Finance Loans 101: A Step-by-Step Application Guide

Table of Contents

Understanding Different Types of Finance Loans

Choosing the right finance loan depends heavily on your specific needs. Let's explore some common loan types:

Personal Loans: Your Personal Financial Solution

Personal loans are versatile and ideal for various purposes, including debt consolidation, covering unexpected expenses (like medical bills or home repairs), or financing personal projects (home improvements, vacations, etc.).

- Unsecured vs. Secured Loans: Unsecured personal loans don't require collateral, while secured loans use assets (like a car or savings account) as collateral. Secured loans typically offer lower interest rates but carry the risk of losing your collateral if you default.

- Fixed vs.VariableInterest Rates: Fixed interest rates remain constant throughout the loan term, offering predictable monthly payments. Variable interest rates fluctuate with market conditions, potentially leading to unpredictable payments.

- Loan Terms: Loan terms range from a few months to several years, influencing your monthly payment amount and the total interest paid. Shorter terms mean higher monthly payments but less overall interest.

- Typical APRs: Annual Percentage Rates (APRs) for personal loans vary depending on your credit score, loan amount, and lender. Shop around to compare offers and find the best APR.

Business Loans: Fueling Your Business Growth

Business loans are crucial for startups, expansion, equipment purchases, and managing operational costs. Securing the right financing can be the key to success.

- Small Business Loans: Several options exist, including SBA loans (guaranteed by the Small Business Administration), term loans (fixed repayment schedule), and lines of credit (access to funds as needed).

- Commercial Real Estate Loans: These loans are specifically designed for purchasing or refinancing commercial properties. They often require a significant down payment and strong financial history.

- Equipment Financing: This type of loan helps businesses purchase essential equipment, with the equipment itself often serving as collateral.

Eligibility requirements for business loans typically include a solid business plan, strong financial statements, and a good credit history.

Other Loan Types: A Quick Overview

While personal and business loans are common, other types of loans cater to specific needs:

- Mortgages: Used to finance the purchase of a home. Eligibility depends on credit score, income, and down payment. [Link to a mortgage resource]

- Auto Loans: Finance the purchase of a vehicle. Interest rates vary depending on the vehicle's value, your credit score, and the loan term. [Link to an auto loan resource]

- Student Loans: Help finance higher education. Repayment begins after graduation, with various repayment plans available. [Link to a student loan resource]

Checking Your Loan Eligibility and Credit Score

Before applying for any finance loan, assess your eligibility and creditworthiness.

Importance of Credit Score: The Key to Approval

Your credit score significantly impacts your loan approval chances and the interest rate you'll receive. A higher credit score often translates to lower interest rates and better loan terms.

- Factors Influencing Credit Score: Your payment history (on-time payments are crucial), debt utilization (the amount of credit you're using compared to your total credit limit), length of credit history, and new credit applications all affect your score.

- How to Check Your Credit Report: You can access your free credit report annually from AnnualCreditReport.com. Check for errors and take steps to correct them.

- Improving Your Credit Score: Paying bills on time, reducing debt, and maintaining a good credit history are essential for improving your credit score.

Gathering Required Documents: Prepare for a Smooth Application

Loan applications require specific documentation to verify your identity, income, and financial stability.

- Personal Loans: Typically require income statements (pay stubs or W-2s), bank statements, and possibly proof of address.

- Business Loans: Demand more extensive documentation, including business tax returns, financial statements, business plan, and sometimes personal financial statements.

The Loan Application Process: A Step-by-Step Guide

Applying for a finance loan involves several key steps.

Choosing the Right Lender: Comparing Apples to Apples

Researching and comparing lenders is critical to finding the best loan terms. Consider these factors:

- Interest Rates: Look for the lowest APR possible.

- Fees: Be aware of origination fees, prepayment penalties, and other charges.

- Customer Service: Read reviews and check the lender's reputation.

- Comparing Offers: Use online comparison tools to easily compare different loan offers.

Completing the Application: Accuracy is Key

The application process can be online or in-person. Accuracy is paramount.

- Step-by-Step Instructions: Carefully fill out the application form, providing accurate information. Double-check all details before submitting.

- Potential Challenges: Be prepared to address any questions or concerns the lender may have.

- Troubleshooting Tips: If you encounter problems, contact the lender's customer service for assistance.

Loan Approval and Disbursement: The Final Steps

After submitting your application, the lender will review it and inform you of their decision.

- Timeline for Loan Approval: The approval process can take several days to several weeks.

- Disbursement Methods: Funds are typically disbursed via direct deposit or check.

- Potential Delays: Delays can occur due to incomplete applications or issues with documentation.

Understanding Loan Terms and Repayment Options

Understanding loan terms and repayment options is essential for successful loan management.

Interest Rates and Fees: Know What You're Paying

- APR (Annual Percentage Rate): This reflects the total cost of borrowing, including interest and fees.

- Origination Fees: A fee charged by the lender for processing the loan.

- Prepayment Penalties: Fees charged for paying off the loan early.

- Calculating Monthly Payments: Use online calculators to estimate your monthly payments.

Repayment Schedules: Choosing the Right Plan

- Fixed Payments: Consistent monthly payments throughout the loan term.

- Variable Payments: Monthly payments may fluctuate based on interest rates.

- Choosing the Right Schedule: Select a repayment plan that aligns with your budget and financial goals.

Conclusion

Securing the right finance loan can significantly impact your personal or business goals. By understanding the different loan types, assessing your eligibility, and carefully navigating the application process, you can increase your chances of approval and secure favorable terms. Remember to compare offers from multiple lenders, read the fine print carefully, and choose a repayment plan that aligns with your financial capabilities. Start your journey towards financial success by exploring your finance loan options today! Don't hesitate to use this guide as your roadmap to understanding and applying for finance loans.

Featured Posts

-

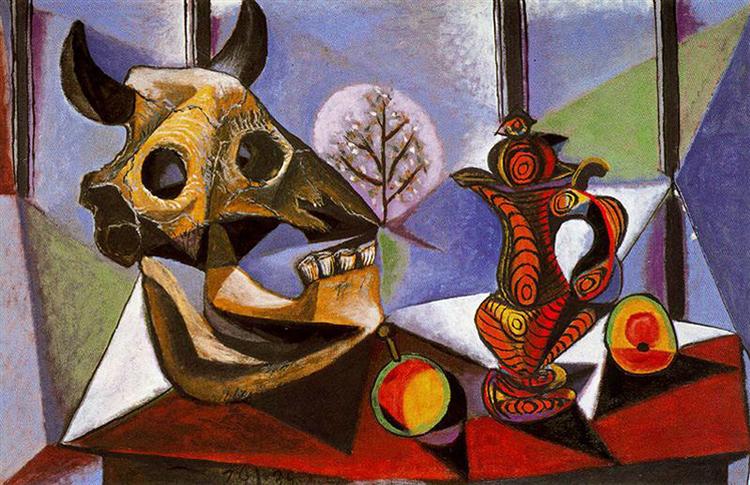

Chicagos Art History The Impact Of Picassos 1939 Exhibition

May 28, 2025

Chicagos Art History The Impact Of Picassos 1939 Exhibition

May 28, 2025 -

National Mlb Power Rankings Show Padres Decline

May 28, 2025

National Mlb Power Rankings Show Padres Decline

May 28, 2025 -

Nba 2 K25 Playoff Push Significant Player Rating Increases In Latest Update

May 28, 2025

Nba 2 K25 Playoff Push Significant Player Rating Increases In Latest Update

May 28, 2025 -

Cuaca Kaltim Hari Ini Ikn Balikpapan Samarinda Dan Lainnya

May 28, 2025

Cuaca Kaltim Hari Ini Ikn Balikpapan Samarinda Dan Lainnya

May 28, 2025 -

Afc Bournemouth Vs Ipswich Town Team News And Injury Report

May 28, 2025

Afc Bournemouth Vs Ipswich Town Team News And Injury Report

May 28, 2025

Latest Posts

-

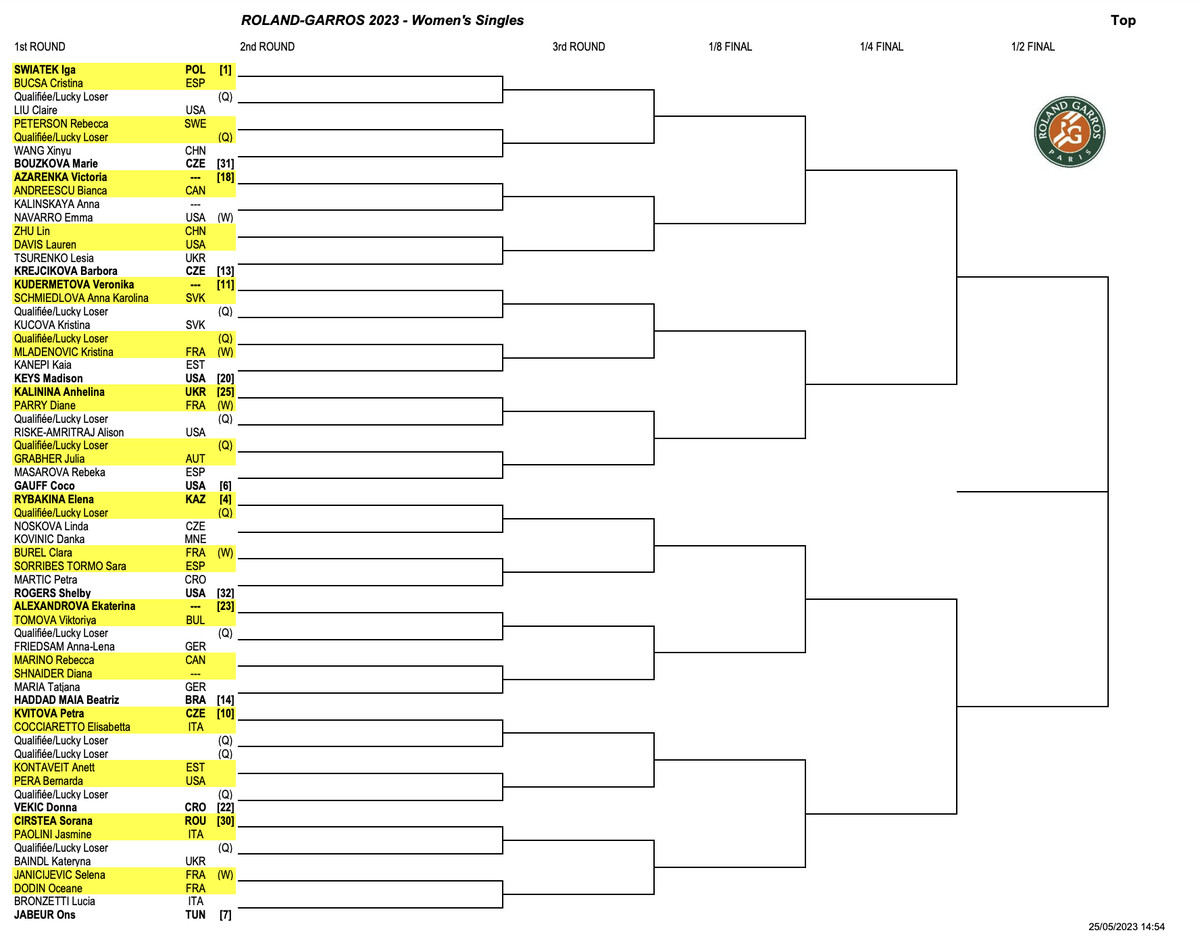

Casper Ruud Withdraws From Roland Garros Due To Knee Pain

May 30, 2025

Casper Ruud Withdraws From Roland Garros Due To Knee Pain

May 30, 2025 -

Djokovic And Sinners French Open Battle A Closer Look

May 30, 2025

Djokovic And Sinners French Open Battle A Closer Look

May 30, 2025 -

Knee Injury Sidelines Casper Ruud At Roland Garros Borges Secures Upset Win

May 30, 2025

Knee Injury Sidelines Casper Ruud At Roland Garros Borges Secures Upset Win

May 30, 2025 -

Sinner And Djokovic Rise To The French Open Challenge

May 30, 2025

Sinner And Djokovic Rise To The French Open Challenge

May 30, 2025 -

Ruuds Painful Knee Hinders Performance Leading To Defeat At Roland Garros

May 30, 2025

Ruuds Painful Knee Hinders Performance Leading To Defeat At Roland Garros

May 30, 2025