Find The Lowest Personal Loan Interest Rates Today

Table of Contents

Understanding Personal Loan Interest Rates

Before embarking on your search for the lowest personal loan interest rates, it's crucial to understand what influences them. The Annual Percentage Rate (APR) is the total cost of borrowing, including the interest rate and any fees. A lower APR means lower overall borrowing costs. Several factors significantly impact your personal loan interest rate:

- Credit Score: Your credit score is a major determinant of the interest rate you'll receive. A higher credit score (above 700 is generally considered excellent) demonstrates creditworthiness to lenders, resulting in lower interest rates. Make sure to check your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) regularly for accuracy and to dispute any errors.

- Loan Amount: The amount you borrow directly affects your interest rate. Larger loan amounts often come with higher interest rates, as they represent a greater risk to the lender.

- Loan Term: The length of your loan term (the repayment period) influences both your monthly payment and the total interest paid. A longer loan term leads to lower monthly payments but higher overall interest costs. A shorter term means higher monthly payments but less interest paid in the long run.

- Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, shows lenders your ability to manage debt. A lower DTI suggests you can comfortably handle additional debt, leading to potentially better interest rates.

- Type of Lender: Different lenders—banks, credit unions, and online lenders—offer varying interest rates. Credit unions often provide more competitive rates for members, while online lenders may offer convenience but potentially higher rates. Understanding these differences is crucial for securing the lowest personal loan interest rates.

How to Find the Lowest Personal Loan Interest Rates

Finding the lowest personal loan interest rates requires a strategic approach. Here are key steps to follow:

Shop Around and Compare Offers

Never settle for the first offer you receive. Comparing rates from multiple lenders is essential to secure the best deal. Utilize online comparison tools and personal loan calculators to streamline the process. Remember to check pre-qualification offers, which provide an estimated rate without impacting your credit score. This allows for effective comparison shopping without hurting your credit.

Improve Your Credit Score

A higher credit score significantly increases your chances of securing lower interest rates. Focus on improving your creditworthiness by:

- Paying bills on time consistently.

- Reducing your credit utilization ratio (the amount of credit you use compared to your total available credit). Keeping this below 30% is ideal.

- Maintaining a mix of credit accounts (credit cards, installment loans).

- Avoiding opening multiple new credit accounts in a short period.

Use resources like AnnualCreditReport.com to check your credit report and dispute any inaccuracies.

Negotiate with Lenders

Once you've received several offers, don't hesitate to negotiate. If you have a strong credit history and a healthy DTI, you may be able to negotiate a lower interest rate. Highlight your responsible debt management and strong financial standing to strengthen your negotiating position.

Consider Different Loan Types

Explore different personal loan options:

- Secured loans: These loans require collateral (e.g., a car or savings account), often resulting in lower interest rates due to reduced risk for the lender.

- Unsecured loans: These loans don't require collateral, but they typically come with higher interest rates because of the increased risk for the lender.

Carefully weigh the pros and cons of each loan type before making a decision.

Avoiding Personal Loan Scams and Predatory Lending

Be wary of lenders offering unusually low interest rates or demanding upfront fees. These could be signs of a scam or predatory lending practices. Always:

- Check the lender's reputation and licensing.

- Read online reviews from other borrowers.

- Seek advice from a trusted financial professional before making any decisions.

Conclusion: Securing the Best Personal Loan Interest Rates for You

Securing the lowest personal loan interest rates involves careful planning and diligent research. By comparing offers from multiple lenders, improving your credit score, negotiating effectively, and understanding different loan types, you can significantly reduce your borrowing costs. Remember to always be vigilant against scams and predatory lending practices. Don't delay your financial dreams! Start comparing rates and finding the lowest personal loan interest rates that fit your needs today. Use reputable loan comparison websites to begin your search for the best personal loan options available.

Featured Posts

-

Guaranteed Approval Personal Loans Navigating Bad Credit Loan Options

May 28, 2025

Guaranteed Approval Personal Loans Navigating Bad Credit Loan Options

May 28, 2025 -

French Open Sinner Defeats Rinderknech Secures 15th Consecutive Grand Slam Victory

May 28, 2025

French Open Sinner Defeats Rinderknech Secures 15th Consecutive Grand Slam Victory

May 28, 2025 -

Cristiano Ronaldo Al Nassr Da 2 Yil Daha

May 28, 2025

Cristiano Ronaldo Al Nassr Da 2 Yil Daha

May 28, 2025 -

Western Massachusetts Rainfall Understanding The Climate Change Connection

May 28, 2025

Western Massachusetts Rainfall Understanding The Climate Change Connection

May 28, 2025 -

Alejandro Garnacho Should He Leave Manchester United

May 28, 2025

Alejandro Garnacho Should He Leave Manchester United

May 28, 2025

Latest Posts

-

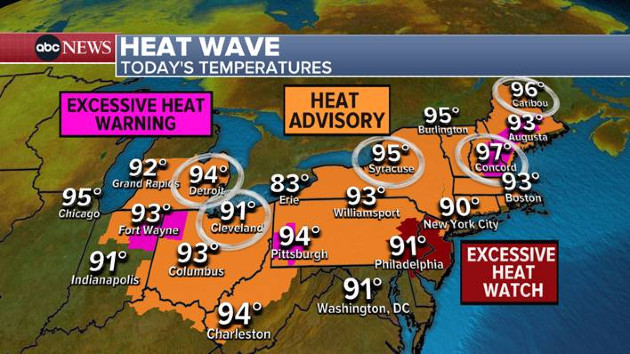

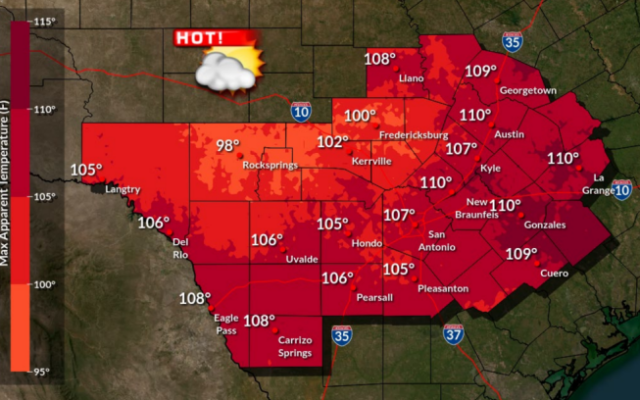

Understanding The Nwss Simplified Heat Alerts A Guide For Public Safety

May 30, 2025

Understanding The Nwss Simplified Heat Alerts A Guide For Public Safety

May 30, 2025 -

Bts Jins Coldplay Appearance Promise Of A Speedy Return

May 30, 2025

Bts Jins Coldplay Appearance Promise Of A Speedy Return

May 30, 2025 -

El Episodio De Run Bts Con Jin Una Aventura De Accion

May 30, 2025

El Episodio De Run Bts Con Jin Una Aventura De Accion

May 30, 2025 -

Improving The Accuracy Of Excessive Heat Warnings In Weather Forecasts

May 30, 2025

Improving The Accuracy Of Excessive Heat Warnings In Weather Forecasts

May 30, 2025 -

New System For Nws Heat Alerts Clearer Simpler Communication

May 30, 2025

New System For Nws Heat Alerts Clearer Simpler Communication

May 30, 2025