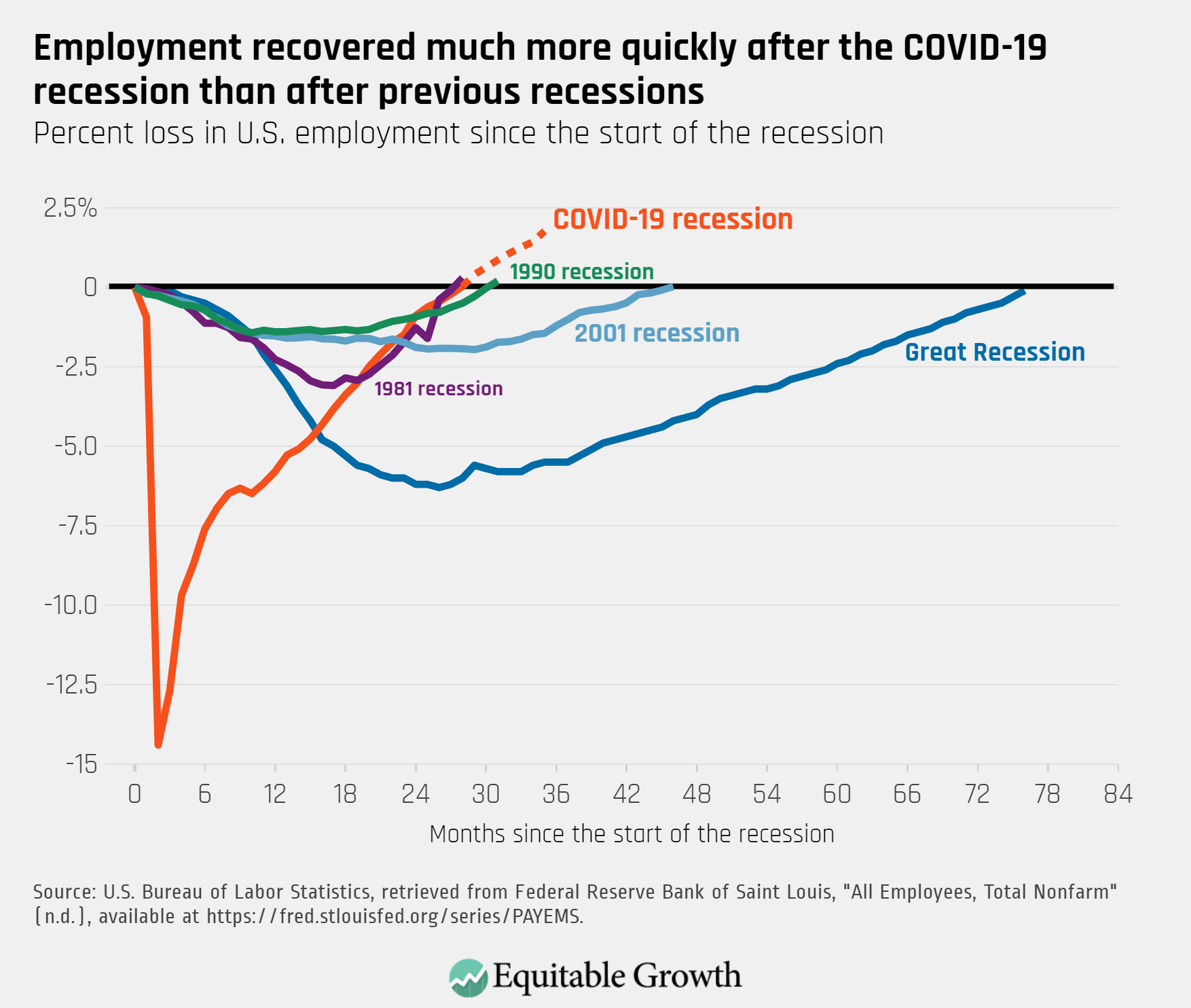

Unemployment Figures and Labor Market Strength

The strength of the labor market presents another critical factor influencing the Federal Reserve's decision.

Robust Job Growth

The current unemployment rate remains low, and job creation numbers continue to be robust. Key employment statistics reflecting this strength include:

- A low unemployment rate.

- Strong job creation numbers consistently exceeding expectations.

- A rising labor force participation rate, indicating more people are entering the workforce.

This robust job growth contributes to higher wages, which can, in turn, fuel further inflation creating a wage-price spiral. Analyzing the employment report provides valuable insights into the health of the economy and the potential for inflationary pressures.

Wage Inflation and its Impact

Strong employment translates into increased wage growth. While this is positive for workers, it also raises concerns about wage inflation, a phenomenon where rising wages contribute to a broader increase in prices. Data indicates:

- Significant wage growth in several key sectors.

- Higher salary increases in response to labor shortages.

- Potential for a wage-price spiral pushing inflation further upwards.

The Fed is carefully monitoring wage growth to assess its contribution to overall inflation and its potential impact on the future trajectory of Federal Reserve interest rates.

The Fed's Forward Guidance and Future Rate Hikes

The Federal Reserve's communication regarding future rate decisions is crucial for market stability and economic planning.

Data Dependency and Future Meetings

The Fed has adopted a data-dependent approach, indicating that future interest rate decisions will depend on incoming economic data. Key data releases to watch include:

- Upcoming CPI and PPI reports.

- Employment reports.

- Reports on consumer spending and business investment.

Based on this incoming data, the Fed may choose to raise interest rates further, maintain the current rate, or potentially even cut rates if economic conditions warrant it. Different economic scenarios can lead to different policy responses.

Balancing Risks and Uncertainties

The Fed faces considerable economic uncertainty, including:

- Geopolitical risks that could disrupt supply chains and energy markets.

- Recessionary fears fueled by persistently high inflation and potential tightening of monetary policy.

- Uncertainty about the future trajectory of inflation and its impact on consumer spending and business investment.

Balancing the risks of persistent inflation and a potential recession requires a nuanced and adaptable approach. The Fed must carefully weigh the potential benefits of further rate hikes against the risks of triggering a downturn. The decisions around Federal Reserve interest rates reflect this ongoing assessment of risks and uncertainties.

Conclusion

The Federal Reserve's decision to hold interest rates steady reflects a careful assessment of competing economic forces. The ongoing tension between managing persistent inflation and supporting strong employment growth remains a key challenge. The Fed's data-dependent approach and its emphasis on balancing risks underscore the complexities inherent in navigating the current economic landscape. To stay informed about future Federal Reserve interest rates decisions and their impact on your financial planning, follow our updates for the latest insights and analysis. Subscribe to our newsletter or follow us on social media for regular updates on Federal Reserve interest rates and related economic news.

Featured Posts

-

Warren Buffett Among Billionaires Hit By Trumps 174 Billion Tariff Losses

May 09, 2025

Warren Buffett Among Billionaires Hit By Trumps 174 Billion Tariff Losses

May 09, 2025 -

Disrupted Supply Chains How Trade Disputes Affect Products Like Bubble Blasters

May 09, 2025

Disrupted Supply Chains How Trade Disputes Affect Products Like Bubble Blasters

May 09, 2025 -

Analyzing Figmas Ai Advantage Over Adobe Word Press And Canva

May 09, 2025

Analyzing Figmas Ai Advantage Over Adobe Word Press And Canva

May 09, 2025 -

Prognoz Pogody V Mae Pochemu Snegopady Tak Trudno Predskazat

May 09, 2025

Prognoz Pogody V Mae Pochemu Snegopady Tak Trudno Predskazat

May 09, 2025 -

Ne Vse Soyuzniki Ukrainy V Kieve 9 Maya Kommentarii Politikov

May 09, 2025

Ne Vse Soyuzniki Ukrainy V Kieve 9 Maya Kommentarii Politikov

May 09, 2025