Frankfurt DAX Closes Lower Than 24,000 Points

Table of Contents

Factors Contributing to the DAX Decline Below 24,000

Several interconnected factors contributed to the Frankfurt DAX's fall below 24,000 points.

Global Economic Uncertainty

The global economic landscape is currently fraught with uncertainty. Several key issues are impacting investor confidence and driving down stock markets worldwide, including the Frankfurt DAX.

- Inflationary Pressures: Persistent high inflation across many developed economies is forcing central banks to implement aggressive interest rate hikes. This increases borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings.

- Rising Interest Rates: The aggressive interest rate hikes by the European Central Bank (ECB), mirroring similar actions by the US Federal Reserve, directly impact borrowing costs for businesses and consumers, leading to reduced investment and spending.

- Geopolitical Risks: The ongoing war in Ukraine continues to fuel energy price volatility and supply chain disruptions, further exacerbating global economic uncertainty. The energy crisis, particularly impacting Europe, adds significant pressure on businesses and consumer confidence.

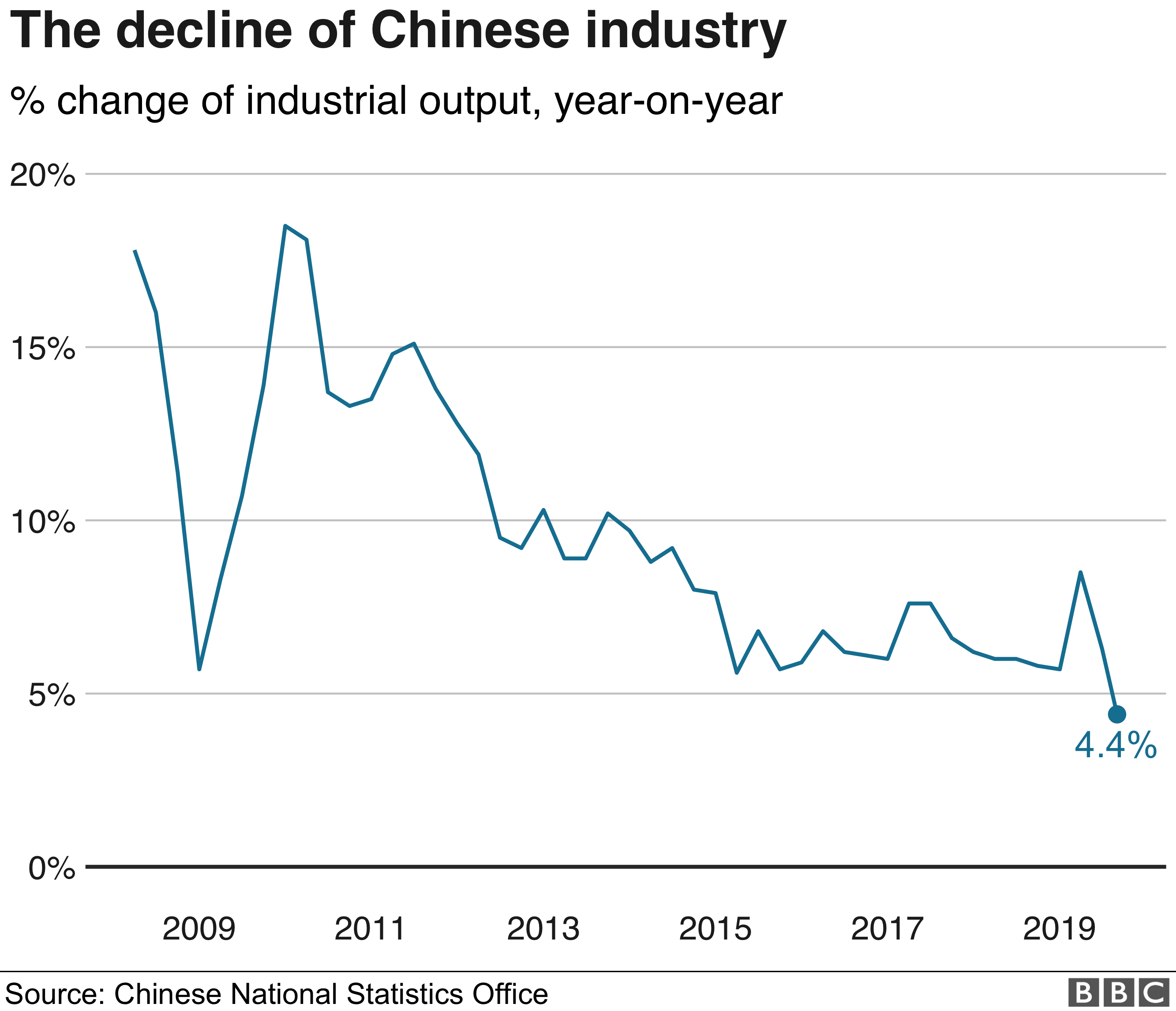

- Economic Indicators: Weakening economic indicators, such as declining manufacturing PMI (Purchasing Managers' Index) figures and slowing consumer spending, point towards a potential economic slowdown or even recession in several key markets, adding to the negative sentiment reflected in the DAX.

Performance of Key DAX Companies

The decline in the DAX index is also linked to the underperformance of several major companies listed on the exchange. Specific sectors have been particularly hard hit:

- Automotive Sector: The automotive industry, a major component of the German economy, is facing challenges related to supply chain disruptions, the chip shortage, and the transition to electric vehicles. Several major automotive manufacturers listed on the DAX experienced significant stock price declines.

- Technology Sector: The technology sector, globally impacted by rising interest rates and reduced investor appetite for growth stocks, also contributed to the overall DAX decline. Several tech companies listed on the DAX saw their share prices fall considerably.

- Company Earnings: Disappointing earnings reports from several DAX-listed companies further fueled the sell-off, indicating a potential weakening in corporate profitability and contributing to the overall negative market sentiment.

Investor Sentiment and Market Reactions

The prevailing investor sentiment is characterized by fear and uncertainty, leading to significant market volatility.

- Increased Trading Volume: The decline below 24,000 points was accompanied by increased trading volume, reflecting heightened activity as investors reacted to the deteriorating market conditions.

- Risk-Off Sentiment: Investors are adopting a “risk-off” strategy, shifting away from riskier assets like stocks and towards safer havens such as government bonds. This flight to safety contributes to the downward pressure on the DAX.

- Sell-Off: A significant sell-off was observed across various sectors, as investors sought to reduce their exposure to the market's increased uncertainty.

Implications of the DAX Falling Below 24,000 Points

The DAX's dip below 24,000 points has significant implications for both the German economy and the broader European market.

Impact on the German Economy

The performance of the DAX is closely linked to the health of the German economy. A sustained decline could:

- Slow Economic Growth: Reduced business investment and consumer spending, driven by negative market sentiment, could significantly slow German economic growth.

- Impact Employment: A weakening economy could lead to job losses in various sectors, impacting consumer confidence and further depressing economic activity.

- Reduce Consumer Confidence: Negative market sentiment, coupled with rising inflation and interest rates, is likely to reduce consumer confidence, leading to decreased spending and further impacting economic growth.

Potential Future Market Movements

Predicting future market movements with certainty is impossible. However, considering current economic conditions and expert opinions, several scenarios are plausible:

- Support and Resistance Levels: Technical analysts will be closely monitoring potential support and resistance levels for the DAX to gauge its short-term trajectory.

- Potential Catalysts: Positive catalysts, such as easing inflationary pressures, improved geopolitical stability, or better-than-expected corporate earnings, could trigger a market rebound. Conversely, further escalation of geopolitical tensions or a deeper-than-expected economic slowdown could lead to further declines.

Analyzing the Frankfurt DAX Dip Below 24,000 – What's Next?

The Frankfurt DAX's fall below 24,000 points reflects a confluence of factors, including global economic uncertainty, the underperformance of key DAX companies, and a prevailing risk-off investor sentiment. The implications for the German economy are significant, potentially impacting growth, employment, and consumer confidence. The future trajectory of the DAX remains uncertain, dependent on evolving economic conditions and geopolitical developments. To stay informed about the Frankfurt DAX and its movements, subscribe to our newsletter, follow market updates, and consult with a qualified financial advisor. Use keywords like "DAX forecast," "German stock market," "market volatility," and "Frankfurt DAX analysis" for further research and insights.

Featured Posts

-

Escape To The Country Choosing The Right Rural Property

May 24, 2025

Escape To The Country Choosing The Right Rural Property

May 24, 2025 -

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike E Lululemon

May 24, 2025

Crisi Moda Come I Dazi Di Trump Hanno Colpito Nike E Lululemon

May 24, 2025 -

Annie Kilners Sparkling New Ring A Sign Of Commitment To Kyle Walker

May 24, 2025

Annie Kilners Sparkling New Ring A Sign Of Commitment To Kyle Walker

May 24, 2025 -

The Ultimate Escape To The Country Choosing The Right Location

May 24, 2025

The Ultimate Escape To The Country Choosing The Right Location

May 24, 2025 -

Brazils Banking Power Play Brb Challenges Giants After Banco Master Acquisition

May 24, 2025

Brazils Banking Power Play Brb Challenges Giants After Banco Master Acquisition

May 24, 2025

Latest Posts

-

Luxury Goods Slump Paris Budget Feels The Pinch March 7 2025

May 24, 2025

Luxury Goods Slump Paris Budget Feels The Pinch March 7 2025

May 24, 2025 -

Paris In The Red Luxury Goods Downturn Hits City Budget

May 24, 2025

Paris In The Red Luxury Goods Downturn Hits City Budget

May 24, 2025 -

The Implications Of Massimo Vians Exit From Guccis Supply Chain

May 24, 2025

The Implications Of Massimo Vians Exit From Guccis Supply Chain

May 24, 2025 -

Paris Economic Slowdown Luxury Sector Decline Impacts City Finances March 7 2025

May 24, 2025

Paris Economic Slowdown Luxury Sector Decline Impacts City Finances March 7 2025

May 24, 2025 -

Departure Of Guccis Chief Industrial And Supply Chain Officer Analysis

May 24, 2025

Departure Of Guccis Chief Industrial And Supply Chain Officer Analysis

May 24, 2025