Global Bond Market Instability: A Posthaste Warning

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

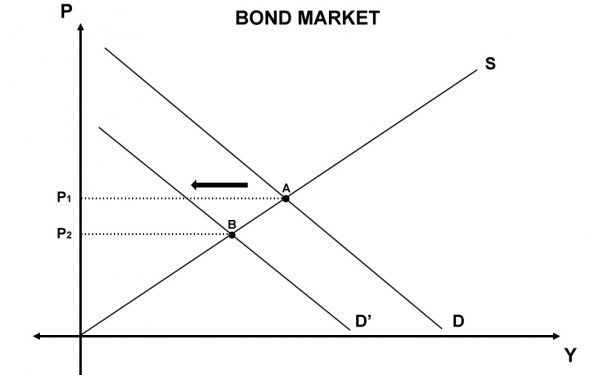

The relationship between interest rates and bond prices is inversely proportional. When interest rates rise, the yields on newly issued bonds become more attractive, causing the prices of existing bonds with lower yields to fall. The recent aggressive actions by central banks, particularly the Federal Reserve's multiple interest rate hikes in response to inflation, are a primary driver of the current global bond market instability. This has led to a significant decline in the value of many bond portfolios.

- Impact on different bond types: Government bonds, generally considered safer, have also experienced price declines, albeit often less dramatic than corporate bonds. High-yield corporate bonds, which carry higher risk, have been particularly hard hit.

- Increased risk of capital losses: Bondholders face the risk of substantial capital losses if interest rates continue to climb or if the issuer defaults.

- Potential for further rate hikes: The possibility of further interest rate hikes by central banks globally adds to the uncertainty and amplifies the risk of further price declines in the bond market. This creates a significant challenge for investors navigating the complexities of global bond market volatility.

Data from major bond indices show significant negative returns in 2022 and into 2023, underscoring the severity of the situation. This underlines the need for a cautious approach to bond investing in this environment.

Inflation's Erosive Effect on Bond Yields

High inflation significantly erodes the real return on bonds. While a bond might offer a nominal yield of, say, 4%, if inflation is running at 6%, the real yield is actually negative (-2%). This means that investors are losing purchasing power over time. Persistent inflation presents a major challenge for bond investors, adding another layer to global bond market instability.

- The importance of considering real yields: Investors need to focus on real yields (inflation-adjusted yields) to accurately assess the true return on their bond investments.

- Strategies for mitigating inflation risk: Strategies like investing in inflation-protected securities (TIPS) or diversifying into assets that tend to perform well during inflationary periods, such as real estate or commodities, can help mitigate inflation risk.

- The impact of inflation expectations: Market sentiment is heavily influenced by inflation expectations. If investors anticipate higher inflation in the future, they will demand higher yields on bonds, leading to further price declines. This sentiment contributes significantly to the current global bond market outlook.

(Insert chart/graph here illustrating the relationship between inflation and bond yields.)

Geopolitical Risks and Their Destabilizing Influence

Geopolitical events inject significant uncertainty into the bond market. Wars, trade disputes, and political instability can all lead to shifts in investor sentiment, capital flows, and bond prices. These unexpected events contribute greatly to the current climate of global bond market instability.

- Examples of recent geopolitical events: The ongoing war in Ukraine, escalating US-China tensions, and political instability in various regions have all created significant uncertainty in the global bond market.

- The flight-to-safety phenomenon: During times of geopolitical uncertainty, investors often seek the safety of government bonds, particularly those issued by countries perceived as stable and reliable. This can lead to a decline in yields on these "safe-haven" assets.

- Strategies for managing geopolitical risk: Diversification across different countries and currencies, as well as careful monitoring of geopolitical developments, are essential for managing geopolitical risk in bond investments. Understanding global bond market risk is crucial during such times.

(Include links to relevant news articles or research reports here.)

Assessing and Mitigating Your Exposure to Global Bond Market Instability

Investors need to carefully assess their exposure to global bond market instability. This involves understanding their current bond holdings, their risk tolerance, and their investment goals. Several strategies can be employed to mitigate the impact of this instability.

- Importance of diversification: Diversifying across different asset classes, such as equities, real estate, and alternative investments, can help reduce overall portfolio risk.

- The role of hedging strategies: Hedging strategies, such as using derivatives to protect against potential losses, can also be beneficial.

- Seeking professional advice: Consulting with a qualified financial advisor is crucial for developing a well-defined investment strategy that takes into account the current challenges in the global bond market.

A well-defined investment strategy is paramount in navigating the turbulent waters of the global bond market. Thoroughly understanding your risk tolerance and actively managing your portfolio are key to mitigating potential losses.

Conclusion: Navigating the Turbulent Waters of Global Bond Market Instability

The current global bond market instability presents significant challenges for investors. Rising interest rates, persistent inflation, and escalating geopolitical risks are creating a volatile and uncertain environment. Understanding the interplay of these factors is crucial for navigating this complex landscape. It's vital to carefully evaluate your bond portfolio's risk exposure and consider diversifying your investments. Seeking professional financial advice is strongly recommended to develop a robust strategy to weather this period of global bond market volatility. Further research into topics like "global bond market volatility," "managing bond market risk," and "global bond market outlook" is encouraged to make informed investment decisions.

Featured Posts

-

Us Bands Glastonbury Gig Unofficial Confirmation Ignites Social Media

May 24, 2025

Us Bands Glastonbury Gig Unofficial Confirmation Ignites Social Media

May 24, 2025 -

Michael Caine On Filming A Sex Scene With Mia Farrow An Unforgettable Experience

May 24, 2025

Michael Caine On Filming A Sex Scene With Mia Farrow An Unforgettable Experience

May 24, 2025 -

Tva Group Cuts 30 Jobs Ceo Cites Streamers And Regulators

May 24, 2025

Tva Group Cuts 30 Jobs Ceo Cites Streamers And Regulators

May 24, 2025 -

Today Show Anchor Co Hosts Address Long Absence We Were Praying For Her

May 24, 2025

Today Show Anchor Co Hosts Address Long Absence We Were Praying For Her

May 24, 2025 -

Air Traffic Controllers Sound Alarm Faulty Plan Cripples Newark Airport

May 24, 2025

Air Traffic Controllers Sound Alarm Faulty Plan Cripples Newark Airport

May 24, 2025

Latest Posts

-

Asexual Identity Insights From Jonathan Groffs Interview With Instinct Magazine

May 24, 2025

Asexual Identity Insights From Jonathan Groffs Interview With Instinct Magazine

May 24, 2025 -

Jonathan Groff And Asexuality A Candid Conversation

May 24, 2025

Jonathan Groff And Asexuality A Candid Conversation

May 24, 2025 -

Instinct Magazine Interview Jonathan Groff On Asexuality

May 24, 2025

Instinct Magazine Interview Jonathan Groff On Asexuality

May 24, 2025 -

Jonathan Groff Discusses His Past And Asexual Identity

May 24, 2025

Jonathan Groff Discusses His Past And Asexual Identity

May 24, 2025 -

Jonathan Groff A Conversation About His Asexuality

May 24, 2025

Jonathan Groff A Conversation About His Asexuality

May 24, 2025