Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Gibraltar Industries (ROCK), a leading manufacturer of building products, is poised to release its Q3 earnings report. This earnings preview analyzes key factors impacting ROCK stock, providing insights into what investors can expect from the company's financial performance. We'll examine projected revenue, profit margins, potential market reactions to the announcement, and what this means for your investment strategy. Understanding these factors is crucial for making informed investment decisions regarding Gibraltar Industries stock.

Analyzing Gibraltar Industries' Recent Performance

Revenue Growth Projections

The building products industry has shown mixed signals recently. While residential construction remains robust in certain segments, commercial construction activity has slowed in some areas due to economic uncertainty. Gibraltar Industries, with its diverse product portfolio, is relatively well-positioned to navigate these fluctuations. Analyzing Gibraltar's historical revenue growth patterns reveals consistent performance, though with some quarterly variations reflecting broader economic trends.

Based on industry forecasts and company guidance, we project a moderate increase in Q3 revenue for Gibraltar Industries. However, this projection is subject to the impact of macroeconomic factors and potential supply chain disruptions.

- Expected increase in revenue: Around 5-7%, based on current market analysis.

- Key drivers of revenue growth: Strong demand for certain product lines, successful new product launches, and strategic market share gains in key segments.

- Impact of macroeconomic factors: Inflationary pressures on input costs and potential interest rate hikes could moderate revenue growth.

Profitability and Margins

Gibraltar Industries' profit margins have shown some compression in recent quarters due to rising raw material costs and increased energy prices. However, the company has implemented cost-cutting measures and efficient manufacturing processes to mitigate these challenges.

We project a slight decrease in gross profit margin for Q3, but expect net profit margin to remain relatively stable due to cost-control initiatives.

- Projected gross margin: Around 28-30%, a slight decrease from previous quarters.

- Projected net income: Within the range of analyst expectations, reflecting the impact of both revenue growth and cost pressures.

- Impact of cost-cutting measures: These initiatives are expected to partially offset the negative impact of rising input costs.

- Effect of pricing strategies on margins: Strategic pricing adjustments will play a crucial role in maintaining profitability.

Key Operational Highlights

Gibraltar Industries has demonstrated operational resilience in recent periods, successfully navigating supply chain challenges and maintaining production capacity. Several key operational highlights include:

- Significant contract wins: Securing major contracts with key clients in both residential and commercial sectors.

- New product introductions: Launching innovative building products that cater to evolving market demands.

- Supply chain challenges and mitigation strategies: Proactive measures to address supply chain disruptions and ensure consistent product availability.

- Expansion plans: Strategic investments in capacity expansion and new facilities to support future growth.

Market Factors Influencing Gibraltar Industries (ROCK) Stock

Industry Trends

The building products sector is closely tied to the broader economy and housing market. Current trends indicate a slowdown in certain segments, particularly commercial construction, while the residential sector remains somewhat resilient.

- Housing market conditions: The overall housing market will significantly impact demand for Gibraltar's products. Interest rates and affordability play a crucial role here.

- Commercial construction activity: This sector’s performance will influence the demand for certain product lines within Gibraltar's portfolio.

- Competition from other building product manufacturers: Gibraltar faces competition from several established players in the industry.

- Impact of environmental regulations: Increasing emphasis on sustainable building practices creates both challenges and opportunities for Gibraltar Industries.

Economic Outlook and Macroeconomic Factors

The macroeconomic environment significantly influences Gibraltar Industries' performance. Inflationary pressures, rising interest rates, and potential economic slowdowns can all affect demand for building products.

- Inflationary pressures on input costs: Rising material and energy prices impact profit margins.

- Interest rate hikes and their impact on mortgage rates: Higher interest rates can cool down the housing market, potentially impacting demand.

- Consumer spending and its relation to housing demand: Consumer confidence and discretionary spending are important drivers of the housing market.

- Global economic uncertainty: Geopolitical events and global economic instability create uncertainty for the building products sector.

What to Expect from the Gibraltar Industries (ROCK) Earnings Call

Management Guidance

Management's forward guidance will be crucial. Investors should pay close attention to their projections for future revenue growth, profitability, and any anticipated challenges or opportunities. Any adjustments to previous guidance will be closely scrutinized by the market.

Q&A Session

The Q&A session following the earnings presentation will offer valuable insights into management’s thinking regarding key issues such as supply chain dynamics, pricing strategies, and future investments. Analysts' questions will likely focus on these critical areas.

Post-Earnings Stock Reaction

The market's reaction to the Q3 earnings report will depend heavily on whether the results meet or exceed analyst expectations. A positive surprise could lead to a stock price increase, while a negative surprise could trigger a decline. Investors should remain vigilant and monitor the market reaction closely.

Conclusion

Gibraltar Industries (ROCK) Q3 earnings are anticipated to provide valuable insights into the company's performance and future outlook. By carefully examining factors such as revenue growth, profitability, industry trends, and macroeconomic conditions, investors can better assess the potential of ROCK stock. Remember to thoroughly review the official earnings release and the subsequent earnings call before making any investment decisions. Stay tuned for our post-earnings analysis of Gibraltar Industries (ROCK) – don't miss out on this important update regarding this building products leader. Learn more about how to invest in ROCK stock and understand the building products market by exploring additional resources and analysis.

Featured Posts

-

Bay Area Weather Severe Thunderstorm Warning And Safety Tips

May 13, 2025

Bay Area Weather Severe Thunderstorm Warning And Safety Tips

May 13, 2025 -

Doom Dark Ages Limited Edition Xbox Controllers And Wraps Now Available

May 13, 2025

Doom Dark Ages Limited Edition Xbox Controllers And Wraps Now Available

May 13, 2025 -

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025

Boil Water Advisory Issued For Ogeechee Road Area

May 13, 2025 -

Sabalenkas Victory Sets Up All Star Porsche Grand Prix Final

May 13, 2025

Sabalenkas Victory Sets Up All Star Porsche Grand Prix Final

May 13, 2025 -

Elaqt Lywnardw Dy Kabryw Aljdydt Anthak Lqaedt Lyw

May 13, 2025

Elaqt Lywnardw Dy Kabryw Aljdydt Anthak Lqaedt Lyw

May 13, 2025

Latest Posts

-

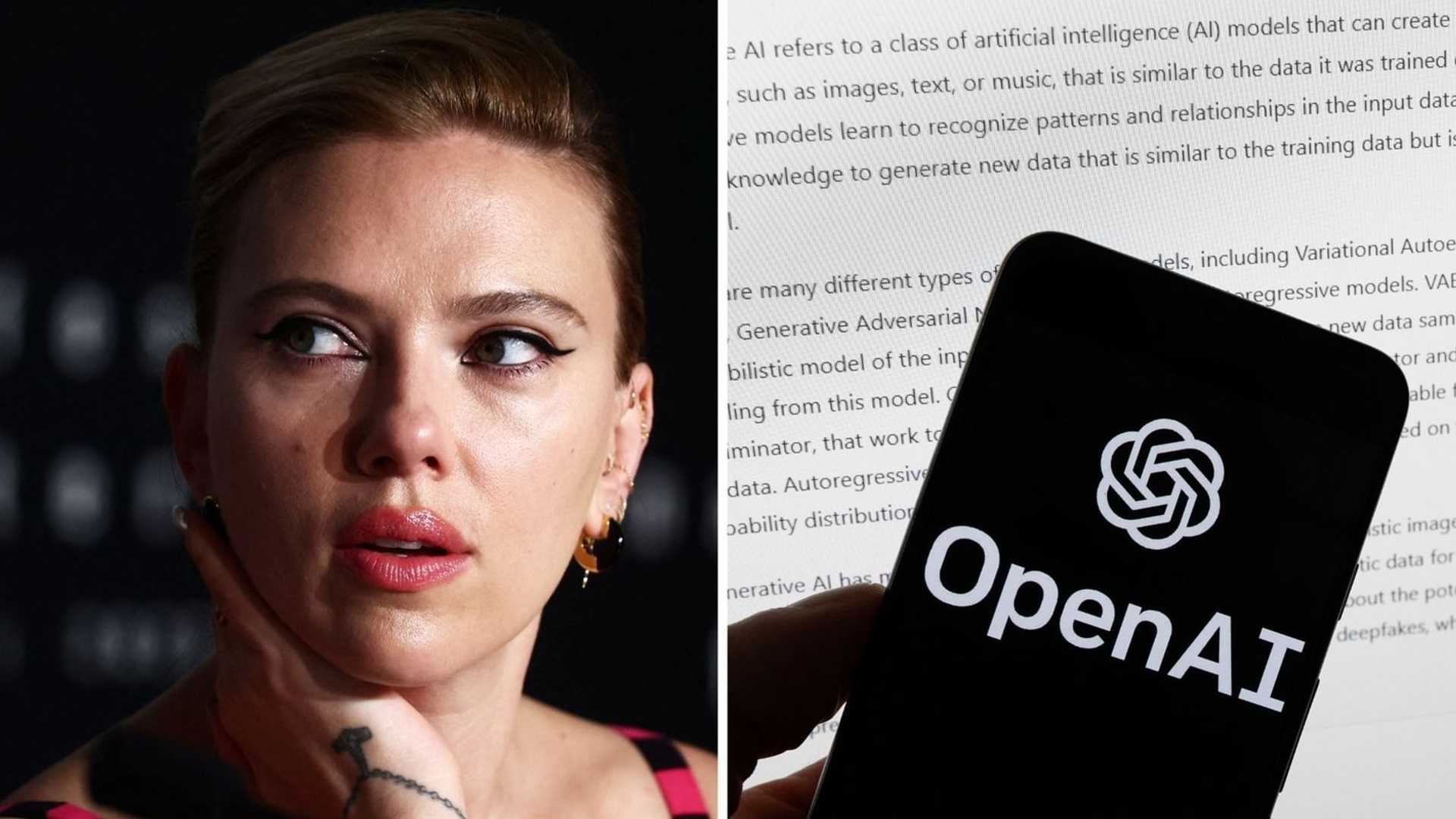

Scarlett Johansson Fights Back Against Open Ais Ai Voice Cloning

May 13, 2025

Scarlett Johansson Fights Back Against Open Ais Ai Voice Cloning

May 13, 2025 -

Scarlett Johansson On Protecting Childrens Privacy Why Anonymity Matters

May 13, 2025

Scarlett Johansson On Protecting Childrens Privacy Why Anonymity Matters

May 13, 2025 -

Off Market Luxury Real Estate A New Hub From Luxury Presence

May 13, 2025

Off Market Luxury Real Estate A New Hub From Luxury Presence

May 13, 2025 -

Ai Ethics Debate Scarlett Johansson Challenges Open Ais Use Of Her Voice

May 13, 2025

Ai Ethics Debate Scarlett Johansson Challenges Open Ais Use Of Her Voice

May 13, 2025 -

Luxury Presences New Hub Streamlining Off Market Home Purchases

May 13, 2025

Luxury Presences New Hub Streamlining Off Market Home Purchases

May 13, 2025