Forecasting Apple Stock (AAPL) Price: Crucial Levels And Potential Movements

Table of Contents

Analyzing Apple's Fundamental Performance

Apple's underlying financial health is a cornerstone of any accurate AAPL stock forecast. Strong fundamentals support a higher stock price, while weaknesses can signal potential declines. Let's examine several key aspects:

Revenue and Earnings Growth

Apple's recent financial reports reveal consistent revenue growth, although the rate of growth can fluctuate from quarter to quarter. Analyzing trends in revenue, earnings per share (EPS), and profit margins is critical.

- Key Financial Metrics: Examine the year-over-year and quarter-over-quarter changes in revenue, net income, EPS, and gross profit margins. Look for consistent growth or signs of deceleration.

- Revenue Stream Analysis: Observe the contributions of different segments like iPhone sales, services (Apple Music, iCloud, App Store), wearables (Apple Watch, AirPods), and Mac sales. A diversification of revenue streams reduces reliance on a single product category.

- Trend Analysis: Compare the current financial performance with previous quarters and years. Identifying consistent patterns and outliers is crucial for AAPL stock forecast accuracy. For example, a significant drop in iPhone sales might indicate a need for a more cautious Apple stock price prediction.

Product Innovation and Future Prospects

Apple's relentless innovation fuels its growth. Analyzing new product releases and their market reception is essential for any Apple stock analysis.

- Upcoming Product Launches: Anticipate the impact of upcoming products like new iPhones, iPads, Macs, and potential entries into new markets. Analyst predictions and market sentiment surrounding these launches are key factors.

- Competitive Landscape: Assess Apple's position against competitors such as Samsung, Google, and other tech giants. Technological breakthroughs by competitors can influence Apple stock price prediction.

- Disruptive Technologies: Consider potential disruptions to Apple's business model, such as emerging technologies or shifts in consumer preferences. This forms part of a thorough AAPL stock forecast.

Debt and Cash Reserves

Apple's financial health is also reflected in its debt levels and significant cash reserves.

- Debt Levels: Low debt levels indicate financial strength and resilience, increasing investor confidence and potentially leading to a higher stock valuation.

- Cash Reserves: Significant cash reserves provide financial flexibility for acquisitions, stock buybacks, research and development (R&D), or weathering economic downturns. This contributes to the overall strength of any Apple stock price prediction.

- Competitor Comparison: Comparing Apple's debt and cash position to its competitors can offer valuable insights into its relative financial health.

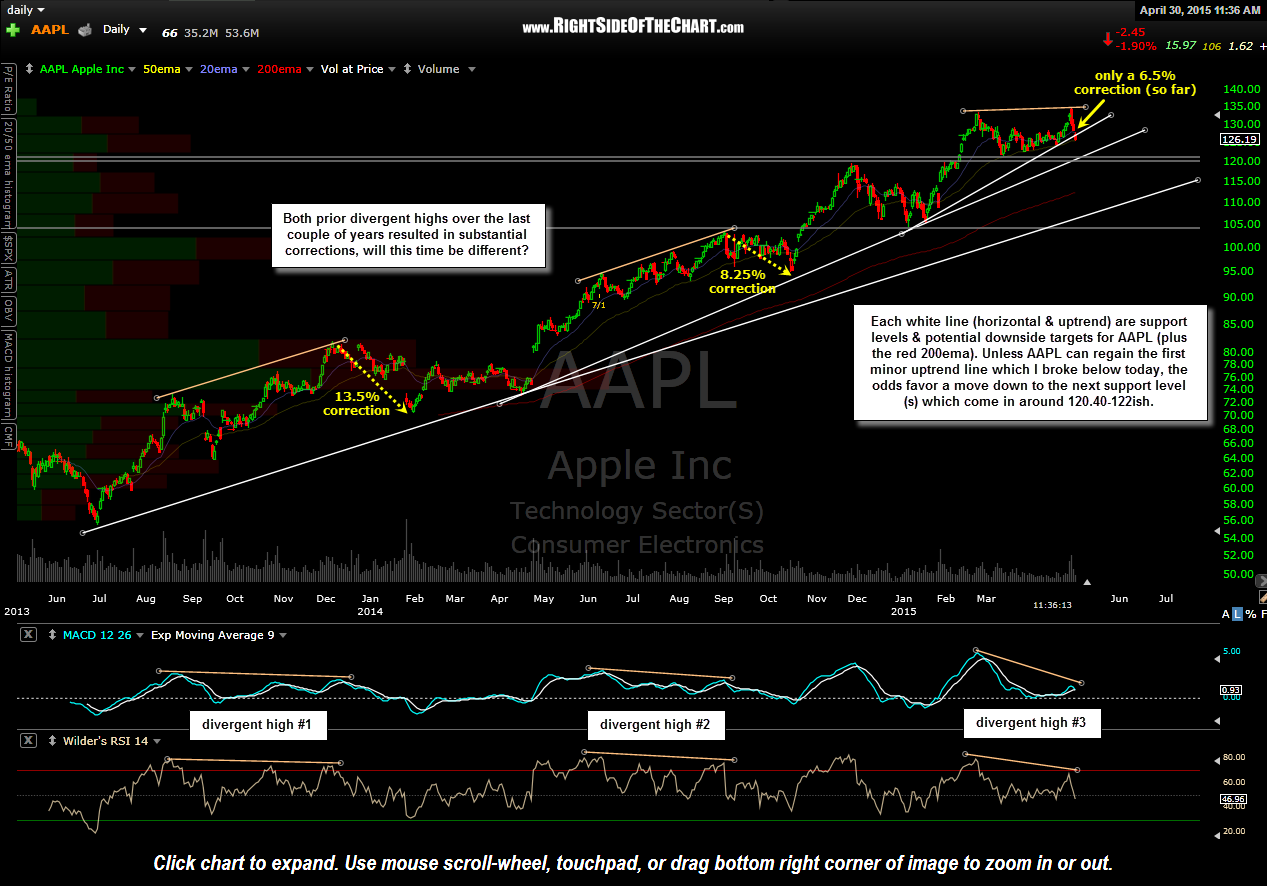

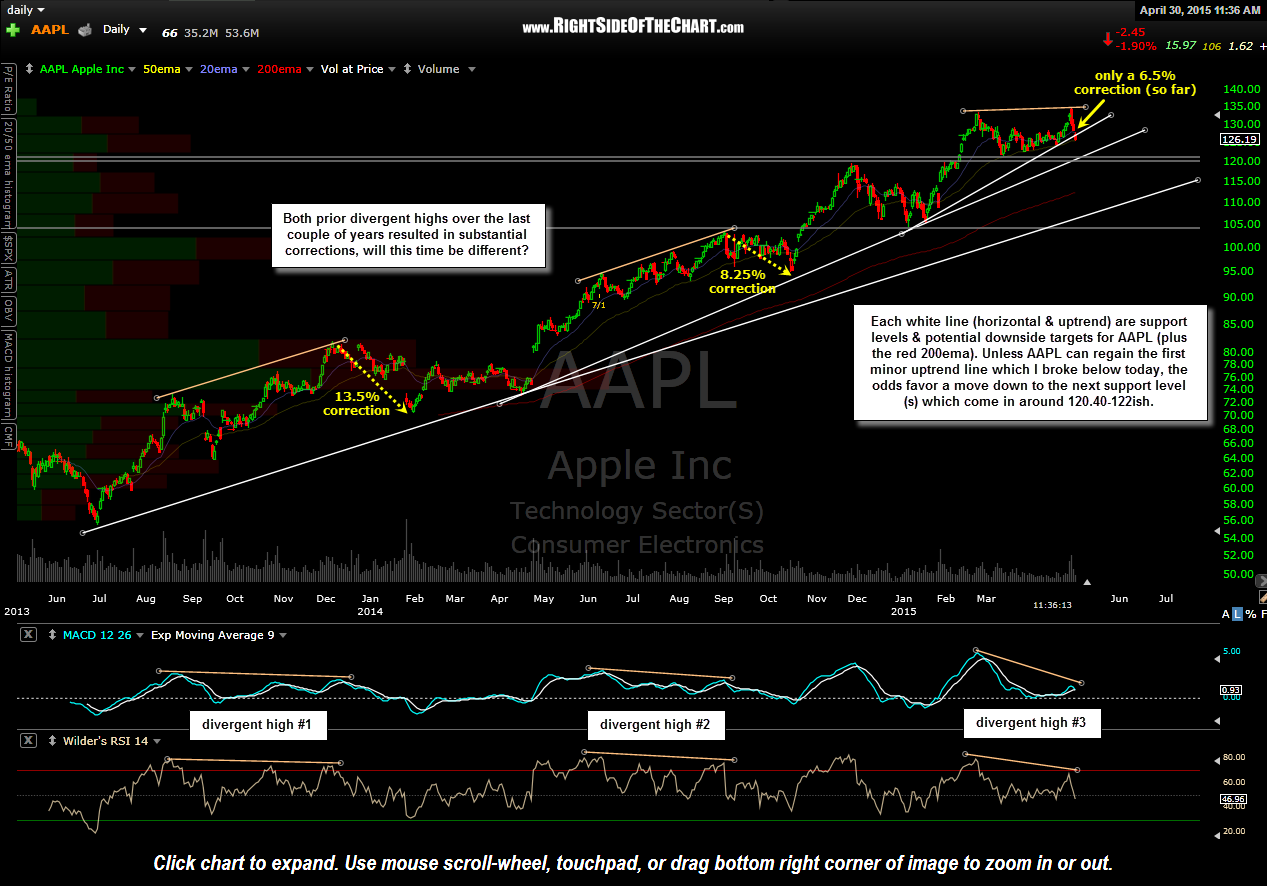

Technical Analysis of AAPL Stock

Technical analysis provides a different lens for AAPL stock forecasting, focusing on price charts and trading volume to predict future price movements.

Identifying Key Support and Resistance Levels

Support and resistance levels represent price points where the stock price has historically struggled to break through.

- Chart Patterns: Identify key support and resistance levels using charts and technical indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

- Breakthrough Significance: A break above resistance often signals a bullish trend, while a break below support can indicate a bearish trend.

- Price Targets: Combining support/resistance levels with other technical indicators can help establish potential price targets.

Chart Patterns and Trend Analysis

Chart patterns can provide insights into potential future price movements.

- Head and Shoulders, Double Tops/Bottoms: These patterns can signal potential trend reversals. Observing these patterns in AAPL's historical data can contribute to your AAPL stock forecast.

- Trend Lines: Drawing trend lines can help identify the overall direction of the price.

- Volume Confirmation: Changes in price should be confirmed by corresponding changes in trading volume. High volume confirms a significant price movement.

Using Technical Indicators

Technical indicators like RSI, MACD, and Bollinger Bands offer additional signals.

- Buy/Sell Signals: These indicators can generate buy or sell signals, offering short-term and long-term trading opportunities.

- Indicator Limitations: It's crucial to remember that technical indicators are not foolproof and should be used in conjunction with fundamental analysis. Over-reliance on any single indicator can be detrimental.

External Factors Influencing Apple Stock Price

External factors significantly impact Apple's stock price.

Global Economic Conditions

Macroeconomic conditions heavily influence investor sentiment.

- Interest Rates and Inflation: Rising interest rates and high inflation can dampen economic growth and negatively affect stock prices, including AAPL.

- Recessionary Fears: Economic uncertainty and recessionary fears can lead to increased volatility in the stock market.

- Geopolitical Events: Global events, such as trade wars or political instability, can impact investor confidence and market sentiment.

Competitor Analysis

Apple's position relative to competitors shapes its market share and profitability.

- Major Competitors: Samsung, Google, and other tech companies compete directly with Apple in various product categories.

- Technological Innovations: Competitors' innovative products and technologies can impact Apple's market share and revenue.

Regulatory and Legal Factors

Regulatory scrutiny and legal challenges can affect Apple's operations and stock price.

- Antitrust Concerns: Government investigations or legal battles relating to antitrust issues can impact Apple's stock price.

- Data Privacy Regulations: Changes in data privacy regulations can affect Apple's business model and operations.

Conclusion: Forecasting Apple Stock (AAPL) Price: Key Takeaways and Next Steps

This analysis combined fundamental and technical perspectives to provide a comprehensive AAPL stock forecast. We identified crucial support and resistance levels, discussed potential price movements based on both fundamental strength and technical indicators, and highlighted the importance of considering external factors like macroeconomic conditions and competitive pressures. Remember that no Apple stock price prediction is foolproof. Continuous monitoring of Apple's financial performance, market trends, and competitive landscape is essential for accurate forecasting. Conduct your own thorough research, combining both fundamental and technical analysis AAPL, to create your own Apple stock price prediction. Use the insights provided here as a starting point and supplement your analysis with additional resources to formulate a well-informed AAPL stock forecast. Remember to regularly review your Apple stock analysis to adapt to the ever-changing market dynamics.

Featured Posts

-

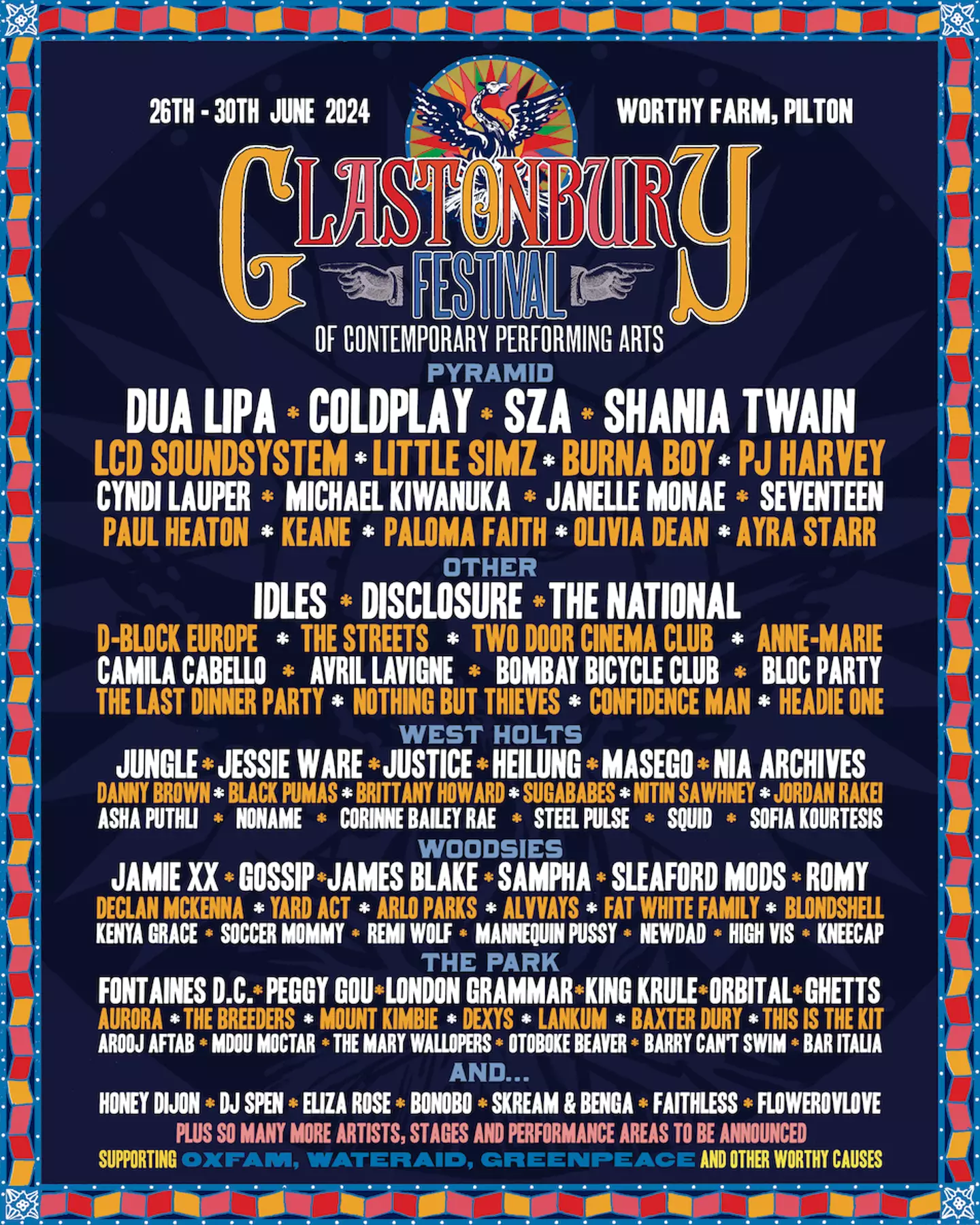

Us Bands Surprise Glastonbury Gig Unofficial Announcement

May 25, 2025

Us Bands Surprise Glastonbury Gig Unofficial Announcement

May 25, 2025 -

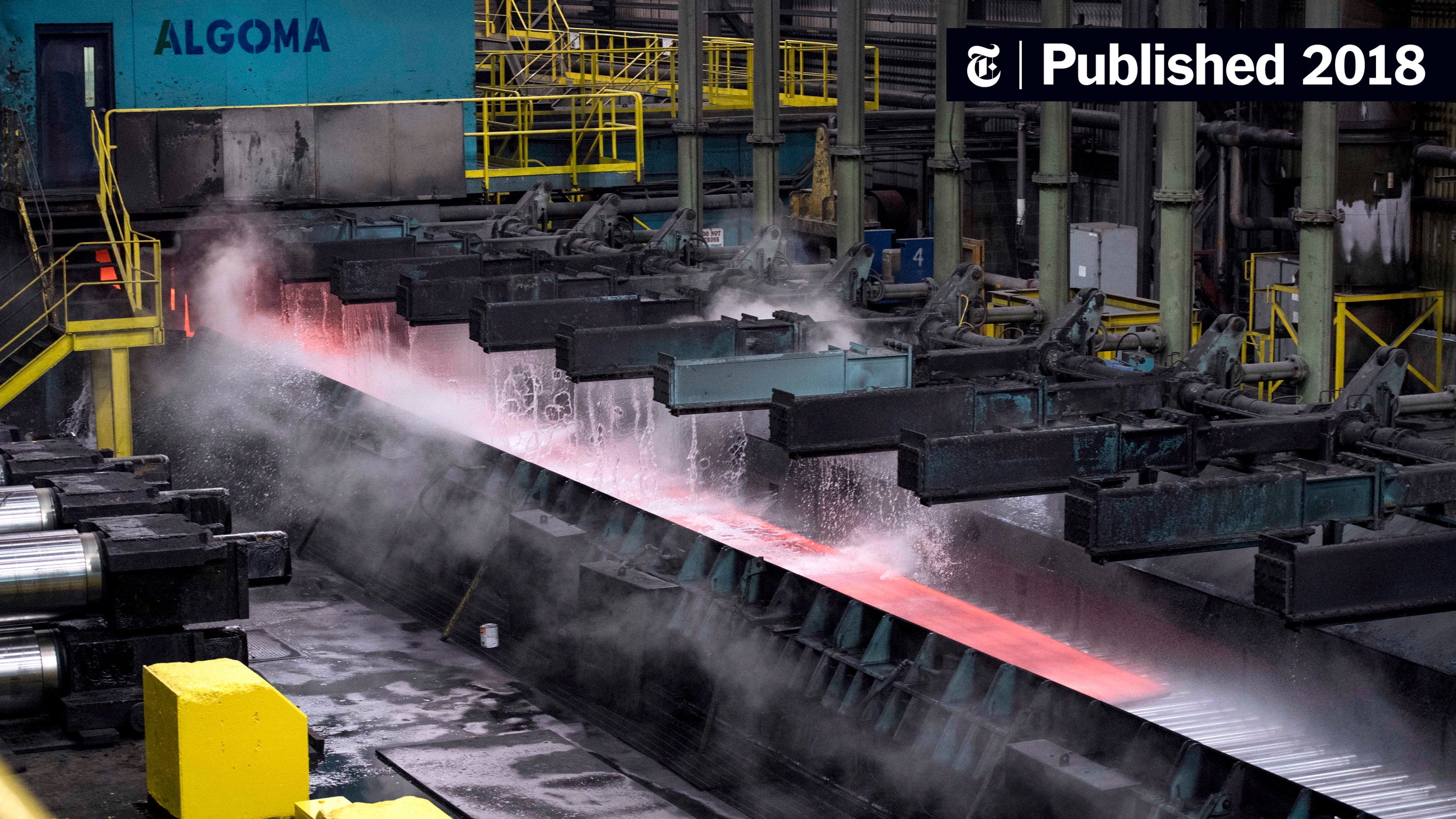

How Canada And Mexico Can Boost Trade Despite Us Tariffs

May 25, 2025

How Canada And Mexico Can Boost Trade Despite Us Tariffs

May 25, 2025 -

Models Partners Posts After Night Out With Kyle Walker Raise Questions

May 25, 2025

Models Partners Posts After Night Out With Kyle Walker Raise Questions

May 25, 2025 -

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 25, 2025

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 25, 2025 -

Seeking Change Facing Punishment A Look At Reprisal For Reform

May 25, 2025

Seeking Change Facing Punishment A Look At Reprisal For Reform

May 25, 2025