Finance Loans 101: Your Complete Guide To Applying For Loans

Table of Contents

Understanding Different Types of Finance Loans

The world of finance loans is diverse, with various options tailored to specific needs. Understanding the key differences between these loan types is crucial for making an informed decision. Let's explore some common types:

-

Personal Loans: These versatile loans are used for various personal expenses, such as debt consolidation, home improvements, or medical bills. They typically have shorter repayment periods (ranging from a few months to several years) and varying interest rates depending on your creditworthiness.

-

Business Loans: Essential for funding business operations, expansion, or equipment purchases, business loans often require a detailed business plan and strong financial projections. Interest rates and terms vary widely based on the loan amount, your business's financial health, and the lender.

-

Student Loans: Designed to help finance education costs, student loans come in federal and private options, each with different repayment plans and interest rates. Understanding the repayment terms and potential for loan forgiveness is crucial before borrowing.

-

Mortgage Loans: Used to purchase real estate, mortgage loans involve significant long-term commitments. Repayment periods are typically lengthy (15-30 years), and interest rates can be substantial. Factors like your down payment, credit score, and the property's value significantly impact the loan terms.

-

Auto Loans: These loans are specifically for financing vehicle purchases. Interest rates and loan terms depend on the vehicle's value, your credit score, and the lender.

It's vital to compare loan interest rates and repayment options across various loan types to find the best fit for your financial situation. Understanding the total cost of borrowing, including interest and fees, is paramount.

Preparing for Your Loan Application: Essential Steps

Applying for a loan without proper preparation can lead to delays and rejection. Taking these essential steps will significantly increase your chances of approval:

-

Check Your Credit Report and Score: Your credit score is a crucial factor in determining your loan eligibility and interest rate. Check your credit report for accuracy and identify any areas for improvement. Sites like AnnualCreditReport.com offer free access to your credit reports.

-

Gather Financial Documents: Lenders require proof of your financial stability. Gather essential documents like pay stubs, tax returns, bank statements, and any other financial records that demonstrate your income and expenses.

-

Calculate Your Debt-to-Income Ratio (DTI): Your DTI reflects your monthly debt payments relative to your gross monthly income. A lower DTI increases your chances of loan approval. Understanding your DTI helps you determine your borrowing capacity.

-

Consider Loan Pre-Approval: Many lenders offer pre-approval, which gives you an estimate of how much you can borrow and at what interest rate. This helps you shop around for the best offers and sets realistic expectations.

Improving Your Credit Score Before Applying

A higher credit score significantly improves your chances of securing favorable loan terms. Consider these steps:

-

Pay Bills on Time: Consistent on-time payments demonstrate responsible financial behavior.

-

Reduce Credit Utilization: Keep your credit card balances low relative to your credit limits.

-

Dispute Inaccuracies: Review your credit report regularly and dispute any inaccurate information.

The Loan Application Process: A Step-by-Step Guide

The loan application process varies slightly depending on the lender and loan type, but these general steps apply:

-

Complete the Loan Application Form: Fill out the application form accurately and thoroughly, providing all requested information. Many lenders offer online applications for convenience.

-

Provide Supporting Documentation: Submit all required documents, ensuring they are clear, legible, and complete.

-

Understand the Terms and Conditions: Carefully review the loan offer, including interest rates, fees, repayment terms, and any other conditions.

-

Ask Questions: Don't hesitate to ask the lender any questions you may have about the application process or the loan terms.

Choosing the Right Lender and Loan Product

Comparing different lenders and loan products is crucial for securing the best terms. Consider these factors:

-

Interest Rates: Compare interest rates from various lenders to find the lowest rate possible.

-

Loan Fees: Be aware of any associated fees, such as origination fees or prepayment penalties.

-

Repayment Terms: Choose repayment terms that align with your budget and financial goals.

-

Customer Reviews: Research lender reputation and customer reviews to ensure you're dealing with a reputable institution.

Conclusion:

Successfully navigating the finance loan application process involves careful planning, understanding different loan types, preparing your financial documents, and thoroughly comparing lenders and loan products. By following these steps, you'll increase your chances of securing the best finance loan for your needs. Start your journey to securing your finance loans today! Find the best finance loans for your needs by following these steps and comparing offers from reputable lenders. Use online loan comparison tools to simplify your search!

Featured Posts

-

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Destroyed Or Damaged

May 28, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Destroyed Or Damaged

May 28, 2025 -

Climate Change And Increased Rainfall In Western Massachusetts

May 28, 2025

Climate Change And Increased Rainfall In Western Massachusetts

May 28, 2025 -

U S Unveils New Missile System To Counter Chinese Navy

May 28, 2025

U S Unveils New Missile System To Counter Chinese Navy

May 28, 2025 -

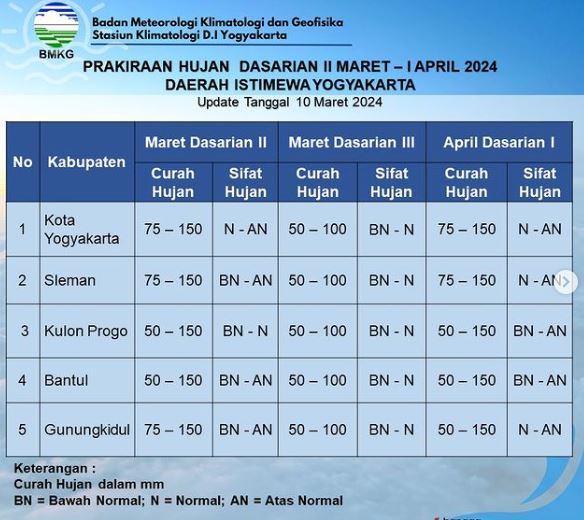

Prakiraan Cuaca Lengkap Jawa Tengah 23 April 2024

May 28, 2025

Prakiraan Cuaca Lengkap Jawa Tengah 23 April 2024

May 28, 2025 -

Cubs Vs Diamondbacks Game Prediction Outright Cubs Victory

May 28, 2025

Cubs Vs Diamondbacks Game Prediction Outright Cubs Victory

May 28, 2025

Latest Posts

-

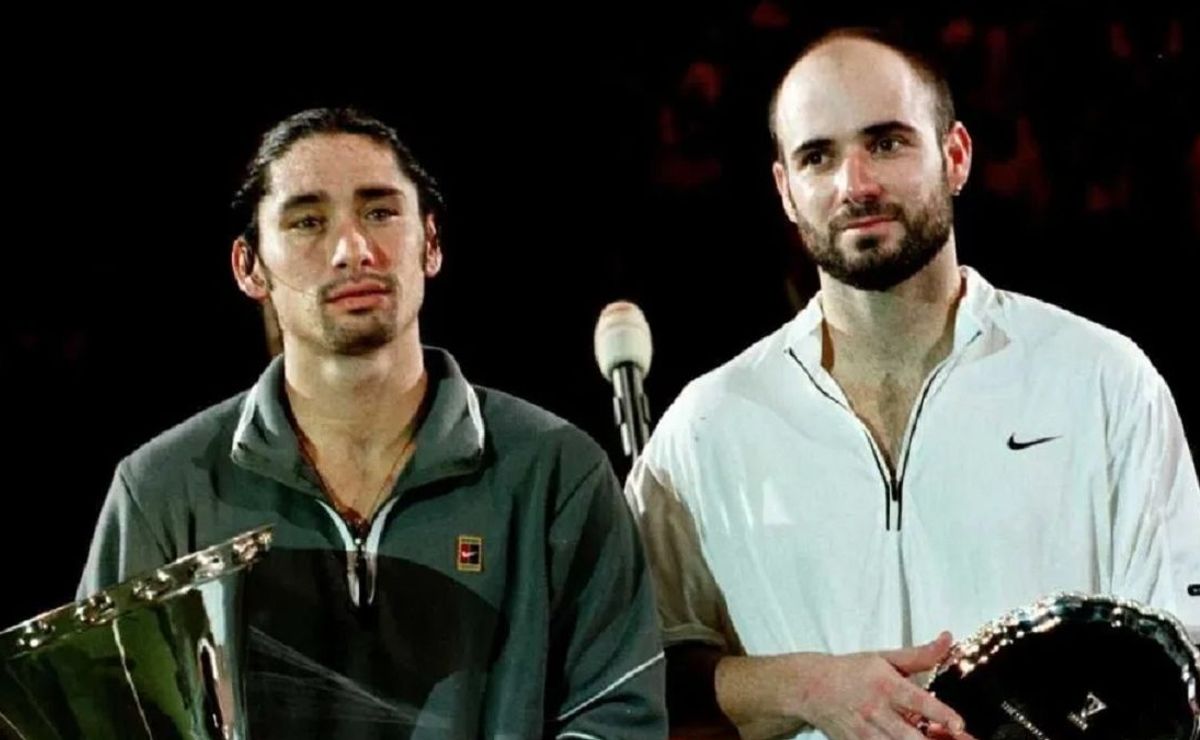

Controversial Revelaciones Un Tenista Argentino Y Su Opinion Sobre Marcelo Rios

May 30, 2025

Controversial Revelaciones Un Tenista Argentino Y Su Opinion Sobre Marcelo Rios

May 30, 2025 -

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025 -

Un Tenista Argentino Arremete Contra Rios Era Un Dios Del Tenis

May 30, 2025

Un Tenista Argentino Arremete Contra Rios Era Un Dios Del Tenis

May 30, 2025 -

Andre Agassi Regresa Al Deporte Un Nuevo Comienzo Fuera De La Pista

May 30, 2025

Andre Agassi Regresa Al Deporte Un Nuevo Comienzo Fuera De La Pista

May 30, 2025 -

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025