Finding The Best Bad Credit Personal Loan: A Direct Lender Comparison

Table of Contents

Understanding Your Credit Score and its Impact

Before you even begin searching for a bad credit personal loan, understanding your credit score is crucial. Your credit score is a three-digit number that lenders use to assess your creditworthiness. Checking your credit report from resources like AnnualCreditReport.com is the first step. This free service allows you to review your credit history from all three major credit bureaus (Equifax, Experian, and TransUnion).

- What to look for: Check your report for any errors. Disputes should be filed immediately if inaccuracies are found.

- Factors affecting your score: Late payments, high credit utilization, and bankruptcies significantly impact your credit score.

- Improving your score: Pay down existing debts, pay bills on time, and keep your credit utilization low to improve your creditworthiness over time. Consider using a credit monitoring service for additional help.

Understanding your credit score range is key. A score below 670 is generally considered "bad credit," impacting the interest rates and loan terms you'll qualify for. However, direct lenders often cater to those with less-than-perfect credit, offering options that may not be available through traditional banks.

Comparing Direct Lenders for Bad Credit Personal Loans

Choosing a direct lender for your bad credit personal loan offers several advantages over using a broker. Direct lenders handle the entire loan process, eliminating extra fees and potentially streamlining the application.

When comparing direct lenders, consider these key factors:

- Interest Rates and APR: The Annual Percentage Rate (APR) represents the total cost of borrowing. Shop around for the lowest APR possible.

- Loan Terms and Repayment Periods: Consider loan terms that fit your budget. Shorter terms mean higher monthly payments but less interest paid overall.

- Fees and Charges: Be aware of origination fees, late payment penalties, and other potential charges. Transparent fee structures are vital.

- Customer Reviews and Reputation: Check online reviews and the Better Business Bureau (BBB) ratings to gauge the lender's reputation and customer service.

Comparison Table Example: (This section would ideally include a real comparison table with sample lenders – for SEO purposes, consider including a dynamic table updating with current information).

- Lender A: Interest Rate: X%, Fees: Y, BBB Rating: Z

- Lender B: Interest Rate: X%, Fees: Y, BBB Rating: Z

- Lender C: Interest Rate: X%, Fees: Y, BBB Rating: Z

Types of Bad Credit Personal Loans Offered by Direct Lenders

Direct lenders typically offer several types of personal loans for bad credit:

- Secured Loans: These loans require collateral (like a car or savings account) to secure the loan. If you default, the lender can seize the collateral. Secured loans usually offer lower interest rates.

- Unsecured Loans: These loans don't require collateral, but they usually come with higher interest rates to compensate for the increased risk to the lender.

- Payday Loans: These are short-term, high-interest loans. While they may seem convenient, they carry significant risks and can trap borrowers in a cycle of debt. Proceed with extreme caution and only as a last resort.

Understanding the pros and cons of each type is crucial before making a decision. Always prioritize responsible borrowing and avoid high-interest loans whenever possible. Seek guidance from reputable financial resources if you’re unsure which loan type suits your situation best.

The Application Process for a Bad Credit Personal Loan

Applying for a bad credit personal loan from a direct lender is generally straightforward:

- Find a Lender: Research and compare different lenders using the criteria mentioned earlier.

- Gather Documentation: You'll typically need proof of income, identification, and possibly bank statements.

- Complete the Application: Fill out the application form accurately and completely.

- Wait for Approval: The approval process can take a few days to a few weeks.

- Review Loan Terms: Carefully review the loan agreement before signing.

Tips for improving your chances of approval:

- Apply with a co-signer who has good credit.

- Provide thorough and accurate information.

- Be prepared to answer questions about your financial situation.

Managing Your Bad Credit Personal Loan Effectively

Once you've secured your bad credit personal loan, responsible management is essential.

- Create a Budget: Develop a realistic budget that incorporates your loan repayment.

- Automatic Payments: Set up automatic payments to avoid late fees.

- Emergency Fund: Building an emergency fund can help prevent you from relying on additional loans in the future.

Defaulting on a loan has serious consequences, impacting your credit score even further. Seek professional financial counseling if you're struggling to manage your debt.

Conclusion: Finding the Right Bad Credit Personal Loan for You

Securing a bad credit personal loan requires careful research and comparison. By understanding your credit score, comparing direct lenders thoroughly, and managing your loan responsibly, you can improve your financial situation. Remember the benefits of using direct lenders – avoiding brokers and potentially securing better terms. Don't let bad credit define your financial future. Use the information in this article to make informed decisions and find your best bad credit personal loan today!

Featured Posts

-

Hujan Di Bandung 26 Maret 2024 Simak Prakiraan Cuaca Jawa Barat

May 28, 2025

Hujan Di Bandung 26 Maret 2024 Simak Prakiraan Cuaca Jawa Barat

May 28, 2025 -

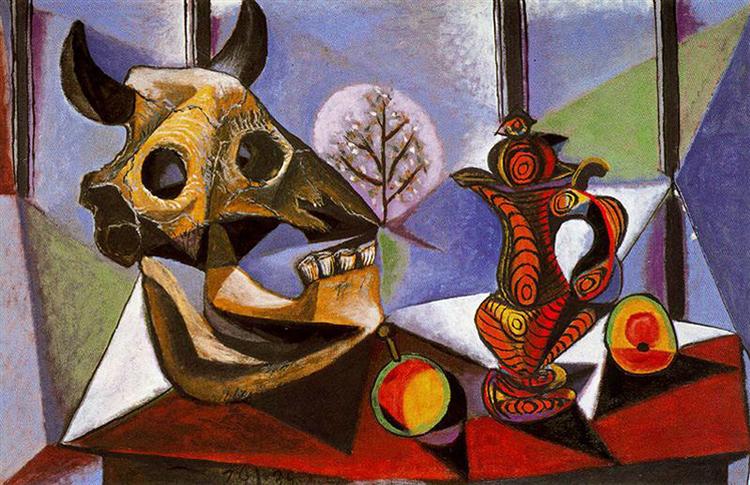

Chicagos Art History The Impact Of Picassos 1939 Exhibition

May 28, 2025

Chicagos Art History The Impact Of Picassos 1939 Exhibition

May 28, 2025 -

Brewers Vs Diamondbacks Prediction Picks And Odds For Todays Mlb Game

May 28, 2025

Brewers Vs Diamondbacks Prediction Picks And Odds For Todays Mlb Game

May 28, 2025 -

Pirates Vs Braves Recap Triolo Highlights Bullpens Consistent Showing

May 28, 2025

Pirates Vs Braves Recap Triolo Highlights Bullpens Consistent Showing

May 28, 2025 -

Marlins Weathers And Stowers Combine For Win Against Cubs

May 28, 2025

Marlins Weathers And Stowers Combine For Win Against Cubs

May 28, 2025

Latest Posts

-

Alcaraz Through To Barcelona Open Round Of 16 Following Ruud

May 31, 2025

Alcaraz Through To Barcelona Open Round Of 16 Following Ruud

May 31, 2025 -

Racial Abuse Case Beautician Receives No Jail Time

May 31, 2025

Racial Abuse Case Beautician Receives No Jail Time

May 31, 2025 -

Musks Dogecoin Support No Regrets Over Trump Administration Involvement

May 31, 2025

Musks Dogecoin Support No Regrets Over Trump Administration Involvement

May 31, 2025 -

Elon Musks Cost Cutting 101 Million In Dei Spending And 8 Million On Transgender Mice Eliminated

May 31, 2025

Elon Musks Cost Cutting 101 Million In Dei Spending And 8 Million On Transgender Mice Eliminated

May 31, 2025 -

Elon Musks Pressure Campaign Did Trumps Team Block An Open Ai Uae Deal

May 31, 2025

Elon Musks Pressure Campaign Did Trumps Team Block An Open Ai Uae Deal

May 31, 2025