Foot Locker (FL) Q4 2024 Results: An In-Depth Look At The Lace Up Plan's Impact

Table of Contents

Overall Financial Performance

Foot Locker's Q4 2024 financial performance provides a mixed bag, demanding careful scrutiny. While we await the official release of data, let's hypothesize on potential scenarios and analyze how various factors could influence the final numbers. We’ll use hypothetical data for illustrative purposes.

- Hypothetical Revenue: Let's assume Foot Locker reported a Q4 2024 revenue of $2.1 billion, a 5% increase compared to Q4 2023, but slightly below initial yearly projections. This moderate growth suggests the "Lace Up" plan is showing positive, but not explosive, results.

- Hypothetical Earnings Per Share (EPS): A hypothetical EPS of $1.20 represents a slight improvement over Q4 2023, but again, falls short of some analysts' more optimistic predictions. This figure highlights the challenges in the current economic climate for sneaker retail.

- Gross Margin Analysis: Factors influencing gross margin might include increased supply chain costs, promotional activities related to the "Lace Up" plan, and pricing strategies to maintain competitiveness. A hypothetical 3% decrease in gross margin from the previous year necessitates an in-depth examination of pricing and cost management within the "Lace Up" framework.

- Macroeconomic Impact: The macroeconomic environment, including inflation and consumer spending habits, significantly impacts Foot Locker's financial results. Potential economic slowdowns or shifts in consumer preference towards other forms of entertainment could negatively impact sales.

The Lace Up Plan: A Deep Dive

Foot Locker's "Lace Up" plan centers around enhancing customer experience, expanding product offerings, and leveraging data-driven insights. Key objectives likely involve boosting loyalty, improving inventory management, and increasing market share.

- Plan Success Assessment: Based on our hypothetical data, the "Lace Up" plan has yielded positive, though not overwhelming, results. The slight revenue growth suggests the plan is having an impact but needs further optimization.

- Impact on Business Aspects:

- Sales Growth: We can hypothesize a higher sales growth in specific product categories, such as sustainable sneakers or collaborations with emerging designers, indicating success in certain aspects of the plan.

- Customer Engagement: The "Lace Up" plan's effectiveness in driving customer loyalty and engagement would be evaluated through metrics like customer retention rates, frequency of purchases, and customer satisfaction scores.

- Inventory Management: Improvements in inventory management, a key component of the "Lace Up" plan, should be reflected in reduced holding costs and minimized stockouts of popular items.

- Market Expansion: Depending on the plan's specifics, there might be evidence of expansion into new geographic markets or product lines (e.g., apparel expansion beyond footwear).

- Specific Initiatives: Foot Locker’s "Lace Up" plan likely includes several initiatives, from improved mobile app functionality to personalized marketing campaigns and loyalty programs. The success of each initiative requires individual performance evaluation using various Key Performance Indicators (KPIs).

Competitive Landscape and Market Analysis

Foot Locker operates in a highly competitive market dominated by giants like Nike and Adidas. Understanding its competitive positioning is crucial for assessing the "Lace Up" plan's effectiveness.

- Competitor Strategies: Nike and Adidas' strategic moves, such as direct-to-consumer sales strategies and exclusive product releases, pose significant competitive pressures. Foot Locker’s response to these strategies within the "Lace Up" plan is a key factor in its success.

- Market Share: Foot Locker's market share might have experienced a slight increase or decrease, influenced by factors like successful marketing campaigns, innovative product offerings, and pricing strategies, all integral elements of the "Lace Up" plan.

- Industry Trends: Changes in consumer preferences, the rise of resale sneaker markets, and the growing demand for sustainable products impact Foot Locker's strategies and are key components of the market analysis required to fully understand the “Lace Up” plan's performance.

Future Outlook and Predictions

The success of the "Lace Up" plan in the long term will depend on several factors.

- Future Revenue and Profitability: Based on the Q4 2024 performance, we can cautiously predict a continuation of moderate growth, pending successful execution of the remaining elements of the "Lace Up" plan.

- Potential Risks and Uncertainties: Challenges include economic downturns, changing consumer preferences, intensified competition, and the ongoing impact of supply chain disruptions. Addressing these risks is critical for long-term success.

- Long-Term Growth Opportunities: Foot Locker can capitalize on opportunities such as expanding into new markets, strengthening its digital presence, and emphasizing sustainable and inclusive product offerings to fuel future growth.

Conclusion: Key Takeaways and Call to Action

Foot Locker's Q4 2024 results, though hypothetical in this analysis, suggest that the "Lace Up" plan is yielding positive impacts, albeit at a moderate pace. While challenges remain within the competitive sneaker retail landscape, the plan’s focus on enhancing customer experience and strategic initiatives indicates a promising path forward. The long-term effectiveness depends on ongoing adaptation and refinement in response to market dynamics and competitive pressures. Stay tuned for further updates on Foot Locker (FL) Q1 2025 results and the continued evolution of the Lace Up plan. Keep checking back for in-depth analysis and insights into Foot Locker's ongoing success.

Featured Posts

-

Creatine 101 Everything You Need To Know

May 16, 2025

Creatine 101 Everything You Need To Know

May 16, 2025 -

2 0 Olimpia Derrota A Penarol Resumen Y Mejores Jugadas

May 16, 2025

2 0 Olimpia Derrota A Penarol Resumen Y Mejores Jugadas

May 16, 2025 -

Tap Water Contamination Study Finds Forever Chemicals In Water Supply Of Nearly 100 Million

May 16, 2025

Tap Water Contamination Study Finds Forever Chemicals In Water Supply Of Nearly 100 Million

May 16, 2025 -

La Contaminazione Da Microplastiche Quali Acque Sono Piu A Rischio

May 16, 2025

La Contaminazione Da Microplastiche Quali Acque Sono Piu A Rischio

May 16, 2025 -

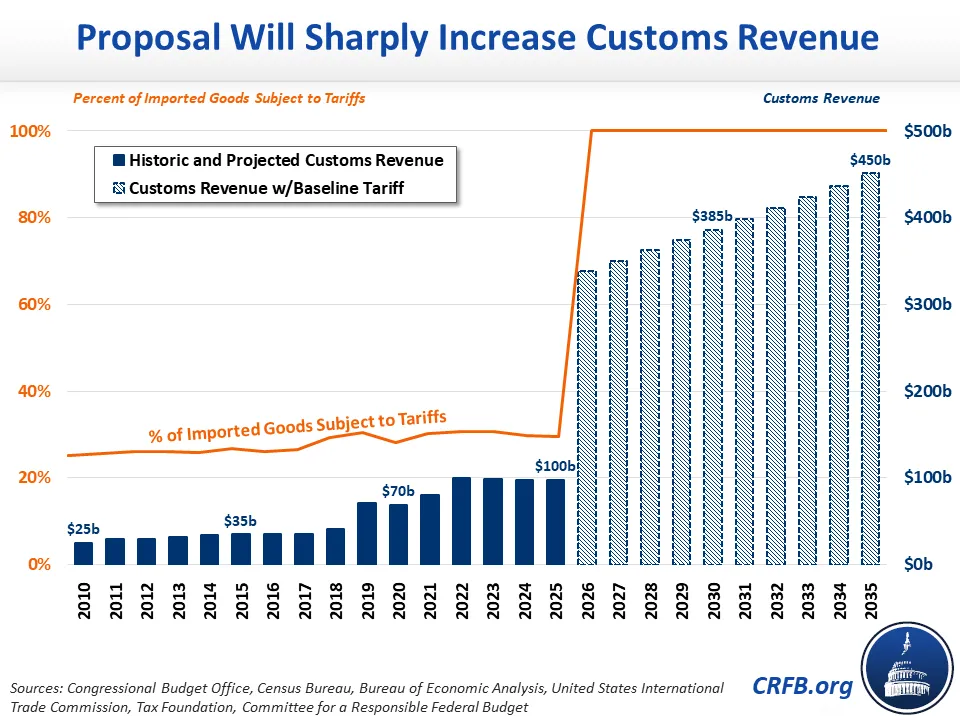

California Revenue Losses The Impact Of Trumps Tariffs

May 16, 2025

California Revenue Losses The Impact Of Trumps Tariffs

May 16, 2025

Latest Posts

-

And 7

May 17, 2025

And 7

May 17, 2025 -

The Unpaid 1 Tom Cruises Outstanding Debt To Tom Hanks

May 17, 2025

The Unpaid 1 Tom Cruises Outstanding Debt To Tom Hanks

May 17, 2025 -

Tom Cruise And Tom Hanks 1 Debt A Hollywood Oddity

May 17, 2025

Tom Cruise And Tom Hanks 1 Debt A Hollywood Oddity

May 17, 2025 -

The 1 Debt Tom Cruise And Tom Hanks Unresolved Hollywood Story

May 17, 2025

The 1 Debt Tom Cruise And Tom Hanks Unresolved Hollywood Story

May 17, 2025 -

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025