G-7 To Review De Minimis Tariffs On Imports From China: Potential Economic Impacts

Table of Contents

Understanding De Minimis Tariffs and their Current Application to Chinese Imports

De minimis tariffs refer to the low value threshold below which imported goods are exempt from customs duties. Their purpose is to simplify customs procedures for smaller shipments, facilitating trade in low-value goods. The current threshold for de minimis tariffs on imports from China varies among G7 nations, but generally sits at a relatively low value, often aiming to ease the burden on small businesses and consumers purchasing goods online. Common goods affected include consumer electronics, clothing, small household items, and various components used in manufacturing.

The benefits and drawbacks of low de minimis tariffs are significant and often debated:

-

Benefits:

- Lower costs for consumers, making imported goods more affordable.

- Increased ease of importing smaller quantities for businesses, particularly e-commerce ventures.

- Potential for increased competition among importers, leading to lower prices and more choices for consumers.

-

Drawbacks:

- Potential for increased smuggling of goods that would otherwise be subject to higher duties, undermining fair trade practices.

- Reduced revenue for governments, impacting their ability to fund public services.

- Concerns about the potential for unfair competition from countries with lower labor costs or lax environmental regulations.

The G7's Rationale for Reviewing De Minimis Tariffs

The G7's decision to review the current de minimis tariff policy stems from several converging factors. Concerns about unfair trade practices by China, including allegations of dumping and the violation of intellectual property rights, are prominent drivers. Domestic industries within G7 nations have also lobbied for adjustments, arguing that low tariffs allow unfairly cheap Chinese imports to undercut their businesses. National security concerns related to reliance on specific Chinese imports are also being considered.

Potential motivations for the review include:

- Addressing persistent trade imbalances with China.

- Protecting domestic industries from what is perceived as unfair competition from cheap imports.

- Enhancing enforcement of intellectual property rights, combating counterfeiting and patent infringement.

- Concerns about the potential for dumping and government subsidies from China, distorting global markets.

Potential Economic Impacts of Changes to De Minimis Tariffs

Altering de minimis tariffs on Chinese imports carries profound economic implications. Increased tariffs could lead to higher consumer prices, potentially dampening consumer spending and slowing economic growth. Businesses that rely heavily on importing goods from China, especially SMEs, could face significant challenges, potentially impacting their profitability and competitiveness. This could lead to job losses and reduced investment. Conversely, maintaining or lowering tariffs could lead to increased competition, potentially benefiting consumers but potentially harming domestic producers.

Let's consider several scenarios:

- Scenario 1: Increased tariffs: This could lead to higher inflation, reduced consumer spending, decreased business profitability, and potentially retaliatory tariffs from China.

- Scenario 2: Maintaining current tariffs: This risks continuing existing trends, including the potential for increased smuggling and further pressure on domestic industries. It also presents challenges in addressing concerns about unfair trade practices.

- Scenario 3: Reduced tariffs: This might lead to lower prices for consumers and increased competition, but could also exacerbate concerns about unfair competition and potential job losses in domestic industries.

Alternative Policy Options and their Consequences

The G7 is not limited to simply raising or lowering de minimis tariffs. Alternative policy options include:

- Targeted tariffs: Imposing higher tariffs on specific goods or sectors deemed to pose a threat to national security or domestic industries. This offers a more nuanced approach than blanket tariff increases.

- Stricter enforcement of existing trade regulations: Focusing on combating smuggling and ensuring compliance with intellectual property rights could mitigate some of the negative effects of low tariffs.

- International cooperation and negotiations: Working with China through bilateral or multilateral agreements to address trade imbalances and unfair trade practices could offer a more sustainable solution.

Possible alternative policy approaches include:

- Strengthening customs enforcement to combat smuggling and ensure proper valuation of imported goods.

- Negotiating bilateral trade agreements with China to address specific concerns and establish clearer rules of engagement.

- Implementing targeted sanctions on specific Chinese industries found to be engaging in unfair trade practices.

Conclusion

The G7's review of de minimis tariffs on imports from China holds significant implications for global trade and economic stability. Changes to these tariffs could significantly impact consumer prices, business profitability, and international relations. Understanding the potential economic consequences of various scenarios – increased, maintained, or reduced tariffs – is crucial for policymakers and businesses alike. Exploring alternative policies beyond simple tariff adjustments is also essential.

Stay informed about the G7's decision on de minimis tariffs and its potential impact on your business and the broader economy. Further research into the implications of changing de minimis tariffs on China imports and their impact on the G7 is crucial for understanding future economic trends.

Featured Posts

-

The Hunger Games Kieran Culkin Cast As Caesar Flickerman In Sunrise On The Reaping Assuming This Is A Hunger Games Related Project

May 23, 2025

The Hunger Games Kieran Culkin Cast As Caesar Flickerman In Sunrise On The Reaping Assuming This Is A Hunger Games Related Project

May 23, 2025 -

Cassidy Hutchinson A Jan 6 Memoir To Reveal Key Insights This Fall

May 23, 2025

Cassidy Hutchinson A Jan 6 Memoir To Reveal Key Insights This Fall

May 23, 2025 -

C Beebies Bedtime Stories A Parents Guide To Calming Bedtime Routines

May 23, 2025

C Beebies Bedtime Stories A Parents Guide To Calming Bedtime Routines

May 23, 2025 -

Edinburgh To Host The Tour De France Grand Depart In 2027

May 23, 2025

Edinburgh To Host The Tour De France Grand Depart In 2027

May 23, 2025 -

Lewis Hamilton And Mc Laren The Lingering Issue And A Frank Confession

May 23, 2025

Lewis Hamilton And Mc Laren The Lingering Issue And A Frank Confession

May 23, 2025

Latest Posts

-

Score Big With These 2025 Memorial Day Sales And Deals

May 23, 2025

Score Big With These 2025 Memorial Day Sales And Deals

May 23, 2025 -

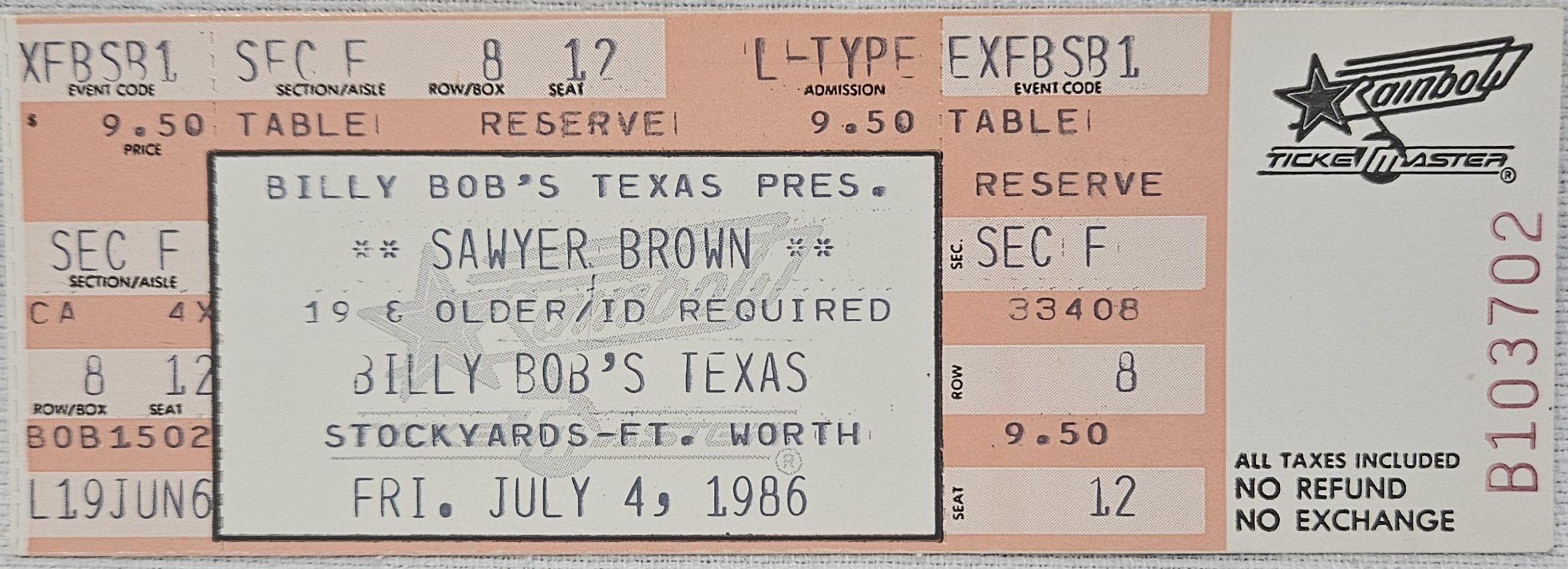

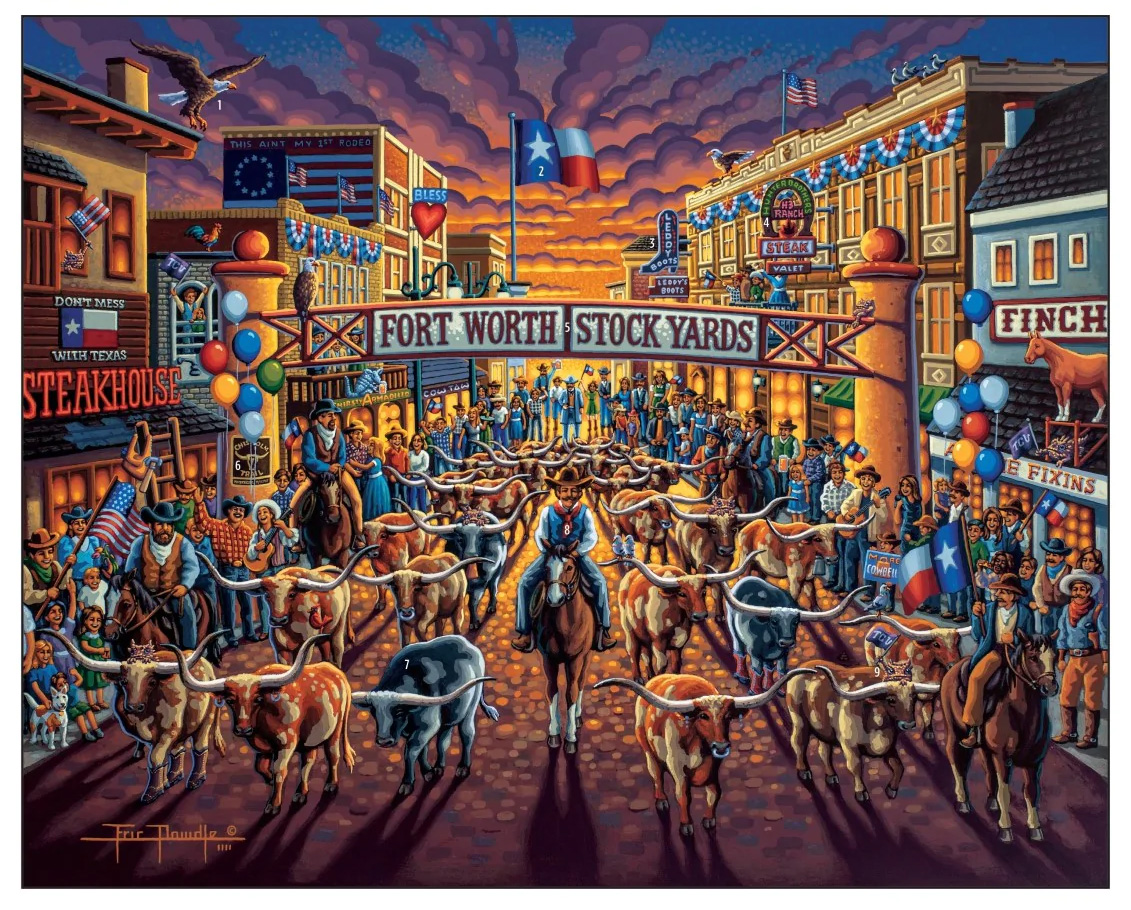

Fort Worth Stockyards Joe Jonas Delivers Unannounced Concert

May 23, 2025

Fort Worth Stockyards Joe Jonas Delivers Unannounced Concert

May 23, 2025 -

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025 -

Joe Jonas Unexpected Fort Worth Stockyards Performance Details And Videos

May 23, 2025

Joe Jonas Unexpected Fort Worth Stockyards Performance Details And Videos

May 23, 2025 -

2025 Memorial Day Sales Best Deals According To A Shopping Expert

May 23, 2025

2025 Memorial Day Sales Best Deals According To A Shopping Expert

May 23, 2025