Financial Mistakes Women Should Avoid

Table of Contents

Underestimating the Importance of Retirement Planning

The gender retirement gap is a stark reality. Women, on average, retire with significantly less savings than men. This disparity stems from several factors, including career interruptions for childcare, lower lifetime earnings due to the gender pay gap, and sometimes less aggressive investment strategies. However, proactive planning can significantly mitigate this risk.

The Gender Retirement Gap: Bridging the Divide

The gender retirement gap is not inevitable. By taking control of your financial future early, you can significantly improve your retirement prospects.

- Start saving early, even if it's a small amount. The power of compound interest means that even small contributions made early in your career can grow substantially over time. Consider using automatic transfers to your retirement accounts to make saving effortless.

- Take advantage of employer-sponsored retirement plans (401k, 403b, etc.). Many employers offer matching contributions, essentially giving you free money. Maximize your contributions to take full advantage of this benefit.

- Consider opening a Roth IRA for tax-advantaged growth. A Roth IRA allows your investments to grow tax-free, providing a significant advantage in retirement.

- Seek professional financial advice to create a personalized retirement plan. A financial advisor can help you develop a tailored strategy based on your individual circumstances, risk tolerance, and retirement goals.

Ignoring Investment Growth Potential: Unlocking Your Financial Future

Many women are less likely to invest aggressively, potentially missing out on significant long-term growth. This often stems from a lack of financial literacy and confidence.

- Educate yourself about different investment options (stocks, bonds, mutual funds, ETFs). Understanding the basics of investing will empower you to make informed decisions. Numerous online resources and educational materials are available.

- Diversify your portfolio to manage risk. Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce the impact of potential losses.

- Consider working with a financial advisor to create an investment strategy aligned with your goals. A financial advisor can provide personalized guidance and help you navigate the complexities of investing.

Failing to Negotiate Salary and Benefits

Negotiating your salary and understanding your benefits package are crucial steps in achieving financial security. Women consistently earn less than men for doing the same job, widening the wealth gap over a lifetime.

The Gender Pay Gap: Advocating for Your Worth

Negotiating your salary is a skill that can significantly impact your earning potential.

- Research industry salary benchmarks before negotiations. Websites and professional organizations offer valuable salary data to inform your requests.

- Practice articulating your value and accomplishments. Prepare a compelling case that highlights your skills, experience, and contributions to the company.

- Don't be afraid to walk away from an offer that doesn't meet your expectations. Your worth is reflected in your compensation.

Underutilizing Employee Benefits: Maximizing Your Resources

Many women fail to fully utilize the benefits offered by their employers, missing out on valuable financial protection and opportunities.

- Review your employee benefits package thoroughly. Understand what's included and how each benefit can protect you financially.

- Understand the value of each benefit and how it can protect you. This includes health insurance, life insurance, disability insurance, and retirement plan matching contributions.

- Maximize your contributions to employer-sponsored retirement plans. This is often a key element to financial security in retirement.

Ignoring Debt Management

High-interest debt, like credit card debt, can severely hinder financial progress. A lack of financial literacy can further exacerbate this issue.

High-Interest Debt: Breaking the Cycle

High-interest debt can quickly spiral out of control. Taking proactive steps to manage it is crucial for long-term financial health.

- Create a budget to track income and expenses. Understanding where your money is going is the first step towards managing debt effectively.

- Prioritize paying down high-interest debt. Focus on the debts with the highest interest rates to minimize the overall cost of borrowing.

- Explore debt consolidation options. Consolidating high-interest debts into a lower-interest loan can simplify payments and reduce the total interest paid.

Lack of Financial Literacy: Empowering Yourself

Financial literacy empowers you to make informed financial decisions.

- Seek out financial education resources (books, websites, workshops, podcasts). Numerous free and affordable resources are available to help you build your knowledge.

- Talk to a financial advisor for personalized guidance. A financial advisor can provide tailored advice based on your specific circumstances and goals.

- Join a financial literacy group or community. Connecting with other women who share similar financial goals can provide support and encouragement.

Neglecting Estate Planning

Estate planning ensures your assets are distributed according to your wishes, providing financial security for your loved ones. This is especially vital for women, often primary caregivers.

Will and Trusts: Protecting Your Legacy

Having a will and potentially a trust ensures your wishes are carried out after your passing.

- Consult with an estate planning attorney. An attorney can help you create a comprehensive estate plan tailored to your specific needs and circumstances.

- Update your will and beneficiary designations regularly. Life changes may necessitate updates to your estate plan to ensure it reflects your current wishes.

- Consider establishing a trust to protect assets and minimize estate taxes. A trust can offer additional protection for your assets and minimize potential tax liabilities.

Conclusion: Taking Control of Your Financial Future

Avoiding common financial mistakes is essential for women to achieve financial security and independence. By proactively addressing retirement planning, salary negotiation, debt management, and estate planning, women can build a strong financial foundation for their future. Don't let these common financial mistakes women make hold you back. Take control of your financial future today by educating yourself, seeking professional advice, and actively managing your finances. Start planning your financial future – avoiding financial mistakes women often make will lead you to success!

Featured Posts

-

Thong Tin Moi Nhat Ve Du An Xay Dung Cau Ma Da Dong Nai

May 22, 2025

Thong Tin Moi Nhat Ve Du An Xay Dung Cau Ma Da Dong Nai

May 22, 2025 -

Blake Lively And Taylor Swift Alleged Blackmail Over Leaked Texts And The Baldoni Feud

May 22, 2025

Blake Lively And Taylor Swift Alleged Blackmail Over Leaked Texts And The Baldoni Feud

May 22, 2025 -

Dexter Resurrection A Look At The Return Of Lithgow And Smits

May 22, 2025

Dexter Resurrection A Look At The Return Of Lithgow And Smits

May 22, 2025 -

Provence Walking Tour Mountains To Mediterranean Coast

May 22, 2025

Provence Walking Tour Mountains To Mediterranean Coast

May 22, 2025 -

Remont Pivdennogo Mostu Oglyad Proektu Ta Yogo Finansuvannya

May 22, 2025

Remont Pivdennogo Mostu Oglyad Proektu Ta Yogo Finansuvannya

May 22, 2025

Latest Posts

-

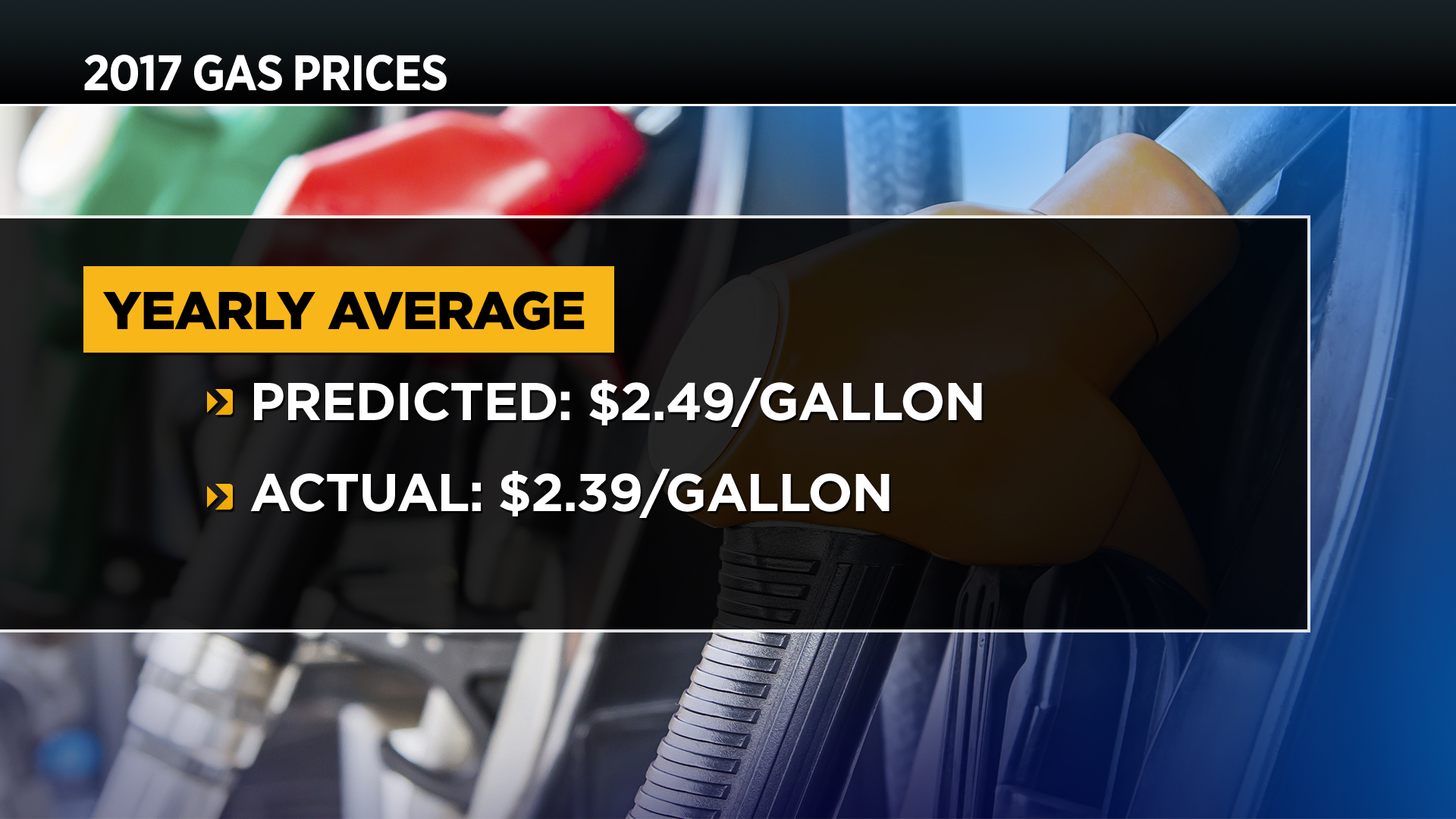

Finding The Cheapest Gas In Columbus A 48 Cent Price Difference

May 22, 2025

Finding The Cheapest Gas In Columbus A 48 Cent Price Difference

May 22, 2025 -

Gas Prices In Columbus Ohio Current Price Comparison

May 22, 2025

Gas Prices In Columbus Ohio Current Price Comparison

May 22, 2025 -

Columbus Fuel Prices Fluctuate 48 Cent Gap Between Stations

May 22, 2025

Columbus Fuel Prices Fluctuate 48 Cent Gap Between Stations

May 22, 2025 -

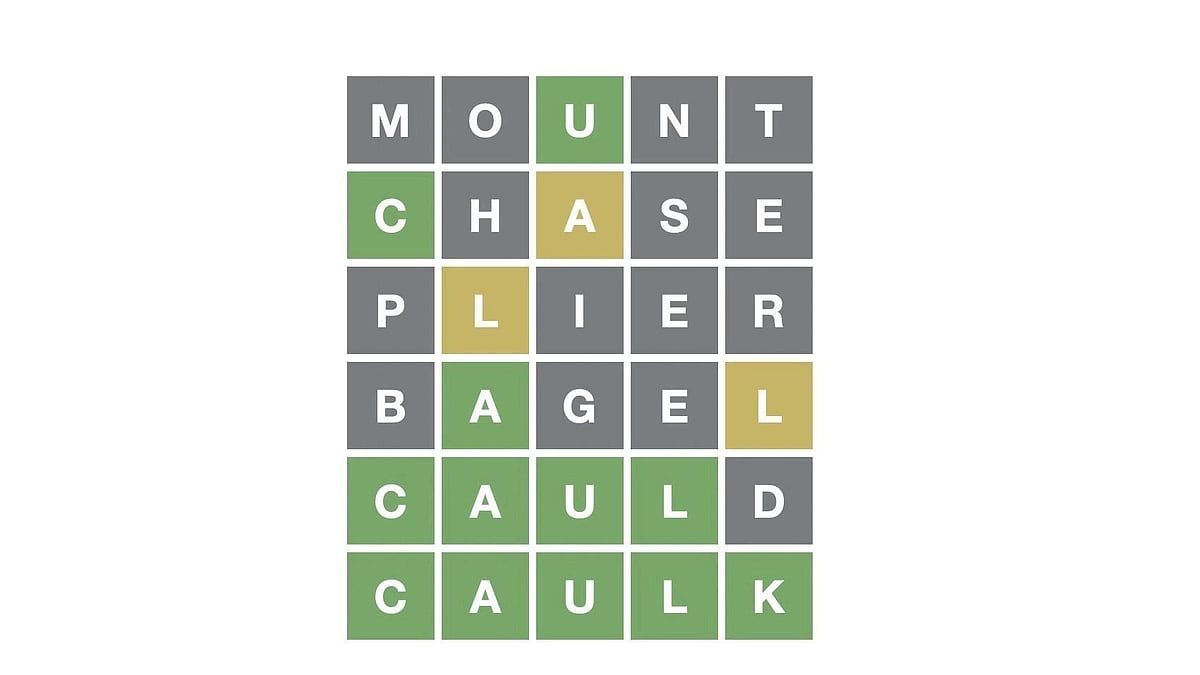

Wordle 367 March 17th Hints Clues And The Solution

May 22, 2025

Wordle 367 March 17th Hints Clues And The Solution

May 22, 2025 -

Wide Gas Price Variation In Columbus From 2 83 To 3 31

May 22, 2025

Wide Gas Price Variation In Columbus From 2 83 To 3 31

May 22, 2025