Funding Opportunities For Sustainable SMEs: A Comprehensive Guide

Table of Contents

Understanding Sustainable SME Funding Needs

Defining Sustainable SMEs and their Unique Funding Requirements

Sustainable SMEs are businesses committed to environmentally and socially responsible practices. Their unique funding requirements often differ from traditional businesses. These needs frequently include:

- Research and Development (R&D) for eco-friendly technologies: Developing innovative, sustainable products and services requires significant investment in R&D.

- Energy efficiency upgrades: Implementing energy-saving measures in operations often involves upfront capital costs.

- Sustainable supply chain development: Sourcing materials responsibly and creating transparent, ethical supply chains demands investment and careful planning.

- Implementation of circular economy principles: Investing in waste reduction, reuse, and recycling strategies requires dedicated funding.

Traditional funding sources may overlook these specific needs. Banks and investors might hesitate due to perceived higher risks or lack of understanding of the long-term return on investment in sustainability initiatives. Demonstrating a clear social and environmental impact, alongside robust financial projections, is crucial for securing funding.

Assessing Your Funding Readiness

Before actively seeking funding, ensure your business is adequately prepared:

- Develop a strong business plan: This plan should clearly articulate your business model, target market, financial projections, and, crucially, your sustainability strategy.

- Prepare comprehensive financial projections: Detailed financial forecasts, including revenue projections, expense budgets, and cash flow statements, are essential for attracting investors.

- Understand your funding needs and timeline: Determine the precise amount of funding required and establish a realistic timeline for securing and utilizing the funds.

- Craft a compelling narrative: Your application needs to showcase not only your financial viability but also the positive environmental and social impact your business creates. Highlight your commitment to sustainability through concrete examples and measurable results.

Exploring Government Grants and Subsidies for Sustainable Businesses

Identifying Relevant Government Programs

Numerous government agencies at local, regional, national, and international levels offer grants and subsidies to support sustainable businesses. These programs often focus on specific areas like renewable energy, waste reduction, and sustainable agriculture. Examples include (Note: Specific programs and links will vary by country. Replace these with relevant examples for your target audience):

- [Insert Link to a Relevant National Grant Program]: Often focusing on green technologies and innovation.

- [Insert Link to a Regional Sustainability Initiative]: Providing funding for local sustainable projects.

- [Insert Link to an EU or International Funding Program for SMEs]: Supporting sustainable development across borders.

Eligibility criteria vary, so carefully review the guidelines for each program. The application process often involves detailed proposals outlining the project's objectives, budget, and anticipated impact.

Maximizing Your Grant Application Success

A successful grant application requires careful planning and execution:

- Write a compelling grant proposal: Clearly articulate your project's goals, methodology, and expected outcomes. Highlight the sustainability aspects and the positive social and environmental impact.

- Highlight your sustainability initiatives: Quantify the environmental benefits of your project wherever possible, using metrics to demonstrate the impact.

- Meet all requirements meticulously: Ensure your application is complete and adheres to all specified guidelines and deadlines.

- Build strong relationships with funding agencies: Networking and engaging with funding agencies proactively can increase your chances of securing funding.

Securing Loans and Financing from Banks and Financial Institutions

Green Loans and Sustainable Finance Initiatives

Many banks and financial institutions now offer green loans and other sustainable finance initiatives tailored to environmentally friendly businesses.

- Green loans often come with attractive features like lower interest rates and flexible repayment terms.

- Specific banks may have dedicated programs for sustainable projects, offering loan guarantees and other support programs to reduce the risk for lenders.

- Explore options such as green bonds and other debt financing solutions specifically designed for sustainable businesses.

Demonstrating Creditworthiness to Lenders

To secure a loan, sustainable SMEs must demonstrate their creditworthiness:

- A strong financial track record: A history of profitability and responsible financial management is crucial.

- Providing collateral: Securing a loan often requires offering collateral, such as assets or property.

- Showing a clear plan for repayment: A detailed repayment plan demonstrating the ability to manage debt responsibly is vital.

Exploring Alternative Funding Options for Sustainable SMEs

Crowdfunding and Impact Investing

Alternative financing sources offer viable options for sustainable SMEs:

- Crowdfunding platforms: Platforms like Kickstarter and Indiegogo allow businesses to raise capital directly from a large number of individuals. Successful campaigns often rely on strong storytelling and a clear demonstration of the business's social and environmental impact.

- Impact investing: Impact investors actively seek investments in businesses that generate positive social and environmental returns alongside financial returns. They are often willing to invest in earlier stages of a company's development compared to traditional investors.

Angel Investors and Venture Capital for Sustainable Startups

Angel investors and venture capitalists can provide significant funding, particularly for high-growth potential sustainable startups.

- Angel investors are typically high-net-worth individuals who invest their own capital in early-stage companies.

- Venture capitalists are firms that invest in startups with high growth potential, often requiring a significant equity stake in exchange for funding.

- Attracting these investors requires a strong business plan, a compelling vision for growth, and a clear articulation of the social and environmental impact.

Conclusion: Finding the Right Funding Opportunities for Your Sustainable SME

Securing funding for your sustainable SME requires a multi-pronged approach. This guide has explored various options, including government grants and subsidies, bank loans, and alternative financing methods such as crowdfunding and impact investing. Remember, a strong commitment to sustainability, backed by a robust business plan and clear demonstration of financial viability, is crucial for attracting investors and securing the necessary capital. Start your search for funding opportunities for sustainable SMEs today! Find the perfect funding opportunity for your sustainable business now!

Featured Posts

-

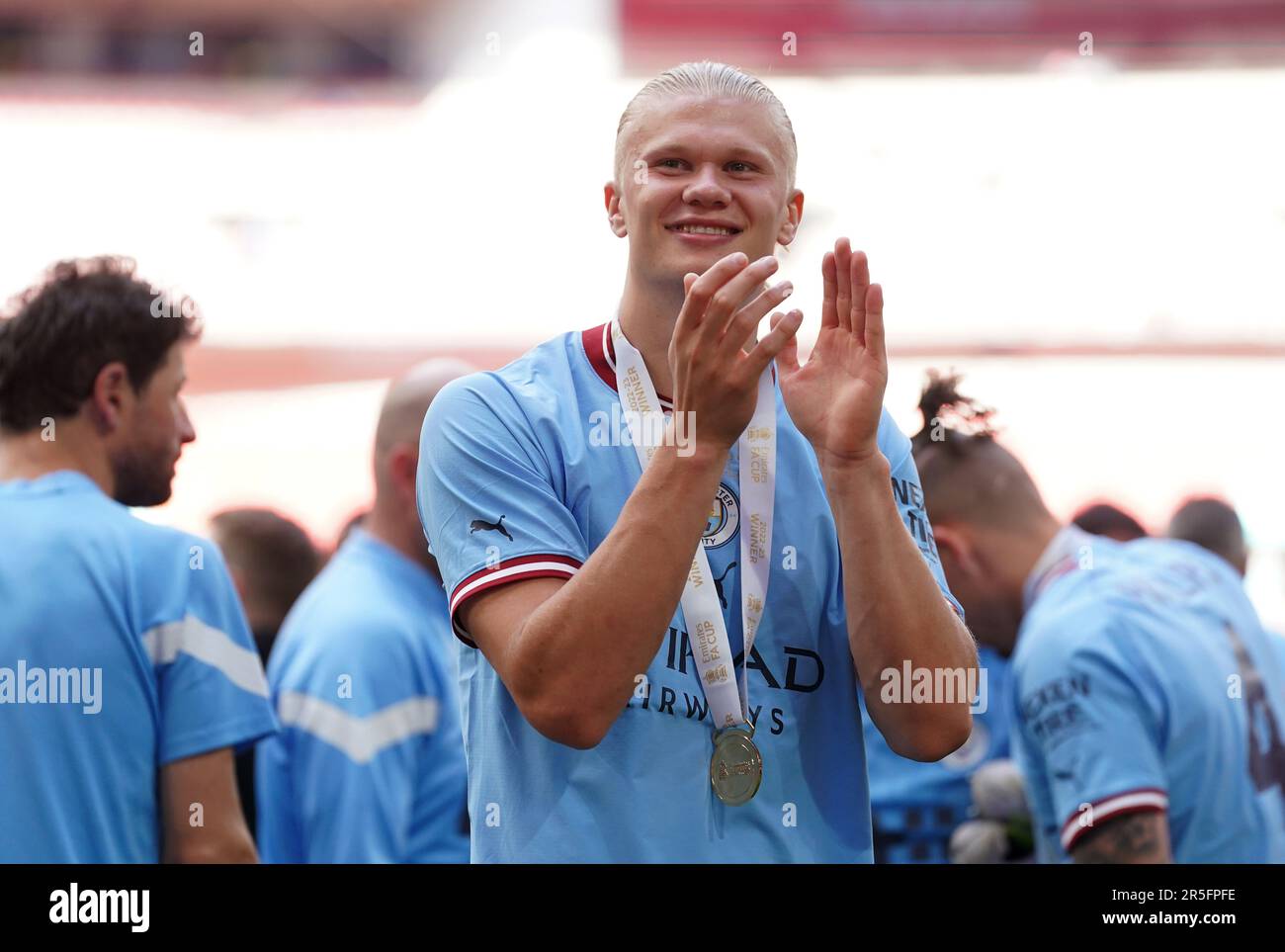

Erling Haalands Wembley Woes Continue In Fa Cup Final

May 19, 2025

Erling Haalands Wembley Woes Continue In Fa Cup Final

May 19, 2025 -

Eurovision 2025 Dates Participants And More

May 19, 2025

Eurovision 2025 Dates Participants And More

May 19, 2025 -

Ufc 313 Full Fight Card Results Pereira Ankalaev And Gaethje

May 19, 2025

Ufc 313 Full Fight Card Results Pereira Ankalaev And Gaethje

May 19, 2025 -

Analysis Broadcoms V Mware Acquisition And The 1 050 Price Hike For At And T

May 19, 2025

Analysis Broadcoms V Mware Acquisition And The 1 050 Price Hike For At And T

May 19, 2025 -

Nyt Connections Answers April 29 2024 Puzzle 688

May 19, 2025

Nyt Connections Answers April 29 2024 Puzzle 688

May 19, 2025