Forecasting Apple Stock (AAPL) Price: Key Support And Resistance Levels

Table of Contents

Understanding Support and Resistance Levels in AAPL Stock

What are Support Levels?

A support level represents a price point where buying pressure is strong enough to prevent a further price decline in AAPL stock. It's a price floor. Think of it as a safety net for the price. When the price approaches a support level, buyers often step in, preventing a significant drop.

- Identification: Support levels are typically identified by looking for previous lows where the price bounced back. A strong support level will show multiple instances of the price finding support at that level.

- Volume Analysis: High volume at a support level confirms its strength. Increased buying volume during a price bounce reinforces the significance of the support level.

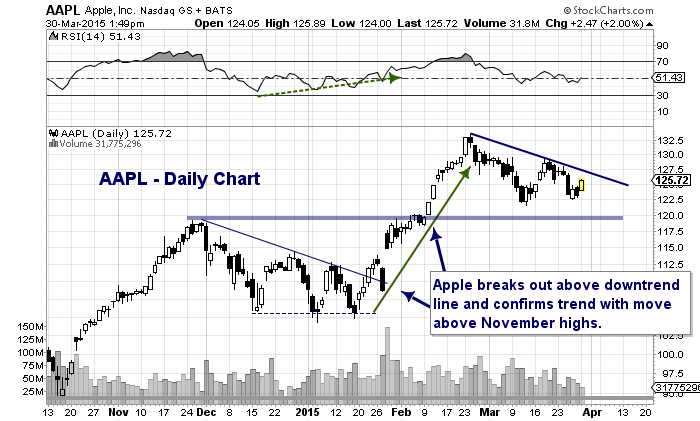

- Example: (Insert a chart here showing a past support level for AAPL, clearly marking the level and the price bounces.) This chart clearly shows how the $150 level acted as robust support for AAPL in Q3 2023.

What are Resistance Levels?

A resistance level is a price point where selling pressure overcomes buying pressure, preventing further price increases in AAPL stock. It's a price ceiling. This is where sellers are more willing to part with their shares, preventing the price from breaking through.

- Identification: Resistance levels are identified by looking for previous highs where the price reversed. A successful break above resistance often signifies a significant bullish trend.

- Volume Analysis: High volume at a resistance level confirms its strength. If the price breaks through resistance with high volume, it indicates strong bullish momentum.

- Example: (Insert a chart here showing a past resistance level for AAPL, clearly marking the level and the price reversals.) This example shows how the $180 level acted as a significant resistance point for AAPL earlier in the year.

Identifying Key Support and Resistance Levels for AAPL using Chart Patterns

Technical analysis utilizes various chart patterns to predict future price movements. These patterns can help identify potential support and resistance levels.

- Head and Shoulders: This pattern suggests a potential price reversal. The "head" represents a high, followed by two lower "shoulders." A break below the neckline often signals a bearish trend.

- Double Tops/Bottoms: These patterns show price reversals after reaching similar high or low points. The neckline provides a key support or resistance level.

- Triangles: These patterns indicate a period of consolidation, with the apex of the triangle often acting as a breakout point, leading to a directional move.

- Moving Averages: 50-day and 200-day moving averages are often used as dynamic support and resistance levels. A break above the 200-day MA can be a strong bullish signal.

- Examples: (Include images of these chart patterns on AAPL's stock chart. Clearly label each pattern.)

Factors Influencing AAPL Stock Price and Support/Resistance Levels

Several factors influence AAPL stock price and consequently shift support and resistance levels. Understanding these is vital for accurate Apple Stock Price Prediction.

Fundamental Analysis

Apple's financial performance directly impacts its stock price. Strong earnings reports, successful product launches, and positive financial metrics generally lead to higher stock prices, shifting support and resistance levels upward.

- Key Metrics: Revenue growth, profit margins, earnings per share (EPS), and return on equity (ROE) are crucial indicators to monitor.

- Product Launches: The success of new iPhones, iPads, Macs, and services significantly influences AAPL's stock performance.

Market Sentiment and News

Positive news, such as strong product reviews or positive analyst upgrades, boosts investor confidence, pushing the price upwards. Conversely, negative news, like supply chain disruptions or regulatory issues, can lead to price declines.

- News Sources: Monitor reputable financial news outlets and analyst reports for updates.

- Social Sentiment: Analyzing social media sentiment towards Apple products can provide insights into market sentiment.

Global Economic Conditions

Broader economic factors, such as interest rate hikes, inflation, and recessionary fears, influence the overall stock market, impacting AAPL stock price. A strong economy generally supports higher stock prices.

- Interest Rates: Higher interest rates can increase borrowing costs, potentially impacting company investments and slowing economic growth.

- Inflation: High inflation erodes purchasing power and can negatively impact consumer spending, affecting Apple's sales.

Developing an AAPL Stock Price Prediction Strategy

Accurately forecasting AAPL stock price requires a holistic approach.

Combining Technical and Fundamental Analysis

For a comprehensive AAPL Stock Price Prediction, integrate technical analysis (support/resistance levels, chart patterns) with fundamental analysis (financial performance, market sentiment). This provides a more balanced perspective.

Risk Management

Trading AAPL stock involves inherent risks. Implement risk management strategies to protect your investments.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes.

- Stop-Loss Orders: Use stop-loss orders to limit potential losses if the price moves against your prediction.

Long-Term vs. Short-Term Strategies

Your investment timeframe significantly influences your strategy.

- Long-Term Investing: Focus on fundamental analysis and long-term growth prospects. Support and resistance levels provide broader context.

- Short-Term Trading: Technical analysis, including support and resistance levels, becomes crucial for identifying short-term price movements.

Conclusion

Forecasting Apple stock (AAPL) price requires a comprehensive approach combining technical and fundamental analysis. By carefully identifying key support and resistance levels, understanding influencing factors, and employing sound risk management strategies, investors can improve their chances of making informed decisions. Remember, this information is for educational purposes and not financial advice. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions regarding AAPL stock or any other security. Continue learning about forecasting Apple stock (AAPL) price to refine your investment strategy and make the most of your opportunities in the dynamic world of stock trading. Start improving your AAPL stock predictions today!

Featured Posts

-

Silence Impose La Chine Et La Repression Des Voix Discordantes En France

May 24, 2025

Silence Impose La Chine Et La Repression Des Voix Discordantes En France

May 24, 2025 -

Koezuti Porsche F1 Es Motor Erejevel

May 24, 2025

Koezuti Porsche F1 Es Motor Erejevel

May 24, 2025 -

Pobeditel Evrovideniya 2014 Konchita Vurst Zhizn Karera I Put K Mechte Stat Devushkoy Bonda

May 24, 2025

Pobeditel Evrovideniya 2014 Konchita Vurst Zhizn Karera I Put K Mechte Stat Devushkoy Bonda

May 24, 2025 -

Porsche Macan Yfirlit Yfir Nyju Rafmagnsutgafuna

May 24, 2025

Porsche Macan Yfirlit Yfir Nyju Rafmagnsutgafuna

May 24, 2025 -

Qfzt Daks Almanya Atfaq Tjary Amryky Syny Ydfe Almwshr Ila 24 Alf Nqtt

May 24, 2025

Qfzt Daks Almanya Atfaq Tjary Amryky Syny Ydfe Almwshr Ila 24 Alf Nqtt

May 24, 2025

Latest Posts

-

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025 -

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

May 24, 2025

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

May 24, 2025