Global Bond Market Instability: A Posthaste Analysis Of Current Risks

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When interest rates rise, newly issued bonds offer higher yields, making existing lower-yielding bonds less attractive. This decreased demand leads to a decline in the price of existing bonds to compensate for the lower relative yield. The aggressive interest rate hikes implemented by central banks like the Federal Reserve and the European Central Bank to combat inflation are significantly impacting bond yields and valuations.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, potentially impacting their ability to service existing debt and slowing economic growth. This can further exacerbate global bond market instability.

- Potential for capital losses for bondholders: As bond prices fall in response to rising interest rates, bondholders face the risk of substantial capital losses, particularly those holding long-term bonds with fixed interest rates.

- Reduced demand for lower-yielding bonds: Investors are less likely to purchase bonds offering lower yields when higher-yielding alternatives are available, further depressing prices of existing bonds.

- Increased risk of defaults: Higher interest rates can strain the finances of both corporations and governments, increasing the risk of defaults on their bond obligations, adding to the instability.

Recent data shows a significant increase in benchmark interest rates globally. For instance, the US Federal Funds rate has increased considerably, impacting the pricing of US Treasury bonds, a key benchmark for global bond markets. This ripple effect is felt across international bond markets, causing considerable volatility.

Geopolitical Risks and Their Influence on Global Bond Markets

Geopolitical events significantly influence investor sentiment and bond yields. The ongoing war in Ukraine, escalating US-China tensions, and other regional conflicts inject uncertainty into the global economic outlook, leading to risk aversion. This often triggers a "flight to safety," where investors move their capital towards perceived safe-haven assets like US Treasuries. This increased demand for safe-haven assets often comes at the expense of other bond markets.

- Increased volatility in bond markets: Geopolitical uncertainty creates unpredictable market swings, making it difficult for investors to accurately assess risk and make informed decisions. This volatility is a key characteristic of current global bond market instability.

- Flight to safety impacting emerging market bonds disproportionately: Emerging market bonds, often considered riskier investments, are particularly susceptible to capital flight during times of geopolitical instability.

- Potential for sovereign debt crises in vulnerable countries: Geopolitical shocks can exacerbate existing economic vulnerabilities in certain countries, increasing the risk of sovereign debt crises.

- Impact on global trade and supply chains: Geopolitical tensions disrupt global trade and supply chains, contributing to inflationary pressures and further impacting bond markets.

For example, the war in Ukraine significantly impacted energy prices and global supply chains, contributing to increased inflation and influencing investor perceptions of risk, thus impacting global bond market stability.

Inflationary Pressures and Their Effect on Bond Yields

Inflation erodes the purchasing power of fixed-income investments like bonds. When inflation rises, the real return on a bond (the nominal yield minus the inflation rate) falls. This makes bonds less attractive to investors, leading to lower bond prices and higher yields. Central banks often respond to inflationary pressures by raising interest rates, which, as discussed earlier, further impacts bond yields.

- Central banks' efforts to combat inflation through rate hikes: Aggressive interest rate hikes by central banks aim to cool down the economy and curb inflation but risk triggering a recession, adding further complexity to the bond market landscape.

- Impact of inflation on investor expectations and demand for bonds: High and persistent inflation leads investors to expect higher future inflation, demanding higher yields on bonds to compensate for the erosion of purchasing power.

- Potential for stagflation and its implications for bond markets: Stagflation (a combination of slow economic growth, high unemployment, and high inflation) creates a particularly challenging environment for bond markets, as investors grapple with low growth prospects and high inflation.

- Role of supply chain disruptions and commodity price volatility: Disruptions to global supply chains and volatile commodity prices contribute significantly to inflationary pressures, influencing bond market dynamics.

Current inflation data shows that many countries are experiencing inflation significantly above their central bank targets, contributing significantly to the current global bond market instability.

Assessing Credit Risk in the Current Environment

The current economic climate presents heightened credit risk. The probability of corporate defaults and sovereign debt crises is increasing as higher interest rates strain borrowers' ability to service their debt. Careful assessment of credit risk is vital for investors.

- Importance of credit ratings and due diligence: Investors should rely on credit ratings from reputable agencies and conduct thorough due diligence before investing in any bond.

- Diversification as a risk management tool: Diversifying a bond portfolio across different issuers, maturities, and sectors can help mitigate credit risk.

- Role of credit default swaps (CDS) in hedging credit risk: Credit default swaps act as insurance against defaults, providing a mechanism to hedge against credit risk.

Conclusion

The current instability in the global bond market presents significant challenges for investors. Rising interest rates, geopolitical uncertainties, and persistent inflationary pressures are creating a complex and volatile environment. Understanding these interconnected risks is crucial for navigating the market successfully. Careful analysis of credit risk and employing diversification strategies are essential for mitigating potential losses. The future trajectory of the global bond market will largely depend on the effectiveness of central bank policies in controlling inflation and the resolution of geopolitical tensions.

Call to Action: Stay informed about developments in the global bond market. Regularly assess your bond portfolio and adjust your investment strategy to account for the evolving risks of global bond market instability. Seek professional financial advice if needed to manage your exposure to this volatile sector.

Featured Posts

-

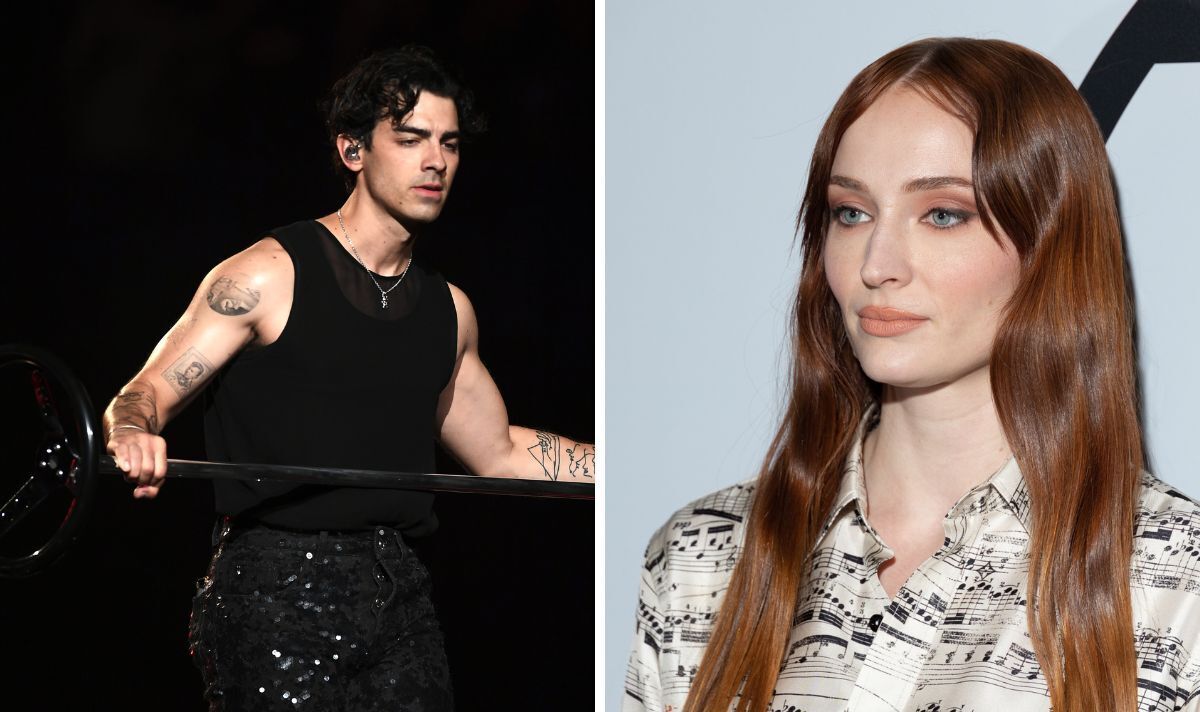

Joe Jonas Addresses Couples Argument About Him The Best Response

May 23, 2025

Joe Jonas Addresses Couples Argument About Him The Best Response

May 23, 2025 -

Muzarabanis Nine Wicket Haul Zimbabwe Triumphs In First Test Against Bangladesh

May 23, 2025

Muzarabanis Nine Wicket Haul Zimbabwe Triumphs In First Test Against Bangladesh

May 23, 2025 -

Vanja Mijatovic Novo Ime Novi Pocetak

May 23, 2025

Vanja Mijatovic Novo Ime Novi Pocetak

May 23, 2025 -

Final Concacaf Todo Sobre El Partido Mexico Vs Panama

May 23, 2025

Final Concacaf Todo Sobre El Partido Mexico Vs Panama

May 23, 2025 -

Indian Wells 2025 Swiatek And Rybakinas Road To The Quarterfinals

May 23, 2025

Indian Wells 2025 Swiatek And Rybakinas Road To The Quarterfinals

May 23, 2025

Latest Posts

-

Essen Ueberraschender Eis Favorit In Nrw

May 23, 2025

Essen Ueberraschender Eis Favorit In Nrw

May 23, 2025 -

Nyt Mini Crossword Answers And Hints Sunday April 19th

May 23, 2025

Nyt Mini Crossword Answers And Hints Sunday April 19th

May 23, 2025 -

Entdecken Sie Essen Radtouren Zu Den Lebensorten Bedeutender Persoenlichkeiten

May 23, 2025

Entdecken Sie Essen Radtouren Zu Den Lebensorten Bedeutender Persoenlichkeiten

May 23, 2025 -

Protest Der Essener Taxifahrer Was Steckt Dahinter

May 23, 2025

Protest Der Essener Taxifahrer Was Steckt Dahinter

May 23, 2025 -

Solve The Nyt Mini Crossword Hints For March 5 2025

May 23, 2025

Solve The Nyt Mini Crossword Hints For March 5 2025

May 23, 2025