Financial Update: How X's Debt Sale Reshaped The Company

Table of Contents

The Details of X's Debt Sale

X's debt sale involved the disposal of a substantial amount of debt obligations. The specifics of this complex transaction are crucial to understanding its overall impact. Let's break down the key details:

- Total amount of debt sold: $500 million

- Type of debt instruments involved: A mix of high-yield corporate bonds and term loans.

- Identity of the purchaser(s): A consortium of institutional investors, including several prominent hedge funds and private equity firms.

- Sale price and terms: The debt was sold at a discounted rate, reflecting prevailing market conditions. Specific terms, including interest rates and maturity dates, remain confidential.

- Timeline of the sale: The sale was completed over a period of three months, involving complex negotiations and regulatory approvals.

The rationale behind X's decision to sell this debt is multifaceted. The company cited a need for debt restructuring to improve its financial strategy and achieve better capital optimization. This move, part of a broader financial restructuring plan, allowed X to reduce its overall debt burden and improve its liquidity position.

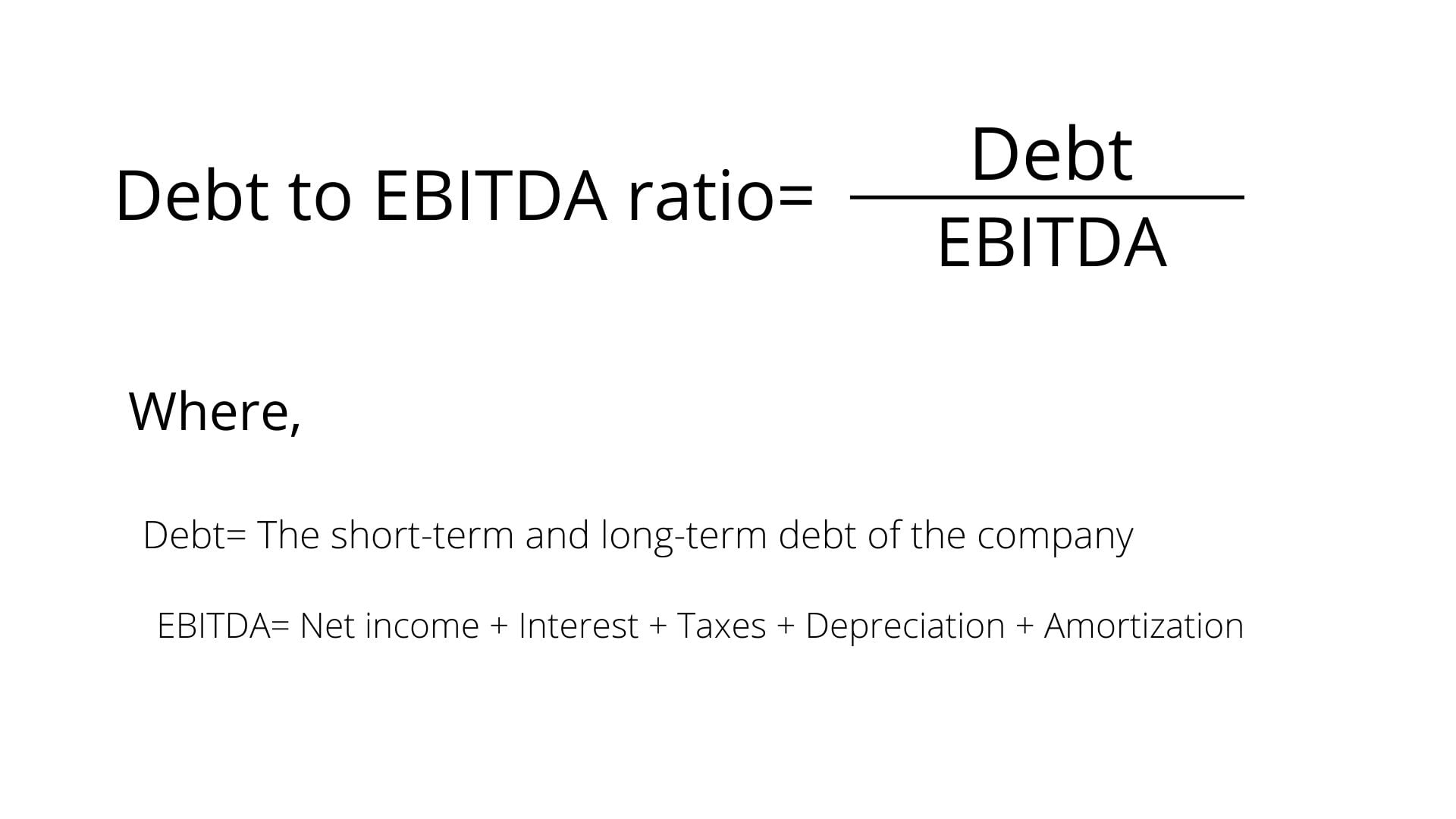

Impact on X's Financial Health

X's debt sale has had a demonstrably positive impact on several key financial metrics, significantly enhancing the company's financial performance. Here's a closer look:

- Improved debt-to-equity ratio: The sale dramatically reduced X's debt-to-equity ratio, lowering the financial risk associated with high levels of leverage.

- Changes in interest expense: By reducing its outstanding debt, X has significantly lowered its annual interest expense, freeing up capital for other strategic initiatives.

- Impact on credit rating: Credit rating agencies have responded positively to the debt sale, upgrading X's credit rating, reflecting improved creditworthiness and reduced risk.

- Increased financial flexibility: The sale has provided X with greater financial flexibility, allowing the company to pursue growth opportunities and withstand potential economic downturns.

- Potential for increased investment in R&D or expansion: The freed-up capital can now be allocated to research and development, facilitating the development of innovative products and services or supporting expansion into new markets.

The impact on X's balance sheet is clear: improved liquidity, reduced liabilities, and a stronger overall financial position. This improved solvency enhances the company's prospects for long-term success.

Long-Term Strategic Implications of X's Debt Sale

The strategic implications of X's debt sale extend beyond the immediate financial benefits. This move is clearly part of a larger strategic plan aimed at achieving significant long-term goals:

- Potential for acquisitions or mergers: The improved financial position enables X to consider acquisitions or mergers to expand its market share and product offerings.

- Opportunities for new product development: Increased investment in R&D can lead to the development of groundbreaking new products, driving further growth and market differentiation.

- Enhanced competitiveness in the market: Reduced debt and improved financial flexibility enhance X's competitiveness, allowing it to respond more effectively to market changes and opportunities.

- Long-term financial stability: The debt sale has created a foundation for long-term financial stability, minimizing the risk of future financial distress.

- Shareholder value enhancement: Ultimately, the improved financial health and strategic opportunities should lead to enhanced shareholder value.

X's strategic planning clearly incorporates the debt sale as a catalyst for future growth and market dominance.

Investor Reaction and Market Analysis

The market's reaction to X's debt sale has been largely positive. The announcement was met with a surge in X's stock price, indicating strong investor confidence in the company's future.

- Immediate stock market reaction: A significant increase in X's share price following the announcement.

- Analyst reports and opinions: Most analysts have issued positive reports, praising the strategic move and predicting improved financial performance.

- Investor sentiment: Investor sentiment towards X has improved considerably, reflecting increased confidence in the company's long-term prospects.

- Long-term market outlook: The market outlook for X remains positive, suggesting continued growth and market share expansion.

The positive stock performance is a strong indicator of investor confidence in X's new financial strategy and improved prospects for future growth.

Conclusion

X's debt sale has undeniably reshaped the company's financial landscape. By significantly reducing its debt burden, improving its credit rating, and increasing its financial flexibility, X has positioned itself for substantial long-term growth. The positive market reaction confirms investor confidence in this strategic move and its potential to enhance shareholder value. The implications for future acquisitions, new product development, and market dominance are significant. Stay informed about the ongoing impact of X's debt sale and its implications for future growth by subscribing to our newsletter and following our updates on X's financial restructuring and debt management strategy.

Featured Posts

-

Johnny Damon Agrees With Trump Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025

Johnny Damon Agrees With Trump Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025 -

Update British Paralympian Sam Ruddock Still Missing In Las Vegas

Apr 29, 2025

Update British Paralympian Sam Ruddock Still Missing In Las Vegas

Apr 29, 2025 -

7 The Point Best Movie One Liners And Election Ballot Trivia

Apr 29, 2025

7 The Point Best Movie One Liners And Election Ballot Trivia

Apr 29, 2025 -

Tylor Megill And The Mets A Winning Combination Analyzing His Recent Performance

Apr 29, 2025

Tylor Megill And The Mets A Winning Combination Analyzing His Recent Performance

Apr 29, 2025 -

The Changing Face Of X Insights From The Recent Debt Financing

Apr 29, 2025

The Changing Face Of X Insights From The Recent Debt Financing

Apr 29, 2025

Latest Posts

-

Une Rencontre Inattendue L Histoire De La Visite De Stallone A L Atelier D Une Artiste

May 12, 2025

Une Rencontre Inattendue L Histoire De La Visite De Stallone A L Atelier D Une Artiste

May 12, 2025 -

Rencontre Exceptionnelle Sylvester Stallone Et L Artiste De Renommee Mondiale

May 12, 2025

Rencontre Exceptionnelle Sylvester Stallone Et L Artiste De Renommee Mondiale

May 12, 2025 -

Exposition D Art Rencontre Avec L Artiste Et Visite De L Atelier Apres La Visite De Stallone

May 12, 2025

Exposition D Art Rencontre Avec L Artiste Et Visite De L Atelier Apres La Visite De Stallone

May 12, 2025 -

Kojak Tv Guide Itv 4 Air Dates And Times

May 12, 2025

Kojak Tv Guide Itv 4 Air Dates And Times

May 12, 2025 -

Sylvester Stallone A Visite Mon Atelier Rencontre Avec Une Artiste Reconnue Internationalement

May 12, 2025

Sylvester Stallone A Visite Mon Atelier Rencontre Avec Une Artiste Reconnue Internationalement

May 12, 2025