FTC V. Meta: A Deep Dive Into The Antitrust Case

Table of Contents

The FTC's Allegations Against Meta

The Federal Trade Commission (FTC) alleges that Meta engaged in a series of anti-competitive practices to maintain its monopoly power in the social networking market. These allegations center around Meta's acquisition strategy, specifically the acquisitions of Instagram and WhatsApp. The FTC argues that these acquisitions were not merely business decisions but deliberate attempts to eliminate potential rivals and stifle competition. The core of the FTC's case rests on the assertion that Meta leveraged its market dominance and vast user data to engage in antitrust violations. These actions, according to the FTC, violated Section 2 of the Sherman Act and the Clayton Act, which prohibit monopolies and anti-competitive mergers.

- Acquisition of Instagram and WhatsApp: The FTC contends that these acquisitions, rather than promoting innovation, eliminated significant competitive threats. By acquiring these platforms, Meta allegedly prevented them from developing into independent, powerful competitors.

- Leveraging User Data: The FTC argues that Meta misused its vast user data to create insurmountable barriers to entry for new competitors. This data, obtained through Facebook, Instagram, and WhatsApp, allows Meta to personalize advertising and maintain its position as the dominant player.

- Anti-Competitive Practices to Exclude Rivals: The FTC's complaint includes various claims detailing how Meta actively worked to exclude competitors, preventing their growth and disrupting the market. These alleged practices may include strategies to limit interoperability and integration with other platforms.

- Specific Examples: While detailed evidence is presented in the formal complaint, the FTC highlights instances where Meta allegedly responded to competitive threats by acquiring rather than competing, illustrating a pattern of anti-competitive behavior.

Meta's Defense and Arguments

Meta vehemently denies the FTC's allegations, arguing that its acquisitions were pro-competitive and ultimately benefited consumers. Their defense emphasizes the positive network effects of integrating services, resulting in a more seamless and integrated user experience. Meta counters that the acquisitions fostered innovation and brought enhanced features and functionalities to users.

- Benefits of Acquisitions to Users: Meta argues that integrating Instagram and WhatsApp into its ecosystem has created a richer and more interconnected online experience for users, providing benefits that outweigh any potential competitive concerns.

- Fostering Competition and Innovation: The company claims that its acquisitions spurred internal innovation and improvements, leading to better products and services for consumers, rather than suppressing competition.

- Legal Strategies: Meta is employing a range of legal strategies, including challenging the FTC's legal standing and arguing against the interpretation of antitrust laws in this context. This includes demonstrating that the acquisitions have increased, not decreased, overall market competition.

- Counterarguments to the FTC's accusations: Meta provides specific counterarguments for each alleged anti-competitive practice, refuting the FTC's evidence and presenting alternative interpretations of its actions.

Key Legal Precedents and Their Relevance

The FTC v. Meta case draws upon numerous antitrust precedents and legal interpretations. Understanding these precedents is crucial for analyzing the case's potential outcomes. Section 2 of the Sherman Act, prohibiting monopolization, is central, as are precedents related to mergers and acquisitions under the Clayton Act. The case will likely involve interpreting the definition of "monopoly power" and the standard for evaluating whether acquisitions are anti-competitive.

- Relevant Cases and Outcomes: Cases like United States v. Microsoft and other significant antitrust rulings regarding mergers and acquisitions in the tech industry will be heavily referenced. The courts will consider how these precedents apply to the unique circumstances of the Meta case.

- Application to the Meta Case: The judges will assess whether Meta’s acquisitions fit within the legal framework established by previous cases. The debate will center on whether these acquisitions substantially lessened competition.

- Potential Legal Implications: Based on past rulings, possible outcomes include financial penalties, structural remedies (such as divestiture of Instagram and/or WhatsApp), or even a complete dismissal of the FTC's complaint.

Potential Impacts and Outcomes of the Case

The FTC v. Meta case's potential consequences are far-reaching, impacting not only Meta but the broader tech industry and its approach to mergers and acquisitions. The outcome could set a precedent for future tech regulation and reshape the competitive landscape of the social media industry.

- Potential Fines and Penalties: If found guilty, Meta could face substantial fines, impacting its financial performance and potentially impacting investor confidence.

- Potential Divestiture: A severe outcome could involve the forced divestiture of Instagram and/or WhatsApp, significantly altering Meta's business model and market position.

- Impact on Future Tech Mergers and Acquisitions: The case's outcome will likely influence how future mergers and acquisitions are scrutinized, making it potentially more difficult for large tech companies to consolidate their market power.

- Implications for Data Privacy: The case could also indirectly affect data privacy regulations, as the court’s interpretation might influence future legislation concerning the use and collection of user data.

- Broader Effects on the Competitive Landscape: The outcome will dramatically influence the competitive dynamics of the social media industry, potentially opening doors for new competitors or further consolidating the industry’s power.

Conclusion: Understanding the Implications of FTC v. Meta

The FTC v. Meta case is a pivotal moment for antitrust law and the tech industry. It underscores the complex challenges of regulating powerful tech companies in a rapidly evolving digital landscape. The FTC's core argument focuses on Meta's alleged anti-competitive acquisitions and leveraging of user data, while Meta defends itself by highlighting the pro-competitive benefits of integration and innovation. The outcome will significantly impact future mergers and acquisitions in the tech sector, shaping the competitive landscape and potentially influencing data privacy regulations. This case highlights the ongoing debate surrounding market regulation and the need to strike a balance between fostering innovation and ensuring fair competition.

What do you think the outcome of the FTC v. Meta case will be and what are its implications for the future of social media? To further your understanding of this significant case and related antitrust issues, explore resources from the FTC, the Department of Justice, and leading legal journals focused on antitrust law and digital monopolies.

Featured Posts

-

The Edan Alexander Situation Latest Developments In Gaza

May 13, 2025

The Edan Alexander Situation Latest Developments In Gaza

May 13, 2025 -

Tory Lanez And His Lawyer A Tense Confrontation In The Megan Thee Stallion Case

May 13, 2025

Tory Lanez And His Lawyer A Tense Confrontation In The Megan Thee Stallion Case

May 13, 2025 -

Air Traffic Control Failures Dot Secretary Points Finger At Biden Administration

May 13, 2025

Air Traffic Control Failures Dot Secretary Points Finger At Biden Administration

May 13, 2025 -

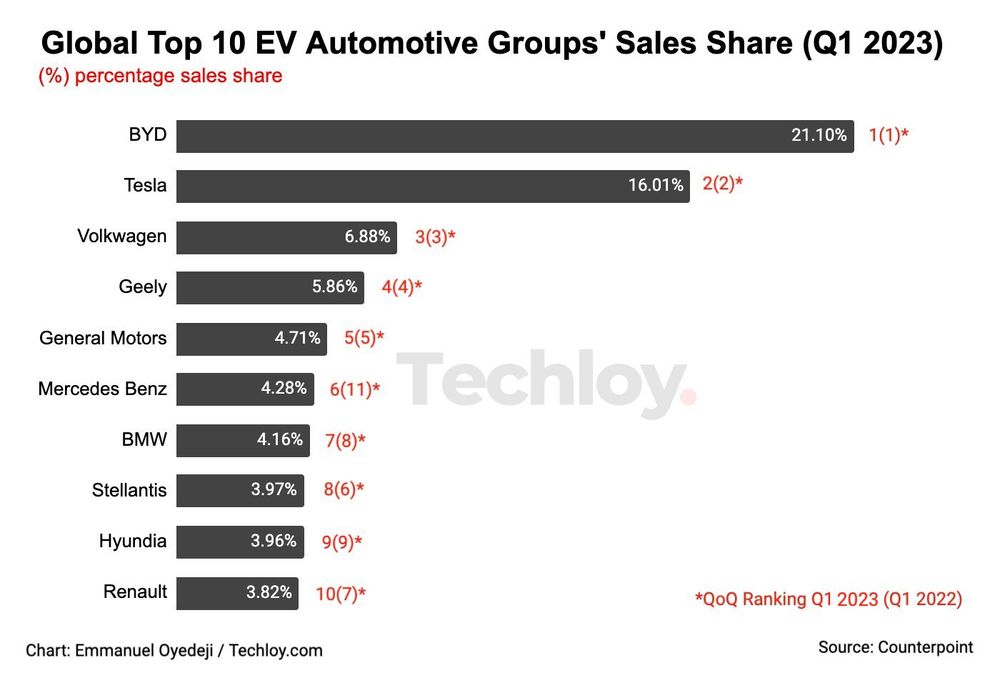

Byds Global Ambitions Half Its Car Sales Outside China By 2030

May 13, 2025

Byds Global Ambitions Half Its Car Sales Outside China By 2030

May 13, 2025 -

Gaza Hostage Crisis A Lingering Nightmare For Families

May 13, 2025

Gaza Hostage Crisis A Lingering Nightmare For Families

May 13, 2025

Latest Posts

-

The Snow White Remake Analyzing The Impact Of Divisive Messaging On Ticket Sales

May 14, 2025

The Snow White Remake Analyzing The Impact Of Divisive Messaging On Ticket Sales

May 14, 2025 -

Disneys Woke Snow White Critical And Commercial Failure

May 14, 2025

Disneys Woke Snow White Critical And Commercial Failure

May 14, 2025 -

Snow White Live Action Remake How Disney Improved On The Original

May 14, 2025

Snow White Live Action Remake How Disney Improved On The Original

May 14, 2025 -

Disneys Snow White A Hilariously Abysmal Flop Im Dbs Worst Ranked Movies

May 14, 2025

Disneys Snow White A Hilariously Abysmal Flop Im Dbs Worst Ranked Movies

May 14, 2025 -

Box Office Disaster How Disneys Snow White Remake Failed To Connect With Viewers

May 14, 2025

Box Office Disaster How Disneys Snow White Remake Failed To Connect With Viewers

May 14, 2025