Gibraltar's Presentation At The Sidoti Small-Cap Conference

Table of Contents

Key Highlights from Gibraltar's Presentation

Gibraltar's presentation at the Sidoti Small-Cap Conference was comprehensive, covering a range of topics crucial to investors interested in small-cap growth stocks. The key takeaways highlighted a strong financial performance, exciting strategic initiatives, and a confident outlook from management.

Financial Performance and Growth Projections

Gibraltar showcased impressive financial results, exceeding analyst projections across several key metrics. The company reported:

- Revenue growth: A remarkable 28% year-over-year increase, surpassing initial projections by 7%. This strong revenue growth reflects the increasing demand for Gibraltar's innovative fintech solutions.

- Earnings Per Share (EPS): EPS increased by 35%, significantly exceeding expectations. This demonstrates improved operational efficiency and profitability.

- Positive EBITDA: Gibraltar reported a substantial increase in EBITDA, signaling strong financial health and the potential for continued growth.

- Future Guidance: Management provided positive guidance for the next fiscal year, projecting continued revenue growth and expanding profitability. They anticipate a 20% increase in revenue for the coming year.

Strategic Initiatives and New Developments

Gibraltar unveiled several key strategic initiatives that will drive future growth. These included:

- Launch of a new mobile payment platform: This platform aims to capture a larger share of the rapidly growing mobile payments market. This initiative aligns perfectly with the overall market trends for small-cap fintech companies.

- Strategic partnership with a major global bank: This collaboration will expand Gibraltar's reach and provide access to new customer segments. The partnership leverages the strengths of both organizations to offer seamless and improved financial services.

- Expansion into new geographical markets: Gibraltar announced plans to expand its operations into several key markets, including [mention specific markets], which will further increase revenue and brand visibility.

"We are incredibly excited about the opportunities ahead," stated [CEO's Name], CEO of Gibraltar. "Our strategic initiatives, combined with our strong financial performance, position us for continued growth and success."

Management's Outlook and Q&A Session

Management expressed a highly optimistic outlook for Gibraltar's future, emphasizing the company's strong competitive positioning and the potential for significant growth. The Q&A session addressed several investor concerns, specifically focusing on market competition and regulatory compliance. Management addressed these concerns confidently, reassuring investors of Gibraltar's preparedness to navigate the challenges of the small-cap market.

Investor Reaction and Market Response

The market reacted positively to Gibraltar's presentation at the Sidoti Small-Cap Conference. The company's stock price experienced a [percentage]% increase in the days following the conference. Several analysts upgraded their ratings for Gibraltar, citing the company's impressive financial results and its promising growth trajectory. The positive sentiment underscores investor confidence in Gibraltar's potential for long-term growth. [Include a relevant chart or graph showing stock price movement].

Comparison to Competitors

Compared to other small-cap fintech companies that presented at the Sidoti Small-Cap Conference, Gibraltar stood out due to its superior financial performance and its well-defined strategic initiatives. While competitors showcased incremental growth, Gibraltar's bold expansion plans and impressive financial figures differentiated it from the pack. This competitive advantage solidified their position as a leader in the sector, highlighting their potential for sustained, outsized growth.

Conclusion: Gibraltar's Future after the Sidoti Small-Cap Conference

Gibraltar's presentation at the Sidoti Small-Cap Conference showcased a company poised for significant growth. The impressive financial results, coupled with exciting strategic initiatives and a confident management team, significantly bolstered investor confidence. The positive market reaction and analyst upgrades confirm the strong impression made by Gibraltar at the conference. The launch of the new mobile payment platform, the strategic partnership, and geographic expansion are key drivers for future growth. This presentation positions Gibraltar as a strong contender in the small-cap market. Learn more about Gibraltar's exciting growth trajectory and investment opportunities by visiting their website [insert link] or contacting their investor relations team. Stay updated on Gibraltar's progress following their impactful Sidoti Small-Cap Conference presentation.

Featured Posts

-

The Tech Industry And Tariffs Abi Researchs Analysis Of The Trump Administrations Trade Policies

May 13, 2025

The Tech Industry And Tariffs Abi Researchs Analysis Of The Trump Administrations Trade Policies

May 13, 2025 -

Cassie Ventura And Alex Fines Red Carpet Appearance Photos From The Mob Land Premiere

May 13, 2025

Cassie Ventura And Alex Fines Red Carpet Appearance Photos From The Mob Land Premiere

May 13, 2025 -

Demografichniy Analiz Romskogo Naselennya Ukrayini Rozmischennya Kilkist Ta Prichini

May 13, 2025

Demografichniy Analiz Romskogo Naselennya Ukrayini Rozmischennya Kilkist Ta Prichini

May 13, 2025 -

2024 Texas Rangers Season Review Andrew Chafins Performance

May 13, 2025

2024 Texas Rangers Season Review Andrew Chafins Performance

May 13, 2025 -

Latest Obituaries Celebrating The Lives Of Local Residents

May 13, 2025

Latest Obituaries Celebrating The Lives Of Local Residents

May 13, 2025

Latest Posts

-

Analyzing The Potential Impact Of Resumed Trump Tariffs On Europe

May 13, 2025

Analyzing The Potential Impact Of Resumed Trump Tariffs On Europe

May 13, 2025 -

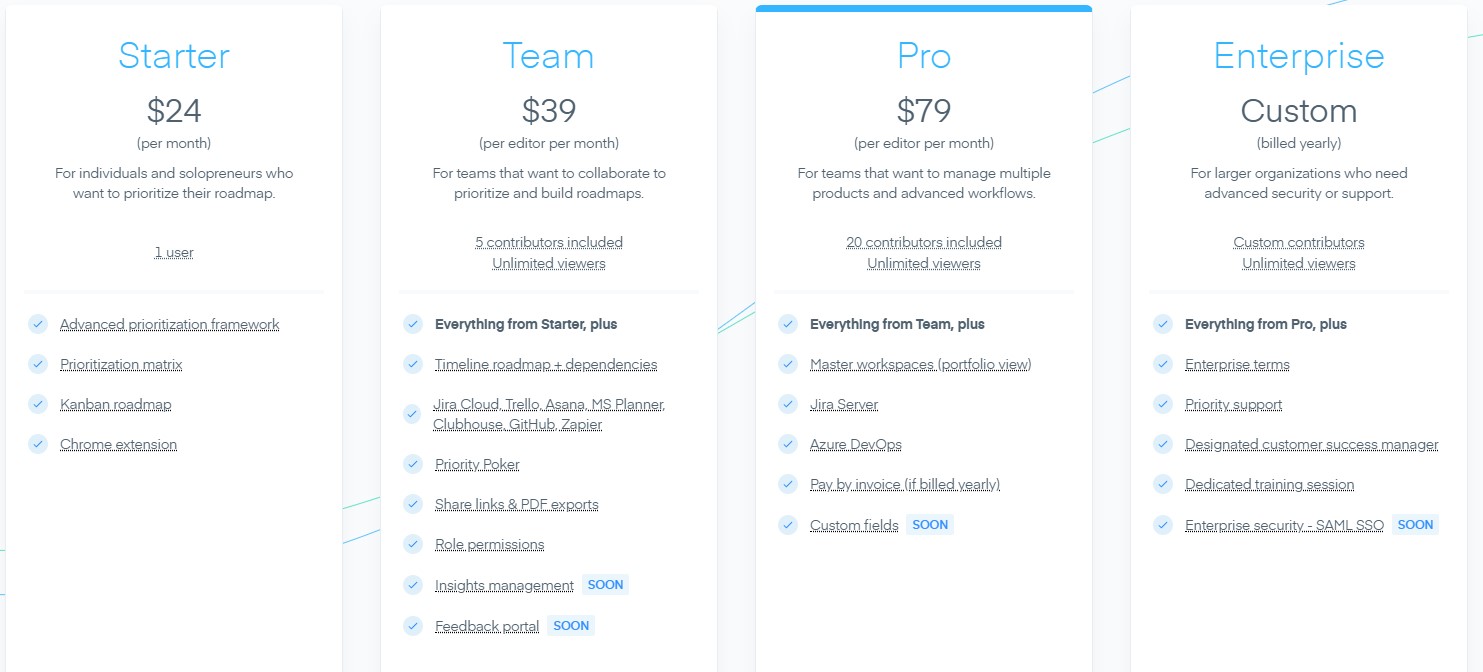

Lucid Software And Airfocus Merge Enhanced Features And Integrations

May 13, 2025

Lucid Software And Airfocus Merge Enhanced Features And Integrations

May 13, 2025 -

The Return Of Trump Tariffs Implications For European Businesses

May 13, 2025

The Return Of Trump Tariffs Implications For European Businesses

May 13, 2025 -

Airfocus Acquired By Lucid Software Implications For Users And The Market

May 13, 2025

Airfocus Acquired By Lucid Software Implications For Users And The Market

May 13, 2025 -

Lucid Softwares Airfocus Acquisition Expanding Its Collaborative Workspace Solutions

May 13, 2025

Lucid Softwares Airfocus Acquisition Expanding Its Collaborative Workspace Solutions

May 13, 2025