Finance Loans: Interest Rates, EMI Calculations, And Loan Tenure

Table of Contents

Understanding Interest Rates in Finance Loans

Interest rates are the cost of borrowing money. They represent the percentage of the principal loan amount you'll pay as a fee for using the lender's funds. Understanding loan interest is fundamental to making smart borrowing decisions. There are two primary types of interest rates: fixed and variable. Knowing the difference is vital when choosing a finance loan.

-

Fixed Interest Rate: This rate remains constant throughout the loan's tenure. You'll know precisely how much you'll pay each month in interest, making budgeting more predictable. However, fixed rates might not always be the lowest available.

-

Variable Interest Rate: This rate fluctuates based on market conditions. While it might initially be lower than a fixed rate, it could increase or decrease over time, making your monthly payments unpredictable.

The Annual Percentage Rate (APR) is a crucial factor when comparing loan offers. The APR reflects the true cost of borrowing, including interest and other fees. Always compare the APR of different loans to ensure you're getting the best deal. Several factors influence interest rates, including:

- Your credit score: A higher credit score typically results in lower interest rates.

- The loan amount: Larger loan amounts might attract higher interest rates.

- The type of loan: Different loan types (e.g., personal loans, auto loans, mortgages) carry varying interest rates.

Consider this example: A loan of $10,000 with a 5% interest rate will cost significantly less in total interest than the same loan with a 10% interest rate. Understanding interest calculation and compound interest (interest calculated on both the principal and accumulated interest) is crucial to grasping the total cost of borrowing.

Calculating EMIs for Your Finance Loan

The equated monthly installment (EMI) is the fixed amount you pay each month to repay your loan. Calculating EMIs involves a formula considering the principal loan amount, interest rate, and loan tenure. While the exact formula is complex, numerous online loan EMI calculators simplify this process.

- The basic components of an EMI calculation are:

- Principal Loan Amount: The total amount borrowed.

- Interest Rate: The annual interest rate on the loan.

- Loan Tenure: The total repayment period in months.

Using an online EMI calculator offers several benefits:

- Ease of Use: Input the loan details, and the calculator instantly provides your EMI.

- Accuracy: Eliminates manual calculation errors, ensuring accurate EMI determination.

- Comparison: You can easily compare EMIs for different loan offers side-by-side.

Understanding loan amortization is also important. An amortization schedule details how each monthly payment is allocated between principal and interest over the loan's lifetime. This schedule helps you track your loan repayment progress.

Choosing the Right Loan Tenure for Your Finance Loan

Loan tenure, or the repayment period, significantly impacts your monthly payments and the total interest paid. A shorter loan tenure leads to higher EMIs but lower total interest payments, while a longer tenure results in lower EMIs but higher total interest paid.

-

Shorter Loan Tenure (e.g., 3 years): Higher EMIs but less interest paid overall. Suitable for those comfortable with higher monthly payments to pay off the debt quickly.

-

Longer Loan Tenure (e.g., 5-7 years): Lower EMIs but more interest paid overall. Suitable for those seeking lower monthly payments but willing to pay more interest over the loan's lifetime.

Choosing the right loan tenure requires careful consideration of your financial capabilities and long-term financial goals. A longer loan tenure might seem appealing initially due to lower EMIs, but remember the higher overall cost due to accumulated interest. Ensure your chosen loan repayment plan aligns with your budget and long-term financial stability.

Factors Influencing Loan Approval and Interest Rates

Securing a loan depends on various factors. Lenders assess applications based on your financial health and creditworthiness. Key factors include:

- Credit Score and History: A good credit score and a positive credit history significantly improve your chances of loan approval and secure better interest rates.

- Income and Debt-to-Income Ratio: Lenders assess your ability to repay the loan by considering your income and existing debt obligations. A lower debt-to-income ratio increases your approval likelihood.

- Collateral (if applicable): Some loans require collateral, an asset you pledge as security for the loan. This can influence loan approval and interest rates.

- Loan Application Process: Follow the lender's application instructions carefully and provide all the necessary documentation to streamline the process.

Conclusion

Successfully navigating the world of finance loans requires a thorough understanding of interest rates, EMIs, and loan tenure. By carefully considering these factors and utilizing available resources like online EMI calculators, you can make informed decisions that align with your financial goals. Ready to explore your finance loan options? Start by using an online EMI calculator to estimate your monthly payments and compare different loan offers. Understanding finance loans, their interest rates, EMIs, and loan tenure will help you secure the best financing solution for your needs.

Featured Posts

-

Household Spending And Chinas Economic Future A Cautious Outlook

May 28, 2025

Household Spending And Chinas Economic Future A Cautious Outlook

May 28, 2025 -

4

May 28, 2025

4

May 28, 2025 -

Ipswich Town Fc Enciso Phillips And Woolfenden Complete Transfers

May 28, 2025

Ipswich Town Fc Enciso Phillips And Woolfenden Complete Transfers

May 28, 2025 -

Will Trump Sanction Russia The Future Of Us Russia Relations Under Scrutiny

May 28, 2025

Will Trump Sanction Russia The Future Of Us Russia Relations Under Scrutiny

May 28, 2025 -

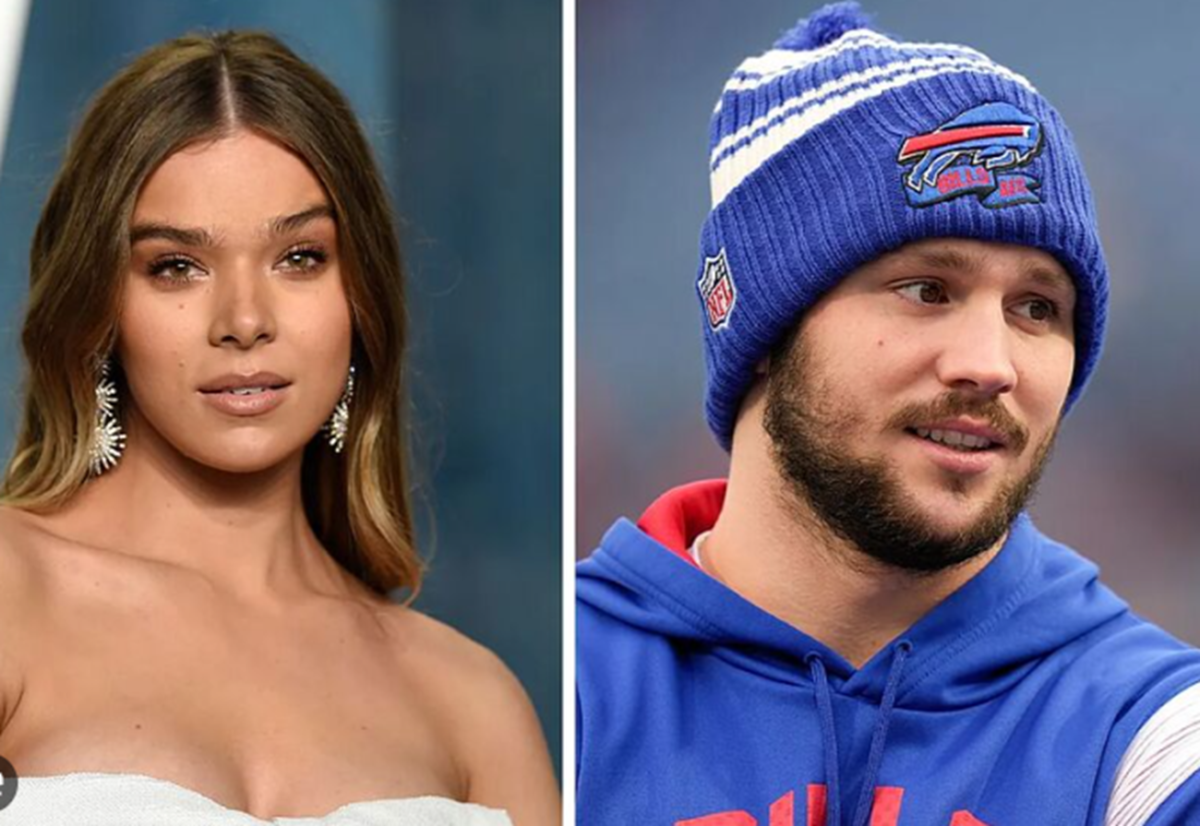

Hailee Steinfelds Wedding Four Months After Engagement Plans Emerge

May 28, 2025

Hailee Steinfelds Wedding Four Months After Engagement Plans Emerge

May 28, 2025

Latest Posts

-

Qui Est Laurent Jacobelli Depute Rn Et Vice President Du Groupe

May 30, 2025

Qui Est Laurent Jacobelli Depute Rn Et Vice President Du Groupe

May 30, 2025 -

Hanouna Et L Affaire Le Pen 2027 Jacobelli Denonce Une Tentative De Blocage

May 30, 2025

Hanouna Et L Affaire Le Pen 2027 Jacobelli Denonce Une Tentative De Blocage

May 30, 2025 -

Laurent Jacobelli Ses Prises De Position Et Ses Interventions A L Assemblee Nationale

May 30, 2025

Laurent Jacobelli Ses Prises De Position Et Ses Interventions A L Assemblee Nationale

May 30, 2025 -

Elections 2027 Laurent Jacobelli S Inquiete D Une Exclusion De Marine Le Pen

May 30, 2025

Elections 2027 Laurent Jacobelli S Inquiete D Une Exclusion De Marine Le Pen

May 30, 2025 -

Politique Francaise Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025

Politique Francaise Laurent Jacobelli Depute Rn De La Moselle

May 30, 2025