From $3K Babysitter To $3.6K Daycare: A Man's Financial Childcare Nightmare

Table of Contents

The Unexpected Rise of Childcare Expenses

Initially, employing a babysitter seemed like a cost-effective childcare solution. Affordable childcare was a priority, and it appeared we'd found it.

The Initial Babysitter Arrangement

We started with a trusted babysitter who charged $15 an hour. With approximately 20 hours of care per week, our monthly cost was around $1200, totaling approximately $3,000 annually. This seemed manageable, especially compared to the daycare costs we'd researched.

The Need for a More Structured Solution

However, our situation changed. My wife's career took off, demanding longer hours, and our daughter reached developmental milestones that required a more stimulating environment than a babysitter could provide. The lack of regulated safety standards with our babysitter also became a growing concern.

- Increased work demands led to needing 40+ hours of childcare weekly.

- Concerns about the lack of structured learning and safety protocols in a babysitter setting.

- Our daughter's social and developmental needs demanded a more interactive and stimulating environment.

- Finding reliable babysitter coverage for unexpected events became incredibly difficult and stressful.

The Daycare Dilemma: A Costly Reality Check

The transition to daycare was unavoidable, but the financial impact was a harsh wake-up call.

The Shocking Daycare Costs

Daycare costs skyrocketed our expenses. The best daycare near us charged $900 a month – a total of $10,800 annually. Adding the cost of additional supplies, snacks and inevitable unexpected fees, the annual cost easily surpassed $12,000. This represented a significant percentage of our annual income.

Hidden Daycare Costs

Beyond the base tuition, several additional daycare costs quickly added up. We encountered unexpected expenses such as:

- Annual registration fee: $500.

- Monthly supply fees: $50.

- Snack costs: $75 per month.

- Field trip fees: $200 per year.

- Late pick-up fees: (Thankfully, we avoided these, but they could have added substantially).

The total annual cost, including all these hidden fees, easily climbed to over $13,000 annually. This represented nearly 20% of our combined annual income – a significant portion for any family. We applied for financial assistance programs, but unfortunately, our income was just above the eligibility threshold.

Strategies for Navigating Expensive Childcare

Facing the financial burden of expensive childcare, we started actively seeking solutions.

Exploring Affordable Childcare Alternatives

We researched several alternatives including:

- In-home daycare: While potentially less expensive than larger centers, finding a qualified and trustworthy provider proved challenging.

- Family assistance: Relatives offering care could provide a cost-effective solution, but it wasn't a practical option for us.

- Government subsidies and tax credits: These programs can help mitigate childcare costs, but eligibility requirements vary greatly.

Budgeting and Financial Planning for Childcare

Successfully navigating expensive childcare requires careful financial planning. We implemented the following:

- Detailed budget: Creating a comprehensive budget highlighting essential and non-essential expenses allowed us to identify areas where we could reduce spending.

- Expense reduction: We cut back on subscriptions, optimized our grocery shopping, and minimized eating out.

- Income increase: I picked up freelance work in the evenings to supplement our income.

To reiterate, affordable childcare solutions are crucial and there are several options to consider.

- Thoroughly research and compare prices from different providers.

- Explore all available government subsidies and tax credits for childcare.

- Consider creative strategies for saving money such as meal prepping, utilizing coupons, and reducing unnecessary subscriptions.

- Seek additional income streams by working part-time or taking on freelance projects.

Conclusion: Confronting the Childcare Cost Crisis

The transition from a seemingly affordable babysitter to costly daycare exposed the harsh reality of expensive childcare. The substantial financial strain it places on families cannot be overstated. However, by carefully evaluating options, aggressively budgeting, and seeking additional income, it's possible to manage these expenses. Share your childcare cost story, let's discuss strategies for finding affordable childcare solutions, and tackle the expensive childcare problem together! We need to advocate for better, more affordable childcare options for all families.

Featured Posts

-

Donner Ses Cheveux A Dijon Un Geste Solidaire

May 09, 2025

Donner Ses Cheveux A Dijon Un Geste Solidaire

May 09, 2025 -

Colin Cowherds Persistent Criticism Of Jayson Tatum Is He Underrated

May 09, 2025

Colin Cowherds Persistent Criticism Of Jayson Tatum Is He Underrated

May 09, 2025 -

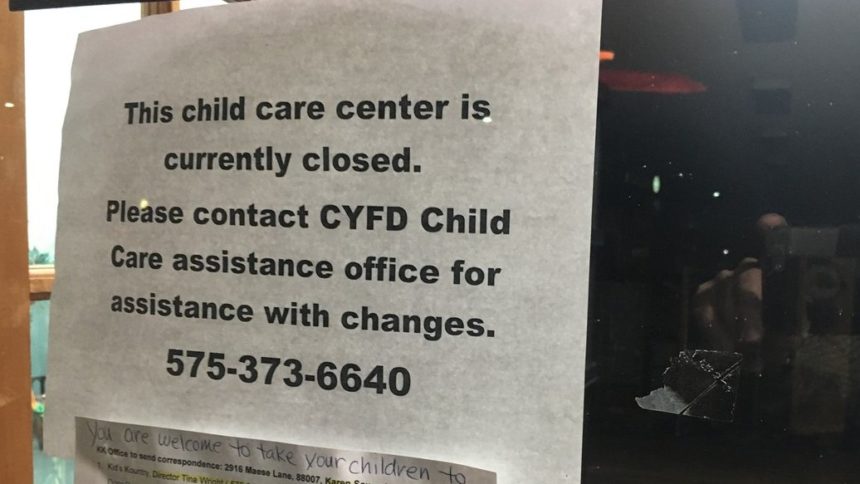

Nc Daycare Suspended State Action And Investigation Details

May 09, 2025

Nc Daycare Suspended State Action And Investigation Details

May 09, 2025 -

Inquiry Into Nottingham Attacks Retired Judge Appointed Chair

May 09, 2025

Inquiry Into Nottingham Attacks Retired Judge Appointed Chair

May 09, 2025 -

Recovery Efforts Complicated Anchorage Fin Whale Skeleton And The Effects Of Thawing Mud

May 09, 2025

Recovery Efforts Complicated Anchorage Fin Whale Skeleton And The Effects Of Thawing Mud

May 09, 2025