Federal Reserve: Why Rate Cuts Are Not On The Horizon

Table of Contents

Persistent Inflation Remains a Primary Concern

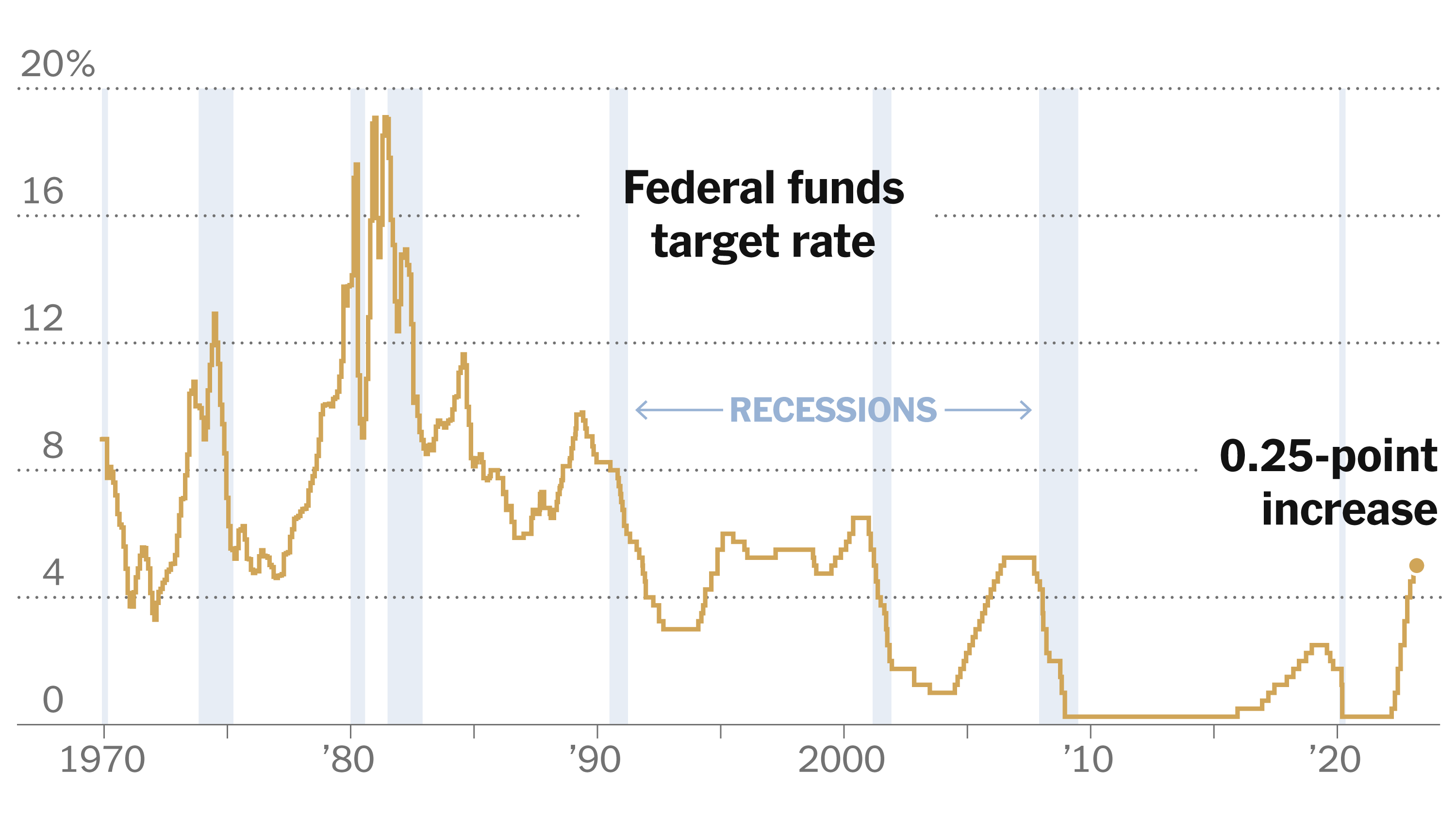

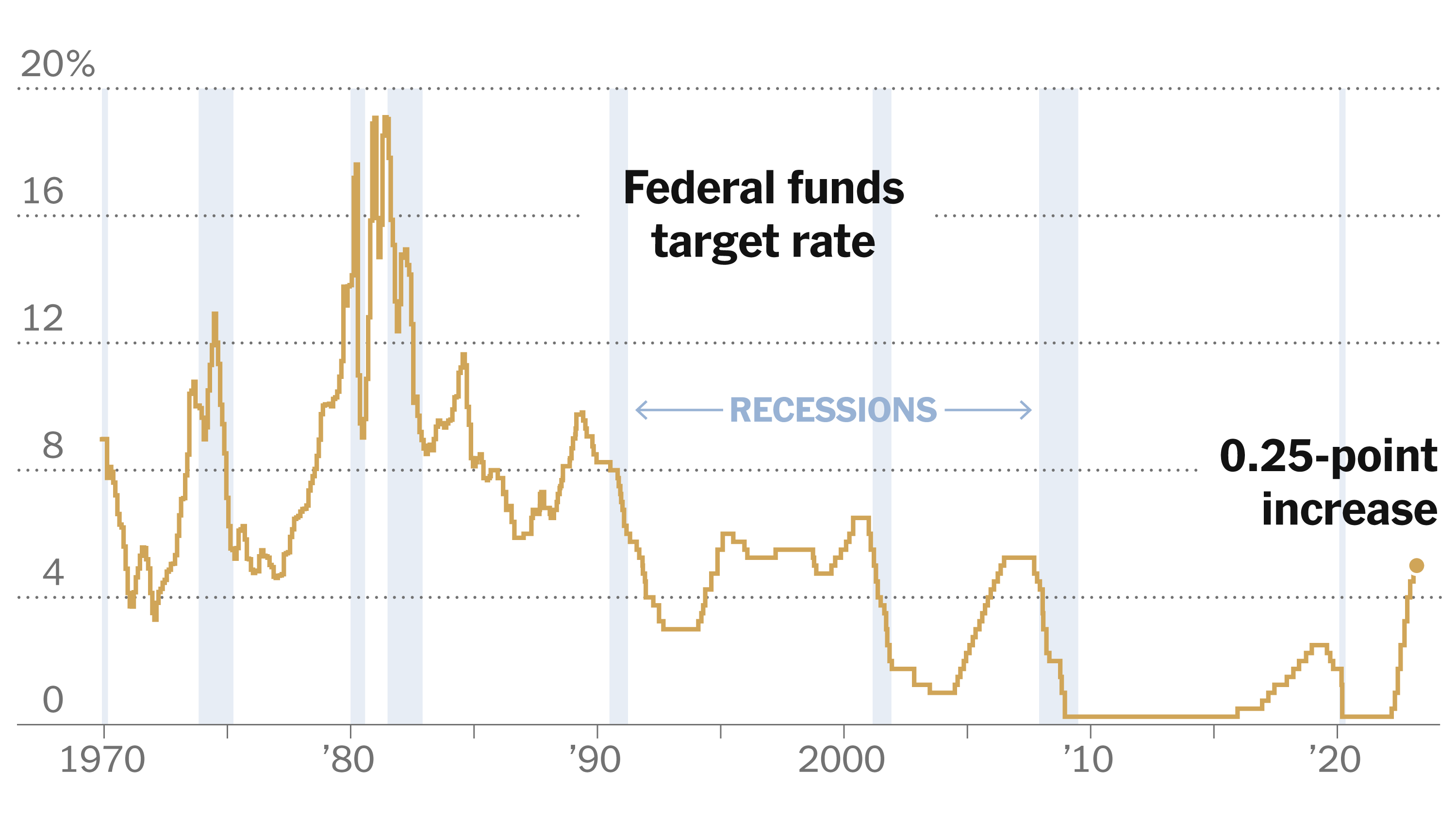

Stubbornly high inflation is the primary reason why Federal Reserve rate cuts are not on the horizon. The current inflation rate significantly exceeds the Fed's target of 2%, indicating an imbalance in the economy. This persistent inflation is fueled by several factors:

- High energy prices: Soaring energy costs, driven by geopolitical instability and increased demand, contribute significantly to overall inflation.

- Supply chain disruptions: Ongoing global supply chain bottlenecks continue to constrain production and drive up prices for various goods.

- Strong consumer demand: Robust consumer spending, fueled by pent-up demand and a strong labor market, puts upward pressure on prices.

- Wage growth exceeding productivity gains: Faster-than-productivity wage growth contributes to inflationary pressures, creating a potential wage-price spiral.

The combination of these factors necessitates a continued focus on curbing inflation before considering any interest rate reductions. The Fed's commitment to controlling inflation overshadows the potential benefits of immediate Federal Reserve rate cuts.

The Labor Market Remains Tight

The US labor market remains remarkably tight, characterized by low unemployment and a high number of job openings. While a strong job market is generally positive, it currently contributes to inflationary pressures. The scarcity of workers empowers employees to demand higher wages, further fueling the inflationary spiral. This situation is highlighted by:

- Low unemployment rate: The unemployment rate remains historically low, indicating a scarcity of available workers.

- High job openings: A large number of unfilled job positions underscores the demand for labor and contributes to wage pressures.

- Increased wage pressures: Employers are forced to offer higher wages to attract and retain talent, contributing to the inflationary cycle.

- Potential for a wage-price spiral: The combination of high wages and rising prices creates a self-perpetuating cycle, making it difficult to control inflation without further action.

The Fed must carefully navigate this tight labor market, recognizing its contribution to inflation, before considering any measures that could exacerbate these issues, such as Federal Reserve rate cuts.

The Fed's Commitment to Price Stability

The Fed operates under a dual mandate: to promote maximum employment and price stability. While traditionally, both goals are pursued simultaneously, the current inflationary environment necessitates prioritizing price stability. Premature Federal Reserve rate cuts risk reigniting inflation and undermining the long-term economic health. The Fed's commitment to this is evident in their:

- The Fed's inflation target: The 2% inflation target remains the benchmark, and the current deviation requires decisive action.

- The importance of anchoring inflation expectations: The Fed aims to manage expectations to prevent inflation from becoming entrenched. Rate cuts could signal a shift away from this goal.

- Risks of premature rate cuts: Reducing interest rates too early could lead to a resurgence of inflation, undoing progress made so far.

- Potential for inflation to become entrenched: Allowing inflation to persist could lead to it becoming a self-fulfilling prophecy, making it significantly harder to control in the future.

Potential Risks Associated with Rate Cuts

Premature Federal Reserve rate cuts carry considerable risks. Lowering interest rates before inflation is under control could have several negative consequences:

- Increased inflationary pressures: Reduced borrowing costs could stimulate further demand, exacerbating existing inflationary pressures.

- Risk of asset bubbles: Lower interest rates can inflate asset prices, potentially creating unsustainable bubbles in the stock market and real estate.

- Weakened dollar: Rate cuts can lead to a decline in the value of the dollar, impacting import costs and overall inflation.

- Uncertainty in the financial markets: Uncertain economic conditions and unpredictable monetary policy can lead to volatility in financial markets.

Conclusion: The Outlook for Federal Reserve Rate Cuts and What to Expect

In summary, several compelling reasons suggest Federal Reserve rate cuts are unlikely in the near future. Persistent inflation, a tight labor market, the Fed's commitment to price stability, and the potential risks associated with premature rate reductions all point to a continued focus on controlling inflation. The current economic climate demands a cautious approach to monetary policy. Understanding the factors influencing Federal Reserve rate cuts is crucial for making informed financial decisions. Stay informed about the Federal Reserve's monetary policy decisions and their impact on the economy. Careful consideration of Federal Reserve policy and interest rates is essential for navigating the current economic landscape.

Featured Posts

-

Yaroslavskaya Oblast Preduprezhdenie O Snegopadakh

May 09, 2025

Yaroslavskaya Oblast Preduprezhdenie O Snegopadakh

May 09, 2025 -

Bayern Munich Vs Inter Milan Match Preview Team News And Prediction

May 09, 2025

Bayern Munich Vs Inter Milan Match Preview Team News And Prediction

May 09, 2025 -

The Shifting Landscape Of The Chinese Auto Market Lessons From Bmw And Porsche

May 09, 2025

The Shifting Landscape Of The Chinese Auto Market Lessons From Bmw And Porsche

May 09, 2025 -

Uk Immigration New Visa Restrictions For Nigerians And Other Countries

May 09, 2025

Uk Immigration New Visa Restrictions For Nigerians And Other Countries

May 09, 2025 -

Oboronnoe Sotrudnichestvo Frantsii I Polshi Signal O Splochennosti Pered Litsom Ugroz

May 09, 2025

Oboronnoe Sotrudnichestvo Frantsii I Polshi Signal O Splochennosti Pered Litsom Ugroz

May 09, 2025