Four Essential Reads On The Influence Of Private Equity

Table of Contents

Understanding Private Equity Investment Strategies

Private equity firms employ various investment strategies to generate returns. Understanding these strategies is crucial to grasping the overall influence of private equity.

Leveraged Buyouts and Their Impact

Leveraged buyouts (LBOs) are a cornerstone of private equity. In an LBO, a firm acquires a company using significant debt financing, often funded by the target company’s assets. This high leverage magnifies returns but also increases risk.

- Financial Engineering of LBOs: LBOs involve complex financial engineering, including debt structuring, refinancing, and asset stripping. The goal is to maximize returns by improving the target company's operational efficiency and reducing debt over time.

- Successful and Unsuccessful LBO Examples: Successful LBOs, like the highly profitable acquisition of Heinz by 3G Capital, demonstrate the potential for substantial value creation. Conversely, poorly executed LBOs can lead to bankruptcy, as seen in some instances involving excessive debt burdens.

- Risks Associated with High Leverage: High levels of debt increase the risk of financial distress, especially during economic downturns. Interest payments can strain a company's cash flow, leaving little room for investment or unexpected expenses.

Venture Capital and Growth Equity

Venture capital (VC) and growth equity represent different stages of private equity investment. VC focuses on early-stage companies with high growth potential, while growth equity targets more mature companies seeking expansion capital.

- Defining Venture Capital and Growth Equity: Venture capital typically involves investing in startups with innovative ideas and significant market disruption potential. Growth equity investments usually support already established companies seeking to scale operations, enter new markets, or acquire competitors.

- Typical Investment Timeline: VC investments often have a longer timeline, spanning several years before a potential exit through an IPO or sale. Growth equity investments typically have a shorter timeline, with exits often occurring within 3-7 years.

- Examples of VC/Growth Equity Funding: Numerous tech giants, such as Google and Facebook (now Meta), received significant VC funding in their early stages. Many established companies also leverage growth equity to fuel their expansion strategies.

Distressed Debt Investing

Distressed debt investing involves purchasing the debt of financially troubled companies at a discounted price. Investors aim to profit from restructuring or liquidation proceedings.

- Defining Distressed Debt: Distressed debt refers to bonds or loans trading below their face value due to the issuer's financial difficulties. These assets can offer substantial returns but also carry significant risk of total loss.

- Potential for High Returns and Significant Losses: While distressed debt can yield exceptional returns if the company successfully reorganizes, it also poses a high risk of default and minimal recovery.

- Role in Corporate Restructuring: Distressed debt investors often play a critical role in corporate restructuring, providing capital and influencing strategic decisions to maximize the value of assets for creditors.

The Societal Impact of Private Equity

The societal impact of private equity is a complex and often debated topic. While it can contribute to economic growth and job creation, concerns exist regarding its impact on corporate governance and market competition.

Job Creation and Economic Growth

Private equity's contribution to job creation and economic growth is a subject of ongoing discussion.

- Statistics on Job Creation in PE-Backed Companies: Studies show mixed results regarding job creation in private equity-backed companies. Some research suggests a positive correlation, while others indicate job losses due to restructuring or automation.

- Potential Job Losses Due to Restructuring and Automation: Private equity firms often implement cost-cutting measures, which can lead to job losses, although often followed by increased efficiency and potential future job creation.

- Impact on Local Economies: The impact on local economies varies depending on factors like the industry, company size, and the private equity firm's investment strategy.

Corporate Governance and Ethical Considerations

Concerns about private equity's impact on corporate governance and ethical considerations are frequently raised.

- Impact on Corporate Strategy and Decision-Making: Private equity ownership can influence corporate strategy and decision-making, often prioritizing short-term financial gains over long-term sustainability and employee welfare.

- Controversies Related to Ethical Considerations: Instances of controversial private equity transactions, such as those involving excessive debt loading or environmental damage, have fueled ethical concerns.

- Role of ESG Factors in Private Equity Investment Decisions: Increasingly, ESG (Environmental, Social, and Governance) factors are being integrated into private equity investment decisions, reflecting a growing awareness of the importance of sustainable and responsible investing.

Influence on Market Competition

Private equity's consolidation of industries raises concerns about its impact on market competition.

- Monopolies or Oligopolies Created Through PE Acquisitions: Private equity acquisitions can lead to increased market concentration, resulting in monopolies or oligopolies, potentially harming consumers through higher prices and reduced choice.

- Potential for Reduced Consumer Choice and Increased Prices: Reduced competition can limit consumer choice and lead to inflated prices, impacting overall market efficiency and consumer welfare.

- Antitrust Concerns: Antitrust regulators actively monitor private equity deals to prevent anti-competitive behavior and ensure fair market practices.

Essential Reads: Book Recommendations

To gain a deeper understanding of the influence of private equity, consider these essential reads:

- "Private Equity: A Comprehensive Guide" (This would need a real book title and author here). This book provides a detailed overview of private equity investment strategies and their impact on the global economy.

- "The Black Swan" by Nassim Nicholas Taleb: While not exclusively focused on private equity, this book offers crucial insights into the unpredictability of markets and the risks associated with high-leverage investments.

- (Insert Title and Author of a book focusing on the ethical aspects of Private Equity): This book would offer a critical perspective on the social and ethical implications of private equity's actions.

- (Insert Title and Author of a book focusing on the impact of Private Equity on specific industries): This could focus on a sector significantly impacted by private equity activity, providing a case study analysis. (Remember to replace placeholder titles with actual book titles and author names and provide links if possible).

Conclusion

This article explored the multifaceted influence of private equity, highlighting its investment strategies, societal impact, and the importance of understanding its complex dynamics. By examining the recommended essential reads, investors, policymakers, and interested individuals can gain a more nuanced perspective on this powerful force in the global economy. Further research and engagement with the topic of private equity influence are crucial for navigating the ongoing evolution of this sector and its profound impact on our world. To delve deeper into the subject, start with the recommended books listed above. Understanding the private equity's influence is key to making informed decisions in the modern financial landscape.

Featured Posts

-

Demenagement Des Maternelles De Saint Ouen Le Trafic De Drogue Cause Le Depart

May 27, 2025

Demenagement Des Maternelles De Saint Ouen Le Trafic De Drogue Cause Le Depart

May 27, 2025 -

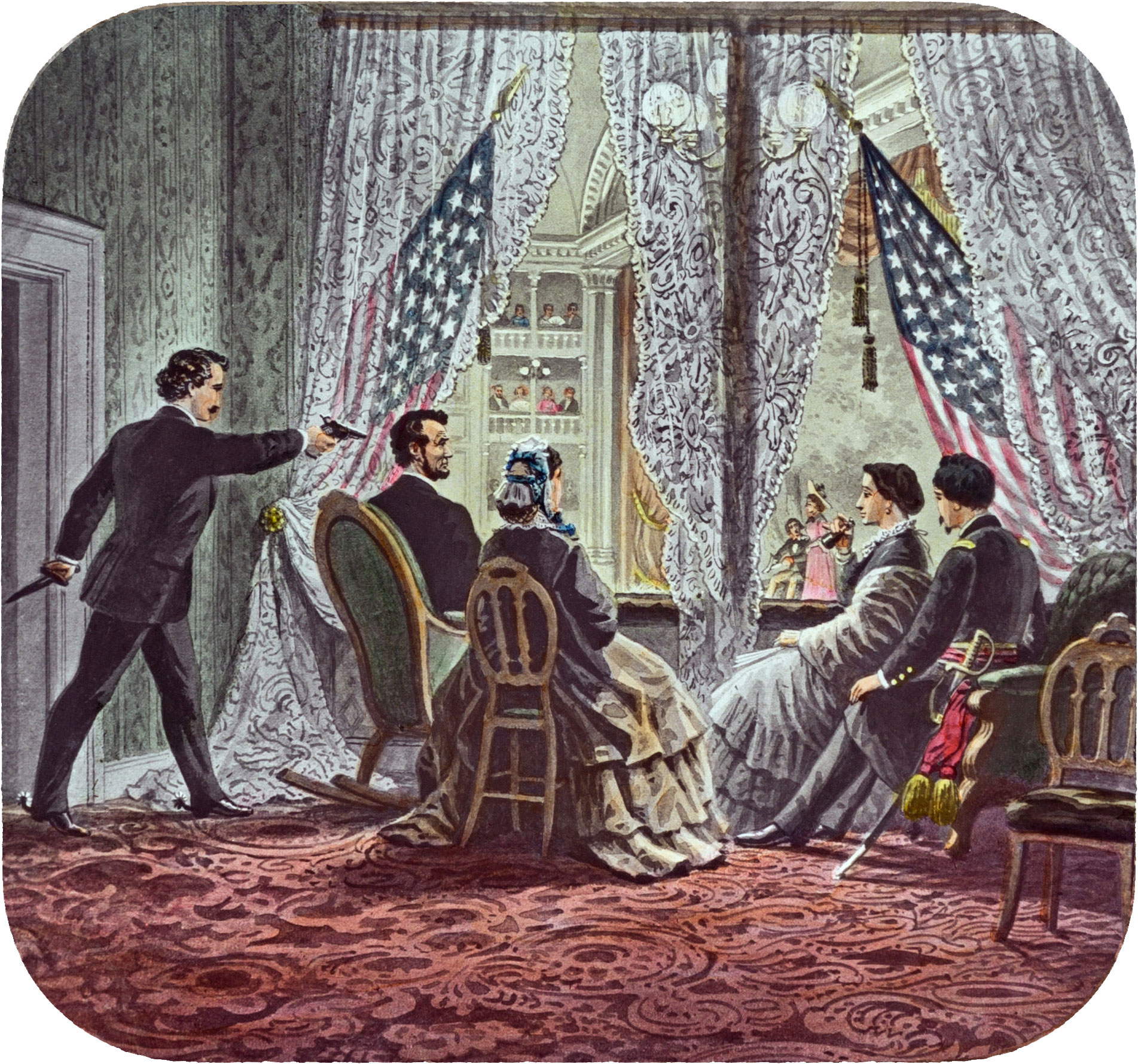

Raz Asnuvanje Na Atentatot Na Robert Kenedi 10 000 Novoob Aveni Stranitsi

May 27, 2025

Raz Asnuvanje Na Atentatot Na Robert Kenedi 10 000 Novoob Aveni Stranitsi

May 27, 2025 -

90 Day China Goods Export A Practical Guide

May 27, 2025

90 Day China Goods Export A Practical Guide

May 27, 2025 -

Ranking Taylor Swifts Albums A Critical Analysis

May 27, 2025

Ranking Taylor Swifts Albums A Critical Analysis

May 27, 2025 -

Twelve Bandits Killed In Katsina By Security Forces

May 27, 2025

Twelve Bandits Killed In Katsina By Security Forces

May 27, 2025

Latest Posts

-

Rcmp Probe Winter Long Poaching Operation At Remote Northern Lodge

May 30, 2025

Rcmp Probe Winter Long Poaching Operation At Remote Northern Lodge

May 30, 2025 -

Illegal Hunting Operation Uncovered Near Manitoba Nunavut Border Rcmp

May 30, 2025

Illegal Hunting Operation Uncovered Near Manitoba Nunavut Border Rcmp

May 30, 2025 -

Caribou Poaching Suspects Target Remote Lodge Rcmp Investigation

May 30, 2025

Caribou Poaching Suspects Target Remote Lodge Rcmp Investigation

May 30, 2025 -

Remote Lodge Burglary Leads To Winter Long Poaching Investigation In Northern Canada

May 30, 2025

Remote Lodge Burglary Leads To Winter Long Poaching Investigation In Northern Canada

May 30, 2025 -

Press Release Joy Smith Foundation Official Launch

May 30, 2025

Press Release Joy Smith Foundation Official Launch

May 30, 2025