Fed's Rate Hike Pause: Why A Cut Isn't Imminent

Table of Contents

H2: Persistent Inflation Remains a Major Concern

Inflation remains a significant headwind for the US economy, exceeding the Federal Reserve's 2% target. While headline inflation may show some signs of easing, core inflation—which excludes volatile food and energy prices—remains stubbornly high. This persistent inflation undermines the case for immediate rate cuts. The Fed's primary mandate is price stability, and until inflation significantly retreats, further action is likely to be considered.

- Sticky wages contribute to persistent inflation. Strong wage growth, while positive for workers, fuels inflationary pressures as businesses pass increased labor costs onto consumers. This wage-price spiral is a key factor contributing to the Fed's cautious approach.

- Supply chain disruptions continue to impact prices. Although improving, lingering supply chain issues continue to constrain production and contribute to higher prices for goods and services. Until these disruptions are fully resolved, inflationary pressures will persist.

- Strong consumer demand fuels inflationary pressures. Robust consumer spending, despite some softening, continues to put upward pressure on prices. This suggests that the economy remains resilient but also that demand-pull inflation remains a concern.

Related keywords: inflation, core inflation, wage growth, supply chain, consumer demand, Fed monetary policy, inflation rate, CPI

H2: Strong Labor Market Undermines the Case for Rate Cuts

The exceptionally strong US labor market further complicates the case for immediate interest rate cuts. The unemployment rate remains historically low, indicating a tight labor market with high demand for workers. This robust job market fuels wage growth, adding to inflationary pressures. The Fed is unlikely to risk reigniting inflation by cutting rates prematurely.

- High job openings indicate continued demand for labor. The number of job openings remains elevated, suggesting that employers are still actively hiring. This tight labor market dynamic suggests continued wage pressure and inflationary risk.

- Wage growth is outpacing productivity growth. This disparity contributes to unit labor costs rising, fueling inflation. The Fed needs to see a more sustainable balance between wage growth and productivity growth before considering rate cuts.

- Low unemployment reduces the pressure on the Fed to stimulate the economy. With the unemployment rate near historic lows, there's less pressure on the central bank to use interest rate cuts to stimulate economic activity.

Related keywords: unemployment rate, job growth, wage growth, labor market, tight labor market, employment report, jobs data

H2: The Fed's Commitment to Price Stability

The Federal Reserve's primary mandate is to maintain price stability. This commitment to controlling inflation overrides other considerations, such as short-term economic growth. The current inflationary environment necessitates a cautious approach, and premature rate cuts risk reigniting inflation. This would severely damage the Fed's credibility.

- The Fed's credibility is at stake. If the Fed is perceived as prematurely lowering rates and causing inflation to spike again, its credibility and effectiveness will be significantly damaged.

- Policymakers are prioritizing long-term price stability over short-term economic growth. A potential recession is deemed a less severe outcome than runaway inflation. This long-term perspective shapes the Fed's current policy stance.

- Data dependency will guide future monetary policy decisions. The Fed will closely analyze incoming economic data, especially inflation and employment figures, before making any decisions on interest rates.

Related keywords: price stability, monetary policy, Fed credibility, interest rate target, Federal Reserve policy, inflation expectations

H3: Potential for Further Rate Hikes Remains

While the Fed has paused rate hikes, the possibility of further increases remains. The central bank will continue to monitor inflation data closely. If inflation proves more persistent than anticipated, or if the labor market remains exceptionally tight, further rate hikes are a distinct possibility.

- Inflation expectations are a key factor. The Fed will watch carefully to ensure that inflation expectations remain anchored. Rising inflation expectations can become self-fulfilling, making it even harder to bring inflation down.

- Uncertainty around future economic growth influences the Fed’s decisions. The Fed's actions are carefully calibrated to manage the risks to both inflation and economic growth. Unforeseen economic shocks could alter their course.

- The Fed's actions are data-driven. The Fed's decisions will be heavily influenced by incoming economic data. Any shifts in the economic outlook could lead to adjustments in monetary policy.

3. Conclusion:

While the Fed's pause on rate hikes offers a temporary reprieve, a rate cut is highly unlikely in the near future. Persistent inflation and a robust labor market continue to justify a cautious monetary policy stance. The Fed's commitment to price stability and its data-driven approach suggest that any rate cuts are contingent upon substantial progress in reducing inflation. Understanding the intricacies of the Fed's rate hike pause and its implications is crucial for investors and businesses alike.

Call to Action: Stay informed about the Fed's decisions and their impact on the economy. Follow our updates for further analysis on the Fed's rate hike pause and its implications for the future. Understanding the nuances of the Fed's rate hike pause is crucial for making informed financial decisions.

Featured Posts

-

Frantsiya I Polsha Ukreplyayut Otnosheniya Detali Novogo Dogovora

May 10, 2025

Frantsiya I Polsha Ukreplyayut Otnosheniya Detali Novogo Dogovora

May 10, 2025 -

Snls Impression Of Harry Styles Leaves Him Devastated

May 10, 2025

Snls Impression Of Harry Styles Leaves Him Devastated

May 10, 2025 -

Trump Weighs Action On Migrant Detention Challenges What To Expect

May 10, 2025

Trump Weighs Action On Migrant Detention Challenges What To Expect

May 10, 2025 -

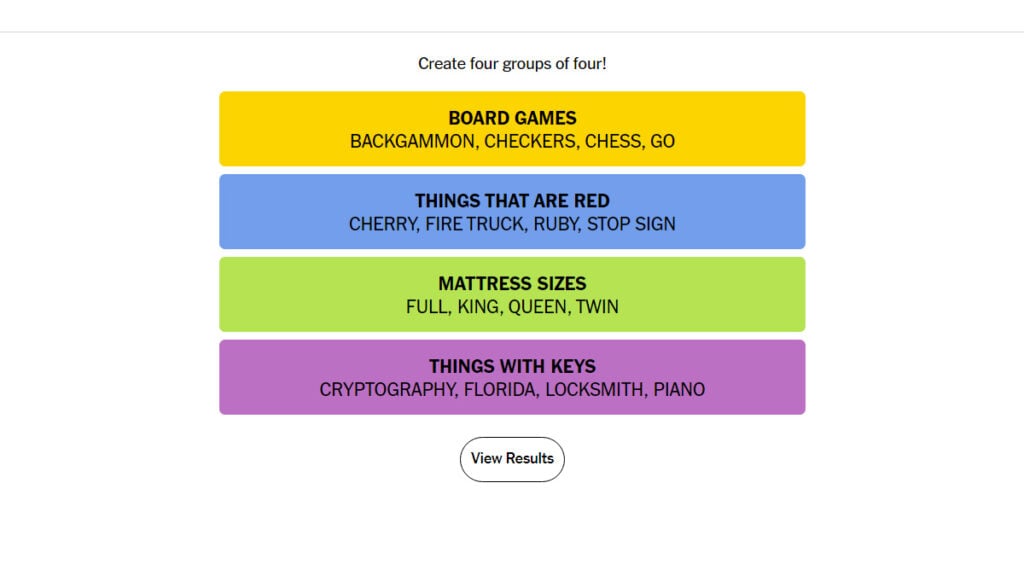

April 10th Nyt Strands Solutions Game 403

May 10, 2025

April 10th Nyt Strands Solutions Game 403

May 10, 2025 -

Solve The Nyt Strands Puzzle April 9 2025 Hints And Answers

May 10, 2025

Solve The Nyt Strands Puzzle April 9 2025 Hints And Answers

May 10, 2025