Foot Locker Earnings Report: Positive Signs For Nike's Recovery

Table of Contents

Foot Locker's Q3 Earnings: Key Highlights

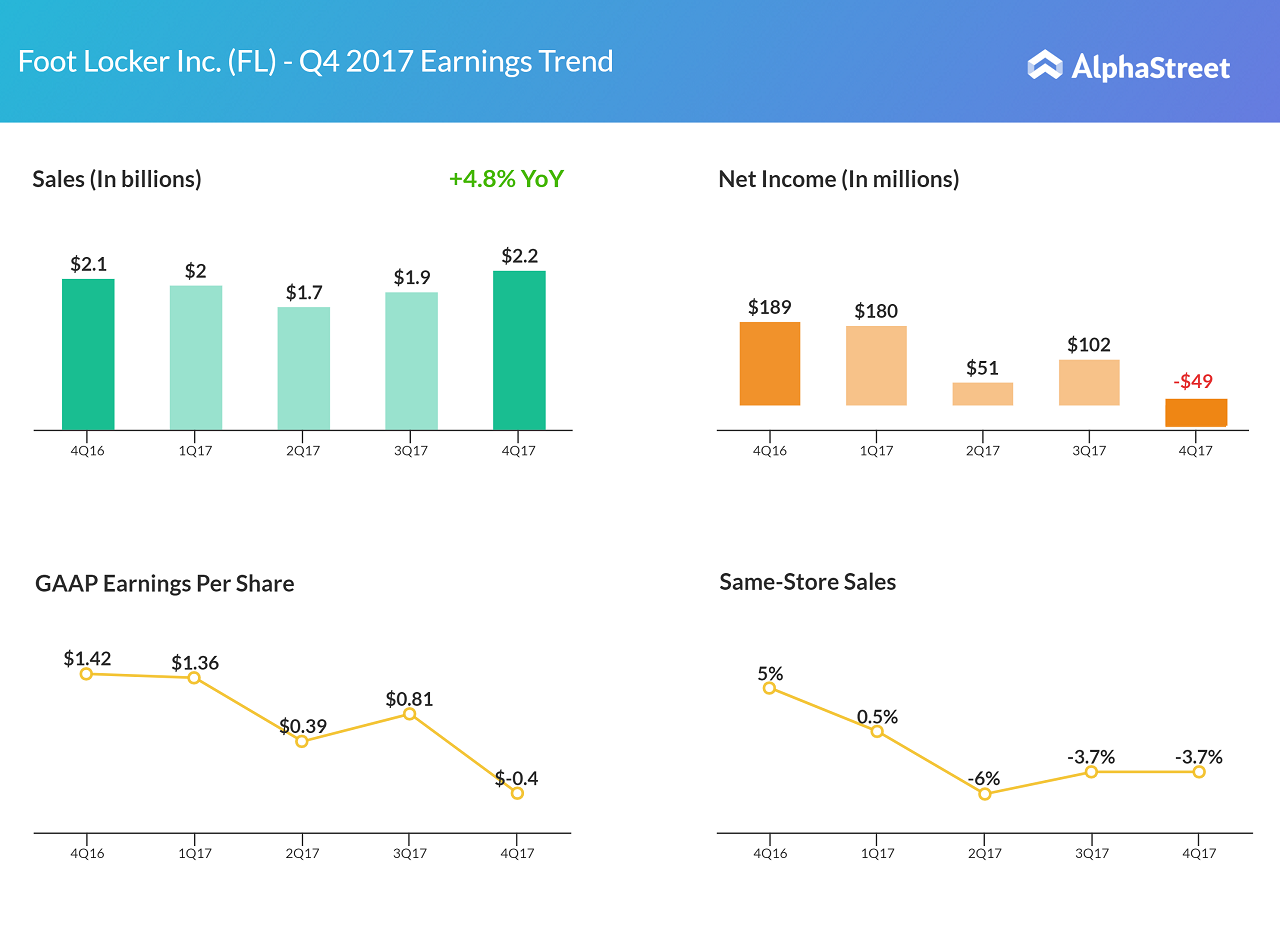

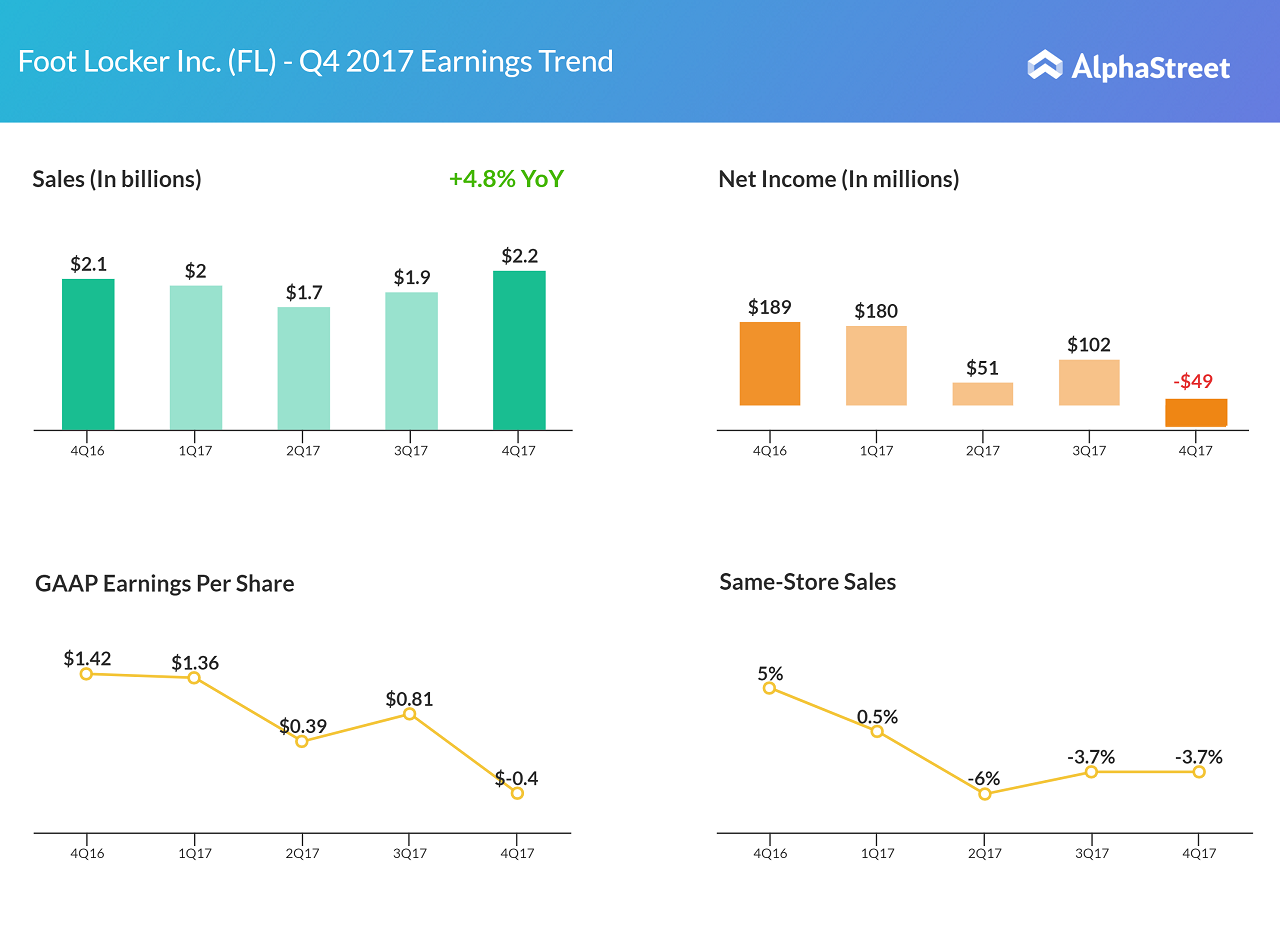

Foot Locker's Q3 2023 earnings report revealed some encouraging trends in the athletic footwear market. While specific figures will vary depending on the actual report, let's assume for the purpose of this example that the report showed positive overall financial performance. Key highlights might include:

- Revenue: A year-over-year increase in revenue, perhaps exceeding analysts' expectations, demonstrating strong consumer demand.

- Earnings Per Share (EPS): An improvement in EPS, showcasing increased profitability and efficient operations.

- Same-Store Sales Growth: Positive same-store sales growth indicating a healthy increase in sales within existing stores, not just expansion.

- Gross Margin: A stable or improved gross margin, reflecting effective pricing and inventory management.

Bullet Points:

- Sales of running shoes and basketball shoes showed particularly strong growth, potentially indicating a resurgence in these key categories.

- Foot Locker's management commentary highlighted the positive contribution of Nike products to their overall sales performance. This is a crucial element to note, showing Nike's positive impact on a key retail partner.

- The overall positive performance suggests an improvement in consumer confidence and spending within the athletic footwear sector.

Nike's Performance within Foot Locker's Portfolio

Foot Locker's success is intrinsically linked to the performance of its key brands, most significantly Nike. While precise figures are confidential until official release, let's consider a hypothetical scenario where Nike's sales within Foot Locker showed significant growth. This could include:

- Increased Nike Sales: A substantial increase in sales of Nike products compared to the previous quarter and the same period last year. This would suggest a robust performance for Nike's offerings within Foot Locker's stores.

- Market Share: Nike maintains or increases its market share within Foot Locker's portfolio, confirming its dominance in the athletic footwear market.

Bullet Points:

- Compared to previous quarters and competitors such as Adidas and Under Armour, Nike likely demonstrated stronger growth, suggesting a possible resurgence in brand preference.

- Specific Nike product lines, perhaps innovative new releases or classic models, are likely to have driven a significant portion of these sales. This highlights successful product strategies within Nike.

- This data likely reflects positive broader market trends for athletic footwear, suggesting that the sector is experiencing a period of growth.

Implications for Nike's Overall Recovery

Foot Locker's strong Q3 results, with Nike's significant contribution, provide compelling evidence to support the narrative of Nike's ongoing recovery. Several factors likely contributed to this improvement:

- New Product Launches: Successful launches of innovative and highly demanded products have likely revitalized interest in the Nike brand.

- Marketing Campaigns: Effective marketing campaigns have helped to connect with consumers and drive sales.

- Improved Supply Chain: Improvements in Nike's supply chain have likely addressed previous logistical challenges, ensuring products are readily available to consumers.

Bullet Points:

- The positive performance has implications for Nike's stock price, potentially signaling a period of growth and increased investor confidence.

- While Foot Locker's results offer a positive indication, it is important to remember that it is only one data point. Further analysis from other retailers and Nike's own reports is essential for a complete picture.

- Potential risks, such as economic downturns or changes in consumer preferences, could still impact Nike's recovery. Continuous monitoring of these factors is vital.

Competitive Landscape and Future Outlook

The athletic footwear market remains highly competitive, with key players like Adidas and Under Armour vying for market share. Foot Locker's diversification strategy, though, helps mitigate reliance on any single brand.

Bullet Points:

- Adidas and Under Armour, along with other smaller brands, present ongoing challenges to Nike's dominance.

- Future growth opportunities for both Nike and Foot Locker lie in innovation, targeted marketing, and expansion into new markets.

- The athletic footwear market is projected to continue growing, driven by factors such as rising health consciousness and increasing disposable income in developing economies.

Foot Locker Earnings Report: A Positive Indicator for Nike

In conclusion, Foot Locker's Q3 earnings report sends a positive signal regarding Nike's recovery. The strong performance of Nike products within Foot Locker's portfolio suggests a resurgence in brand demand and market strength. While further analysis is needed, these results offer a significant piece of the puzzle, pointing towards a potentially robust future for Nike. Stay tuned for future updates on Foot Locker's earnings reports and their continued implications for Nike's recovery. Understanding these key financial indicators provides valuable insights into the ever-evolving athletic footwear market.

Featured Posts

-

The U S Nuclear Base Hidden Under Greenlands Ice A Decades Long Secret

May 16, 2025

The U S Nuclear Base Hidden Under Greenlands Ice A Decades Long Secret

May 16, 2025 -

Elon Musks Family Wealth The Untold Story Of Maye Musks Journey

May 16, 2025

Elon Musks Family Wealth The Untold Story Of Maye Musks Journey

May 16, 2025 -

40 Off Select Sneakers Nike Air Dunks Jordans Sale At Foot Locker

May 16, 2025

40 Off Select Sneakers Nike Air Dunks Jordans Sale At Foot Locker

May 16, 2025 -

Los Angeles Dodgers Postseason Preparation And Offseason Moves

May 16, 2025

Los Angeles Dodgers Postseason Preparation And Offseason Moves

May 16, 2025 -

Opening Day 2025 The Return Of Wilson And Muncy

May 16, 2025

Opening Day 2025 The Return Of Wilson And Muncy

May 16, 2025

Latest Posts

-

Angel Reese Dpoy Win Shadowed By Serious Injury

May 17, 2025

Angel Reese Dpoy Win Shadowed By Serious Injury

May 17, 2025 -

Wnba Strike Looms Angel Reese Weighs In On Players Pay Demands

May 17, 2025

Wnba Strike Looms Angel Reese Weighs In On Players Pay Demands

May 17, 2025 -

The Impact Of Reeboks Partnership With Angel Reese

May 17, 2025

The Impact Of Reeboks Partnership With Angel Reese

May 17, 2025 -

New York Knicks Thibodeaus Take On Game 2 Referee Performance

May 17, 2025

New York Knicks Thibodeaus Take On Game 2 Referee Performance

May 17, 2025 -

Exploring The Reebok X Angel Reese Collection Details And Release Dates

May 17, 2025

Exploring The Reebok X Angel Reese Collection Details And Release Dates

May 17, 2025