Fluctuations In Elon Musk's Net Worth: Examining The US Economic Context (Tesla)

Table of Contents

Tesla's Performance as a Primary Driver

Tesla's performance is undeniably the most significant driver of Elon Musk's net worth. His substantial stake in the company means that even small shifts in Tesla's market capitalization directly translate to massive changes in his personal wealth.

Stock Market Volatility and its Impact

The correlation between Tesla's stock price and Elon Musk's net worth is nearly direct. A surge in Tesla stock translates to a significant increase in Musk's wealth, and conversely, a drop in the share price leads to a substantial decrease. Several factors contribute to this volatility:

- Market Sentiment: Investor confidence in Tesla heavily influences the stock price. Positive news, successful product launches, and strong financial reports boost investor sentiment, driving up the share price. Negative news, production issues, or controversies can quickly sour sentiment, leading to a sell-off.

- Financial Performance: Tesla's quarterly earnings reports, revenue growth, and profitability directly impact its stock valuation. Strong financial results generally lead to higher stock prices, while disappointing results can trigger significant drops.

- New Product Releases: The launch of new Tesla vehicles, energy solutions, or technological advancements often creates excitement and anticipation among investors, potentially boosting the stock price. Conversely, delays or setbacks in new product development can negatively impact investor confidence.

- Competition: Increased competition in the electric vehicle market from established automakers and new entrants can impact Tesla's market share and, subsequently, its stock price.

- Regulatory Changes: Changes in government regulations impacting the automotive or energy sectors can affect Tesla's operations and profitability, influencing investor sentiment and the stock price.

Tesla's Financial Health and its Influence

Tesla's financial health is paramount to its stock price and, therefore, to Elon Musk's net worth. Analyzing key financial indicators is crucial:

- Revenue Growth: Consistent and substantial revenue growth signifies a healthy and expanding business, bolstering investor confidence.

- Profitability: Achieving and maintaining profitability demonstrates Tesla's ability to generate sustained earnings, a key factor in attracting investors.

- Debt Levels: High levels of debt can be a concern for investors, potentially impacting the stock price if they perceive significant financial risk.

- Quarterly Earnings: Tesla's quarterly earnings reports provide crucial insights into its financial performance, heavily influencing market reactions and the stock price.

Innovation and Technological Advancements

Tesla's reputation for innovation and technological advancements plays a vital role in shaping investor perception and the company's valuation.

- New Car Models: The introduction of new electric vehicles (EVs), such as the Model 3, Model Y, Cybertruck, and Roadster, generates significant media attention and investor interest, often leading to stock price increases.

- Sustainable Energy Solutions: Tesla's expansion into solar energy and energy storage solutions diversifies its revenue streams and appeals to environmentally conscious investors.

- Autonomous Driving Technology: Progress in autonomous driving technology is a major driver of investor excitement and expectations regarding future growth.

The Broader US Economic Context

While Tesla's performance is the primary driver, broader US economic conditions significantly impact Elon Musk's net worth.

Macroeconomic Indicators and their Influence

Key macroeconomic indicators have a considerable effect on the overall stock market and, consequently, Tesla's valuation:

- Interest Rates: Changes in interest rates set by the Federal Reserve influence borrowing costs for businesses and consumers, impacting overall economic growth and investor sentiment. Higher interest rates can curb investment and slow economic growth, potentially affecting Tesla's performance.

- Inflation Rate: High inflation erodes purchasing power and can lead to uncertainty in the market, impacting investor confidence and potentially reducing demand for luxury goods like Tesla vehicles.

- GDP Growth: Strong GDP growth generally indicates a healthy economy, boosting investor confidence and benefiting companies like Tesla. Economic downturns or recessions can negatively impact investor sentiment and reduce demand for Tesla's products.

Consumer Confidence and Spending Habits

Consumer confidence and spending patterns play a crucial role in the demand for electric vehicles, including Tesla's products:

- Consumer Confidence: High consumer confidence generally leads to increased spending, boosting demand for luxury goods like Tesla vehicles.

- Spending Patterns: Shifts in consumer spending habits, such as increased preference for sustainable products, can positively impact the demand for electric vehicles.

Geopolitical Factors and Global Market Instability

Geopolitical events and global market instability can significantly impact the stock market and Tesla's valuation:

- Trade Wars: Trade disputes and tariffs can disrupt supply chains, increase production costs, and negatively impact Tesla's profitability.

- Global Pandemics: Major global events, like the COVID-19 pandemic, can significantly disrupt supply chains, affect consumer demand, and create uncertainty in the markets.

Conclusion: Understanding the Fluctuations in Elon Musk's Net Worth and its Implications

The fluctuations in Elon Musk's net worth are intricately linked to Tesla's performance and the broader US economic context. His wealth mirrors the company's success, reacting to both its internal achievements and the external pressures of the global economy. Understanding the dynamics of Tesla's stock price, US macroeconomic indicators, and global events provides valuable insight into the complexities of wealth creation and market volatility. To stay informed about Elon Musk's net worth, Tesla stock performance, and crucial US economic indicators, follow reputable financial news sources and stay updated on macroeconomic data releases. This will allow you to better understand the intricate relationship between individual wealth, corporate performance, and the wider economic landscape.

Featured Posts

-

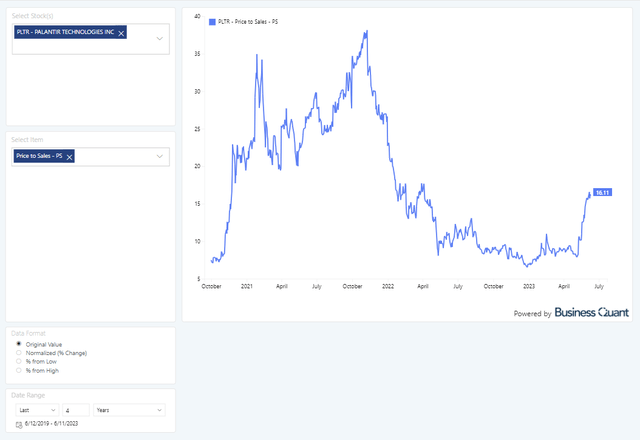

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 09, 2025

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 09, 2025 -

Liga Chempionov 2024 2025 Polufinaly I Final Prognozy Daty Vremya I Translyatsiya

May 09, 2025

Liga Chempionov 2024 2025 Polufinaly I Final Prognozy Daty Vremya I Translyatsiya

May 09, 2025 -

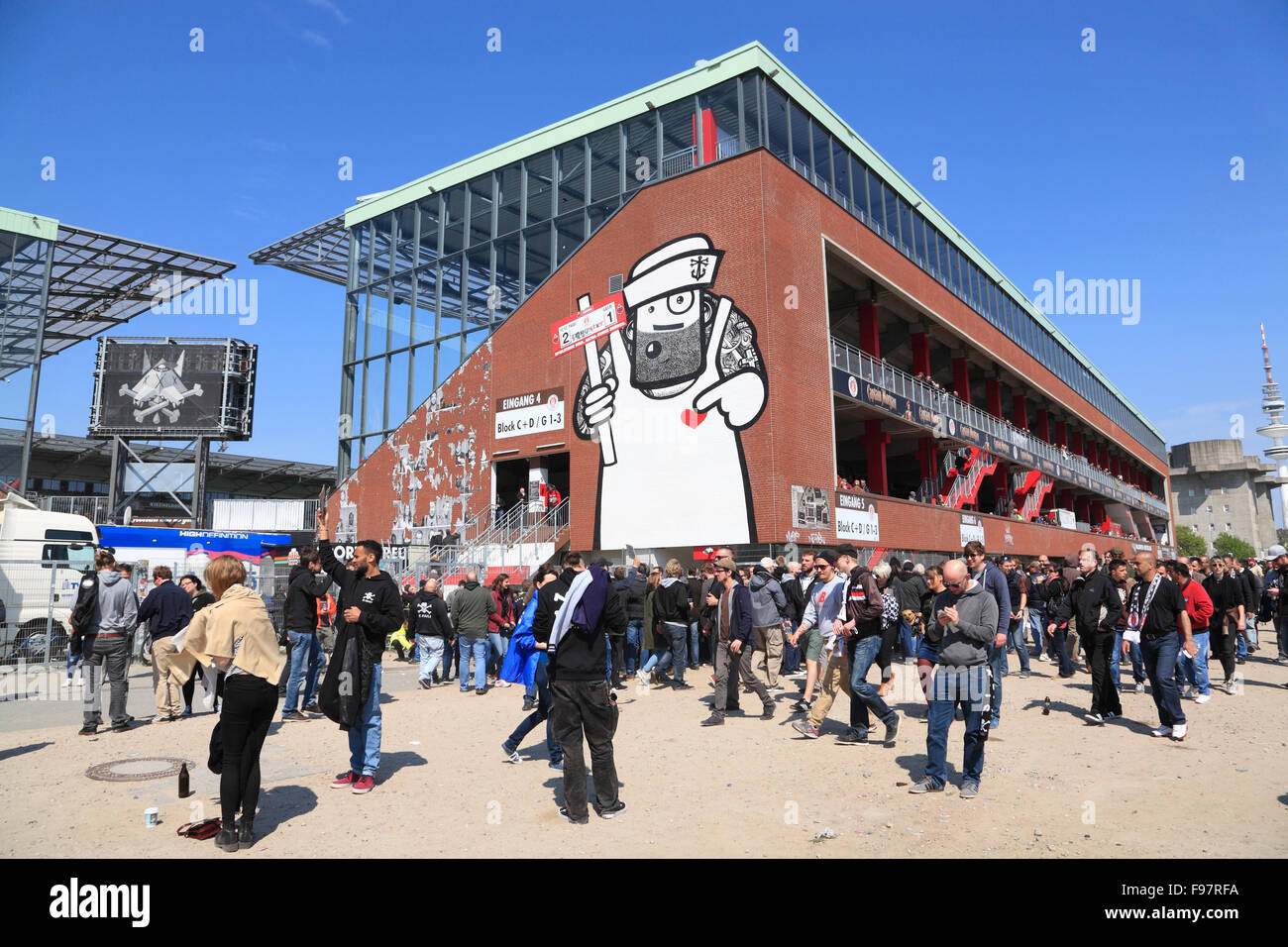

Bayern Munich Vs Fc St Pauli A Detailed Match Preview

May 09, 2025

Bayern Munich Vs Fc St Pauli A Detailed Match Preview

May 09, 2025 -

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025 -

Jayson Tatums Bone Bruise Will He Play In Game 2

May 09, 2025

Jayson Tatums Bone Bruise Will He Play In Game 2

May 09, 2025