Figma's IPO: A Year After Abandoning Adobe Acquisition

Table of Contents

One year after Adobe's attempted acquisition of Figma collapsed, the design software giant is forging its own path. This article examines Figma's journey since the failed merger, its current standing, and what the future might hold, focusing on its potential IPO and the implications for the design software market. The failed acquisition left many questioning the future of Figma, but the company has proven its resilience and continues to innovate. Let's delve into the details.

The Fallout from the Failed Adobe Acquisition

The failed Adobe acquisition of Figma sent shockwaves through the tech industry. The deal, valued at a staggering $20 billion, ultimately fell apart due to significant antitrust concerns and regulatory scrutiny.

Antitrust Concerns and Regulatory Scrutiny

The primary obstacle to the Adobe-Figma merger was the intense scrutiny from antitrust regulators, primarily the Department of Justice (DOJ) in the United States. The DOJ argued that the acquisition would significantly reduce competition in the already concentrated market for professional design software. They expressed concerns that Adobe, already a dominant player with its Creative Cloud suite, acquiring Figma, a fast-growing competitor, would stifle innovation and lead to higher prices for consumers.

- Detailed explanation of the Department of Justice's concerns: The DOJ argued that the combined entity would hold a near-monopoly in the collaborative design software space, limiting choice and potentially hindering the development of alternative solutions. They highlighted Figma's unique collaborative features and its appeal to a wide range of users, fearing that Adobe would leverage its market power to stifle innovation.

- Impact of the decision on Adobe's strategy: The failed acquisition forced Adobe to reassess its growth strategy. While Adobe continues to be a leader in the professional creative suite market, the inability to acquire Figma highlights the challenges of inorganic growth in a regulated environment.

- Analysis of the legal arguments presented by Adobe and Figma: Adobe argued that the acquisition would benefit consumers through enhanced integration and innovation. Figma, while initially supportive of the acquisition, ultimately had to accept the regulatory decision. The legal battle exposed the complexities of antitrust law in the rapidly evolving tech landscape.

Market Reaction and Investor Sentiment

The news of the failed acquisition sent ripples through the stock market. While Adobe's stock experienced a temporary dip, reflecting investor disappointment, Figma, as an independent entity, saw increased investor interest.

- Stock price fluctuations before, during, and after the announcement: Adobe's stock experienced a slight decrease following the announcement of the failed acquisition, indicating investor concerns about missed growth opportunities. The absence of publicly traded Figma stock at the time prevented a direct observation of its immediate response.

- Analyst opinions and predictions following the failed acquisition: Analysts offered varied perspectives. Some predicted slower growth for Adobe, while others saw the outcome as potentially beneficial for Figma's long-term prospects. Many saw it as an opportunity for Figma to accelerate its independent growth and pursue an IPO.

- Impact on investor sentiment toward both companies: Investor sentiment towards Adobe was temporarily dampened, reflecting the missed acquisition opportunity. Conversely, the blocked acquisition bolstered investor confidence in Figma's independent potential and spurred anticipation for its eventual IPO.

Figma's Independent Trajectory: Growth and Innovation

Despite the failed Adobe acquisition, Figma has continued its impressive growth trajectory, focusing on product development and market expansion.

Product Development and Market Share

Since the abandoned merger, Figma has consistently rolled out new features and improvements, solidifying its position in the design software market.

- New features and updates released by Figma: Figma has been enhancing its collaborative features, improving its performance, and adding new functionalities to attract a wider user base. Specific examples of new features should be listed here (e.g., improved version history, enhanced prototyping tools, integration with other platforms).

- Growth in user base and market share statistics: Data showcasing Figma’s continued user growth and market share should be included here. This would demonstrate the company's strong independent performance. Sources for this data should be cited.

- Comparison to competitor products (e.g., Sketch, Adobe XD): A comparison of Figma's features, market share, and user base to key competitors like Sketch and Adobe XD would further highlight its success.

Financial Performance and IPO Prospects

Figma’s financial performance since the failed acquisition has been strong, fueling speculation about its IPO. While exact figures are often private until an IPO filing, publicly available information, such as funding rounds and investor interest, can be used to assess its financial health.

- Revenue growth figures and profitability analysis: While specific numbers might not be publicly accessible, qualitative analysis of revenue trends and profitability can be provided based on available information.

- Discussion of funding rounds and investor interest: Detailing funding rounds and the participation of prominent investors serves as an indicator of confidence in Figma's future.

- Speculation on IPO timing, valuation, and potential investors: Based on its growth trajectory and market position, analysts' predictions on Figma's potential IPO valuation and timing can be discussed. Mentioning potential investors adds further context.

The Future of Figma and the Design Software Landscape

Figma's independent path has significant implications for the broader design software landscape.

Competitive Dynamics and Strategic Partnerships

The competitive landscape in the design software market remains intense. Figma will need to continue to innovate and potentially form strategic partnerships to maintain its competitive edge.

- Analysis of key competitors and their strategies: This section should analyze the strategies of major competitors such as Adobe, Sketch, and other emerging players.

- Discussion of potential partnerships or collaborations: Exploring potential partnerships that could benefit Figma's growth and expansion into new markets would be insightful.

- Figma's long-term competitive strategy: Based on its current trajectory, speculate on Figma's long-term strategy for maintaining its market position and growth.

Impact on the Design Industry

Figma's independent existence has already had a considerable impact on the design industry.

- Impact of Figma's pricing model on the industry: Analyze how Figma's pricing model (often more accessible than traditional professional design software) has influenced the market.

- Figma's role in democratizing design tools: Discuss how Figma's user-friendly interface and accessibility have contributed to making design tools more widely available.

- Long-term influence on design workflows and collaboration: Explore the long-term effects of Figma's collaborative features on design workflows and teamwork.

Conclusion

Figma's journey since the failed Adobe acquisition demonstrates its resilience and potential. The aborted merger, while initially disruptive, ultimately paved the way for Figma's independent growth and fueled anticipation for its highly anticipated IPO. The company’s continued innovation, strong financial performance, and significant market share indicate a bright future.

Call to Action: Stay informed about the latest developments concerning Figma's potential IPO and its impact on the design software market. Follow our blog for continued updates on the Figma IPO and related news in the tech industry. Learn more about the future of Figma and its influence on the design software landscape. Keep an eye on the Figma stock ticker once it goes public!

Featured Posts

-

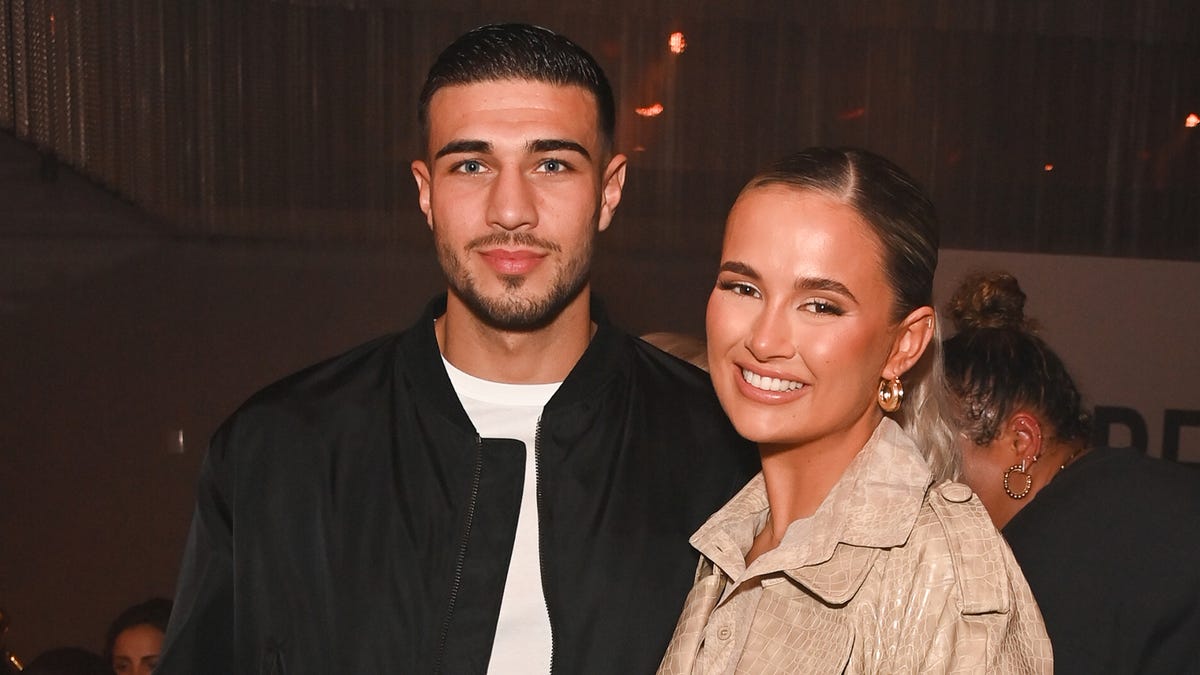

Molly Mae Hague And Tommy Fury The Latest News And Fan Discussion

May 14, 2025

Molly Mae Hague And Tommy Fury The Latest News And Fan Discussion

May 14, 2025 -

Is Your Coffee Creamer Safe Michigan Recall Alert

May 14, 2025

Is Your Coffee Creamer Safe Michigan Recall Alert

May 14, 2025 -

Tommy Fury Fined For Speeding After Molly Mae Hague Split

May 14, 2025

Tommy Fury Fined For Speeding After Molly Mae Hague Split

May 14, 2025 -

Scotty Mc Creerys Sons Adorable George Strait Tribute A Must Watch Video

May 14, 2025

Scotty Mc Creerys Sons Adorable George Strait Tribute A Must Watch Video

May 14, 2025 -

Expat Exodus To Canada A Boon For The Canadian Economy

May 14, 2025

Expat Exodus To Canada A Boon For The Canadian Economy

May 14, 2025

Latest Posts

-

New Docuseries Explores The Lives Of Wynonna And Ashley Judd

May 14, 2025

New Docuseries Explores The Lives Of Wynonna And Ashley Judd

May 14, 2025 -

Judd Family Docuseries Wynonna And Ashley Reveal All

May 14, 2025

Judd Family Docuseries Wynonna And Ashley Reveal All

May 14, 2025 -

Is Vince Vaughn Italian A Look At His Family History

May 14, 2025

Is Vince Vaughn Italian A Look At His Family History

May 14, 2025 -

The Truth About Vince Vaughns Italian Background

May 14, 2025

The Truth About Vince Vaughns Italian Background

May 14, 2025 -

Uncovering Vince Vaughns Heritage Italian Roots

May 14, 2025

Uncovering Vince Vaughns Heritage Italian Roots

May 14, 2025