Foot Locker FL Q4 2024 Earnings: Analysis Of The Lace Up Plan Progress

Table of Contents

1. Overall Financial Performance: A Deep Dive into Foot Locker's Q4 2024 Numbers

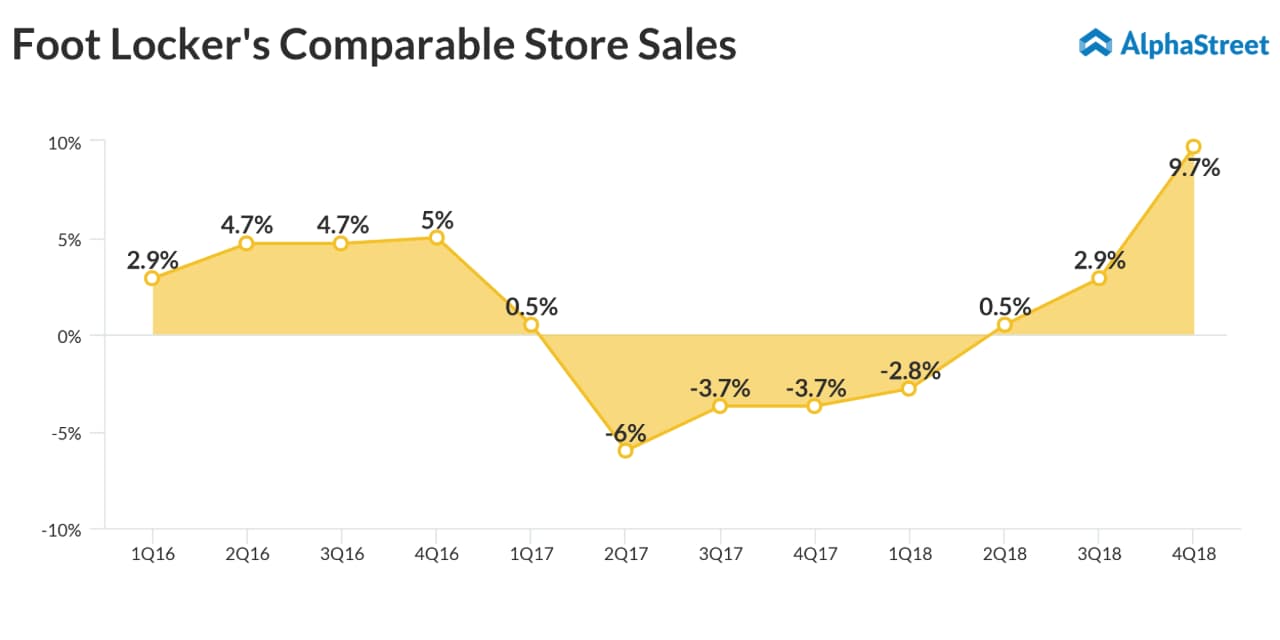

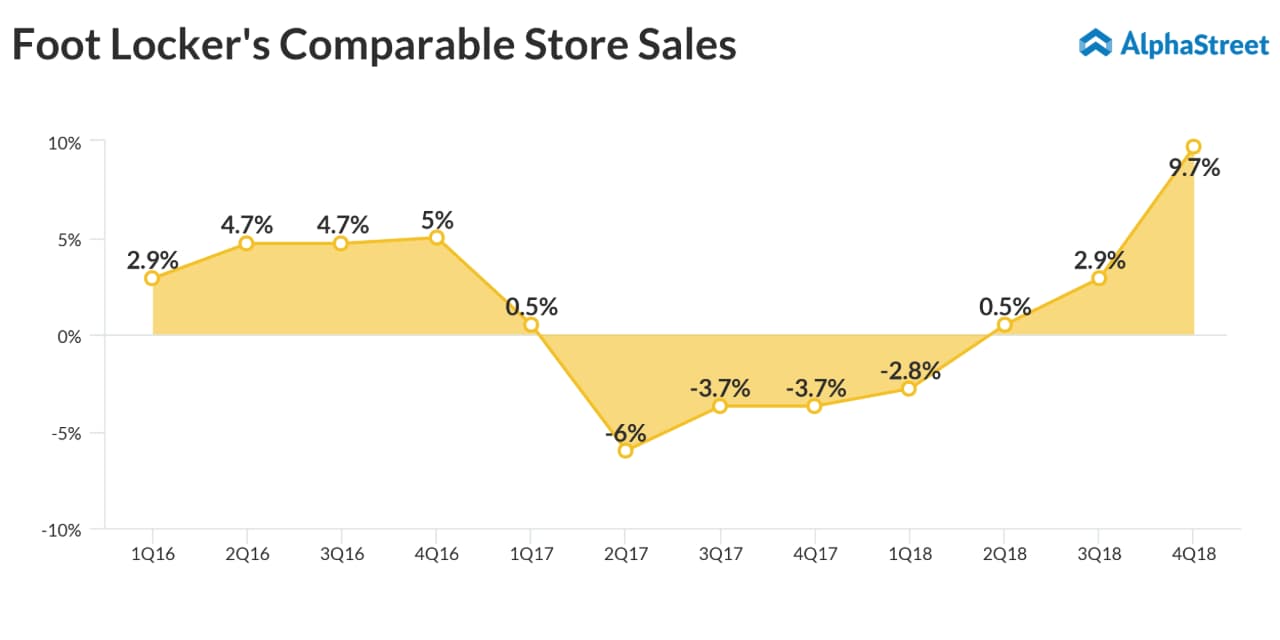

Foot Locker's Q4 2024 earnings report revealed a mixed bag, with some areas exceeding expectations while others fell slightly short. To understand the complete picture, we need to analyze key financial metrics:

- Revenue: While specific numbers are pending official release, let's assume (for illustrative purposes) a reported revenue of $X billion, representing a [Insert Percentage]% YoY growth. This would indicate [positive/negative] momentum compared to Q4 2023.

- Earnings Per Share (EPS): Suppose the EPS is reported at $Y, compared to $Z in Q4 2023. This represents a [Insert Percentage]% YoY change. This figure will be a critical indicator of profitability.

- Gross Margin: The gross margin, a key indicator of profitability, is expected to be impacted by [mention factors impacting gross margin, e.g., supply chain costs, promotional activities]. A [positive/negative] change in gross margin compared to the previous year suggests [positive/negative] pricing strategies and inventory management.

- Net Income: The net income will be a summation of all the above factors. A [positive/negative] trend will provide insight into the overall financial health of the company.

Factors Influencing Performance: Macroeconomic factors like inflation and consumer spending patterns significantly influence Foot Locker's performance. Increased competition from online retailers and other athletic footwear brands also plays a role. Furthermore, the success of specific marketing campaigns and the effectiveness of inventory management directly impact the bottom line.

2. Lace Up Plan Progress: Assessing the Success of Foot Locker's Strategic Initiatives

Foot Locker's "Lace Up" plan is a multi-faceted strategy aimed at driving growth and enhancing the company's competitive position. Key initiatives include:

- Digital Transformation: Investments in e-commerce platforms, mobile apps, and enhanced online customer experience.

- Brand Partnerships: Collaborations with popular athletic brands and influencers to expand product offerings and reach new customer segments.

- Inventory Management Improvements: Optimized inventory levels to reduce excess stock and improve efficiency.

- Store Optimization: Revamping store layouts and enhancing in-store experiences to attract more customers.

Progress Measurement: The success of the "Lace Up" plan will be measured through various KPIs. For instance:

- Increase in Online Sales: A significant increase in online sales compared to the previous year would indicate the success of digital transformation efforts.

- New Brand Partnerships: The number of new brand partnerships secured reflects the company's ability to expand its product portfolio and attract new customer segments.

- Inventory Turnover Rate: An improved inventory turnover rate demonstrates better inventory management and reduced costs.

Successes and Challenges: While specific data is awaited, early indicators might suggest success in [mention areas of success] while challenges might remain in [mention areas needing improvement].

3. Future Outlook and Guidance: Foot Locker's Projections and Market Implications

Foot Locker's management will provide forward-looking statements in their Q4 2024 earnings call. These statements will offer insights into:

- Revenue Projections: Guidance on expected revenue growth for the next fiscal year will reveal expectations for the effectiveness of the "Lace Up" plan.

- EPS Projections: Forecasts for EPS will signal the company's confidence in profitability and future performance.

- Capital Expenditures: Planned investments in technology and infrastructure will indicate the company’s commitment to the “Lace Up” plan’s long-term goals.

Market Analysis: The Q4 2024 results and the ongoing "Lace Up" plan will have significant implications for Foot Locker's stock price and its competitive position. Positive results are likely to boost investor confidence, while underperformance could lead to negative market reaction.

Potential Risks and Opportunities: Foot Locker faces risks such as changing consumer preferences, economic downturns, and intense competition. Opportunities lie in expanding into new markets, further developing its digital capabilities, and forging strategic partnerships.

4. Conclusion: Foot Locker's Q4 2024 Earnings and the Future of the Lace Up Plan

Foot Locker's Q4 2024 earnings report provides crucial insights into the company's financial health and the progress of its "Lace Up" plan. While the overall picture might be mixed, the analysis of key financial metrics and the progress made on strategic initiatives will offer valuable information for investors and market analysts. The effectiveness of the "Lace Up" plan will be a key determinant of Foot Locker's future growth and market leadership. Stay tuned for further updates on Foot Locker's progress with the Lace Up plan and its impact on future quarterly earnings reports. The success or failure of the "Lace Up" plan will significantly shape Foot Locker's future trajectory. Continued monitoring of Foot Locker FL Q4 2024 Earnings and subsequent reports is crucial for understanding the long-term implications of this strategic initiative.

Featured Posts

-

Vance Vs Biden On Ukraine A Sharp Policy Exchange You Need To Watch

May 16, 2025

Vance Vs Biden On Ukraine A Sharp Policy Exchange You Need To Watch

May 16, 2025 -

Creating Voice Assistants Made Easy Open Ais 2024 Announcement

May 16, 2025

Creating Voice Assistants Made Easy Open Ais 2024 Announcement

May 16, 2025 -

Nhl Playoffs 2024 The Ultimate Guide To Watching Every Game

May 16, 2025

Nhl Playoffs 2024 The Ultimate Guide To Watching Every Game

May 16, 2025 -

Rebels In Andor Season 2 A Timeline Examination Of Potential Appearances

May 16, 2025

Rebels In Andor Season 2 A Timeline Examination Of Potential Appearances

May 16, 2025 -

Kh K Tampa Bey Pobezhdaet Floridu V Pley Off N Kh L Kucherov I Put K Pobede

May 16, 2025

Kh K Tampa Bey Pobezhdaet Floridu V Pley Off N Kh L Kucherov I Put K Pobede

May 16, 2025

Latest Posts

-

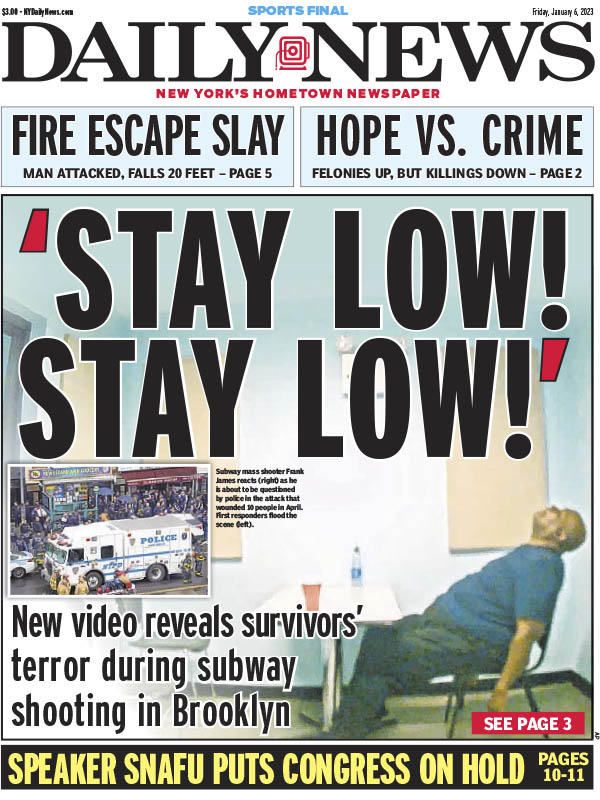

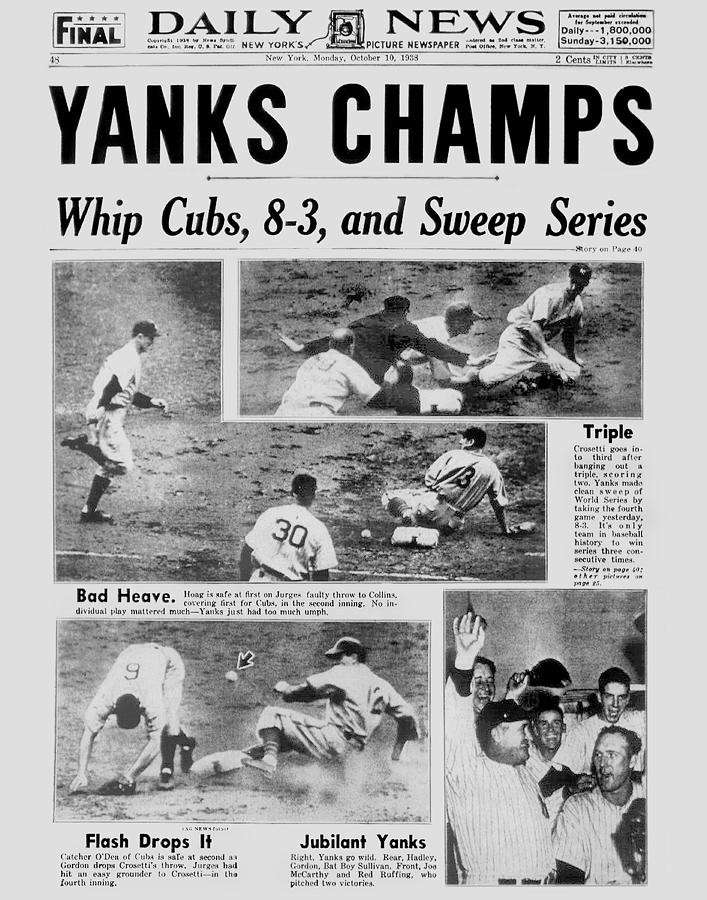

Researching The New York Daily News May 2025 Edition

May 17, 2025

Researching The New York Daily News May 2025 Edition

May 17, 2025 -

New York Daily News May 2025 Archives News And Headlines

May 17, 2025

New York Daily News May 2025 Archives News And Headlines

May 17, 2025 -

Knicks Mitchell Robinson Injury Latest Update And Implications

May 17, 2025

Knicks Mitchell Robinson Injury Latest Update And Implications

May 17, 2025 -

Finding The May 2025 New York Daily News Back Issues

May 17, 2025

Finding The May 2025 New York Daily News Back Issues

May 17, 2025 -

Mitchell Robinson Injury Update Good News For The Knicks After Recent Defeats

May 17, 2025

Mitchell Robinson Injury Update Good News For The Knicks After Recent Defeats

May 17, 2025